Professional Documents

Culture Documents

Joel H Slomsky Financial Disclosure Report For 2009

Uploaded by

Judicial Watch, Inc.Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Joel H Slomsky Financial Disclosure Report For 2009

Uploaded by

Judicial Watch, Inc.Copyright:

Available Formats

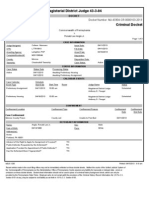

ao t0

tcev. 1/~oto

FINANCIAL DISCLOSURE REPORT

FOR CALENDAR YEAR 2009

2. Court or Organization Eastern District of Pennsylvania 5a. Report Type (check appropriate L,~) [] Nomination, Date I [] A ........ [] Final

R~t,,,,, Required by the Ethicx

in Government Act of 197,$

~5 u.s.c. .pp. ~oJ-tH)

3. Date of Report 04/06~010 6. Reporting Period 01101/2009 tO 12/31/2009

1. Person Reporting 0ast name. first, middle initial) Slomsky, Joel tl. 4. Title (Article Ill judges indiuate active ot senior $1atus; magistrate judges indicate f - or par -time) District Judge-active

[] hfitia|

5b. [] Amended Report 7. Chambers or Off-ice Address Urtited States Courthouse 601 Market Street Philadelphia, Pennsylvania 19106 8. On the basis of the information contained in Ibis Report and aoy modifications pertaining thereto, it is, in my opinion, in compliance with applicable laws and regulations. Reviewing Officer__ __ Date

IMPORTANT NOTES: The instructions accompanying this form must be followed. Complete all parts,

checking the NONE box for each part where you have no reportable informatioa. Sign on last page.

I. POSITIONS. ~,~o,~,~g individual only; seepp. 9-13 of filing in.~tr~,ctions.)

NONE (No reportable positions.)

POSITION

1. 2. 3. 4. 5.

NAME

II. AG~EMENTS. (Reposing inairiduM only; see pp. 14-I6 of filing i .....

NONE (No reportable agreements.)

aionx.)

DATE

1. 2009

PARTIES AND TE~S

loel II~ey Slomsky Individual Retirement Account (IRA), control

Slomsky, Joel H.

FINANCIAL DISCLOSURE REPORT Page 2 of I 1

N .... rPer~n Reporting S~on,sky, Joel n.

Date of Report

0~/06/20Z0

III. NON-INVESTMENT INCOME. tne, o,to,~ individual ana sp ....

A. Filers Non.Investment Income

NONE (No reportable non-investment income.) DATE SOURCE AND ~PE Joel Ha~ey Slomsky. ~quire--Law Fi~

; see pp. 17-24of filing instructions.)

(),ours, not spousesl $1,288.~

1. 2009 2. 3. 4.

B. Spouses No~-l~vgslmg~I l~ome - lf you were mar~ed du~ng any po~on of th~ repoaing year. complete this section.

~ Dollar amount not required e.rceptfor honoraria.)

NONE (No reportable non-invesm~ent income.)

SOURCE AND TYPE

1.2009 :; 2. 3. 4.

IV. REIMBURSEMENTS --tranxportation, ladglng, food, enter~al ....

(bwhtdes those to spouse and dep~t~cnt chihtrtn; .see pp. 25-27 of filing inst~tctions I

t.

NONE (No reportable reimbursements.) ~ ~ 3/27-28/2~9 LOCATION New York. New York PURPOSE Annual Event to Honor Fedcr~ Judges ITEMS PAID OR PROVI DED Itolel, Food, Transpoflation, Seminar

1.

New York Intellectual Pro~ny Lawyers Assn.

3. 4. 5.

FINANCIAL DISCLOSURE REPORT Page 3 of 11

: Name of Person Reporting

Slomsky, Joel H.

Dale of Report

04/06~010

[]

NONE (No reportable gifts.) S__QURCE DESCRIPTION VALUE

1.

2. 3.

4.

5.

VI. LIABILITIES. ancl,,d,, ,h ..... ,.t,~, ........ d dependent children; see pp. 32-33 of filing instructions.)

NONE (No reportable liabilities.)

CREDITOR

1. 2. 3. 4. 5.

