Professional Documents

Culture Documents

Calanuga Assignment Final Period Activity - TAX 202A

Calanuga Assignment Final Period Activity - TAX 202A

Uploaded by

cjmarie.cadenasOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Calanuga Assignment Final Period Activity - TAX 202A

Calanuga Assignment Final Period Activity - TAX 202A

Uploaded by

cjmarie.cadenasCopyright:

Available Formats

CJ Marie C.

Cadenas

BSBA OM 3A

TAX 202A

Assignment - Final Period Activity

Solve the following given problems:

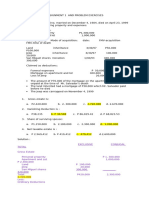

1. Romeo, a resident citizen, died with the following information properly determined:

Net estate subject to tax - Philippines P12,000,000

Net estate subject to tax - Australia 4,000,000

Estate tax paid in Australia 700,000

Required: Determine the amount of estate tax due.

Answer: P720,000

Solution:

Net taxable estate to Philippines P 12,000,000

Net taxable estate to Australia 4,000,000

World Net taxable estate P 16,000,000

Estate tax: P 16,000,000 x 6% = P 960,000

Actual Foreign estate tax paid P 700,000

Limit (4,000,000/16,000,000 x 960,000) 240,000

Foreign Tax Credit (Lower) P 240,000

Estate tax due P 960,000

Less: Foreign Tax Credit 240,000

Estate Tax Due/Payable P 720,000

2. Romy, a resident citizen, died with the following information properly determined:

Net estate subject to tax - Philippines P11,000,000

Net estate subject to tax - Australia 4,000,000

Net estate subject to tax - Singapore 5,000,000

Estate tax paid in Australia 200,000

Estate tax paid in Singapore 350,000

Required: Determine the amount of estate tax due.

Answer: P 700,000

Solution:

Net taxable estate Estate tax paid

Philippines P 11,000,000

Australia 4,000,000 200,000

Singapore 5,000,000 350,000

Total P 20,000,000

Estate tax: P 20,000,000 x 6% = P 1,200,000

Australia Singapore Total

Actual Estate Tax Paid 200,000 350,000

Limit 1: Per country limit

- (4,000,000 / 20,000,000 x 1,200,000) 240,000

- (5,000,000 / 20,000,000 x 1,200,000) 300,000

LOWER 200,000 300,000 500,000

Limit 2: Total Foreign Countries

Lower in limit 1 500,000

Limit 2: (4,000,000 + 5,000,000) /20,000,000 x 1,200,000 540,000

Final Foreign Tax Credit - LOWER 500,000

Estate tax due P 1,200,000

Less: Foreign Tax Credit 500,000

Estate Tax Due/Payable P 700,000

3. A single decedent died with the following data regarding his estate:

Family home P14,000,000

Agricultural land 6,000,000

Cash and other personal properties 8,000,000

Total ₱ 28,000,000

Expenses and claims against the estate:

Funeral expenses ₱ 400,000

Medical expenses 200,000

Judicial expenses 300,000

Unpaid taxes 300,000

Claim against the estate 500,000

Total ₱ 1,700,000

Compute the net taxable estate.

Answer: 12,200,000

Solution:

Family home ₱ 14,000,000

Agricultural land 6,000,000

Cash and other personal properties 8,000,000

Total Gross Estate ₱ 28,000,000

Less:

Unpaid taxes 300,000

Claim against the estate 500,000

Net estate before special deductions ₱ 27,200,000

Less:

Family Home 10,000,000

Standard deduction 5,000,000

Net taxable estate ₱ 12,200,000

4. Mr. Y died leaving the following properties and estate deductions:

Separate properties of Mr. Y P10,000,000

Separate properties of Mrs. Y 24,000,000

Communal properties 26,000,000

Funeral expenses P 500,000

Other ordinary deductions of communal properties 8,000,000

Ordinary deductions - exclusive of Mr. Y 4,000,000

Ordinary deductions - exclusive of Mrs. Y 5,000,000

Family home - exclusive of Mrs. Y 6,000,000

Compute the taxable net estate of Mr. Y.

