Professional Documents

Culture Documents

FIMM Pre-Investment Form

Uploaded by

Cik SuOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FIMM Pre-Investment Form

Uploaded by

Cik SuCopyright:

Available Formats

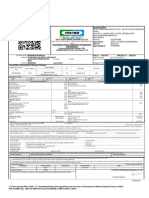

PRE-INVESTMENT FORM

ATTENTION UNIT TRUST INVESTORS IMPORTANT! Your Unit Trust Consultant (UTC) is required to explain all of the following to you Signing this form does not preclude you from taking action against relevant party/parties under any circumstances.

5) Your UTC may represent a company that uses a nominee system and your rights as a unit holder may be limited if you invest in unit trust funds through it. If his or her company uses a nominee system, ask if your rights as a unit holder will be limited in any way.

Investors Confirmation

I/We confirm that the UTC has explained all the points overleaf to me/us. 1) Applicant Signature : _______________________________ Name : _______________________________

You Should Also Know

a) Only registered UTCs are allowed to sell unit trust funds. Your UTC should show you a valid authorisation card confirming that he/she is registered with the Federation of Investment Managers Malaysia (FIMM). b) A unit trust fund may only be offered to the public if it is approved by the Securities Commission Malaysia (SC). Go to www.sc.com.my for a list of unit trust funds currently available in the market or call 603-6204 8777 for assistance. c) When you buy into a unit trust fund, you should be given the latest copy of prospectus for free. Read the prospectus carefully; understand its contents before investing. d) You may have to pay direct and indirect fees and possibly other charges too. Ask about applicable fees. e) If you have concerns or complaints about any unit trust fund, you can contact FIMM at 6032092 3800 (www.fimm.com.my) or the Investor Affairs & Complaints Department of the SC at 603-6204 8999. f) You should not make payment in cash to the UTC or issue a cheque in the name of UTC.

NRIC/Identification Number/Passport No.: ________________________________________ Date :_______________________________

Do You Know?

1) You can buy unit trusts either through a Unit Trust Consultant (UTC), Institutional Unit Trust Advisers (IUTA), Corporate Unit Trust Advisers (CUTA) or directly from Unit Trust Management Company (UTMC) or online, but each has different sales charge and level of service. Choose the one that best suits your needs. 2) If you redeem your units in a unit trust fund and then purchase units in another, you will probably have to pay a sales charge. However, if you switch from one fund to another managed by the same UTMC, it is likely that you may not have to pay any sales charge. Ask about switching before you redeem. 3) Different types of unit trust funds carry different levels of risk. Some are higher in risk than others. Ask about the risks before investing in a fund. Make sure you know what your fund is investing in. 4) If you are a first time investor in a UTMC, you may be eligible for cooling-off rights, whereby you can change your mind within six (6) business days after investing and withdraw your unit trust investment. Ask about your eligibility for cooling-off.

Yes()/ No(X)

2) Joint Applicant (If applicable) Signature :_______________________________ Name :_______________________________

NRIC/Identification Number/Passport No.: _______________________________________ Date :_______________________________

Unit Trust Consultants Declaration I declare that I have explained the points overleaf and the investor(s) understand(s) them. Signature :_______________________________ Name :_______________________________

NRIC/Identification Number/Passport No.: ________________________________________ Registered as UTC of UTMC/IUTA/CUTA^: ________________________________________

^Delete where not applicable.

