Professional Documents

Culture Documents

FNM

FNM

Uploaded by

Shadab Hanafi0 ratings0% found this document useful (0 votes)

4 views5 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views5 pagesFNM

FNM

Uploaded by

Shadab HanafiCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 5

Paper Code 209

ony AK

MAA (INTERNATIONAL BUSINESS) | XAMINAT

PART. 1(ESEMESTER H)

FINANCIAL MANAGEMENT

(MIBICT3)

ION

Maximum Marks: 60 Duration: Two Hours

Note. This question paper has three parts as detailed below

pat A has 10 Questions. a to j, all are compulsory and each carries O16 mark

FNC has 06 questions. 210 7- attempt any 05, in maximum SO words cach, each

part C has 03 questions. 8, 9 and 10 attempl any 02 of them. Each earries 15 marks

ries 4 marks:

yelow, Fill in the blank with

Que 01. Draw a table in your answer book as per sample given Ds f

below. Do not copy the entire

suitable word(s) / options and write in relevant column as shown

question in the answer book.

Answer _ Que No.

¢

“w) : =

(a) IRR is also known as. _

{by If Ke is 12% personal taxes applicable to shareholder are 30%, Kr would be %

(c) Most important limitation of IRR is, its assumption

(@) Higher degree of Financial Leverage benefits a firm only so tong as its ROA is

{@) Incase Kd is 09% and taxes applicable are 30%, Ket would be __%

(f) In case inflows of a project are uniform, itis advisable to use table of PV

{2) Which of the following isnot a rationale of financial market intermediaries?

(a) Higher transaction cost (b) Signaling (e) Confidentiality (4) Diversification

(h) Which of the following is not true in respect of reduction of collection effort on debtors?

{a) Increases sales (b) Increases bad debt loss (c) Longer average collection period

(d) Increases collection expense

(i) Cancelability is the feature of

(a) Financial lease (b) Operating lease (c) Primary lease, (d) Tripartite lease

G) Which of the following is not assumption of Walter model?

(a) Firm is all equity, firm (b) Constant rate of return (c) Constant cost of capital

(d) Growth rate is less than east of capital

Part B

(Attempt any FIVE)

Que02 A firm purchases machinery worth Rs 90,00,000 and paiys Rs 2,50,000 as down

payment. The remaining amount is paid in 9

charges 13% interest, calculate the amount of

wal installments. If the supplier

allment

Contd. 2-

—

-2- Lage

Vv & Cots Rs 70,00,000 The company 1% planning to adapy jy

Que OF — Current sales of NV/ : 70.0 fi ht mn the

increase 99

js 80% Theaverage collection perio 140 jy. §

615 80%

11%. The company falls in the tax bracket gy

credit policy hich

be 12% The variable cust to

The cost of capital to the company 18 a

40% Should the company liberalise its credit policy

due 04 “depres * and “normal busine

clev sing, ‘deprecation’ a

Que Od HMlustrate the concept of relevant inflows using

pee 50.00 per share

. ket for rupees 50.00 per share

Que OS A company's share is available in the mad 50.00 per

7 Cane paying a dividend of Rupees 5.00 per share which is expected f0 prov

constant rate of S% per annum. Which category of prospective investors woul

g to buy this share” ;

Que 06 Mention any two MOS important merits and two MOST important demerits of

f

Payback P thod of project appr

Que 07 ™ feel Pre ig brea aor sc amount is Rs 18,00.000. The Lesse

wants to earn Rs 4.00.00 profit from leasing. The lease period is 6 years. The cost

capital of the Lessor is 14%, The tax rate applicable to the Lessor is 30%. Calculat

the equated amount of lease rental to be charged from the lessee.

Part C

(Attempt any TWO)

(Que 08 Assume three projects. each with life span of five years and each having uneven

outflow of Rupees one lakh, For each project, assume different inflows over life s

of projects, In each case caleulate (a) NPV i cost of capital is 10%, (b) PBP (c) W

ane should be accepted and why’ (Present value of rupee I received at the each ye

for five years is 0.909, 0.826 0.751. 0.683 and 0.621)

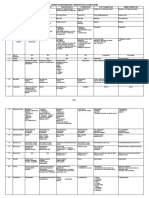

Que 09 Financial data of three firms is wi

Data

Current Ratio

Debtors turnover

Inventory turnover

Creditors turnover

Investment turnov

Gross Profit Margin 18%

Net Profit Margin 15%

Debt Equity Rati 3:5 "I

ROA 20% 21%

Assume that Stock constitute 50%. 40% and 30% of Current Assetg

C respectively and cach firm had 300 working days, q

Based on above information and further calculations, if req

relevant observations / recommendations

(Que 10 (a) Explain the M-M Approach on dividend policy

(b) The ABC and Company has 10.000 equity shares of Rs 100 each, ty

MASTER OF BUSINE

Maximum Marks 70

All questions carry equal marks. Question numbe

questions in sequence

Que 1

Que 1*

fa)