Answer: 10,000,000

Solution:

Mr. Y Communal Total

Properties P 10,000,000 P 26,000,000 P 36,000,000

Funeral expense 0

Other ordinary deductions (P 4,000,000) (P 8,000,000) (P 12,000,000)

Net estate before special deductions P 6,000,000 P 18,000,000 P 24,000,000

Less: Share of surviving spouse 9,000,000

Family home 0

Standard deductions 5,000,000

Net taxable estate of Mr. Y P 10,000,000

5. The following pertain to the estate of a citizen decedent:

Separate properties of the decedent P12,400,000

Common properties of the spouses 15,600,000

Possible deductions:

Funeral expenses P 480,000

Judicial expenses 220,000

Obligations (1/4 is separate property) 1,800,000

Family home - common property 15,000,000

What is the taxable net estate?

Answer: P6, 575, 000

Solution:

Citizen Common Total

Decedent

Properties P 12,400,000 P 15,600,000 P 28,000,000

Less: Obligations (P 450,000) (P 1,350,000) (1,800,000)

Net estate before special deductions P 11,950,000 P 14,250,000 P 26,200,000

Less: Share of surviving spouse 7,125,000

Family home 7,500,000

Standard deductions 5,000,000

Net taxable estate P 6,575,000

6. A single resident citizen died leaving the following estate and deductions:

Philippines China Taiwan Total

Family home P1,300,000 P - P - P 1,300,000

Other properties 6,200,000 3,000,000 4,500,000 13,700,000

Total estate P7,500,000 P3,000,000 P4,500,000 P15,000,000

Loss P 300,000 P 150,000 P 100,000 P 550,000

Obligations 1,250,000 450,000 200,000 1,900,000

Total P1,550,000 P 600,000 P 300,000 P 2,450,000

Estate before

Standard deduction P5,950,000 P2,400,000 P4,200,000 P12,550,000

Philippines China Taiwan Total

Estate tax paid P - P 100,000 P 160,000 P 260,000

1. Compute respectively the net taxable estate in the Philippines, China and Taiwan.

Answer:

Philippines - P2,150,000

China - P1,400,000

Taiwan - P2,700,000

Solution:

Philippines China Taiwan

Total Estate before P 5,950,000 P 2,400,000 P 4,200,000

Special Deductions

Standard Deductions 2,500,000 1,000,000 1,500,000

Family Home 1,300,000

Net Taxable Estate P 2,150,000 P 1,400,000 P 2,700,000

Standard deductions

Philippines: 5,000,000 x 7,500,000/15,000,000 = P 2,500,000

China: 5,000,000 x 3,000,000/15,000,000 = P 1,000,000

Taiwan: 5,000,000 x 4,500,000/15,000,000 = P 1,500,000

2. Compute for Estate tax still due.

Answer:

The Philippine estate tax payable is:

Global tax due P 375,000

Less: China tax credit 84,000

Taiwan tax credit 160,000

Estate tax payable P 131,000

Solution:

Gross Estate P 12,550,000

Less: Deductions

Family Home 1,300,000

Standard Deduction 5,000,000

Taxable Net Estate 6,250,000

Multiply: Tax Rate 6%

Estate tax due P 375,000

China Tax Credit

Limit Tax Paid Allowed

Net Taxable Estate/Total Taxable Estate x Estate Tax due

1,400,000/6,250,000 x 375,000 P 84,000 P 100,000 P 84,000

Taiwan Tax Credit

Limit Tax Paid Allowed

Net Taxable Estate/Total Taxable Estate x Estate Tax due

2,700,000/6,250,000 x 375,000 P 162,000 P 160,000 P 160,000

Total Per Country Limit P 244,000

Overall Country Limit

Limit Tax Paid Allowed

Net Taxable Estate (Foreign) / Total Taxable Estate x Estate tax due

4,100,000/6,250,000 x 375,000 P 246,000 P 260,000 P 246,000

You might also like

- Estate Tax ProblemsDocument22 pagesEstate Tax ProblemsfanchasticommsNo ratings yet

- TAXATION 2 Chapter 5 Estate Tax Payable PDFDocument5 pagesTAXATION 2 Chapter 5 Estate Tax Payable PDFKim Cristian MaañoNo ratings yet

- Answer: 2,000,000 Solution:: Sample ProblemDocument17 pagesAnswer: 2,000,000 Solution:: Sample ProblemJohayra AbbasNo ratings yet

- Determination of The Net Taxable Estate Illustration 1: Single Resident or Citizen DecedentDocument14 pagesDetermination of The Net Taxable Estate Illustration 1: Single Resident or Citizen DecedentLea ChermarnNo ratings yet

