0% found this document useful (0 votes)

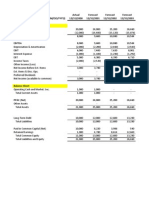

50 views7 pages2008 Financial Forecast Analysis

The document contains financial forecasts for a company for the years 2007 and 2008. It includes forecasts for line items like sales, costs, assets, liabilities, equity. It also contains calculations for additional funds required and how that amount could be raised through various financing options like new debt or equity.

Uploaded by

abdulsammad13690Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

50 views7 pages2008 Financial Forecast Analysis

The document contains financial forecasts for a company for the years 2007 and 2008. It includes forecasts for line items like sales, costs, assets, liabilities, equity. It also contains calculations for additional funds required and how that amount could be raised through various financing options like new debt or equity.

Uploaded by

abdulsammad13690Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd