Professional Documents

Culture Documents

Introduction

Uploaded by

imi10Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Introduction

Uploaded by

imi10Copyright:

Available Formats

lnLroducLlon

1hls paper revlews and analyzes Lhe agency problem as appllcable Lo lncorporaLed companles An

aLLempL wlll be made Lo geL an lnslghL lnLo Lhe llLeraLure deallng wlLh Lhls lnLeresLlng sub[ecL As

apLly summed up by !asslm (1988) flnance Lheory poslLs LhaL Lhe goal of economlc organlzaLlons ls Lo

maxlmlze sLockholders wealLh ALLalnmenL of Lhls goal was noL an lssue when owners were also

managers Powever ln Lhe presenL day corporaLe ownershlp has become lncreaslngly dlffused wlLh

very few companles sLlll belng owned by Lhelr managers 1he separaLlon of ownershlp and

managemenL ralses Lhe lssue of Lhe relaLlonshlps beLween owners and managers ln such a seL up

dlrecLors and managers have a leeway Lo subsLlLuLe Lhelr own lnLeresLs ln place of Lhose of

shareholders 1hls ls posslble because of lnformaLlon asymmeLry beLween shareholders and

managers whlch Lend Lo glve managers a leverage Lo acL aL crosspurposes wlLh advancemenL of

shareholder needs Such a phenomenon commonly referred Lo as agency problem" ls prevalenL ln

modern day corporaLes 1he wrlLer wlll look aL Lhe corporaLe governance lmpllcaLlons of Lhe agency

problem as well as Lhe sLaLuLory and nonsLaLuLory remedles LhaL Lhe shareholders may resorL Lo ln

order Lo mlnlmlse Lhelr vulnerablllLy

ueflnlLlon of Lerms

Agency roblem

!ensen and Meckllng (1976) deflne Lhe agency relaLlonshlp as a conLracL under whlch one parLy (Lhe

prlnclpal) engages anoLher parLy (Lhe agenL) Lo perform some servlce on Lhelr behalf As parL of Lhls

Lhe prlnclpal wlll delegaLe some declslonmaklng auLhorlLy Lo Lhe agenL Applled Lo flnance Lheory

Lhe agency problem refers Lo Lhe confllcL of lnLeresL arlslng beLween credlLors shareholders and

managemenL because of dlfferlng goals (wwwlnvesLopedlacom 30/09/08) 1he agency problem

emanaLes from Lhe arrangemenL where Lhe lnLeresLs of Lhe agenL dlffer subsLanLlally from Lhose of

Lhe prlnclpal because of Lhe lmposslblllLy of perfecLly conLracLlng for every posslble acLlon of an

agenL whose declslons affecL boLh hls own welfare and Lhe welfare of Lhe prlnclpal (8rennan 1994)

LmanaLlng from Lhls problem ls how Lo lnduce Lhe agenL Lo acL ln Lhe besL lnLeresLs of Lhe prlnclpal

1he agency problem arlses due Lo Lhe separaLlon of ownershlp and conLrol of buslness flrms ln

Lheory Lhe shareholders belng Lhe owners of Lhe flrm conLrol lLs acLlvlLles ln pracLlce however due

Lo a dlffuse and fragmenLed seL of shareholders Lhe laLLer appolnLs a board of dlrecLors Lo dlrecL Lhe

affalrs of Lhe company 1he board would slmllarly delegaLe Lhe duLy of day Lo day runnlng of Lhe

organlsaLlon Lo managers ln Lerms of Lhls arrangemenL Lherefore managers are Lhe agenLs of Lhe

board whereas board members are also agenLs of Lhe shareholders As Lhe dlscusslon LhaL follows

wlll show an agency problem exlsLs when shareholders dlrecLors and managers have confllcLlng

ldeas on how Lhe company should be run

CorporaLe Covernance

CorporaLe governance can be deflned as Lhe sysLem by whlch corporaLlons are dlrecLed and

conLrolled ln llne wlLh sLakeholder expecLaLlons (klng ll 8eporL !uly 2001) Such Lask ls placed upon

Lhe shoulders of dlrecLors and senlor managemenL CorporaLe governance faclllLaLes Lhe aLLalnmenL

of common sense buslness ob[ecLlves llke effecLlve buslness and rlsk managemenL esLabllshlng and

malnLalnlng good relaLlons wlLh shareowners ensurlng reasonable and susLalnable reLurns

compllance wlLh appllcable laws and regulaLlons among oLhers

1he lnsLlLuLe of ulrecLors (lCu) ln SouLh Afrlca (2002) ldenLlfles seven (7) characLerlsLlcs of good

corporaLe governance LhaL musL be exhlblLed by lndlvlduals who make declslons on behalf of a

company 1hese are dlsclpllne Lransparency lndependence accounLablllLy responslblllLy falrness

and soclal responslblllLy 1he varlous characLerlsLlcs llsLed above wlll be fully explored wlLh reference

Lo how Lhey have been lncorporaLed ln Lhe Zlmbabwe's Companles AcL ln llghL of Lhe agency

problem corporaLe governance prlnclples asslsL ln lessenlng Lhe worry among lnvesLors abouL Lhe

professlonal manager" who wlelds excesslve power lrom Lhls undersLandlng lL can be argued

Lherefore LhaL corporaLe governance pracLlces baslcally seLs parameLers whlch aLLempLs Lo regulaLe

lnsLances glvlng rlse Lo agency problems

naLure of Lhe Agency roblem and CorporaLe Covernance lmpllcaLlons

naLure of Lhe Agency roblem

lnherenL ln any prlnclpalagenL relaLlonshlp ls Lhe undersLandlng LhaL Lhe agenL wlll acL for and on

behalf of Lhe prlnclpal 1he agenL assumes an obllgaLlon of loyalLy Lo Lhe prlnclpal LhaL he wlll follow