DESCRIPTION

VALUE CODE

Name of Person Reporting

Date of Report

FINANCIALpage 4 of 11 DISCLOSURE REPORT I

Slomsky, Joel H.

04/06/2010

NONE (No reportable income, assets, or transactions.)

g.

Description of Assets (including trust assets) Place "(X)" after each asset exempt from prior disclosure

~.

Income during reporting period Amount Type le.g., : Code 1 ] div.. rent, or int.l i (A-H) [

C.

Gross value at end of reporting period Value Code 2 (J-P) Value " Method i Code 3 [ Type (e.g., ] buy. sell. l ! redemptionl

" ..... D. ...............

Transactions during reixFting period ~ Date i a, alue [ Gain I mm!dd/yy Code 2 Code I i (J-P) I (A-H) Identity of buyer/seller (itprivate

1.

IRA # 1 --Vanguard Wellington Fund

Dividend

T Sold Sold Buy Sold 03/02/09 03/02/09 03/0~09 06/05/09 K K I. L A A

3, 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17.

-Vanguard Star Fund --Vanguard Bond Index Fund-lnterpnediate Term --Vanguard Bo~d Index Fund-Intermediate Term IRA #2 --First Merchants Bank NA (CD) --Morgan Stanley Bank (CD) --Fidelity Money Market Account IRA #3 --Ivy Asset Strategy Fund --Vangua.rd Wellington Fund --Vanguard Star Fund --Vanguard Bond Index Fund-Intermediate Term --U.S. Treasury Strip --Israel State Bond --BancoPopular(CD) F lnt./Div. PI T B Interest K T

Sold Sold Sold Sold M~.tured

03/072/09 03102109 03102109 06/08109 02/17109

K K K K L

A A A B C

Matured

11123109

2. Value Codes (See Columns CI and D3)

J =$15,000 Or lt,s.~ N ~$250,001 - $5~).000

K --,$15.001 - $50,000 0 =$.500,001 - S 1,000.000

L =$50.001 - $ 100.0(X) Pl =$1,000,001 - $L00),060

M :$ 100.001 - $250.000 P2 -~$ 5,000,001 - $25,000,1)00

Name of Person Rel~rfing

Date

PageFINANCIAL5 of 11 DISCLOSURE REPORT VII. INVESTMENTS and TRUSTS -. i ........

A~ .................

Descfpfion of Assets Place "(X)" aft~ e~h ~t exem~ fmtn prior di~losure

Slomsky, Joel It.

04/06/2.010

lue, t ....... lions ~lncludes those of spouse aM dependent children; see pp. 34-60 of filing instructions.)

NONE (No reportable income, assets, or transactions.)

~ ........

Income during

c. ......................

Gross v~ue at end of repo~iog period Value C~c 2 (J-P~ Value Method ~ Code 3 i Ty~ (e.g.. ~ buy. ~ell, rcdem~ion~

D.

Amount ~ C~e I (A-II)

"F)pe ~e.g.. div.. rent, tr int.l

~ Date I Value Gain ]m~d~ Code 2 ~ Code 1 I IJP) ~ (A-H) [

Identity of buyer/se~[er (if private

~

18. , 19. 20.

--BancoPopul~(CD) --B~ of the O~rkz (CD) --Clevel~d Stole Bank (CD) --DiscoverBank --East West Bank (CD) --Farmers and Merchants Bank (CD) --Foundations Bank (CD) --First Natitmal Bank (CD) --Magnet Bank (CDi --Paragon National Bank (CD) --Fidelity Money ZVlarket Account --Bank Clark County (CD) --Mercantile Bank (CD) --Mercantile Bank (CD) --Capital One Bank lISA (CD) --First Merchants Bank NA (CD) --Morgan Stanley Bank NA (CD) Merged (with line 30) Matured Matu~d Matured Matured Matured Matured Closcd Matured 02~09 1~14109 01/23109 01130109 02/10109 134/27/09 01/30109 0~0~09 K L L L K L M K A C A B A B A A Matured Matured 03113109 05126109 K L A B

~

2t. 22. ~3. 24. 25. 26.

27. -8. 29. 30.

