Professional Documents

Culture Documents

2012 City of Lawrence Tax Classification

Uploaded by

Dan RiveraOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2012 City of Lawrence Tax Classification

Uploaded by

Dan RiveraCopyright:

Available Formats

CITY COUNCIL BUDGET & FINANCE SUB-COMMITTEE TAX CLASSIFICATION PRESENTATION

November 30, 2011

Presented By The Board Of Assessors

BACKGROUND

The Classification Act Requires Municipalities To Classify Real Property Into One Of Four Classes, According To Use: Residential, or Commercial, Industrial, And Personal Property (CIP). Cities That Are Certified as Assessing Property at Full And Fair Cash Value May Elect to Shift Tax Burden Among The Major Property Classes Within Certain Limits Established By Law. The Bureau Of Local Assessment Have Certified Lawrence as Assessing Property at Full And Fair Cash Value.

The Adoption Of Different Rates DOES NOT CHANGE the Total Property Tax Levy. Rather it Determines The Share Of The Total Levy To Be Borne By Each Class.

The Minimum Residential Factor Established By The Commissioner Of

Revenue Ensures That the shift of the tax burden complies with the Classification Act.

November 30, 2011 BOARD OF ASSESSORS CLASSIFICATION HEARING

CLASSIFICATION/ TAX RATE PROCESS

Step 1:

The Bureau of Local Assessment have certified Lawrence as assessing property at full and

fair cash value

Step 2:

The Board of Assessors will provide the councilors with information to select the

residential factor toward the determination of the rate for each class of property. A limited set of possible choices will be provided by the Board of Assessors, but City Councilors may, if desired, explore other tax rate combinations that meet their needs.

Step 3:

City Councilors are required to determine the percentage of the tax levy to be borne by

each class of real property: residential, commercial, industrial and by personal property (CIP). The decision is made after holding a public hearing. The Conclusion of the hearing MUST result in a vote of required choices

Step 4:

The split tax rates for Fiscal Year 2012 are certified by the Department of Revenue

Step 5:

Mail 3rd quarter actual bills January 1, 2012

November 30, 2011

BOARD OF ASSESSORS

CLASSIFICATION HEARING

CURRENT STATUS

Lawrence Completed The Triennial Revaluation (Once

every 3 Years) for all Real and Personal Property as Required by DOR For FY 2012. This Revaluation ensures that changes in market conditions are Reflected in the Current Assessment.

November 30, 2011

BOARD OF ASSESSORS

CLASSIFICATION HEARING

PREVIOUS YEAR LEVY LIMIT + 2-1/2 % + GROWTH + OVERRIDES

DETERMINE LEVY

DECISIONS BELOW DO NOT CHANGE LEVY

SINGLE RATE

YES

RESIDENTIAL & CIP RATE THE SAME

VERY HIGH

RESIDENTIAL

TAX RATE

NO

HIGHER RESIDENTIAL RATE & LOWER CIP RATE

LOW

FACTOR (1.00- 1.75)

HIGH

LOWER RESIDENTIAL RATE & HIGHER CIP RATE

1.75 MAXIMUM SHIFT OF TAX BURDEN TO CIP & LOWEST RESIDENTIAL TAX RATE

CITY OF LAWRENCE - BOARD OF ASSESSORS

5 CLASSIFICATION HEARING

WHAT IS NEW GROWTH?

New Growth is a calculation of the net increase in municipal property values because of new construction, improvements to properties, subdivisions, condo conversions, the return of exempt property to the tax rolls or new personal property accounts as well as new personal property equipment at existing locations. New Growth is added to the Citys Levy Limit, thereby increasing the Citys taxing capacity. Assessors must submit documentation of New Growth to the Bureau of Local

Assessment annually and receive approval prior to setting the tax rate. The assessed value of real estate and personal property New Growth during the twelve-month period January 1, 2010 to December 31, 2010 is $54,200,000. This Growth translates into $1,388,208 of increased tax levy capacity over the basic limits of Proposition 2 .