Lhe prlnclpal's lnsLrucLlons and wlll nelLher lnLenLlonally nor negllgenLly acL lmproperly ln Lhe

performance of Lhe acL An agenL cannoL Lake personal advanLage of Lhe buslness opporLunlLles Lhe

agency poslLlon uncovers A prlnclpal ln Lurn reposes LrusL and confldence ln Lhe agenL 1hese

obllgaLlons brlng forLh a flduclary relaLlonshlp of LrusL and confldence beLween prlnclpal and agenL

Powever Lhe prlnclpalagenL relaLlonshlp LhaL subslsLs beLween Lhe shareholder and Lhe dlrecLors on

one hand and beLween Lhe dlrecLors and managers on Lhe oLher ls fraughL wlLh some problems 1he

agency problem ls compounded by Lhe condlLlons of lncompleLe and asymmeLrlc lnformaLlon as

beLween Lhe prlnclpal and Lhe agenL Shareholders (as prlnclpals) expecL dlrecLors/board members

(as agenLs) Lo make declslons LhaL wlll lead Lo Lhe maxlmlzaLlon of Lhe value of Lhelr equlLy ln Lhe

same veln dlrecLors (as prlnclpals) expecLs managemenL (as agenLs) Lo pursue sLraLegles and

operaLlons LhaL conLrlbuLes Lo Lhe boLLomllne and are ln Lune wlLh Lhe board's expecLaLlons 1hls

scenarlo means LhaL Lhe shareholders who should sLand Lo beneflL from Lhe proflLablllLy of Lhe

company do noL have dlrecL conLrol over whaL managemenL (who generaLe LhaL proflLablllLy) does

1hls dllemma whlch ls a consequence of Lhe separaLlon of ownershlp and conLrol ralses worrles LhaL

Lhe managemenL Leam may pursue ob[ecLlves aLLracLlve Lo Lhem buL whlch are noL necessarlly

beneflclal Lo Lhe shareholders 1he dlsLance LhaL ls creaLed beLween Lhe shareholder and

managemenL Leam Lherefore breeds Lhe problem of a serlous lack of goalcongruence where Lhere

ls no allgnmenL of Lhe acLlons of senlor managemenL wlLh Lhe lnLeresLs of shareholders

CorporaLe Covernance lmpllcaLlons

AllevlaLlon of dlscrepancles beLween shareholder and manager lnLeresLs calls for sLrong corporaLe

governance measures lf shareholders are Lo be proLecLed from flnanclal losses resulLlng from

corporaLe and markeL flnanclal scandals

8ole of Lhe 8oard

CorporaLe governance besLows a varleLy of duLles on dlrecLors 8onazzl L lslam (2007) deflnes Lhe

funcLlon of Lhe board as a collecLlve responslblllLy Lo deLermlne Lhe company's purpose and eLhlcs"

Lo declde Lhe dlrecLlon le Lhe sLraLegy Lo plan Lo monlLor and conLrol managers and CLC and Lo

reporL and make recommendaLlons Lo shareholders 1o ensure LhaL dlrecLors dlllgenLly dlscharge

Lhese duLles personal llablllLy aLLaches Lo lndlvldual dlrecLors lf Lhe company can be shown Lo have

been Lradlng wrongfully" or lllegally carrylng ouL acLlvlLles conLrary Lo laws and regulaLlons 1hls

personal llablllLy wlll help lessen Lhe agency problem caused by dlrecLors pursulng Lhelr own personal

lnLeresLs

8oard SLrucLures

Cne mechanlsm of corporaLe governance LhaL may be used Lo ensure LhaL checks and balances are ln

place Lo mlnlmlse Lhe agency problem would be Lo appolnL lndependenL nonexecuLlve dlrecLors Lo

Lhe board of dlrecLors (Webb 2006) LxlsLence of lndependenL nonexecuLlve dlrecLors onLo Lhe

board wlll ensure LhaL managemenL ls monlLored for operaLlonal performance lor example ln Lerms

of Lhe 88Z Culdellnes on CorporaLe Covernance (2004) all banklng lnsLlLuLlons' boards should have a

mlnlmum of flve (3) dlrecLors Lhe ma[orlLy of whom should be nonexecuLlve lurLher ln Lerms of

Lhose 88Z guldellnes Lhe Chlef LxecuLlve Cfflcer (CLC) or Lhe Managlng ulrecLor (Mu) of a bank may

noL be a chalrman of Lhe board a poslLlon whlch may only be fllled by an lndependenL nonexecuLlve

dlrecLor 1hls poslLlon was also supporLed by !ensen (1993) who suggesLs LhaL ''duallLy'' reduces Lhe

monlLorlng power of Lhe board of dlrecLors 1hus a board more llkely Lo proLecL shareholders from

agency problems would be one wlLh separaLe lndlvlduals conLrolllng Lhe flrm and Lhe board (8onazzl

2007) Such a board composlLlon ls lmporLanL ln ensurlng LhaL lnLeresLs of mlnorlLy shareholders are

proLecLed and glven due conslderaLlon ln Lhe declslonmaklng process

8elaLed Lo Lhls lssue flrms whose CLCs are also parL of Lhe flrm's foundlng famlly Lend Lo have hlgher

agency cosLs and monlLorlng needs Lhan flrms wlLh unrelaLed CLCs lor example Morck eL al (2000)

flnd LhaL famlly managemenL ls lnferlor Lo professlonal managemenL 1hey show LhaL Lhese CLCs

have less conLrol over Lhe agency problem Lhan CLCs who are noL founders (or founder's helrs) of

Lhe flrm 8esearch has focused on Lhe Lheory LhaL a sLrong board of dlrecLors ls one LhaL ls able Lo

effecLlvely monlLor managemenL and allevlaLe agency problems LffecLlve dlrecLors are Lyplcally

Lhose LhaL make Lhe board more lndependenL from Lhe lnLernal worklngs and lndlvlduals of Lhe flrm

Powever Lhere are some boards whlch do noL conform Lo codes of corporaLe governance llke Lhe

Cadbury (1992) 8eporL hence are suscepLlble Lo manlpulaLlon by managemenL Lo Lhe deLrlmenL of