31. 32. 33. 34.

Name of Person FINANCIAL DISCLOSURE REPORT [ Slomsky, Joel |1.Reporting Page 6 of 1 1

Date of Report

04/{)6/2011)

VII. INVESTMENTS and TRUSTS -- inco,.e, ,.~.e, , ...... ,ions (Inch, des those of sp ...... d dependent children; see pp. 34-60 of filing instructions.)

NONE (No reportable income, assets, or transactions.)

Description of Asset:i (including trust assets) Place "(X)" after each as~eI exempt from prior disclosure Gauss v:due at cad l ......during [ of reporting period i reporting period !Amuun! i Code I (A-B) Type (e,g., | Value div., rent, or int.) ; (J-P) { Value Type (e.g., Date I (JP} ! (A-It) (if private traslsacd on) Transac60ns dar ng reporting period

Code 3 redemptiou) (Q-W) i

35. 36.

--First Commercial Bank FL (CD) --First Commercial Bank FI (CD) Merged (wilh line 35)

37.

--GMAC Bank (CD) -.America Fund-Capital Income Builder 03/09/09 K A

~ 38.

Sold Matured

i

39. i 40. 41.

--Concord Bank (CD)

0~06/09

--Cowlitz Bank (CD) --Discover Bank (CD)

Malured Matured

02106/09 03~3109

K J

A A

42.

43.

--Discover Bank (CD)

--First National Bank (CD) Matured 01/30/09 t3~10/09 J L A

44.

--Magnet Bank (CD)

Matured

45. 46. 47. 48. 49. 50. 51.

--Fidelity Money Market Account --Bank North (CD) --First Chicago Bank and Trust (CD) --LegacyTcxa~ Bank (CD) --Legacy Bank of Texas (CD) --Bank of the Commonwealth of Virginia (CD) --Merrick Bank (CD)

Closed

01130/09

Buy Buy Buy Buy Buy

0~06109 02/06/09 02/06/09 02106/09 02/06/09

K J K K K

2. Value Cod~ i~ ~~:e Columns CI and D])

J =$t5.0~0 or le~ N :$250,001 - $500.0(X) P3 =$25.000.001 - $50.000,000

K =$15.L~)1 - $50.000 O

L =$50.001 - $100,0(1) P4 ~Morc than $50,0L~1.000

M =$100,.00! - 5250.(X10

FINANCIAL DISCLOSURE REPORT Page 7 of 11 VII. INVESTMENTS and TRUSTS .- ~ ........

Name or Person Relmr~ing

" Stomsk, a,~t ~. . ] ~.., tran,actions [Includes those q~p ...... d dependent chiMren; see pp. 34-60 of filing inst~ction,.)

NONE

reportable income, assets, or transactions.)

I Income durng ~ ~p~ing ~fi~ [Amount ~ C~e I ] (A-H) ~ Gross value at end ~ of reporting wdod Value[ Type (e.g., Method buy. sell. Code 3 ~ r~emption) (Q-W) Tran~caons during re~ng

~scdption of Assets (including ~st a~ts) PI~e(X~" ~fter ench asse~ exempt fromprior di~losu~

Value Ty~ (e.g.. ~ div.. rent, C~le 2 or iut.J , (J-P)

Date : Value ~mm/dd!yy [ Code 2 } . (J-P)

Gain Code 1 ~A-H) ~

Idemily of buyer/seller {if private tr~saction)

52.

--Georgia Bank and T~st Co. (CD)

Buy

021~/09

53. 54.

--Bank Union (CD) --Bank Union (CD)

Buy Buy

02126/~ 02126109 02126109~

K K

55. 56.

--Cit Bank (CD) --Cit Bank (CD)

Buy

Buy

02/26109

57. 58. 59. 60.

61.

--Mid Carolina Bank (CD) - Ch,u-ter Bank (CD) --Charter Bartk (CD) --Macon Bank (CD)

-DMB Community Bank (CD)

Buy Buy Buy Buy

Buy Buy

02.,26109 02/26109 !O2/26~09 103/05109

03105109 O3/05/09

K K K K

L K

62. 63. 64.

