Professional Documents

Culture Documents

NY Midtown Dec-11

Uploaded by

Anonymous Feglbx5Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

NY Midtown Dec-11

Uploaded by

Anonymous Feglbx5Copyright:

Available Formats

CBRE

Midtown Manhattan Snapshot

www.cbre.com/research December 2011

Market Activity

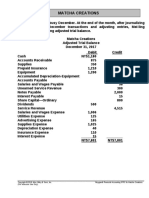

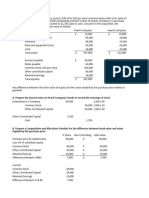

Leasing Activity Absorption Availability Rate Vacancy Rate Average Asking Rent Taking Rent Index Nov 11 1.24 MSF 0.47 MSF 11.6% 7.9% $61.77 PSF 93.3% Oct 11 0.83 MSF (0.26) MSF 11.8% 8.0% $61.49 PSF 92.7% Nov 10 2.37 MSF 0.77 MSF 12.6% 8.3% $55.16 PSF 86.9% YTD 11 15.17 MSF 0.84 MSF YTD 10 15.23 MSF 4.83 MSF

Definitions

Availability Space that is being actively marketed and is available for tenant build-out within 12 months. Includes space available for sublease as well as space in buildings under construction. Asking Rent Asking gross face rents (excluding all concessions and tenant electric). ) Leasing Activity Total amount of square feet leased within a specified period of time, including preleasing and purchases of space for occupancy and excluding renewals. Net Absorption The change in the amount of occupied square feet within a specified period of time. Taking Rent Actual initial base rent in a lease agreement (excluding all concessions and tenant electric). Taking Rent Index Initial taking rents (actual initial base rent excluding all concessions and tenant electric) as a percentage off asking rents; l ti) t ki t index represents a six-month rolling weighted average (for size and month). Vacancy Unoccupied space available for lease.

Hot Topics

Midtown posted 1.24 million sq. ft. of leasing activity in November, topping its five-year monthly average of 1.18 million sq. ft. Year-to-date 2011 leasing of 15.17 million sq. ft. fell just short of the 15.23 million sq. ft. recorded during the same period last year. Strong leasing offset the handful of mid-size new availabilities brought to market, fueling positive absorption of 470,000 sq. ft. for the month, and pushing year-to-date absorption to positive 840,000 sq. ft. With no new availabilities above 50,000 sq. ft. added to the market in November, the overall availability rate fell 0.2 points to 11.6%. The sublease availability rate dropped 0.1 point to 2.6%. Midtowns average asking rent increased $0 28 to $61 77 per sq ft Midtown s $0.28 $61.77 sq. ft.

Top Lease Transactions

Size (Sq. Ft.) 329,900* 198,915* 122,210* 105,803 73,537** Tenant Credit Agricole SA Morgan, Lewis & Bockius LLP B&H Foto & Electronics Corp. Baker & McKenzie Human Rights Watch Address 1301 Avenue of the Americas 101 Park Avenue 440 Ninth Avenue 452 Fifth Avenue 350 Fifth Avenue

* Renewal ** Renewal & Expansion

Major New Availabilities

50,000 50 000 sq. f of M ft. f Macquarie G i Group sublease space at 125 West 55th Street bl W 55 h S 39,000 sq. ft. of Westwood One, Inc. sublease space at 1166 Avenue of the Americas 37,000 sq. ft. of direct space at 1 Penn Plaza 36,000 sq. ft. of JPMorgan Chase & Co. sublease space at 245 Park Avenue 32,000 sq. ft. of Rodale Press, Inc. sublease space at 733 Third Avenue

For more information regarding MarketView, please contact: Kurt Lindsey, Senior Director CBRE, 200 Park Avenue New York, New York 10166 T. 212.984.8216 F. 212.984.8207 kurt.lindsey@cbre.com

This Snapshot reflects market activity through November 30 2011 Unless otherwise agreed to in writing by CBRE this information may not be re 30, 2011. CBRE, redistributed in whole or in part to any third party.

2011 CBRE, Inc. CBRE statistics contained herein may represent a different data set than that used to generate National Vacancy and Availability Index statistics published by CBREs Corporate Communications Department or CBREs research and econometric forecasting unit, CBREEconometric Advisors. Information herein has been obtained from sources believed reliable. While we do not doubt its accuracy, we have not verified it and make no guarantee, warranty or representation about it. It is your responsibility to independently confirm its accuracy and completeness. Any projections, opinions, assumptions or estimates used are for example only and do not represent the current or future performance of the market. This information is designed exclusively for use by CBRE, and cannot be reproduced without prior written permission of CBRE.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- CitikeyDocument54 pagesCitikeyJacob PochinNo ratings yet

- Capstone Project-Grainger and Bosch: Digital Marketing CampaignDocument25 pagesCapstone Project-Grainger and Bosch: Digital Marketing Campaignk.saikumar100% (1)

- CIO Bulletin - DiliVer LLC (Final)Document2 pagesCIO Bulletin - DiliVer LLC (Final)Anonymous Feglbx5No ratings yet