- EncodedDocument8 pagesEncodedMary Benedict AbraganNo ratings yet

- Illustrations PDFDocument3 pagesIllustrations PDFCharrey Leigh FormaranNo ratings yet

- Tandem Activity GE Allowable DeductionsDocument6 pagesTandem Activity GE Allowable DeductionsErin CruzNo ratings yet

- Pe On Estate TaxDocument25 pagesPe On Estate TaxErica NicolasuraNo ratings yet

- Solutions To Problems: Pe On Estate TaxDocument11 pagesSolutions To Problems: Pe On Estate TaxErica NicolasuraNo ratings yet

- Activity 6Document4 pagesActivity 6Mystic LoverNo ratings yet

- Chapter 5Document6 pagesChapter 5Briggs Navarro BaguioNo ratings yet

- Chapter 5 - Estate Tax2013Document12 pagesChapter 5 - Estate Tax2013Anjo Ellis100% (2)

- M6 - Estate Tax Payable Students'Document17 pagesM6 - Estate Tax Payable Students'micaella pasionNo ratings yet

- Answers To Assignment 1 and Problem Exercises Taxation2Document4 pagesAnswers To Assignment 1 and Problem Exercises Taxation2Dexanne BulanNo ratings yet

- Business and Transfer Taxes Problem HDocument1 pageBusiness and Transfer Taxes Problem HAcctg101No ratings yet

- Estate Tax PayableDocument8 pagesEstate Tax PayableHazel Jane Esclamada100% (2)

- Project Taxation (Ouano)Document16 pagesProject Taxation (Ouano)GuiltyCrownNo ratings yet

- Exercises On Estate Tax Additional ProblemsDocument8 pagesExercises On Estate Tax Additional ProblemsMidas Troy VictorNo ratings yet

- Copy 3 ACC 321 Sample Problems For Estate Taxation of Married Individuals and Computation of Tax CreditDocument2 pagesCopy 3 ACC 321 Sample Problems For Estate Taxation of Married Individuals and Computation of Tax CreditMitsuke MitsukeNo ratings yet

- Vanishing Deductions X Estate Tax ComputationDocument2 pagesVanishing Deductions X Estate Tax ComputationShiela Mae OblanNo ratings yet

- Taxation Suggested SolutionsDocument3 pagesTaxation Suggested SolutionsSteven Mark MananguNo ratings yet

- Problem 1: Net Taxable Estate 530,000 75,000 605,000Document3 pagesProblem 1: Net Taxable Estate 530,000 75,000 605,000camscamsNo ratings yet

- Answer To Assignment No. 2Document1 pageAnswer To Assignment No. 2Sophia Angelica Marie MarasiganNo ratings yet

- NCR Frontliners 2017 TaxDocument12 pagesNCR Frontliners 2017 Taxjsus22No ratings yet

- Estate and Donors Tax in Re TRAIN LAWDocument8 pagesEstate and Donors Tax in Re TRAIN LAWRona RososNo ratings yet

- RECITATIONDocument3 pagesRECITATIONSoremn PotatoheadNo ratings yet

- Tax Credit For Foreign Estate Tax Paid and Net Distributable EstateDocument16 pagesTax Credit For Foreign Estate Tax Paid and Net Distributable EstateAlmeera KalidNo ratings yet

- ActivityDocument4 pagesActivityDom PaciaNo ratings yet

- Sample Computaion of Estate TaxDocument6 pagesSample Computaion of Estate TaxlheyniiNo ratings yet

- Estate Tax - Exercises On Allowable Deduction and Taxable Net EstateDocument5 pagesEstate Tax - Exercises On Allowable Deduction and Taxable Net EstateGileah ZuasolaNo ratings yet

- Prelim TaskDocument8 pagesPrelim TaskHeidi KaterineNo ratings yet

- Tax ComputationDocument10 pagesTax ComputationCZARINA AUDREY SILVANONo ratings yet

- TaxfinDocument3 pagesTaxfinShr BnNo ratings yet

- Exercise 7-7. Multiple Choice Problem: Items 1 and 2 Are Based On The Following InformationDocument14 pagesExercise 7-7. Multiple Choice Problem: Items 1 and 2 Are Based On The Following InformationSheie WiseNo ratings yet

- Ae 208 Bustax ProblemDocument3 pagesAe 208 Bustax ProblemPaulo OronceNo ratings yet