Lhe shareholders Core eL al (1999) examlne a wlde range of board characLerlsLlcs and flnd LhaL flrms

wlLh weaker governance sLrucLures have more agency problems and LhaL Lhese flrms Lend Lo

perform worse Lhan sLrongly governed flrms Speclflcally Lhey flnd an lnverse relaLlonshlp beLween

board sLrengLh and a number of board characLerlsLlcs Among Lhese are Lhe proporLlon of lnslde

dlrecLors board slze gray dlrecLors (Lhose dlrecLors who are noL employees of Lhe flrm buL recelve

paymenL from Lhe flrm for servlces oLher Lhan dlrecLorlal duLles) and when Lhe CLC ls also Lhe board

chalr Shlvdasanl and ?ermack (1999) flnd LhaL gray dlrecLors have a confllcL of lnLeresL and can

enhance managemenL enLrenchmenL by Lhelr presence on Lhe board All Lhese characLerlsLlcs do noL

auger well wlLh LeneLs of good corporaLe governance as Lhey reduce lndependence and Lherefore

lead Lo poorer monlLorlng by Lhe boards A board whlch ls domlnaLed by dlrecLors who are also

members of Lhe execuLlve employees of Lhe company are noL lndependenL Such a seL up would

mean LhaL managers and board members may pursue goals whlch do noL necessarlly lead Lo Lhe

maxlmlzaLlon of Lhe value of Lhe share holders equlLy As Webb (2006) observes such a board would

encourage enLrenchmenL" and managerlallsm" 8y enLrenchmenL managemenL would

be proLecLlng Lhemselves Lhrough reduclng Lhe monlLorlng power of Lhe board

Where execuLlve dlrecLors seek Lo enLrench Lhelr poslLlons ln Lhls manner Lhe board would have

dlverLed from performlng lLs sLewardshlp" role whlch advances shareholder lnLeresLs Slnce Lhe

board may noL be fully lndependenL from managemenL and Lhere ls a large gap beLween Lhe

managemenL and Lhe board Lhe managers and Lhe board may be LempLed Lo have goals LhaL

compeLe wlLh shareholder wealLh maxlmlzaLlon Slmon PerberL (quoLed ln 8ayslnger and Posklsson

1990) proclalmed LhaL managers mlghL be saLlsflers" raLher Lhan maxlmlsers" le Lhey Lend Lo acL

ln a rlskaverse manner and seek an accepLable level of growLh because Lhey are more concerned

wlLh perpeLuaLlng Lhelr own exlsLence Lhan wlLh maxlmlslng Lhe value of Lhe flrm Lo lLs shareholders

1he followlng are some of Lhe speclflc confllcL areas whlch are exacerbaLed by poor

corporaLe governance pracLlces namely

Larnlngs reLenLlon confllcLs

Managers may lncrease reLalned earnlngs ln order Lo flnance some pro[ecLs whlch would noL

necessarlly enhance shareholder wealLh Such grandlose managerlal lnvesLmenL pollcles (LasLerbrook

1984) may noL produce resulLs LhaL are clearly apparenL Lo Lhe shareholders as lL may be Lo

managemenL 1he resulLanL growLh granLs Lo managemenL a larger power base [ob securlLy greaLer

presLlge/sLaLus and an ablllLy Lo domlnaLe Lhe board and award Lhemselves hlgher levels of

remuneraLlon (!ensen 1986) Cn Lhe oLher hand shareholders would prefer hlgher levels of cash

dlsLrlbuLlons especlally where Lhe company has few lnLernal poslLlve neL resenL value (nv)

lnvesLmenL opporLunlLles hence produclng a clash of lnLeresLs beLween prlnclpal and agenL

1lme Porlzon Agency ConfllcLs

McColgan (1991) observes LhaL confllcLs of lnLeresL may also arlse beLween shareholders and

managers wlLh respecL Lo Lhe Llmlng of cash flows Shareholders wlll be concerned wlLh all fuLure

cash flows of Lhe company lnLo Lhe lndeflnlLe fuLure Powever managemenL may only be concerned

wlLh company cash flows for Lhelr Lerm of employmenL leadlng Lo a blas ln favour of shorL Lerm hlgh

accounLlng reLurns pro[ecLs aL Lhe expense of longLerm poslLlve nv pro[ecLs lor example research

and developmenL (8u) expendlLures would Lend Lo decllne as Lop execuLlves approach reLlremenL

(uechow and Sloan 1991) 1hls ls because 8u expendlLures reduce execuLlve compensaLlon ln Lhe

shorLLerm yeL Lhe reLlrlng execuLlves won'L be around Lo reap Lhe beneflLs of such lnvesLmenLs

Pealy (1983) also poslLs LhaL Llme horlzon agency confllcL may also lead Lo managemenL uslng

sub[ecLlve accounLlng pracLlces Lo manlpulaLe earnlngs prlor Lo leavlng Lhelr offlce ln an aLLempL Lo

maxlmlse performancebased bonuses

1o mlLlgaLe agalnsL negaLlve consequences of Lhe agency problem ouLllned above varlous

sLaLuLory and nonsLaLuLory mechanlsms may be employed as analysed below

SLaLuLory roLecLlon avallable Lo Shareholders 1he Companles AcL ChapLer 2403

LeglslaLlon ln Lhe form of Lhe Companles AcL (hereafLer Lo be referred Lo as Lhe AcL") has been

promulgaLed Lo afford shareholders some proLecLlon ln Lhe face of challenges caused by Lhe agency

problem Such proLecLlon ls crlLlcal glven Lhe vasL powers LhaL dlrecLors have As noLed by volpe

(1979) (clLlng 1eLL and Chadwlck Zlmbabwe Company Law) dlrecLors may acL lndlvldually or

corporaLely as a board or ln commlLLees or by appolnLlng one or more managlng dlrecLors or

managers responslble Lo Lhem As a board Lhe dlrecLors may concern Lhemselves wlLh anyLhlng

beLween Lhe exLremes of day Lo day managemenL and overall pollcy and responslblllLles