--DMB Community Bank (CD)

--First Jackson Bank (CD) --First Commericial Bank {Jackson, MS) (CD) --American Bank CD) --Commerce Bank (CD)

Buy

O3/05109

K K

Buy Buy Buy

03/05/09 03105109

65. 66.

03105109

67. 68.

--Commen:e Bank (CD --Crescent Bank (CD)

Buy Buy

03105/09 O3105109

K L

I. Income Gain Ct~J~): (See Columng B1 and D4} (See Columns C 1 and D3)

A mS 1,000 o,r 1~ F =$50.001 - $100,000 N -~250,001 - $500.000

B =$1,(~| - $2,500 G =$100.001 - $1,0003300 O =$500,~O I - $ I ,@~,000

C =$2.501 - $5.000 HI =$1,000,001 - $5,Ot_~.0~K/ PI =$1 .O00.001 - $5,000,000

D =$5.1~(; I - $15.001) H2 =More than $5,0(IO,000 P2 =$5.0(~.001. $25

E =$15,1XI I -

FINANCIAL DISCLOSURE REPORT Page 8 of 11

Na~e of Person Reporting Slomsky, Joel H.

[

Date oi" Report

04/06/2010 [

VII. INVESTMENTS and TRUSTS --~ .......... ...... AT-- .......

Description of Assets (including trust assets) Plane"(X)" after each asset exempt from prior disclosure

,.,, , ......,~o,, (Includes ,hose of ~p .......d dependent children; see pp. 34-60 of filing instructions.) I

[

[~ NONE (No reportable income, assets, or transactions.)

: ........B.

I i Income during reporting period

c.

Gross value at end of reporting period I Value [ Method Code3

" ........

Type (e.g., buy, sell. redemption)

~ ................

Transactions during reporting period

[Amount ~ Type (e.g., ] Value Code l t i di ........ , I Code2 orint.) { (J-P) I(A-H) i

~l) i (2)

. li~ i % ....

ib --(2i--i (3)i-M .... ~) ....

D~te ! Value Gain Im,rddd/vy i Code2 l Codel " { (J-P) I(A-H) hJentity of buyer/scller (ifpdvate

69.

--Salfie Mac Bank (CD)

Buy

03i2.6/09

70. 71. 72.

--SallieMae Bank(CD) --Great Southern Bank (CD) --Pacific Continental Bank (CD) --General Electric Capital (Bond) --Goldman Sachs Grouplnc. (Bond) --Genworth Financial Inc.(Bond) --Citigrouplnc. (Bond) --Prudential Financial Inc. (Bond) --American International Group(Bond) --Vanguard Wellington --Vanguard Total Bond Market Index Fund --Fidelity Money Market Account 1RA#4 --Vanguard Target Retirement 2045 Fund Flcxible Annuity Plan --Mutual of America Conservative Allocation Fund C Int./Div. L T A Diqdcnd J r

Buy Buy Buy Buy Buy Buy Buy Buy Buy Buy Buy

03/26/09 05108/I)9 06109109 106/02/09 ~06/0~09 ! 12/30/09 12/30/09 12/30/09 I~J30/09 06108/09 03110/09

K L J K K J J K J L L

i73.

74. 75. 76. 77. J78.

79. 80. 81. 82. 83. 84. 85.

1. I.come Gain Cedes:

^ =$1.000 or less

8 =1

FINANCIAL DISCLOSURE REPORT Page 9 of 1 1

S~me Of Persan Reporting I

Dale of Reporl

SIomsky, Joel H.

04/06~010

VII. INVESTMENTS and TRUSTS -- i ........

---]

A. Description of Assets (including trust assets) Place "IX)~ after each as,set exempt from prior disclosure ........................................... ~_ .... 86. --Mutual o[America Mid-Term Bond Fund --Mutual of America Moderate Allocation Fund --Mutual of America General Account

t lue, t ...... ions (Includes those of sp ..... nd dependent children; see pp. 34-60 of filing instructions.)

NONE (No reportable income, assets, or transactions.)

B.