November 30, 2011

BOARD OF ASSESSORS

CLASSIFICATION HEARING

LEVY, LEVY LIMIT & EXCESS LEVY CAPACITY

Levy is the amount the City raises each year through Property Taxes . The Levy Limit is the Maximum amount the City can levy. FY 2012 Tax

Levy Limit increased by $2,672,250 over FY 2011. Excess Levy capacity is the difference between the Levy Limit and the Actual Levy.

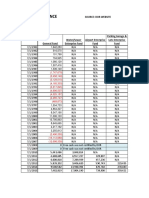

Levy Summary FY 2011 Levy FY11 Amended Growth Prop 2 1/2 Increase New Growth Overrides FY 2012 Maximum Levy FY 2012 Proposed Levy Excess Capacity

November 30, 2011 BOARD OF ASSESSORS

$49,642,351 $41,935 $1,242,107 $1,388,208 $0 $52,314,601 $52,314,601 $0

CLASSIFICATION HEARING

FY 2012 VALUES

Values are based on Sales in Calendar Year 2010 The residential values decreased by 0.70% and

commercial/industrial increased by 0.78%. The City of Lawrence Total FY2012 Property value is $2.843 Billion. This is a 0.39% decrease from FY 2011. The average single family home assessed value in FY 2012 is $176,836. This is a $1,413 decrease from FY 2011 average assessed value of $178,249.

November 30, 2011

BOARD OF ASSESSORS

CLASSIFICATION HEARING

PROPERTY VALUE CHANGE 2011 VS. 2012

Total Real Property Value FY2011 Total Real Property Value FY2012 Real Property Value Change Residential Property Value FY2011 Residential Property Value FY2012 Residential Value Change Commercial Property Value FY2011 Commercial Property Value FY2012 Commercial Value Change Industrial Property Value FY2011 Industrial Property Value FY2012 Industrial Value Change Personal Property Value FY2011 Personal Property Value FY2012 Personal Property Value Change Total Value FY 2011 Total Value FY 2012

November 30, 2011

$2,705,022,200.00 $2,693,646,700.00 ($11,375,500.00) $2,193,228,846.00 $2,177,867,654.00 ($15,361,192.00) $308,416,654.00 $313,314,846.00 $4,898,192.00 $203,376,700.00 $202,464,200.00 ($912,500.00) $149,199,370.00 $149,378,760.00 $179,390.00 $2,854,221,570.00 $2,843,025,460.00 ($11,196,110.00)

-0.42%

-0.70%

1.59%

-0.45%

0.12%

-0.39%

CLASSIFICATION HEARING

BOARD OF ASSESSORS

LARGEST TAXPAYERS

Total Assessed Valued

$37,161,700

$34,267,130 Verizon New England Inc $27,707,960

Mass Electric

Bay State Gas Bouwfonds Jefferson LP Lincoln Andover LLC

$205,884,560

$25,460,810

New Balance Athletic Shoe Hampton on Beacon Chi Energy Inc Lawrence/Methuen Props

$17,716,600

Princeton Andover Total

$14,682,500 $13,770,630

$13,240,430

$10,098,600 November 30, 2011 $11,778,200 BOARD OF ASSESSORS CLASSIFICATION HEARING

10

TAX LEVY- SINGLE TAX RATE

Tax Levy

FY 2012 Maximum Allowable Levy = $52,314,601 FY 2012 Estimated Levy = $ 52,314,601

FY 2012 Estimated Excess Capacity= $0

Total Value

FY 2012 Total Value = $2,843,025,460

FY 2012 Residential Value = $2,177,867,654 or 76.6039% of Total

Assessed Value. FY 2012 C.I.P. Value = $665,157,806 or 23.3961% of Total Assessed Value. Single Tax Rate $18.40 / $1,000

November 30, 2011

BOARD OF ASSESSORS

CLASSIFICATION HEARING

11

THE FACTOR - SHIFTING DEFINITION

Shifting allows the City to reduce the Residential Classes

(R.O.) tax burden while increasing the C.I.P. tax share. The combination of the two tax classification amounts must equal the total property tax. The chosen Factor for FY2011 was 1.75,which provided for maximum Tax Shifting, as allowed by law, from Residential to C.I.P. Continuing with a Factor of 1.75, the residential tax rate for FY 2012 would be $14.19, a $0.74 increase over FY 2011. The correspondent C.I.P. tax rate for FY 2012 would be $32.20, a $1.79 increase over FY 2011.