- Semi Quiz 1Document2 pagesSemi Quiz 1jp careNo ratings yet

- Aec10 - Business Taxation Solution Tabag CH4Document8 pagesAec10 - Business Taxation Solution Tabag CH4EdeksupligNo ratings yet

- Computation Gross EstateDocument6 pagesComputation Gross Estatemusic lyricsNo ratings yet

- Screenshot 2023-08-09 at 6.20.34 PMDocument1 pageScreenshot 2023-08-09 at 6.20.34 PMelvirapcolumnaNo ratings yet

- CHAPTER 15 - Transfer Business TaxDocument9 pagesCHAPTER 15 - Transfer Business TaxKatKat Olarte67% (3)

- Chapter 8-1. ProblemsDocument10 pagesChapter 8-1. ProblemsCloudKielGuiangNo ratings yet

- 2019-0443 - Osorio, Pauline - II-12 - ACED 18 - Reinforcement 4Document3 pages2019-0443 - Osorio, Pauline - II-12 - ACED 18 - Reinforcement 4Keddy GorospeNo ratings yet

- 04 - Task - Performance - 1 (10) BUSTAXDocument5 pages04 - Task - Performance - 1 (10) BUSTAXAries Christian S PadillaNo ratings yet

- 598481Document10 pages598481btstanNo ratings yet

- Problem 1 Communal PropertiesDocument11 pagesProblem 1 Communal PropertiesJuanaNo ratings yet

- Taxation Cup SeriesDocument5 pagesTaxation Cup SeriesGlaiza Atillo Batuto Orgino100% (1)

- Estate Tax Activities (Questions)Document4 pagesEstate Tax Activities (Questions)Christine Nathalie BalmesNo ratings yet

- Chapter 4 - Property RelationsDocument7 pagesChapter 4 - Property RelationsRachelNo ratings yet

- Bryan Moises PDFDocument5 pagesBryan Moises PDFMary DenizeNo ratings yet

- Illustration Deduction and Taxable EstateDocument8 pagesIllustration Deduction and Taxable EstateLadybellereyann A TeguihanonNo ratings yet

- 16Document11 pages16Sheie WiseNo ratings yet

- Chapter 15 - Estate Tax Payable: Multiple Choice - TheoryDocument12 pagesChapter 15 - Estate Tax Payable: Multiple Choice - TheorytruthNo ratings yet

- Less: Ordinary: P 12,400,000 (A) P 19,500,000 (B)Document4 pagesLess: Ordinary: P 12,400,000 (A) P 19,500,000 (B)Mystic LoverNo ratings yet

- Deductions From The Gross Estate Supplementary Pro 230712 100820Document8 pagesDeductions From The Gross Estate Supplementary Pro 230712 100820nichNo ratings yet

- Lesson 3 ActivityDocument5 pagesLesson 3 ActivityVjoy LimNo ratings yet

- Wealth Management Planning: The UK Tax PrinciplesFrom EverandWealth Management Planning: The UK Tax PrinciplesRating: 4.5 out of 5 stars4.5/5 (2)

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Property & Taxation: A Practical Guide to Saving Tax on Your Property InvestmentsFrom EverandProperty & Taxation: A Practical Guide to Saving Tax on Your Property InvestmentsNo ratings yet

- Logistics ManagementDocument1 pageLogistics Managementcjmarie.cadenasNo ratings yet

- CHAPTER 1 - 3 (GROUP 6) pt.4 (Repaired)Document54 pagesCHAPTER 1 - 3 (GROUP 6) pt.4 (Repaired)cjmarie.cadenasNo ratings yet

- Western Institute of Technology BSTM A Feasibility Study Chapters 1 7Document169 pagesWestern Institute of Technology BSTM A Feasibility Study Chapters 1 7cjmarie.cadenasNo ratings yet

- 62a07e0326202 Perez tmc224 RRLDocument6 pages62a07e0326202 Perez tmc224 RRLcjmarie.cadenasNo ratings yet

- SST 01Document1 pageSST 01OSAMANo ratings yet

- Emerging Jurisprudence in The Law of Arbitration in KenyaDocument35 pagesEmerging Jurisprudence in The Law of Arbitration in KenyaIbrahim Abdi AdanNo ratings yet

- Works Contract Service and Construction ServiceDocument17 pagesWorks Contract Service and Construction Serviceavinash rai100% (1)