[ Income during reporting period

C.

i

Tran~acfio~ls during ~epordng period

Gross value at end of reporting period Value .~ Code. (J-P)

!Amount J Type (e.g.. (_ode I I -. . ~v.,rent. [ (A-tl) . or int.I i

Datu Value i Gain Value l Type (e.g., Method [ buv,~l., mm/dd/yy ~ Code 2 Code I . Code 3 redempfion) i (JP) i (A-HI (Q-WI i i .......... Buy ~ 03/02/09 K i .................

Identity of bayertseller transactionl

87.

Sold

03/02R)9

88. 89. 90.

Tax Deferred Annuity --Mutual of America Conservative Allocation Fund --Mutual of America Mid-Term Bond Fund

Int./Div.

91.

Buy

03102109 i L

92. 93. 94. 95. 96.

--MutualofAmerica Moderate Allocation Fund --Mutual of America Interest Accumulatir, n

Aecoont

Sold

03102109

PNC Bank Money Maxket Account Citizens Bank Select Money Market Account Citizens Bank Checking Account

A B

Interest Interest None

L K J

T T T

]Name PageFINANCIAL10 of 1 1 DISCLOSURE REPORT I SIomsky, Joel IL

of Person Reporting

Date of Report

04106/2010

VII1. ADDITIONAL INFORMATION OR EXPLANATIONS. an~i~,a,~,,IR~,or.)

Part VII. Investments and Trusts: The Joel Harvey Slornsky, Esquire, 401(k) Prt~fit-Sharing Plan and the Joel Harvey Slomsky. Esquire. Defined Benefit Pension Plan. reported on the Financial Disclosure Form for 2008, were terminated as of December 31, 20{)8 and the a.sscts of the Pians were rolled over in 2009 into a new Joel H. Slomsky Individual Retirement Account (IRA/, which is listed in this Form as IRA #3 (lines I0 to 81)_ IRA #1, referred to o~a lines I to 5, held at Vanguard Mutual Funds was terminated in 2009 and the as~ts were also rolled over into the Joel I1. Slomsky Individual Retirement Account (IRA). which is listed in this Form at IRA #3 (lines I0 to 81). The assets in the Vanguard Wellinglon Accnunt (llne 79) were purchased in bc~th the IRA #1 ,~nd IRA #3 on various dates in 2009, beginning on 6/g/09, and are consolidated in line 79. The assets in the Vanguard Total Bond Market Index Fund (line ~0) were purchased and sold on various dates in 2009. beginning on 3/10/09, and are consolidated in line 80. The assets in the Vanguard Bond Index Fund-lntermediate Term (line 14) were also purchased and sold on various dates in 2009, beginning on 3/2/09, :and finally sold on 6/8/09. 111. Non-Investment Income: In 2009.1 received a fee in a case in which I had been appointed by the Third Circuit Court of Appeals to represenl an Appellant in an appeal of a criminal conviction and sentence. I was compensated for my services on the appeal only for the time I worked on Ihe ca.~e when 1 was still in private practice in 2008. I bacame a federal judge ~n October 8, 2008. The income listed as Non-lnvestment Income (line 1) is the income reported on a Schedule C (net profits) reported on my 2009 federal tax return.

FINANCIAL DISCLOSURE REPORT Page 1 1 of 1 1 IX. CERTIFICATION.

N~., or p~on R~po,~i.g

Slomsky, Joel H.

] t~t, or Re~,,,rt 04/06/2010 ]

I certify that all information given above (including information pertaining to my spoose and minor or dependent children, if any) is accnrate, true, and complete to the best of my knowledge and belief, and that any information not reported was withheld because it met applicable statulory provisions permitting non-disclosure. l further certify that earned income from ontside employment and honoraria and the acceptance of gifts which have been reported are in compliance with the provisions of 5 U.S.C. app. 501 ct. seq., 5 U.S.C. 7353, and Judicial Conference regulations.