November 30, 2011 BOARD OF ASSESSORS CLASSIFICATION HEARING

12

THE FACTOR- SUMMARY

Total Levy FY 2012

$52,314,601

Shift Determined Based on (1.75)

C.I.P. Tax Share =40.9432% New C.I.P. Levy amount $21,414,740 Residential Tax Share = 59.0568%

Residential Levy Amount = $30,895,318

Residential Tax Rate

$14.19 / $1,000

C.I.P Tax Rate

$32.20 / $1,000

November 30, 2011 BOARD OF ASSESSORS CLASSIFICATION HEARING

13

FY 2012 TAX LEVY BREAKDOWN

Valuation Factor= 1.75 Valuation % Factor= 1.75 Valuation %

Tax Share TaxTax Share Share % %

FY 2012

Residential Residential Commercial Commercial Industrial Industrial $2,193,227,846 76.6039% 76.7590% $2,177,867,654 $311,487,554 $313,314,86 $203,376,700 $202,464,200 10.9015% 11.0205% 7.1178% 7.1214% $29,451,930 $30,895,318 $9,470,575 $10,089,304 $6,183,536 $6,519,713 59.3282% 59.0568% 19.0776% 19.2858% 12.4562% 12.4625%

Personal Personal

Total Total

$149,199,370 $149,378,760

5.2217% 5.2542%

$4,536,310 $4,810,266

9.1380% 9.1949%

$2,857,292,470 100.00% $2,843,025,460 100.0000%

$49,642,351 $52,314,601 100.0000% 100.00%

November 30, 2011

BOARD OF ASSESSORS

CLASSIFICATION HEARING

14

CHOICE OF TAX RATES

Various Tax Rate Factors are shown below Other choices are possible and can be shown if desired. As

a reminder, a factor below 1.75 will increase the residential tax bill.

Residential Factor 1.75 1.74 1.73 1.72

November 30, 2011

RO Rate $14.19 $14.24 $14.30 $14.35

RO Change $ From 2011 $0.74 $0.79 $0.85 $0.90

BOARD OF ASSESSORS

C.I.P Rate $32.20 $32.02 $31.83 $31.65

C.I.P. Change $ From 2011 $1.79 $1.61 $1.42 $1.24

CLASSIFICATION HEARING

* All $ are per $1,000 of Assessed Value

15

FACTOR COMPARISON

Below is a comparison of a factor of 1.75 and 1.72

Factor of 1.75 FY 2011 Avg Value Tax Avg Tax Rate $186,769 $13.45 $2,512 $316,416 $30.41 $9,622 $1,001,856 $30.41 $30,466 FY 2011 Factor of 1.75 $186,769 $13.45 $316,416 $30.41 $1,001,856 $30.41 Factor of 1.75 FY 2012 Avg Value Tax Avg Tax Delta $ Delta % Rate $185,138 $14.19 $2,627 $115 4.58% $321,371 $32.20 $10,348 $726 7.54% $965,790 $32.20 $31,098 $632 2.07% FY 2012 Factor of 1.72 $185,138 $14.35 $321,371 $31.65 $965,790 $31.65

Class Res Com Ind

Res Com Ind

$2,512 $9,622 $30,466

$2,657 $10,171 $30,567

$145 $549 $101

5.76% 5.71% 0.33%

November 30, 2011

BOARD OF ASSESSORS

CLASSIFICATION HEARING

16

OTHER FACTORS IMPACT

November 30, 2011

BOARD OF ASSESSORS

CLASSIFICATION HEARING

17

OTHER FACTORS IMPACT (CONT.)