You might also like

- UTI Transaction SlipDocument2 pagesUTI Transaction SlipSanjay Puri0% (1)

- External Factors For BMWDocument18 pagesExternal Factors For BMWMehereen Aubdoollah0% (1)

- Marketing ManagementDocument130 pagesMarketing ManagementGuruKPO88% (25)

- Logistics Project FinalDocument27 pagesLogistics Project FinalDhaval ThackerNo ratings yet

- Question 5Document4 pagesQuestion 5Siti Latifatul ZannahNo ratings yet

- Ecommerce Handbook: Growth Outlook and Competitive LandscapeDocument43 pagesEcommerce Handbook: Growth Outlook and Competitive LandscapeTiago SoaresNo ratings yet

- Mutual Fund Service System (MFSS) FAQ for InvestorsDocument7 pagesMutual Fund Service System (MFSS) FAQ for InvestorsAJAY KUMAR TALATHOTANo ratings yet

- Surrender FormDocument2 pagesSurrender Formvi_sharNo ratings yet

- I Barnes - MIRF-withdrawalretreanchmentretDocument8 pagesI Barnes - MIRF-withdrawalretreanchmentretridbastraNo ratings yet

- Tool Kit - TFM A-015 MF - TWPLDocument10 pagesTool Kit - TFM A-015 MF - TWPLAshish Ranjan JhaNo ratings yet

- Takaful MyMotor Motor PDS ENGDocument4 pagesTakaful MyMotor Motor PDS ENGNamirahMujahidahSyahidahNo ratings yet

- UTI-Focussed Equity Fund-Series I to III SID SummaryDocument56 pagesUTI-Focussed Equity Fund-Series I to III SID SummaryKanwal Jit SinghNo ratings yet

- Payout FormDocument3 pagesPayout FormavisekgNo ratings yet

- Autoswitcher Application Form: (Available With Unit Linked Insurance Plans Only)Document2 pagesAutoswitcher Application Form: (Available With Unit Linked Insurance Plans Only)vijayinndia87No ratings yet

- Tool Kit - CFH Fa-050 21m - TWPLDocument9 pagesTool Kit - CFH Fa-050 21m - TWPLAshish Ranjan JhaNo ratings yet

- Ulip RFC FutureDocument2 pagesUlip RFC Futuresuchak52No ratings yet

- Indiafirst Life CSC "Insurance Khata" Plan: Instructions For Filling The FormDocument2 pagesIndiafirst Life CSC "Insurance Khata" Plan: Instructions For Filling The FormSHAHID MALIKNo ratings yet

- Product Disclosure Sheet FLEXI PA TakafulDocument2 pagesProduct Disclosure Sheet FLEXI PA Takafulashyraf81No ratings yet

- Withdrawal and Surrender Form (V. 03.2019)Document2 pagesWithdrawal and Surrender Form (V. 03.2019)Nina De LeonNo ratings yet

- Manulife Withdrawal/Surrender FormDocument2 pagesManulife Withdrawal/Surrender FormPenielle SaguindanNo ratings yet

- Sid - Mirae Asset Nyse Fang Etf - FinalDocument88 pagesSid - Mirae Asset Nyse Fang Etf - FinalMohamed Rajiv AshaNo ratings yet

- SEBI Compliance for Rights Issue & Bonus SharesDocument22 pagesSEBI Compliance for Rights Issue & Bonus SharesarjunjoshiNo ratings yet

- SME PDS STTF ENG v2 06102022 PDFDocument4 pagesSME PDS STTF ENG v2 06102022 PDFAccounts DeptNo ratings yet

- Questionnair MEDocument5 pagesQuestionnair MEsadaquat123No ratings yet

- Appendices: Takafulink SeriesDocument23 pagesAppendices: Takafulink SeriesdikirNo ratings yet

- Investor awareness & preferences towards Neeladri ChitsDocument12 pagesInvestor awareness & preferences towards Neeladri ChitsGayatriThotakuraNo ratings yet

- Your Free Purchase Protection Insurance PolicyDocument8 pagesYour Free Purchase Protection Insurance PolicyskijacklamNo ratings yet

- HSC SP Q.5. Answer in Brief PDFDocument4 pagesHSC SP Q.5. Answer in Brief PDFTanya SinghNo ratings yet

- Partial Withdrawal FormDocument2 pagesPartial Withdrawal FormPinkys Venkat100% (1)

- Investor Guide: A Y N T K (Vol: II)Document15 pagesInvestor Guide: A Y N T K (Vol: II)Jaleel AhmadNo ratings yet