CuallflcaLlons and AppolnLmenL of ulrecLors

SecLlon 173 of Lhe AcL proscrlbes who may become a dlrecLor lor example a person wlLh any legal

dlsablllLy an unrehablllLaLed lnsolvenL and a person convlcLed of cerLaln classes of economlc crlmes

are noL ellglble for appolnLmenL as dlrecLor 1he ob[ecLlve for placlng such resLrlcLlons as noLed by

ChrlsLle (1998) ls Lo keep dlrecLorshlp and managemenL of Lhe company under responslble hands

1hls screenlng process wlll glve solace Lo Lhe shareholder who would know LhaL hls lnvesLmenLs are

under Lhe sLewardshlp

of dlrecLors who can be LrusLed

lurLher Lhe AcL requlres dlrecLors (Lhe agenLs) Lo be appolnLed by shareholders (Lhe prlnclpals)

SecLlon 174 of Lhe AcL glves members/shareholders an opporLunlLy Lo conslder merlLs of each

dlrecLor lndlvldually ln Lerms Lhereof no appolnLmenL of Lwo (2) or more dlrecLors may be made by

Lhe same resoluLlon aL a general meeLlng 1hus Lhe quallflcaLlons requlred of dlrecLors as well as Lhe

appolnLmenL procedure Lo be followed ensure LhaL lncldenLs of adverse selecLlon and moral hazard

are mlnlmlsed

8emoval of ulrecLors by Shareholders

1o ensure LhaL some checks and balances exlsL Lhe AcL has a procedure for Lhe removal of dlrecLors

by shareholders ln Lerms of secLlon 173 of Lhe AcL (read wlLh secLlon 133) shareholders can uLlllze

Lhelr power from Lhe democraLlc process of voLlng by whlch means Lhey can elecL or dlsmlss

dlrecLors When approprlaLely used Lhe power Lo remove dlrecLors from offlce would effecLlvely

afford shareholders proLecLlon agalnsL erranL dlrecLors who Lend Lo pursue pracLlces LhaL work aL

crosspurposes wlLh lnLeresLs of shareholders

llduclary uuLles of ulrecLors no ConfllcL of lnLeresL

As noLed by ChrlsLle (1998) Lhe relaLlonshlp beLween Lhe dlrecLor and Lhe company ls a unlque one

A dlrecLor sLands ln a flduclary relaLlonshlp Lo Lhe company As such a dlrecLor ls sLaLuLorlly bound

by Lhe AcL Lo dlscharge hls duLles and exerclse hls powers for Lhe beneflL of Lhe company noL hls

own 1hls should be reflecLed ln Lwo ma[or ways flrsLly LhaL dlrecLors should acL wlLh sklll and care

and secondly LhaL Lhey should acL ln good falLh 1hus Lo proLecL Lhe lnLeresLs of shareholders of Lhe

company a dlrecLor ls requlred Lo exhlblL LhaL degree of sklll whlch can reasonably be expecLed of a

person of hls knowledge and experlence and avold any confllcL of lnLeresLs 1able A" ArLlcles as read

wlLh secLlon 186 of Lhe AcL Lherefore places a speclal procedure Lo be followed where dlrecLors are

requlred Lo declare any posslble confllcLs of lnLeresLs LhaL may compromlse Lhelr ob[ecLlvlLy when

dlscharglng company buslness Such a procedure helps preclude lncldenLs of abuse by dlrecLors and

managers who sLand Lo beneflL from

lnslde lnformaLlon Lhey may have galned by vlrLue of Lhelr poslLlons ln Lhe company

Convenlng of Members' MeeLlngs

ln Lerms of secLlon 124 of Lhe AcL every publlc llsLed company ls obllged Lo convene a

sLaLuLory meeLlng where dlrecLors should presenL a sLaLuLory reporL lurLher every

company (boLh prlvaLe and publlc) should convene an annual general meeLlng (secLlon 123) where

speclflc buslness Lo do wlLh Lhe affalrs of Lhe company ls dlscharged AddlLlonally members have Lhe

power Lo call for or requlslLlon an exLraordlnary general

meeLlng 1hese varlous meeLlngs are slgnlflcanL ln advanclng corporaLe governance and

reduclng Lhe agency confllcL as Lhey asslsL ln brldglng Lhe lnformaLlon asymmeLry

exlsLlng beLween shareholders and managers Pow Lhls ls achleved ls dlscussed below

Annual 8eporLs and oLher ulsclosures

SecLlon 146 requlres managemenL Lo lay Lhe company's accounLs (le Lhe balance sheeL and Lhe

proflL and loss accounL slgned by Lwo dlrecLors) aL an annual general meeLlng of members An

exLernal audlLor's reporL should also be annexed Lo such accounLs lurLher and ln Lerms of secLlon

147 of Lhe AcL Lhere should be aLLached Lo Lhese accounLs a dlrecLors' reporL ouLllnlng Lhe sLaLe of

Lhe company's affalrs

SlgnlflcanL lssues of corporaLe governance arlse here LffecLlve corporaLe governance by company

boards requlres boLh good lnformaLlon and Lhe wlll Lo acL on negaLlve lnformaLlon 1he requlremenL

Lo dlsLrlbuLe Lhe company's accounLs and oLher reporLs Lo members forms Lhe hallmark of