November 30, 2011

BOARD OF ASSESSORS

CLASSIFICATION HEARING

18

AVERAGE TAX BILL IMPACT ANALYSIS FISCAL YEAR 2012 VS. 2011 (1.75 Factor)

November 30, 2011

BOARD OF ASSESSORS

CLASSIFICATION HEARING

19

AVERAGE TAX BILL IMPACT ANALYSIS FISCAL YEAR 2012 VS. 2011 (1.73 Factor)

November 30, 2011

BOARD OF ASSESSORS

CLASSIFICATION HEARING

20

AVERAGE TAX BILL IMPACT ANALYSIS FISCAL YEAR 2012 VS. 2011 (1.71 Factor)

November 30, 2011

BOARD OF ASSESSORS

CLASSIFICATION HEARING

21

AVERAGE TAX BILL IMPACT ANALYSIS FISCAL YEAR 2012 VS. 2011 (1.70 Factor)

November 30, 2011

BOARD OF ASSESSORS

CLASSIFICATION HEARING

22

AVERAGE TAX BILL IMPACT ANALYSIS FISCAL YEAR 2012 VS. 2011 (CONT.)

November 30, 2011

BOARD OF ASSESSORS

CLASSIFICATION HEARING

23

PROPERTY TAX ANALYSIS CLASSIFICATION AVERAGE VALUE FISCAL YEAR 2012 VS. 2011

* 1.75 Factor

November 30, 2011

BOARD OF ASSESSORS

CLASSIFICATION HEARING

24

WHATS NEXT?

Full Council Vote on the Classification Factor Upon the Commissioners determination that the percentages meet statutory requirements and the public hearing has been held, the assessors will submit to the Bureau of Accounts the local tax rates for final approval. Councilors certify the excess levy capacity on recap. (Form LA5). This will happen after full Council Meeting.

November 30, 2011

BOARD OF ASSESSORS

CLASSIFICATION HEARING

25

DISCUSSION

November 30, 2011

BOARD OF ASSESSORS

CLASSIFICATION HEARING

26

CONCLUSION OF CLASSIFICATION PRESENTATION

November 30, 2011

BOARD OF ASSESSORS

CLASSIFICATION HEARING

27

You might also like

- Question 67 (5 Minutes) (Chapter 14)Document59 pagesQuestion 67 (5 Minutes) (Chapter 14)Vu Khanh LeNo ratings yet

- Constitutional Law OutlineDocument49 pagesConstitutional Law Outlinemaxcharlie1No ratings yet

- Nature of Public PolicyDocument8 pagesNature of Public Policykimringine100% (1)

- LMT 2011 1st Quarter Finance ReportDocument14 pagesLMT 2011 1st Quarter Finance ReportBucksLocalNews.comNo ratings yet

- Introduced Budget InformationDocument3 pagesIntroduced Budget InformationAndrew CasaisNo ratings yet

- Town of Galway: Financial OperationsDocument17 pagesTown of Galway: Financial OperationsdayuskoNo ratings yet

- Classification Hearing FY2013Document38 pagesClassification Hearing FY2013trcNo ratings yet

- Ncies' Compliance With Small Business Enterprise Expediture Goals For The 1st, 2nd, and 3rd Quaters For Fiscal Year 2011Document34 pagesNcies' Compliance With Small Business Enterprise Expediture Goals For The 1st, 2nd, and 3rd Quaters For Fiscal Year 2011John Vaught LaBeaumeNo ratings yet

- HW#2Document6 pagesHW#2Kristy WuNo ratings yet

- Correction ActivityDocument5 pagesCorrection ActivityGlizette SamaniegoNo ratings yet

- Community Budget Workshop 2011 Slides Presented by Mayor Leo Wiegman (Updated With Moody's Bond Rating 3/2/2011)Document19 pagesCommunity Budget Workshop 2011 Slides Presented by Mayor Leo Wiegman (Updated With Moody's Bond Rating 3/2/2011)crotondemsNo ratings yet

- City of Los Angeles Budget Overview Presentation 2012Document35 pagesCity of Los Angeles Budget Overview Presentation 2012Bill RosendahlNo ratings yet

- Quarterly Budget Report: City of ChicagoDocument14 pagesQuarterly Budget Report: City of ChicagoZoe GallandNo ratings yet

- 2011 Preliminary Budget & Levy PresentationDocument15 pages2011 Preliminary Budget & Levy PresentationCity of HopkinsNo ratings yet