Que 1*

(b)

Que 2

Que 2*

Que 3 (a)

Que 3 (b)

Que 4 (a)

Que 4 (b)

Que 5

Paper Code: 1694

2018-2019

ADMINISTRATION EXAMINATIONS

{RNATIONAL BL

PART 1 - (SEMESTER)

FINANCIAL MANAGEMENT

MIBICI3

Time: 2 % Hours

+: and 2 have alternatives. Try to answer all

Discuss the importance of financial management

reference to time value of money.

decision making with

OR

‘After 6 years from now, a company needs to finance a machine costing rupec®

30 Lakiee. It wishes to start saving money for this purpose. Bank can offer 13%

interest on deposit, Calculate the amount of money to be deposited yearly with

bank for this purpose.

Discuss basic principles of finance

Ilustrate the determination of working capital using suitable data of your

choice.

OR

'A firm expects to sell 80,000 units per annum. The carrying cost of inventory

is Rs 2.00 per unit and cost of each unit is Rs 9.00. Per order cost is Rs. 60.00

Based on above, calculate economic order quantity (BOQ). If there is 3%

discount on purchase of 3,000 or more units, explain why or why not order size

be revised? Also discuss the selective inventory control methods briefly.

Explain and illustrate the merits and demerits

of Payback Period Method of

Project Appraisal using relevant data.

While evaluating a project using Present Value Method and Internal Rate of

Return Method, at times disparities in life and size of projects result in

contradictory recommendations. Elaborate with suitable example.

Iustrate the concept of M.M. Hypothesis and highlight its limitations

Ordinary share of a firm is currently being traded at rupees 40.00 per share. The

firm paid dividend of rupees 4 per share in current year which is likely to grow

4 15% per annum. For ashareholder, whose Ke. is 10%, the share is overvalued

or undervalued? Should he purchase this share or not?

Mustrate M.M. Approach on dividend decision using suitable data of your

choice. fi

xienu

gus (I) Anema auestions Pach question carries 14 marks. Que

‘aemal cl 2) Use of programmable calculator and its exchange or borrowing is not

gloved

el)

Que Hib)

Que 24a)

Que 2(b)

Que 3a)

Que 36)

Que 3*

n Marks: 70)

755

Paper Cod

Session 2021-22

Master of Business,

Administration Examinations

_ Part h Term =I

Course se NOs. MBAICI3

‘ourse Title: Financial Management

Time: Two and a Half Hours

tion numbers 3 and 4 have

inancial Management is all about maximization of sharcholders’ wealth. Comment on

this statement (7 marks)

You have won a prize of Rs. one million. The organizers offer you two options. Option

‘a’ is that you can claim the entire amount now and option *b” is Rs. 2,00,000 to be given

in the beginning of every year for the next 7 years starting right now. If your expected

rate of return is 10%, showing all calculations, explain by what margin value of one

option is better than the other? Value of one rupee, received at the end of each year,

discounted at 10%, from | to 7 years are; 0.909, 0.862, 0.751, 0.683, 0.621, 0.564, 0.513

and the value of one rupee received every year for 7 years is 4.868

‘You may assume any other data if you wish and state your assumptions. (7 marks)

Assuming data of your choice, illustrate how does a firm work out “investment in

receivables” while deciding “Credit Standards” and “Credit Terms” (7 marks)

Assuming annual inventory requirements equal to 100 times of your roll number, per

Unit inventory carrying cost equals 10 times of sum of the digits of your enrolment

number and ordering cost as Rupees 1,000/= per order, find out BOQ. (7 marks)

Work out “payback period” ‘of your education assuming ‘outflow from class XI onwards

till completion of Master's degree. ‘Show all calculations clearly. You can assume any

‘other information / data and state it clearly (7 marks)

While calculating relevant inflows or ‘outflows of a project, we often use terms like

“written down value, salvage value and working capital recovery”. Explain these terms

and their relevance in decision making a marks)

ow and write [4 relevant observations related to pros and

der the data given b

Eee or ‘of any one of the given projects. (14 marks)

cons of deciding in favou

Years Cash flows -"X" Cash flows -*Y" Cash flows = ‘2°

7 5,00,000 ~5,00,000 =5,00,000

; 1,00,000 2,50,000 100000

2 150.000, 1,50,000 100000

5 3,50,000 96,000 100000

+ 2,00,000 104,000 200000

: 100,000, 200,000 400000

Tears 1 days TYears

Pop 32% 36%

ARR. ~_ Rs. 118,750 Rs. 133,600

) a 20% (approximately) | 18%(approximately)

Contd...