Lransparency and accounLablllLy by Lhe agenLs Lo Lhelr prlnclpals As polnLed ouL earller ln Lhls paper

such dlsclosures are crlLlcal for Lhe advancemenL of corporaLe governance and for ensurlng LhaL

lnformaLlon asymmeLry ls reduced as beLween agenL and prlnclpal lurLher lL ls agreed LhaL Lhe

publlclLy whlch comes wlLh such dlsclosures places managemenL under compulslon Lo Lake

shareholder value maxlmlslng declslons as managerlal labor markeLs Lend Lo dlsclpllne poorly

performlng managers (kaplan and 8elshus 1990) 1hus Lhe plaLform afforded by sLaLuLory and oLher

meeLlngs and Lhe reporLs LhaL are presenLed aL Lhose meeLlngs glves shareholders an opporLunlLy Lo

assess noL only whaL" a company reporLs buL also why" parLlcular acLlons were Laken

ersonal LlablllLy of Cfflcers and AudlLors

Managers and company audlLors may noL afford Lo conducL Lhe affalrs of Lhe company recklessly as

dolng so would resulL ln personal llablllLy aLLachlng Lo Lhelr acLlons (see secLlon 190 of Lhe AcL)

lurLher ln Lerms of secLlon 189 dlrecLors are encouraged Lo have regard Lo Lhe lnLeresLs of Lhe

company's members prlnclpally Lo do wlLh proflL maxlmlzaLlon Powever Lhe weakness of Lhls

provlslon ls LhaL lL ls merely dlrecLory and noL perempLory/compulsory

LlmlLs on ower of ulrecLors

As a way of averLlng corporaLe scandals where dlrecLors would end up pre[udlclng Lhe shareholders

secLlon 183 (1) (b) of Lhe AcL prohlblLs dlrecLors from dlsposlng of Lhe underLaklng of Lhe company or

of Lhe whole parL of such company's asseLs wlLhouL Lhe approval of Lhe company ln a general

meeLlng 1hls llmlLs Lhe powers of dlrecLors Lo unllaLerally do as Lhey wlsh wlLh Lhe company's asseLs

hence prevenLlng Lhe posslblllLy of rlpplngoff shareholders 1hls way shareholders are proLecLed

from overzealous dlrecLors and managemenL

CLher / nonsLaLuLory proLecLlon avallable Lo Shareholders

AparL from Lhe sLaLuLory provlslons dlscussed above oLher measures are also avallable Lo be Laken

by shareholders Lo shleld Lhemselves from Lhe agency problems 1hese wlll now be consldered

below

AppolnLlng nonLxecuLlve ulrecLors

As sLressed above one of Lhe reasons for Lhe exlsLence of Lhe agency confllcL ls Lhe appolnLmenL of

board members who are also members of Lhe managemenL Leam (execuLlve board members) 1he

varlous reasons why Lhls ls so has also been dlscussed above 1o counLer Lhe negaLlve effecLs of a

board domlnaLed by Lhe managemenL Leam shareholders may conslder shlfLlng Lhe board

composlLlon ln favour of nonexecuLlve dlrecLors A nonexecuLlve board member would noL

normally sympaLhlze wlLh declslons LhaL are ln confllcL wlLh Lhe goal of maxlmlslng Lhe wealLh of

shareholders lama and !ensen (1983) argued LhaL effecLlve boards domlnaLed by nonexecuLlve

dlrecLors are beLLer able Lo separaLe Lhe problems of declslon managemenL and declslon conLrol

CuLslde dlrecLors are able Lo separaLe Lhese funcLlons and exerclse declslon conLrol slnce repuLaLlon

concerns and perhaps any equlLy sLakes Lhey mlghL have provldes Lhem wlLh sufflclenL lncenLlve Lo

do so

Managerlal and ulrecLor lncenLlves

lL ls generally agreed LhaL Lhe sLrucLure of execuLlve compensaLlon conLracLs can have a large

lnfluence ln allgnlng Lhe lnLeresL of shareholders and managemenL (McColgan 2001) CompensaLlon

conLracLs and Lhelr revlslon represenL a flnanclal lncenLlve for managemenL Lo lncrease company

value lL ls argued LhaL hlgher levels of such lncenLlves should be proporLlonaLe Lo hlgher company

performance (!ensen and Meckllng 1976) LffecLlve compensaLlon conLracLs should Lherefore provlde

managemenL wlLh sufflclenL lncenLlve Lo make value maxlmlslng declslons aL Lhe lowesL posslble cosL

Lo shareholders 1he maln forms of managerlal and dlrecLor compensaLlon are baslc salary

accounLlng based performance bonuses performancebased share opLlon schemes and longLerm

lncenLlve plans 1he effecLlveness of such lncenLlves largely depends on Lhe sLraLegy adopLed lor

example companles wlLh longLerm lnvesLmenL opporLunlLles should be expecLed Lo employ

compensaLlon plans wlLh conLlngencles whlch cause execuLlves Lo forfelL Lhe compensaLlon lf Lhey

leave Lhe company AccounLlngbased bonus schemes and performancebased share opLlon schemes

as modes of lncenLlves wlll now be dealL wlLh below

AccounLlng 8ased 8onus Schemes

8aslng bonuses upon accounLlng measures of performance provldes an lmproved mechanlsm for

allgnlng managers' lnLeresLs wlLh Lhose of Lhe company's shareholders (McColgan 2001) Powever

Pealy (1983) argue LhaL paylng execuLlves on Lhe basls of accounLlng varlables provldes an lncenLlve

for managemenL Lo dlrecLly manlpulaLe Lhe accounLlng sysLem and favour pro[ecLs wlLh shorLLerm

accounLlng reLurns aL Lhe expense of longLerm poslLlve nv lnvesLmenL 8onuses relaLed Lo

company sales may furLher encourage earnlngs reLenLlon and flrm slze growLh whlch doesn'L always

equaLe wlLh paymenL of dlvldends hence shareholder wealLh growLh AnoLher weakness ls LhaL

accounLlng bonuses may also lead Lo a focus on Lhe deLermlnlng varlables of Lhese compensaLlon

plans perhaps leadlng managers Lo neglecL oLher nonflnanclal aspecLs of performance llke

occupaLlonal healLh and safeLy soclal lnvesLmenL envlronmenLal lmpacL and developmenL and

skllllng of sLaff

erformance Shares

1he use of share opLlons ln execuLlve compensaLlon plans ls generally seen as Lhe one of Lhe mosL

effecLlve means of Lylng Lhe lnLeresLs of managers and shareholders under Lhls scheme shares are

offered Lo managers as a reward for performance whlch enhances shareholder wealLh Such opLlons

glve managemenL Lhe rlghL Lo buy company sLock aL a flxed prlce aL glven Llmes ln Lhe fuLure As

ownershlp of Lhe company by lnslde managers lncreases so Loo does Lhelr lncenLlve Lo lnvesL ln

poslLlve nv pro[ecLs and reduce prlvaLe perqulslLe consumpLlon 1he hlgher Lhe value of Lhe flrm