- 2011-2012 County RevenuesDocument23 pages2011-2012 County RevenuesMichael ToddNo ratings yet

- F1 - Financial OperationsDocument20 pagesF1 - Financial OperationsMarcin MichalakNo ratings yet

- 11-10-20 Memo From Susan Wright - Revenue ReportDocument3 pages11-10-20 Memo From Susan Wright - Revenue ReportOwenFDNo ratings yet

- Economic Focus 12-12-11Document1 pageEconomic Focus 12-12-11Jessica Kister-LombardoNo ratings yet

- Vanguarde PropertyDocument12 pagesVanguarde PropertySharon ANo ratings yet

- Accounting For Changing Prices (Inflation Accounting)Document6 pagesAccounting For Changing Prices (Inflation Accounting)Yudiyanto YudiyantoNo ratings yet

- 2012 Preliminary Budget & Levy PresentationDocument14 pages2012 Preliminary Budget & Levy PresentationCity of HopkinsNo ratings yet

- Countdown To Zero FINALDocument10 pagesCountdown To Zero FINALtscupeNo ratings yet

- Comptroller's DRAFT Audit of SchenectadyDocument19 pagesComptroller's DRAFT Audit of SchenectadyDavid LombardoNo ratings yet

- Llwe 2011 Tax Update NewsletterDocument2 pagesLlwe 2011 Tax Update NewsletterangiemanaNo ratings yet

- Dutchess County UnemploymentDocument10 pagesDutchess County Unemploymentapi-107641637No ratings yet

- WK 3 Textbook AssignmentDocument4 pagesWK 3 Textbook AssignmentTressa audellNo ratings yet

- On BudgetDocument17 pagesOn Budgetmittal_anishNo ratings yet

- Property Tax Reform DOF SlidesDocument25 pagesProperty Tax Reform DOF SlidesClarissa DegamoNo ratings yet

- Ac550 FinalDocument4 pagesAc550 FinalGil SuarezNo ratings yet

- Practice Exam Chapter 1-5 Part2Document5 pagesPractice Exam Chapter 1-5 Part2John Arvi ArmildezNo ratings yet

- Levy Limits: A Primer On Proposition 2: Massachusetts Department of Revenue Division of Local ServicesDocument15 pagesLevy Limits: A Primer On Proposition 2: Massachusetts Department of Revenue Division of Local ServicesbarnbeatNo ratings yet

- Review of FY 2013 Mid-Year Budget Monitoring ReportDocument22 pagesReview of FY 2013 Mid-Year Budget Monitoring Reportapi-27500850No ratings yet

- Summary of December Finance CommitteeDocument43 pagesSummary of December Finance CommitteeAthertonPOANo ratings yet

- Agriculture Law: RL33718Document20 pagesAgriculture Law: RL33718AgricultureCaseLawNo ratings yet

- 2012 Budget PresentationDocument29 pages2012 Budget PresentationCity of HopkinsNo ratings yet

- Principles of Accounting Chapter 14Document43 pagesPrinciples of Accounting Chapter 14myrentistoodamnhighNo ratings yet

- MnDOR LetterDocument3 pagesMnDOR LetterTim NelsonNo ratings yet

- (JOURNAL Pajak Daerah) 201350Document20 pages(JOURNAL Pajak Daerah) 201350Ryzky JamaludinNo ratings yet

- Angel Fund ChartDocument1 pageAngel Fund ChartRob PortNo ratings yet

- Council MPAC Assessment 2012 BriefingDocument20 pagesCouncil MPAC Assessment 2012 BriefingJon WillingNo ratings yet

- Dumont 2011 Municipal Data SheetDocument57 pagesDumont 2011 Municipal Data SheetA Better Dumont (NJ, USA)No ratings yet

- Alsip December 21 2009 Board SpecialDocument2 pagesAlsip December 21 2009 Board SpecialMy Pile of Strange 2013 Election CollectionNo ratings yet

- Fringe Benefits Tax - Rates and ThresholdsDocument4 pagesFringe Benefits Tax - Rates and Thresholdsmowr2001No ratings yet

- SLB Q311 Supp 102111Document4 pagesSLB Q311 Supp 102111CARLOS ANDRES GUEVARA MUNOZNo ratings yet