Siguaturet NOTE: ANY INDIVIDUAL WHO KNOWINGLY AND WILFULLY FALSIFIES OR FAILS TO FILE THIS REPORT MAY BE SUBJECT TO CIVIL AND CRIMINAL SANCTIONS (5 U.S.C. app. 104)

FILING INSTRUCTIONS Mail signed original and 3 additional copies to: Committee on Financial Disclosure Administrative Office of the United States Courts Suite 2-301 One Columbus Circle, N.E. Washington, D.C. 20544

You might also like

- 2161 DocsDocument133 pages2161 DocsJudicial Watch, Inc.83% (12)

- 1878 001Document17 pages1878 001Judicial Watch, Inc.100% (5)

- CC 081213 Dept 14 Lapp LDocument38 pagesCC 081213 Dept 14 Lapp LJudicial Watch, Inc.No ratings yet

- 1488 09032013Document262 pages1488 09032013Judicial Watch, Inc.100% (1)

- 11 1271 1451347Document29 pages11 1271 1451347david_stephens_29No ratings yet

- State Dept 13-951Document4 pagesState Dept 13-951Judicial Watch, Inc.No ratings yet

- Stamped Complaint 2Document5 pagesStamped Complaint 2Judicial Watch, Inc.No ratings yet

- July 2007 BulletinDocument23 pagesJuly 2007 BulletinJudicial Watch, Inc.No ratings yet

- Stamped ComplaintDocument4 pagesStamped ComplaintJudicial Watch, Inc.No ratings yet

- Gitmo Freezer Inspection ReportsDocument4 pagesGitmo Freezer Inspection ReportsJudicial Watch, Inc.No ratings yet

- Gitmo Freezer Inspection ReportsDocument4 pagesGitmo Freezer Inspection ReportsJudicial Watch, Inc.No ratings yet

- CVR LTR SouthCom Water Safety ProductionDocument2 pagesCVR LTR SouthCom Water Safety ProductionJudicial Watch, Inc.No ratings yet

- SouthCom Water Safety ProductionDocument30 pagesSouthCom Water Safety ProductionJudicial Watch, Inc.No ratings yet

- JTF GTMO Water Safety App W ExhDocument13 pagesJTF GTMO Water Safety App W ExhJudicial Watch, Inc.No ratings yet

- Cover Letter To Requester Re Response Documents130715 - 305994Document2 pagesCover Letter To Requester Re Response Documents130715 - 305994Judicial Watch, Inc.No ratings yet

- Model UNDocument2 pagesModel UNJudicial Watch, Inc.No ratings yet

- December 2005Document7 pagesDecember 2005Judicial Watch, Inc.No ratings yet

- June 2004Document17 pagesJune 2004Judicial Watch, Inc.No ratings yet

- September 2004Document24 pagesSeptember 2004Judicial Watch, Inc.No ratings yet

- LAUSD Semillas AckDocument1 pageLAUSD Semillas AckJudicial Watch, Inc.No ratings yet

- 13-1150 Response Re Judicial WatchDocument1 page13-1150 Response Re Judicial WatchJudicial Watch, Inc.No ratings yet

- Atlanta IntraregionalDocument4 pagesAtlanta IntraregionalJudicial Watch, Inc.No ratings yet

- July 2006Document24 pagesJuly 2006Judicial Watch, Inc.No ratings yet

- 13-1150 Responsive Records 2 - RedactedDocument29 pages13-1150 Responsive Records 2 - RedactedJudicial Watch, Inc.No ratings yet

- December 2005 Bulletin 2Document14 pagesDecember 2005 Bulletin 2Judicial Watch, Inc.No ratings yet

- STAMPED ComplaintDocument4 pagesSTAMPED ComplaintJudicial Watch, Inc.No ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Plagiarism Mariano Del CastilloDocument3 pagesPlagiarism Mariano Del CastilloJerome Aviso100% (1)

- Timothy Thomas v. Diana Thomas, 3rd Cir. (2013)Document6 pagesTimothy Thomas v. Diana Thomas, 3rd Cir. (2013)Scribd Government DocsNo ratings yet

- Motion For Writ of Execution-DannaraDocument4 pagesMotion For Writ of Execution-DannaraJose BonifacioNo ratings yet

- WWW Lawteacher Net Free Law Essays English Legal System HighDocument21 pagesWWW Lawteacher Net Free Law Essays English Legal System Highravi_bhateja_2No ratings yet

- Capilano Honey LTD V Dowling (No 2) (2018) NSWCA 217Document44 pagesCapilano Honey LTD V Dowling (No 2) (2018) NSWCA 217Anonymous SEraxYuGjNNo ratings yet