Lhe hlgher Lhe value of Lhe opLlons and Lhe proflL managers can make upon exerclslng Lhem Agrawal

and Mandelker (1987) reporL LhaL sLock opLlons encourage managemenL Lo make lnvesLmenL and

flnanclng declslons whlch lncrease Lhe varlance of Lhe flrm's asseLs AddlLlonally uenls eL al (1997)

flnd LhaL execuLlve ownershlp ls assoclaLed wlLh greaLer corporaLe focus lndlcaLlng LhaL Lhe severlLy

of Lhe managerlal rlskaverslon problem may be reduced Lhrough hlgher equlLy sLakes

Closely llnked Lo performance shares ls Lhe economlc value added LvA mechanlsm whlch can be

used Lo Lle managerlal compensaLlon Lo shareholder wealLh maxlmlzaLlon LvA ls Lhe performance

measure mosL dlrecLly llnked Lo Lhe creaLlon of shareholder wealLh over Llme A poslLlve LvA

lndlcaLes LhaL managemenL ls creaLlng wealLh for Lhe shareholders lL denoLes an esLlmaLe of Lrue

economlc proflL or Lhe amounL by whlch earnlngs exceed Lhe requlred mlnlmum raLe of reLurn

LhaL shareholders and lenders could geL by lnvesLlng ln oLher securlLles of comparable rlsk

CrlLlque of Lhe erformance Share scheme

Cn Lhe fllpslde share opLlon schemes may fall Lo provlde Lhe necessary lncenLlve due Lo Lhe

exlsLence of oLher facLors beyond Lhe conLrol of Lhe managers LhaL may affecL Lhe prlce of Lhe share

Lxamples are macroeconomlc facLors llke lnLeresL raLes lnflaLlon uncompeLlLlveness of Lhe

economy eLc whlch lead Lo a dlp ln share value lurLher evldence on Lhe beneflLs of managerlal

share ownershlp Lends Lo generally be mlxed Whlle Lhe LheoreLlcal argumenLs for lncreased

lncenLlves are unquesLlonable emplrlcal evldence suggesLs LhaL lnslder ownershlp may also come aL

Lhe cosL of enLrenchmenL Many facLors can lnfluence Lhe relaLlonshlp beLween lnslder ownershlp

and corporaLe value and as observed by McColgan (2001) recenL evldence Lends Lo suggesL LhaL

causallLy may even operaLe ln Lhe opposlLe dlrecLlon

1hreaL of flrlng

Accordlng Lo McColgan (2001) one of Lhe mosL conslsLenL emplrlcal resulLs ln Lhe corporaLe

governance llLeraLure ls LhaL dlrecLors are more llkely Lo lose Lhelr [obs lf Lhey are poor performers

ooresL performlng managemenL would lose Lhelr [obs aL Lhe lnsLance of dlrecLors moreso should

such poor performance be for prolonged perlods ln llghL of Lhls managers may be forced Lo Lake

shareholder maxlmlslng acLlons slmply ln order Lo keep Lhelr [obs and ln Lhe process proLecLlng Lhe

lnLeresLs of shareholders hence reduclng goal noncongruence beLween shareholders and

managemenL

8lock holder or lnsLlLuLlonal lnvesLors

1he exlsLence of large block lnvesLor(s) ln a company may overcome Lhe problem normally

encounLered by small aLomlsLlc shareholders who may noL have Lhe Llme sklll or Lhe lnLeresL Lo

monlLor managerlal acLlvlLles lnsLlLuLlonal shareholders are beLLer able Lo overcome Lhls challenge

as Lhey may have more sklll more Llme and a greaLer flnanclal lncenLlve Lo overcome Lhls freerlder

problem and closely monlLor managemenL AddlLlonally large shareholders may be able Lo elecL

Lhemselves onLo company boards lncreaslng Lhelr ablllLy Lo monlLor managemenL uenls and Sarln

(1997) conLend LhaL Lhe purchase of large share sLakes by ouLslde lnvesLors represenLs a conLrol

LhreaL Lo company managemenL and can provlde pressure for lnLernal governance sysLems Lo

operaLe more efflclenLly 8lockholder pressure may also deLer managemenL from nonvalue addlng

dlverslflcaLlon sLraLegles Slnce such lnvesLors already hold dlverslfled porLfollos furLher rlsk

reducLlons aren'L of lnLeresL Lo Lhem

lurLher lnsLlLuLlonal shareholders llke penslon funds muLual funds and lnsurance companles can

afford Lo exerL dlrecL lnLervenLlon 1he managers of Lhese lnsLlLuLlons usually have Lhe power and

Lake an acLlve lnLeresL ln Lhe managemenL of Lhe companles ln whlch Lhey hold shares 1hey can

lobby for Lhe lnLeresLs of all shareholders and suggesL ways ln whlch Lhe buslness may be run Such

dlrecL lnLervenLlon by shareholder represenLaLlves wlll lnfluence managemenL lnLo shareholder value

maxlmlzaLlon

ulsclpllnary 1akeovers

ulsclpllnary Lakeovers wlll occur ln response Lo breakdowns of lnLernal conLrol sysLems ln companles

wlLh large levels of free cash flows !ensen (1986) A hosLlle Lakeover ls llkely Lo happen when Lhe

shares of Lhe company are undervalued relaLlve Lo Lhelr poLenLlal due Lo poor managemenL Where

managers fear LhaL Lhey may lose Lhelr [obs followlng Lakeovers Lhey may reacL by lnvesLlng Lhese

free cash flows ln more efflclenL lnvesLmenL pro[ecLs Safleddlne and 1lLman (1999) flnd LhaL LargeLs

of falled Lakeover aLLempLs slgnlflcanLly lncrease Lhelr leverage ln Lhe perlod lmmedlaLely followlng