- 08 Book Special Rev 2011 BudgetDocument73 pages08 Book Special Rev 2011 BudgetseoversightNo ratings yet

- IrvingCC Packet 2011-09-01Document546 pagesIrvingCC Packet 2011-09-01Irving BlogNo ratings yet

- Zimplow FinancialsDocument60 pagesZimplow FinancialsMuteba Ngonga100% (1)

- Uses of Accounting Information and The Financial Statements - SolutionsDocument31 pagesUses of Accounting Information and The Financial Statements - SolutionsmacfinpolNo ratings yet

- Revised Fauquier County 2021 Proposed Budget SummaryDocument16 pagesRevised Fauquier County 2021 Proposed Budget SummaryFauquier NowNo ratings yet

- 2012 Tax Rate ReportDocument88 pages2012 Tax Rate ReportZoe GallandNo ratings yet

- Memorandum: City of DallasDocument13 pagesMemorandum: City of DallasDallasObserverNo ratings yet

- Case Study Accounting Policy, Changes in Accounting Estimate, and ErrorsDocument2 pagesCase Study Accounting Policy, Changes in Accounting Estimate, and ErrorsHAO HUYNH MINH GIANo ratings yet

- Conference Committee Agenda: February 23Document20 pagesConference Committee Agenda: February 23kyamamuraNo ratings yet

- Đinh Trang Linh - HS153055 - Individual Assignment 03Document4 pagesĐinh Trang Linh - HS153055 - Individual Assignment 03Tiến Thành HoàngNo ratings yet

- Chap 4Document7 pagesChap 4hcw49539No ratings yet

- CAS QuizDocument6 pagesCAS QuizLeng ChhunNo ratings yet

- 09 Book Debt Service 2011 BudgetDocument9 pages09 Book Debt Service 2011 BudgetseoversightNo ratings yet

- Estimated Full Value of Real Property in Cook County 2009 - 2018Document21 pagesEstimated Full Value of Real Property in Cook County 2009 - 2018Ann DwyerNo ratings yet

- Homeowner's Simple Guide to Property Tax Protest: Whats key: Exemptions & Deductions Blind. Disabled. Over 65. Property Rehabilitation. VeteransFrom EverandHomeowner's Simple Guide to Property Tax Protest: Whats key: Exemptions & Deductions Blind. Disabled. Over 65. Property Rehabilitation. VeteransNo ratings yet

- Essential Employee Guidance Covid 19Document4 pagesEssential Employee Guidance Covid 19Dan RiveraNo ratings yet

- Friday Briefing CallDocument21 pagesFriday Briefing CallDan RiveraNo ratings yet

- COVID-19 - Summary Business Emergency Order Letter - Lawrence BOHDocument1 pageCOVID-19 - Summary Business Emergency Order Letter - Lawrence BOHDan RiveraNo ratings yet

- Rivera - Spring 2017 Biz ReceptionDocument1 pageRivera - Spring 2017 Biz ReceptionDan RiveraNo ratings yet

- Rivera Business Fundraiser 2016Document1 pageRivera Business Fundraiser 2016Dan RiveraNo ratings yet

- Freecash Certifications FY1981-FY2015Document1 pageFreecash Certifications FY1981-FY2015Dan RiveraNo ratings yet

- FY14 Free Cash CertificationDocument1 pageFY14 Free Cash CertificationDan RiveraNo ratings yet

- Law Land: The Definitive Gateway CityDocument2 pagesLaw Land: The Definitive Gateway CityDan RiveraNo ratings yet

- FY12 Free Cash CertificationDocument1 pageFY12 Free Cash CertificationDan RiveraNo ratings yet

- FY11 Free Cash CertificationDocument1 pageFY11 Free Cash CertificationDan RiveraNo ratings yet

- FY13 Free Cash CertificationDocument1 pageFY13 Free Cash CertificationDan RiveraNo ratings yet

- Important Dates IEDDocument3 pagesImportant Dates IEDMihika Guntur100% (1)

- The World Is Very Different NowDocument7 pagesThe World Is Very Different NowCharles AbelNo ratings yet