- Season 1, Episodes 1-10 Questions & Activities: Making - A - MurdererDocument76 pagesSeason 1, Episodes 1-10 Questions & Activities: Making - A - Murderershaney ONeal0% (2)

- Philippine School Business Admin. v. CADocument1 pagePhilippine School Business Admin. v. CAPia Janine ContrerasNo ratings yet

- PUNONGBAYAN-VISITACION Vs PEOPLE G.R. No. 194214, January 10, 2018 PDFDocument10 pagesPUNONGBAYAN-VISITACION Vs PEOPLE G.R. No. 194214, January 10, 2018 PDFRPSMU CORDILLERANo ratings yet

- 001 - 2006 - Arbitration Law-1 PDFDocument27 pages001 - 2006 - Arbitration Law-1 PDFkrishnakumariramNo ratings yet

- Bouvier Law Dictionary 1856 - CDocument210 pagesBouvier Law Dictionary 1856 - CTRUMPET OF GODNo ratings yet

- CARR v. BOMBARDIER AEROSPACE CORPORATION DocketDocument1 pageCARR v. BOMBARDIER AEROSPACE CORPORATION DocketbombardierwatchNo ratings yet

- DEARBC vs. Sangunay and LabunosDocument9 pagesDEARBC vs. Sangunay and LabunosAJ AslaronaNo ratings yet

- Warrant Recal in Absence of The Accused PDFDocument4 pagesWarrant Recal in Absence of The Accused PDFRaja RNo ratings yet

- Go29 PDFDocument6 pagesGo29 PDFEso EeplNo ratings yet

- (Melongo v. Spizzirri Et Al) 6/9/15 Order by Judge John Z. LeeDocument13 pages(Melongo v. Spizzirri Et Al) 6/9/15 Order by Judge John Z. LeePeter M. HeimlichNo ratings yet

- 2014-01-28 USA v. Vleisides TranscriptDocument117 pages2014-01-28 USA v. Vleisides TranscriptArs TechnicaNo ratings yet

- 2/14/2010, Larry Tanoury: The Leon Koziol I KnowDocument5 pages2/14/2010, Larry Tanoury: The Leon Koziol I KnowLeon R. KoziolNo ratings yet

- Right To A Fair TrialDocument22 pagesRight To A Fair TrialRitika RishiNo ratings yet

- Ron AngleDocument3 pagesRon Anglealpharomeo1999No ratings yet

- Evidence Digests Part 3Document33 pagesEvidence Digests Part 3cmv mendozaNo ratings yet

- Adrian Escalona Dominguez, A201 245 549 (BIA March 7, 2017)Document4 pagesAdrian Escalona Dominguez, A201 245 549 (BIA March 7, 2017)Immigrant & Refugee Appellate Center, LLCNo ratings yet

- Tan vs. CincoDocument2 pagesTan vs. CincoKing Badong67% (3)

- Dismiss For Failure To Join Necessary and Indispensable Partie-O&R.indisp - CGLDocument23 pagesDismiss For Failure To Join Necessary and Indispensable Partie-O&R.indisp - CGLRicharnellia-RichieRichBattiest-CollinsNo ratings yet

- 02 Pagcor Vs AugmentadoDocument2 pages02 Pagcor Vs AugmentadoPiaNo ratings yet

- Nominal and Temperate DamagesDocument16 pagesNominal and Temperate DamagesNadine BediaNo ratings yet

- United States v. Martin Carbajal-Tafolla, 4th Cir. (2014)Document5 pagesUnited States v. Martin Carbajal-Tafolla, 4th Cir. (2014)Scribd Government DocsNo ratings yet

- Specific Performance (Complaint)Document6 pagesSpecific Performance (Complaint)CarlMarkInopia100% (1)

- Castillo V EacutinDocument30 pagesCastillo V EacutinRvic CivrNo ratings yet

- Republic vs. CatubagDocument2 pagesRepublic vs. CatubagTheodore Dolar100% (2)

- Singed in The Presence ofDocument3 pagesSinged in The Presence ofRex TrayaNo ratings yet