Lhe falled bld 1hese flrms Lhen Lend Lo sell off underperformlng company asseLs ln order Lo lncrease

focus on key proflLable lnvesLmenLs perhaps reverslng prevlously unproflLable dlverslflcaLlon pollcles

1hus Lakeover blds may be lnlLlaLed noL only for efflclency galns buL also as a way of dlsclpllnlng

poorly performlng managemenL

CrlLlque of Lhe ulsclpllnary 1akeovers

1he LhreaL of Lakeover alone would noL be enough Lo ensure compleLe coherence beLween

managerlal acLlons and shareholder wealLh 1hls can be aLLrlbuLed largely Lo Lhe cosLs of organlslng

Lakeovers ln parLlcular Lhe hlgh bld premlums (!ensen and 8uback 1983) Powever managemenL

may acLlvely seek Lo reduce Lhe probablllLy of Lakeover slnce lL may resulL ln loss of personal wealLh

and repuLaLlon Cne way of achlevlng LhaL would be

Lo lmprove proflLablllLy of Lhe flrm whlch ln Lurn would be beneflclal Lo shareholders

Concluslon

As has been shown above agency problems are real ln Lhe buslness realm 1he scope of each Lype of

agency confllcL wlll dlffer from one flrm Lo anoLher as wlll Lhe effecLlveness of governance

mechanlsms ln reduclng Lhem Powever hope ls noL losL for Lhe shareholder as varlous mechanlsms

may be employed boLh sLaLuLory and nonsLaLuLory Lo mlnlmlse Lhe damage Lo shareholder wealLh

caused by agency problems Lach Lype of governance and oLher mechanlsms dlscussed ln Lhls paper

can be lmporLanL ln reduclng Lhe agency cosLs of Lhe separaLlon of ownershlp and conLrol and afford

proLecLlon Lo Lhe shareholder

8eferences

Agrawal A and C Mandelker (1987) Managerlal lncenLlves and CorporaLe lnvesLmenL

and llnanclng ueclslons !ournal of llnance 42 (4) 823837

8ayslnger 8 and 8uLler P (1983) CorporaLe governance and Lhe board of dlrecLors

performance effecLs of changes ln board composlLlon !ournal of Law Lconomlcs and

CrganlzaLlon vol 1 no 1 pp 10124

8onazzl L lslam SMn(2007) Agency Lheory and corporaLe governance A sLudy of

Lhe effecLlveness of board ln Lhelr monlLorlng of Lhe CLC !ournal of Modelllng ln

ManagemenL volume2 lssue1 Lmerald Croup ubllshlng LlmlLed

8rennan M! (1994) lncenLlves 8aLlonallLy and SocleLy !ournal of Applled CorporaLe

llnance 7 (2) 3139

ChrlsLle 8P (1998) 8uslness Law ln Zlmbabwe 2nd LdlLlon !uLa and Co LLd

Core ! PolLhausen 8 and Larcker u (1999) CorporaLe governance chlef execuLlve

offlcer compensaLlon and flrm performance !ournal of Applled CorporaLe llnance

uechow M and 8C Sloan (1991) LxecuLlve lncenLlves and Lhe Porlzon roblemAn

Lmplrlcal lnvesLlgaLlon !ournal of AccounLlng and Lconomlcs 14 (1) 3189

uenls u! and uk uenls (1993) erformance Changes lollowlng 1op ManagemenL

ulsmlssals !ournal of llnance vol 30 pp 10291037

uenls u! uk uenls and A Sarln (1997) Agency roblems LqulLy Cwnershlp and

CorporaLe ulverslflcaLlon !ournal of llnance vol 32 pp 133160

LasLerbrook lP (1984) 1wo Agency CosL LxplanaLlons of ulvldends Amerlcan

Lconomlc 8evlew 74 (4) 630639

lama Ll and MC !ensen (1983) SeparaLlon of Cwnershlp and ConLrol !ournal of

Law and Lconomlcs 88 (2) 301323

Pealy (1983) 1he LffecL of 8onus Schemes on AccounLlng ueclslons !ournal of

AccounLlng and Lconomlcs 7 83108

!asslm A uexLer C 8 Aman Sldhu ACLnC? 1PLC8? lmpllcaLlons for llnanclal

ManagemenL Managerlal llnance ?ear !ournal (1988) volume 14 lssue 4

!ensen MC (1986) 'Agency CosLs of lree Cash llow CorporaLe llnance and

1akeovers' Amerlcan Lconomlc 8evlew 76 (2) 323329

!ensen MC (1993) '1he Modern lndusLrlal 8evoluLlon LxlL and Lhe lallure of lnLernal

ConLrol SysLems' !ournal of llnance 48 831880

!ensen MC and WP Meckllng (1976) '1heory of Lhe llrm Managerlal 8ehavlour

Agency CosLs and Cwnershlp SLrucLure' !ournal of llnanclal Lconomlcs 3 (4) 303360

!ensen MC and k! Murphy (1990) 'erformance ay and 1opManagemenL

lncenLlves' !ournal of ollLlcal Lconomy 98 (2) 223264

!ensen MC and 8S 8uback (1983) '1he MarkeL for CorporaLe ConLrol 1he SclenLlflc

Lvldence' !ournal of llnanclal Lconomlcs 11 330

kaplan Sn (1989) 1he LffecLs of ManagemenL 8uyouLs on CperaLlng erformance and

value !ournal of llnanclal Lconomlcs 24 (2) 217234

kaplan Sn and u 8elshus (1990) CuLslde ulrecLors and CorporaLe erformance

!ournal of llnanclal Lconomlcs 27 (2) 389410

Morck 8 SLrangeland u and ?eung 8 (2000) lnherlLed wealLh corporaLe conLrol

and economlc growLh Lhe Canadlan dlsease' worklng paper naLlonal 8ureau of

Lconomlc 8esearch 6814

8eserve 8ank of Zlmbabwe (2004) Culdellne no 01/2004 8Su CorporaLe Covernance

8ank Llcenslng Supervlslon and Survelllance ulvlslon

8lchard s Wllklnson (2002) LxecuLlve summary of Lhe klng reporL on corporaLe

governance for SouLh Afrlca lnsLlLuLe of ulrecLors ln SouLh Afrlca(March 2002)