- iPM Operator's Manual - V12.0 - EN PDFDocument318 pagesiPM Operator's Manual - V12.0 - EN PDFmarceNo ratings yet

- Armscor 1400Document7 pagesArmscor 1400JustinNo ratings yet

- Assignment # 2 - EMERGING MARKETSDocument2 pagesAssignment # 2 - EMERGING MARKETSPrincessqueenNo ratings yet

- University of San Jose-Recoletos College of Law: Magallanes Street, Cebu CityDocument25 pagesUniversity of San Jose-Recoletos College of Law: Magallanes Street, Cebu CityJanileahJudetteInfanteNo ratings yet

- Madarang V MoralesDocument5 pagesMadarang V MoralesJayMichaelAquinoMarquez100% (1)

- International Investment LawDocument28 pagesInternational Investment LawSuyash GuptaNo ratings yet

- Sim900 DatasheetDocument4 pagesSim900 DatasheetNatasha AgarwalNo ratings yet

- FPT - Case Digest Corpo (Riano)Document30 pagesFPT - Case Digest Corpo (Riano)Pamela DeniseNo ratings yet

- Malto v. PeopleDocument5 pagesMalto v. PeoplePaolo BañaderaNo ratings yet

- United States v. Glennis L. Bolden, United States of America v. Clifford E. Bolden, 325 F.3d 471, 4th Cir. (2003)Document41 pagesUnited States v. Glennis L. Bolden, United States of America v. Clifford E. Bolden, 325 F.3d 471, 4th Cir. (2003)Scribd Government DocsNo ratings yet

- Annualreport English2020 21Document232 pagesAnnualreport English2020 21Arun SNo ratings yet

- Laws of Motion RotDocument53 pagesLaws of Motion RotGyrot Gan100% (1)

- Register of Wages in Form X Rule 26 (1) or Form V Rule (29) (1) (Min. Wages Act)Document4 pagesRegister of Wages in Form X Rule 26 (1) or Form V Rule (29) (1) (Min. Wages Act)Praveen KumarNo ratings yet

- Sharmeen Obaid ChinoyDocument6 pagesSharmeen Obaid Chinoymehwish afzalNo ratings yet

- Manual AMOS M&P Vrs. 9.2 User GuideDocument174 pagesManual AMOS M&P Vrs. 9.2 User Guideured cizminNo ratings yet

- Barangay Zamora-Melliza City Proper: Annex G-2 Attachment 3-B: Capacity Development Requirements For BarangaysDocument4 pagesBarangay Zamora-Melliza City Proper: Annex G-2 Attachment 3-B: Capacity Development Requirements For BarangaysVillanueva YuriNo ratings yet

- Ccj-Ojt Orientation Section 4-DELTA 23 February 2021 0700H - 13000HDocument41 pagesCcj-Ojt Orientation Section 4-DELTA 23 February 2021 0700H - 13000HMjay MedinaNo ratings yet

- Threat PreventionDocument34 pagesThreat PreventionMahmud AbdullahNo ratings yet

- Biographical MethodDocument18 pagesBiographical MethodStephen Waddell100% (1)

- State Government Securities As On Year of Maturity Date of Maturity Issue Price (RS.)Document74 pagesState Government Securities As On Year of Maturity Date of Maturity Issue Price (RS.)piupahoneyNo ratings yet

- 17 MAR 2019 EZS8476 16:00 11A SB 16:30 Ewsl7Tx S637: (LGW) London Gatwick (North Terminal) (GVA) GenevaDocument1 page17 MAR 2019 EZS8476 16:00 11A SB 16:30 Ewsl7Tx S637: (LGW) London Gatwick (North Terminal) (GVA) GenevaZubaidah ZamNo ratings yet

- Aurelio V Aurelio DigestDocument1 pageAurelio V Aurelio DigestJolo RomanNo ratings yet

- DRBC Permit For Nestle Deer Park's Interceptor Well To Reduce Groundwater Pollution at Its Bangor PA FacilityDocument11 pagesDRBC Permit For Nestle Deer Park's Interceptor Well To Reduce Groundwater Pollution at Its Bangor PA FacilityDickNo ratings yet

- Administrative ExpensesDocument2 pagesAdministrative ExpensessweetpotatoNo ratings yet

- Law of TortsDocument35 pagesLaw of TortsRishabh Nayyar100% (1)

- Form No.-11Document4 pagesForm No.-11Siddharth PednekarNo ratings yet