- ACLU LTR Re LAPD BWV Policy (4-28-2015)Document5 pagesACLU LTR Re LAPD BWV Policy (4-28-2015)Matthew FeeneyNo ratings yet

- Boy Scouts of The Philippines Vs NLRCDocument3 pagesBoy Scouts of The Philippines Vs NLRCYvon BaguioNo ratings yet

- Montgomery Bus Boycott - Student ExampleDocument6 pagesMontgomery Bus Boycott - Student Exampleapi-452950488No ratings yet

- Define Constitution. What Is The Importance of Constitution in A State?Document2 pagesDefine Constitution. What Is The Importance of Constitution in A State?Carmela AlfonsoNo ratings yet

- Customary Law AssignmnetDocument17 pagesCustomary Law AssignmnetJaime SmithNo ratings yet

- Annex J: Sanggunian Resolution Approving AccreditationDocument2 pagesAnnex J: Sanggunian Resolution Approving AccreditationDILG Labrador Municipal OfficeNo ratings yet

- Constitution of RomaniaDocument8 pagesConstitution of RomaniaFelixNo ratings yet

- Republic v. GielczykDocument148 pagesRepublic v. GielczykKristine RiveraNo ratings yet

- Abundo, Sr. V Comelec GR No. 201716Document2 pagesAbundo, Sr. V Comelec GR No. 201716Adfat Pandan100% (2)

- Tamil Arasu - 7Document20 pagesTamil Arasu - 7naanvenkatNo ratings yet

- CLJ 1 ModuledocxDocument54 pagesCLJ 1 ModuledocxAngel Joy CATALAN (SHS)0% (1)

- 2017 IUJ ThesisDocument107 pages2017 IUJ ThesisKo Myo MinNo ratings yet

- In Re The Kerala Education Bill, Air 1958 SC 996: Aditya Anand 1651Document11 pagesIn Re The Kerala Education Bill, Air 1958 SC 996: Aditya Anand 1651Aditya AnandNo ratings yet

- Aviation SecurityDocument15 pagesAviation SecurityLEX-57 the lex engine50% (2)

- Territorial Nature of LawDocument4 pagesTerritorial Nature of LawSamerNo ratings yet

- Humss PhilDocument10 pagesHumss PhilKristel Anne SadangNo ratings yet

- Montejo v. COMELEC, G.R. No. 118702, March 16, 1995.Document9 pagesMontejo v. COMELEC, G.R. No. 118702, March 16, 1995.Emerson NunezNo ratings yet

- Exercise 4.2.1: Comparing PoliticsDocument4 pagesExercise 4.2.1: Comparing PoliticsThraia GonzalesNo ratings yet

- People Vs Medios: 132066-67: November 29, 2001: J. Quisumbing: Second DivisionDocument7 pagesPeople Vs Medios: 132066-67: November 29, 2001: J. Quisumbing: Second DivisionJoses Nino AguilarNo ratings yet

- The Civil Servants Act, 1973 PDFDocument14 pagesThe Civil Servants Act, 1973 PDFAdnan MunirNo ratings yet

- Sjs v. DDB G.R. No. 157870Document11 pagesSjs v. DDB G.R. No. 157870XuagramellebasiNo ratings yet

- Compassionate Appnt - Not Below Under J.A. - JudgementDocument6 pagesCompassionate Appnt - Not Below Under J.A. - JudgementThowheedh Mahamoodh0% (1)

- Juris Law Offices ProfileDocument5 pagesJuris Law Offices ProfileVikas NagwanNo ratings yet

- Norma A. Del Socorro V Ernst Johan Brinkman Van Wilsem G.R. No. 193707Document6 pagesNorma A. Del Socorro V Ernst Johan Brinkman Van Wilsem G.R. No. 193707FeBrluadoNo ratings yet

- DLSU Vs DLSU Employees AssocDocument2 pagesDLSU Vs DLSU Employees AssocRZ ZamoraNo ratings yet

- Calalang Versus Register of Deeds of Quezon CityDocument8 pagesCalalang Versus Register of Deeds of Quezon CityFarrah MalaNo ratings yet