- MFSS Client Registration FormDocument4 pagesMFSS Client Registration FormbasabNo ratings yet

- Frequent Asked Questions (Faqs) : 1. How Is Takaful and Conventional Insurance Similar?Document3 pagesFrequent Asked Questions (Faqs) : 1. How Is Takaful and Conventional Insurance Similar?Asraf VoikaNo ratings yet

- Bajaj Allianz General Insurance CompanyDocument9 pagesBajaj Allianz General Insurance CompanySporada TechnologiesNo ratings yet

- Topics For Nukkad NatakDocument3 pagesTopics For Nukkad NatakMahesh BabuNo ratings yet

- New Issue Market-An Overview: Chapter-IllDocument15 pagesNew Issue Market-An Overview: Chapter-IllRiya KumariNo ratings yet

- Global Distressed Fund Subscription AgreementDocument5 pagesGlobal Distressed Fund Subscription AgreementkebakkoNo ratings yet

- Non Death Claim FormDocument6 pagesNon Death Claim FormHihiNo ratings yet

- Secured Iifl 12 Percent NcdsDocument3 pagesSecured Iifl 12 Percent NcdsKashmira RNo ratings yet

- Payout FormDocument5 pagesPayout FormMMayoor1984No ratings yet

- Sample KYC Form For Seg FundDocument19 pagesSample KYC Form For Seg FundRenee Barian RomeroNo ratings yet

- REDEEM-SWITCHDocument2 pagesREDEEM-SWITCHarshadjafri123No ratings yet

- UTIMF Transaction SlipDocument2 pagesUTIMF Transaction SlipVinayak SavanurNo ratings yet

- ITC Assets Group Trading D12 Enquiry FormDocument6 pagesITC Assets Group Trading D12 Enquiry FormJohn PRICENo ratings yet

- Transaction Form: Sole/First Unit Holder PANDocument2 pagesTransaction Form: Sole/First Unit Holder PANSilparajaNo ratings yet

- Business Finance Week 3-4Document12 pagesBusiness Finance Week 3-4MOST SUBSCRIBER WITHOUT A VIDEONo ratings yet

- Guide to Offer DocumentsDocument5 pagesGuide to Offer DocumentsGeetika KhandelwalNo ratings yet

- Articles-71061 Recurso 1Document3 pagesArticles-71061 Recurso 1victor castilloNo ratings yet

- Motor Private Car ENGDocument4 pagesMotor Private Car ENGascap77No ratings yet

- Client AuthorisationDocument3 pagesClient AuthorisationGorish SharmaNo ratings yet

- SunnyDocument2 pagesSunnyMukesh ManwaniNo ratings yet

- Broker AccreditationDocument2 pagesBroker AccreditationNorger TayagNo ratings yet

- Chapter 3Document10 pagesChapter 3Ajay PawarNo ratings yet

- Ecco - Faq Ver3Document3 pagesEcco - Faq Ver3sumitkumtha123No ratings yet

- AbitDocument13 pagesAbitmesfinabera180No ratings yet

- Workmens Compensation TakafulDocument3 pagesWorkmens Compensation TakafulFaizZiyannNo ratings yet

- Payout Request for Surrender/Partial WithdrawalDocument2 pagesPayout Request for Surrender/Partial Withdrawalronny_fernandes363No ratings yet

- Finmark Semis AssignmentDocument10 pagesFinmark Semis AssignmentPeachy CamNo ratings yet

- Common NFT Form Rev 1Document2 pagesCommon NFT Form Rev 1Sree Siddarameshwara Agro IndustriesNo ratings yet

- Surrender Form PDFDocument2 pagesSurrender Form PDFL.BISHORJIT MEITEINo ratings yet

- Sai Investment: Portfolio Management Service (PMS)Document5 pagesSai Investment: Portfolio Management Service (PMS)Ajay KharatNo ratings yet