wt

Que diay

Que (by

Que 4

275¢

‘ e can be issued and ree

erms under which a debenture can eemed,

Pe ane ane erro oT con oF debt (ka afer axes (7 marks)

ieee a ae ev eine opens pagina 2.00 as DPS which

share ofthis Co! Also write down one imitation of the model you might have used in

shave of this Co? Aiso

arvingat his desson. 7 mah) ces

8 DIE Ratios of a firm (from *A* to “H°) on jg)

Jiven below data shows the effects of 8 D/ ity

EPS. Based on this write any O7 relevant observations onthe pros wad ons of suey

ratios and financial leverage. (14 marks) 7 a

Details / options alee CRED em SEG

1. Assets 100 { 1900 | 1000 | 1000 | 1000 | 1000 | T000 fron

2 Fquiy x00} roa] 600} 300] 400] 300] 200] 109

3.10% Debt 200| 300} 400} 500] 600| 700 800] 909

4, Debt Equity Ratio ta | 3:7 | 23 | it [3:2 [93 Tan Py. |

5. Return on Assets 20% 200} 200} 200} 200} 200 200} 200} 200

6. Less Interest 20 30, 40. 50 60 70 80] 9

7, EAIBT 180|_ 170} 160] 150] 140 130] 120] Ho

8. Less Taxes 90 85. 80 75 70 65 60] 55

9. EAIT 90 85, 80 75 70 65 60} 55

10. Nos. of Shares 80 70 60 50 40 30, 20 10

U Earnings Per Share 143] 1.20 1.33] 1.50 1.75 | 2.17| 3.00[ 5.50

Que 5(a) Briefly explain the recom:

‘mendations and assumptions of Walter's Model of dividend

decisions (7 marks)

Que 5(b) Explain the steps that a lessor takes to determine the breakeven lease rentals. Illustration

is not required. (7 marks)

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- MALIK - Phy Electromagnetic WavesDocument6 pagesMALIK - Phy Electromagnetic WavesShadab HanafiNo ratings yet

- 2020 Amu Mba-2Document34 pages2020 Amu Mba-2Shadab HanafiNo ratings yet

- MALIK Phy Communication SystemsDocument10 pagesMALIK Phy Communication SystemsShadab HanafiNo ratings yet

- MALIK Phy Kinetic TheoryDocument34 pagesMALIK Phy Kinetic TheoryShadab HanafiNo ratings yet

- Plant Diversity TheoryDocument15 pagesPlant Diversity TheoryShivendra soniNo ratings yet

- MicrobesDocument2 pagesMicrobesTanmay SinghalNo ratings yet

- Human Evolution TheoryDocument6 pagesHuman Evolution TheoryShadab HanafiNo ratings yet

- Reproductive System Etc.Document29 pagesReproductive System Etc.Shadab HanafiNo ratings yet

- Achiever Course (Phase: Maw) : Target: Pre-Medical 2013 Major Test # 03Document3 pagesAchiever Course (Phase: Maw) : Target: Pre-Medical 2013 Major Test # 03Shadab HanafiNo ratings yet

- Root-Knot Disease of Vegetable - Tomato: Berkeley in 1855 First Reported The Occurrence of Root Galls On GlassDocument28 pagesRoot-Knot Disease of Vegetable - Tomato: Berkeley in 1855 First Reported The Occurrence of Root Galls On GlassShadab HanafiNo ratings yet

- Nematode StructureDocument31 pagesNematode StructureShadab HanafiNo ratings yet

- Lower Invertebrates Comparative CharactersDocument5 pagesLower Invertebrates Comparative CharactersShadab HanafiNo ratings yet

- Time and Work: Maths Notes by Shankar SesmaDocument8 pagesTime and Work: Maths Notes by Shankar SesmaShadab HanafiNo ratings yet

- 2019-2020 (General English) Sessional Test (ENB-351)Document4 pages2019-2020 (General English) Sessional Test (ENB-351)Shadab HanafiNo ratings yet

- Leader Test Series / Joint Package Course: Distance Learning ProgrammeDocument32 pagesLeader Test Series / Joint Package Course: Distance Learning ProgrammeShadab HanafiNo ratings yet

- General Principles and Processes of Isolation of Elements PDFDocument20 pagesGeneral Principles and Processes of Isolation of Elements PDFShadab HanafiNo ratings yet

- Allen TST (4-9-16) Work, Energy, Power, Circular Motion, Magnetic Effect of Current and Magnetism, C.K, Eqbm1&2, Genetics2, BihwDocument34 pagesAllen TST (4-9-16) Work, Energy, Power, Circular Motion, Magnetic Effect of Current and Magnetism, C.K, Eqbm1&2, Genetics2, BihwShadab Hanafi100% (2)

- Kinematics MCQ PDFDocument30 pagesKinematics MCQ PDFShadab HanafiNo ratings yet

- 5 6219690051421339892 PDFDocument341 pages5 6219690051421339892 PDFShadab HanafiNo ratings yet

- Excretory System (Excercise)Document17 pagesExcretory System (Excercise)Shadab HanafiNo ratings yet