- Houston's Industrial Market Continues To Expand, Adding 4.4M SF of Inventory in The Third QuarterDocument6 pagesHouston's Industrial Market Continues To Expand, Adding 4.4M SF of Inventory in The Third QuarterAnonymous Feglbx5No ratings yet

- Houston's Office Market Is Finally On The MendDocument9 pagesHouston's Office Market Is Finally On The MendAnonymous Feglbx5No ratings yet

- Progress Ventures Newsletter 3Q2018Document18 pagesProgress Ventures Newsletter 3Q2018Anonymous Feglbx5No ratings yet

- ValeportDocument3 pagesValeportAnonymous Feglbx5No ratings yet

- The Woodlands Office Submarket SnapshotDocument4 pagesThe Woodlands Office Submarket SnapshotAnonymous Feglbx5No ratings yet

- 4Q18 Washington, D.C. Local Apartment ReportDocument4 pages4Q18 Washington, D.C. Local Apartment ReportAnonymous Feglbx5No ratings yet

- 4Q18 Atlanta Local Apartment ReportDocument4 pages4Q18 Atlanta Local Apartment ReportAnonymous Feglbx5No ratings yet

- THRealEstate THINK-US Multifamily ResearchDocument10 pagesTHRealEstate THINK-US Multifamily ResearchAnonymous Feglbx5No ratings yet

- 4Q18 South Florida Local Apartment ReportDocument8 pages4Q18 South Florida Local Apartment ReportAnonymous Feglbx5No ratings yet

- 4Q18 North Carolina Local Apartment ReportDocument8 pages4Q18 North Carolina Local Apartment ReportAnonymous Feglbx5No ratings yet

- 4Q18 New York City Local Apartment ReportDocument8 pages4Q18 New York City Local Apartment ReportAnonymous Feglbx5No ratings yet

- 4Q18 Philadelphia Local Apartment ReportDocument4 pages4Q18 Philadelphia Local Apartment ReportAnonymous Feglbx5No ratings yet

- 4Q18 Houston Local Apartment ReportDocument4 pages4Q18 Houston Local Apartment ReportAnonymous Feglbx5No ratings yet

- 4Q18 Boston Local Apartment ReportDocument4 pages4Q18 Boston Local Apartment ReportAnonymous Feglbx5No ratings yet

- Under Armour: Q3 Gains Come at Q4 Expense: Maintain SELLDocument7 pagesUnder Armour: Q3 Gains Come at Q4 Expense: Maintain SELLAnonymous Feglbx5No ratings yet

- 4Q18 Dallas Fort Worth Local Apartment ReportDocument4 pages4Q18 Dallas Fort Worth Local Apartment ReportAnonymous Feglbx5No ratings yet

- 2018 U.S. Retail Holiday Trends Guide - Final PDFDocument9 pages2018 U.S. Retail Holiday Trends Guide - Final PDFAnonymous Feglbx5No ratings yet

- Asl Marine Holdings LTDDocument28 pagesAsl Marine Holdings LTDAnonymous Feglbx5No ratings yet

- 3Q18 Philadelphia Office MarketDocument7 pages3Q18 Philadelphia Office MarketAnonymous Feglbx5No ratings yet

- Wilmington Office MarketDocument5 pagesWilmington Office MarketWilliam HarrisNo ratings yet

- Mack-Cali Realty Corporation Reports Third Quarter 2018 ResultsDocument9 pagesMack-Cali Realty Corporation Reports Third Quarter 2018 ResultsAnonymous Feglbx5No ratings yet

- Roanoke Americas Alliance MarketBeat Office Q32018 FINALDocument1 pageRoanoke Americas Alliance MarketBeat Office Q32018 FINALAnonymous Feglbx5No ratings yet

- Fredericksburg Americas Alliance MarketBeat Industrial Q32018Document1 pageFredericksburg Americas Alliance MarketBeat Industrial Q32018Anonymous Feglbx5No ratings yet

- Fredericksburg Americas Alliance MarketBeat Office Q32018Document1 pageFredericksburg Americas Alliance MarketBeat Office Q32018Anonymous Feglbx5No ratings yet

- Fredericksburg Americas Alliance MarketBeat Retail Q32018Document1 pageFredericksburg Americas Alliance MarketBeat Retail Q32018Anonymous Feglbx5No ratings yet

- Hampton Roads Americas Alliance MarketBeat Office Q32018Document2 pagesHampton Roads Americas Alliance MarketBeat Office Q32018Anonymous Feglbx5No ratings yet

- Roanoke Americas Alliance MarketBeat Office Q32018 FINALDocument1 pageRoanoke Americas Alliance MarketBeat Office Q32018 FINALAnonymous Feglbx5No ratings yet

- Roanoke Americas Alliance MarketBeat Retail Q32018 FINALDocument1 pageRoanoke Americas Alliance MarketBeat Retail Q32018 FINALAnonymous Feglbx5No ratings yet