- PropertyFinancing BaitiSingleTierDocument5 pagesPropertyFinancing BaitiSingleTierTaraqallah SalehNo ratings yet

- TWP 87187353Document2 pagesTWP 87187353Abilon Smith100% (2)

- Annexure ADocument1 pageAnnexure AKushal KhagtaNo ratings yet

- Structured Settlements: A Guide For Prospective SellersFrom EverandStructured Settlements: A Guide For Prospective SellersNo ratings yet

- Social Responsibility & Ethical Issues in International BusinessDocument16 pagesSocial Responsibility & Ethical Issues in International BusinessRavindra GoyalNo ratings yet

- Lotteria Marketing Plan FinalDocument24 pagesLotteria Marketing Plan FinalTran LinhNo ratings yet

- HPCL Visakhapatnam price listDocument3 pagesHPCL Visakhapatnam price listP. Balaji Chakravarthy0% (2)

- Go To MarketDocument17 pagesGo To MarketshabbirNo ratings yet

- Susmita Dasgupta Economic Research Unit, Joint Plant CommitteeDocument24 pagesSusmita Dasgupta Economic Research Unit, Joint Plant CommitteezillionpplNo ratings yet

- Toyota Innova Crysta 2 and Tata Aris Specification PDFDocument5 pagesToyota Innova Crysta 2 and Tata Aris Specification PDFdebashish patraNo ratings yet

- Or PPT R7Document22 pagesOr PPT R7Aravind MohandossNo ratings yet

- Specialists Control Over Market Openings and Closings by Richard NeyDocument3 pagesSpecialists Control Over Market Openings and Closings by Richard NeyaddqdaddqdNo ratings yet

- CapitalismDocument14 pagesCapitalismmangtae026No ratings yet

- Subhiksha - FinalDocument15 pagesSubhiksha - Finalkushal2711No ratings yet

- Slowdown in Chinese Economy: Submitted By:-Harshit Gupta 126KCDocument4 pagesSlowdown in Chinese Economy: Submitted By:-Harshit Gupta 126KCHarshit GuptaNo ratings yet

- Weighted Average Cost of CapitalDocument4 pagesWeighted Average Cost of CapitalFranz Pratama100% (1)

- Section A: Multiple Choice Questions (25 Marks) : Code: FallDocument30 pagesSection A: Multiple Choice Questions (25 Marks) : Code: FallDennys TNo ratings yet

- Business Ethics EssayDocument4 pagesBusiness Ethics EssayTanmay V KarandeNo ratings yet

- Fall of Venice: Internal and External Factors that Led to its DeclineDocument6 pagesFall of Venice: Internal and External Factors that Led to its DeclinedenlinNo ratings yet

- Chapter 09 MCQsDocument3 pagesChapter 09 MCQsElena Wang100% (1)

- Fdocuments - in PatanjaliDocument16 pagesFdocuments - in PatanjaliMUKUL LATIYANNo ratings yet

- CH 9Document5 pagesCH 9bsodoodNo ratings yet

- Unit 3 GoodwillitsvaluationDocument21 pagesUnit 3 GoodwillitsvaluationMir AqibNo ratings yet

- Chapter 7 ProblemsDocument4 pagesChapter 7 ProblemsZyraNo ratings yet

- Percentage Practice QuestionsDocument4 pagesPercentage Practice QuestionsaltmashNo ratings yet

- Review of GST Vs SST Implementation in MalaysiaDocument10 pagesReview of GST Vs SST Implementation in Malaysiarajes wariNo ratings yet

- Cfin 5th Edition Besley Solutions ManualDocument11 pagesCfin 5th Edition Besley Solutions Manuallaeliavanfyyqz100% (25)

- CA Foundation Accounts RTP May 22Document29 pagesCA Foundation Accounts RTP May 22Ansh UdainiaNo ratings yet

- Network Marketing Success Va PDFDocument103 pagesNetwork Marketing Success Va PDFJoao Paulo Moura100% (1)