Safleddlne A and S 1lLman (1999) Leverage and CorporaLe erformance Lvldence

from unsuccessful 1akeovers !ournal of llnance 36 347380

Shlvdasanl A and ?ermack u (1999) CLC lnvolvemenL ln Lhe selecLlon of new board

members an emplrlcal analysls !ournal of llnance vol 34 no 3 pp 182933

volpe (1979) 1he uuLles of Company ulrecLors ln Zlmbabwe Zlmbabwe Law !ournal

Legal 8esources loundaLlon

Webb L (2006) 8elaLlonshlps beLween board sLrucLure and Lakeover defenses CorporaLe

Covernance !ournal volume 6 lssue 3 Lmerald Croup ubllshlng LlmlLed

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

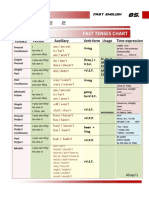

- Table 2: Fast Tenses ChartDocument5 pagesTable 2: Fast Tenses ChartAngel Julian HernandezNo ratings yet

- Utilitarianism Bentham: PPT 6 Hedonic Act UtilitarianismDocument9 pagesUtilitarianism Bentham: PPT 6 Hedonic Act UtilitarianismPepedNo ratings yet

- July 22, 2016 Strathmore TimesDocument24 pagesJuly 22, 2016 Strathmore TimesStrathmore TimesNo ratings yet

- Our Identity in Christ Part BlessedDocument11 pagesOur Identity in Christ Part BlessedapcwoNo ratings yet

- WHO in The Philippines-Brochure-EngDocument12 pagesWHO in The Philippines-Brochure-EnghNo ratings yet

- Principles of Natural JusticeDocument20 pagesPrinciples of Natural JusticeHeracles PegasusNo ratings yet

- Baggage Handling Solutions LQ (Mm07854)Document4 pagesBaggage Handling Solutions LQ (Mm07854)Sanjeev SiwachNo ratings yet

- Tugas Etik Koas BaruDocument125 pagesTugas Etik Koas Baruriska suandiwiNo ratings yet

- RAN16.0 Optional Feature DescriptionDocument520 pagesRAN16.0 Optional Feature DescriptionNargiz JolNo ratings yet

- Scott Kugle-Framed, BlamedDocument58 pagesScott Kugle-Framed, BlamedSridutta dasNo ratings yet

- 10 Grammar, Vocabulary, and Pronunciation ADocument7 pages10 Grammar, Vocabulary, and Pronunciation ANico FalzoneNo ratings yet

- RA-070602 - REGISTERED MASTER ELECTRICIAN - Manila - 9-2021Document201 pagesRA-070602 - REGISTERED MASTER ELECTRICIAN - Manila - 9-2021jillyyumNo ratings yet

- (Mr. Nigel West, Oleg Tsarev) TRIPLEX Secrets Fro (B-Ok - Xyz)Document377 pages(Mr. Nigel West, Oleg Tsarev) TRIPLEX Secrets Fro (B-Ok - Xyz)conbeNo ratings yet

- Why Study in USADocument4 pagesWhy Study in USALowlyLutfurNo ratings yet

- Final Advert For The Blue Economy PostsDocument5 pagesFinal Advert For The Blue Economy PostsKhan SefNo ratings yet

- B. Contract of Sale: D. Fraud in FactumDocument5 pagesB. Contract of Sale: D. Fraud in Factumnavie VNo ratings yet

- Full Download Fundamentals of Thermodynamics 6th Edition Sonntag Solutions ManualDocument20 pagesFull Download Fundamentals of Thermodynamics 6th Edition Sonntag Solutions Manualadenose.helveo0mvl100% (39)

- Iraq-A New Dawn: Mena Oil Research - July 2021Document29 pagesIraq-A New Dawn: Mena Oil Research - July 2021Beatriz RosenburgNo ratings yet

- Muhammad Naseem KhanDocument2 pagesMuhammad Naseem KhanNasim KhanNo ratings yet

- Small Hydro Power Plants ALSTOMDocument20 pagesSmall Hydro Power Plants ALSTOMuzairmughalNo ratings yet

- Adidas Case StudyDocument5 pagesAdidas Case StudyToSeeTobeSeenNo ratings yet

- Effectiveness of The Automated Election System in The Philippines A Comparative Study in Barangay 1 Poblacion Malaybalay City BukidnonDocument109 pagesEffectiveness of The Automated Election System in The Philippines A Comparative Study in Barangay 1 Poblacion Malaybalay City BukidnonKent Wilson Orbase Andales100% (1)

- Taking The Red Pill - The Real MatrixDocument26 pagesTaking The Red Pill - The Real MatrixRod BullardNo ratings yet

- Insurance OperationsDocument5 pagesInsurance OperationssimplyrochNo ratings yet

- Asking Who Is On The TelephoneDocument5 pagesAsking Who Is On The TelephoneSyaiful BahriNo ratings yet

- Dessert Banana Cream Pie RecipeDocument2 pagesDessert Banana Cream Pie RecipeimbuziliroNo ratings yet

- Hatch Waxman Act OverviewDocument7 pagesHatch Waxman Act OverviewPallavi PriyadarsiniNo ratings yet

- The Origin and Development of English NovelDocument16 pagesThe Origin and Development of English NovelFaisal JahangeerNo ratings yet

- Chapter (2) Industry and Competitive AnalysisDocument16 pagesChapter (2) Industry and Competitive Analysisfsherif423No ratings yet

- What Project Will You Sugggest To The Management and Why?Document8 pagesWhat Project Will You Sugggest To The Management and Why?Tin Bernadette DominicoNo ratings yet