- Hampton Roads Americas Alliance MarketBeat Retail Q32018Document2 pagesHampton Roads Americas Alliance MarketBeat Retail Q32018Anonymous Feglbx5No ratings yet

- COB 1 History of ManagementDocument18 pagesCOB 1 History of ManagementWhat le fuckNo ratings yet

- StatementDocument2 pagesStatementAndile mthethwaNo ratings yet

- Dwda 90194743 09102013Document1 pageDwda 90194743 09102013Gauhar Abbas100% (1)

- MIFID Best-Execution-Hot-TopicDocument8 pagesMIFID Best-Execution-Hot-TopicPranay Kumar SahuNo ratings yet

- Independent University, Bangladesh School of Business: Strategic ManagementDocument4 pagesIndependent University, Bangladesh School of Business: Strategic ManagementDevdip ÇhâwdhúrÿNo ratings yet

- Working Capital Management (Bhavani)Document86 pagesWorking Capital Management (Bhavani)gangatulasiNo ratings yet

- Chapter 6 PRACTICING AS AN ETHICAL ADMINISTRATIONDocument8 pagesChapter 6 PRACTICING AS AN ETHICAL ADMINISTRATIONJR Rolf NeuqeletNo ratings yet

- Tax Invoice: Invoice Issued For FlightDocument2 pagesTax Invoice: Invoice Issued For FlightManab HalderNo ratings yet

- Wiley CFA Test Bank 180527 (20 Preguntas)Document12 pagesWiley CFA Test Bank 180527 (20 Preguntas)rafav10No ratings yet

- Lahore School of Economics Financial Management I Time Value of Money - 3 Assignment 4Document2 pagesLahore School of Economics Financial Management I Time Value of Money - 3 Assignment 4Ahmed ZafarNo ratings yet

- Chapter 7 Project Termination and Project Management Practices in BDDocument19 pagesChapter 7 Project Termination and Project Management Practices in BDbba19047No ratings yet

- MC4 Matcha Creations: (For Instructor Use Only)Document2 pagesMC4 Matcha Creations: (For Instructor Use Only)Reza eka PutraNo ratings yet

- Chapter 20 FirmsDocument4 pagesChapter 20 FirmsBasheer KhaledNo ratings yet

- Consolidated Financial Statement Excercise 3-4Document2 pagesConsolidated Financial Statement Excercise 3-4Winnie TanNo ratings yet

- La Campañia Maritima vs. Francisco Muñoz, 12 December 1907, GR No. L-3704Document8 pagesLa Campañia Maritima vs. Francisco Muñoz, 12 December 1907, GR No. L-3704Marianne Hope VillasNo ratings yet

- Review of Related Literature OutlineDocument4 pagesReview of Related Literature OutlineSiote ChuaNo ratings yet

- 01-CalapanCity2019 Transmittal LetterDocument6 pages01-CalapanCity2019 Transmittal LetterkQy267BdTKNo ratings yet

- MAXIMUM Master Socket Set, 300-Pc, CRV, Nickel-ChDocument1 pageMAXIMUM Master Socket Set, 300-Pc, CRV, Nickel-Chbhattikulvir027No ratings yet

- 大萧条:历史与经验Document54 pages大萧条:历史与经验吴宙航No ratings yet

- Kotak Assured Savings Plan Product Presentation 07072021Document17 pagesKotak Assured Savings Plan Product Presentation 07072021Rahul NNo ratings yet

- QC Senior Compliance Attorney in Washington DC Resume Tina GreeneDocument2 pagesQC Senior Compliance Attorney in Washington DC Resume Tina GreeneTinaGreeneNo ratings yet

- Management Accountants. Classify Each of The End-Of-Year Games (A-G) As (I) AcceptableDocument3 pagesManagement Accountants. Classify Each of The End-Of-Year Games (A-G) As (I) AcceptableRhea OraaNo ratings yet

- MAA763 Governance and Fraud: Revision T2 2017Document40 pagesMAA763 Governance and Fraud: Revision T2 2017MalikNo ratings yet

- Complete List of SAP Purchase Document ME21N Exit and BADIDocument8 pagesComplete List of SAP Purchase Document ME21N Exit and BADISamarth ShahNo ratings yet

- 13 - Project Procurement Management-Online v1Document41 pages13 - Project Procurement Management-Online v1Afrina M.Kom.No ratings yet

- Entrepreneurship: It Is A Strategic Process of Innovation & New Venture CreationDocument23 pagesEntrepreneurship: It Is A Strategic Process of Innovation & New Venture CreationsalsabilNo ratings yet

- Philippine Duplicators, Inc. vs. NLRC and Philippine Duplicators Employees Union-TupasDocument2 pagesPhilippine Duplicators, Inc. vs. NLRC and Philippine Duplicators Employees Union-TupasDennis Jay Dencio ParasNo ratings yet

- British Policies That Led To The Exploitation of The Indian EconomyDocument3 pagesBritish Policies That Led To The Exploitation of The Indian EconomyAyushi MishraNo ratings yet