Professional Documents

Culture Documents

Notice

Uploaded by

Vidya SagarOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Notice

Uploaded by

Vidya SagarCopyright:

Available Formats

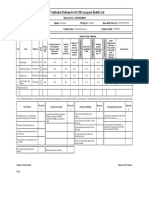

NOTICE

NOTICE is hereby given about the following changes to be carried out in the Combined Scheme Information Document (SID) and Combined Key Information Memorandum (KIM) of the schemes of DSP BlackRock Mutual Fund, pursuant to the resolution passed by the Trustee. (I) CHANGE IN NOMENCLATURE OF DSP BLACKROCK SAVINGS MANAGER FUND (SCHEME) Existing Nomenclature Modified Nomenclature DSP BlackRock Savings Manager Fund (DSPBRSF) DSP BlackRock MIP Fund* (DSPBRMIPF) *Monthly income is not assured and is subject to the availability of distributable surplus. (II) CHANGE IN NOMENCLATURE OF THE OPTIONS AVAILABLE UNDER THE SCHEME Existing Nomenclature Monthly Income Plan (MIP) Quarterly Income Plan (QIP) Modified Nomenclature Monthly Dividend (MD) Quarterly Dividend (QD)

The above changes are effective on and from August 22, 2011. All other provisions/features of the Scheme except as specifically stated above will remain unchanged. Investors may note that they must mention the modified name of the Scheme in all transaction request, payment instrument, etc. with effect from August 22, 2011. Transaction requests/payment instrument bearing old scheme name are liable for rejection. Prior to making investments, investors are requested to carefully read the relevant addenda, reflecting in detail the consequent amendments to the Combined SID and Combined KIM. Any queries/clarifications in this regard may be addressed to DSP BlackRock Investment Managers Pvt. Ltd., Investment Manager for DSP BlackRock Mutual Fund Mafatlal Centre, 10th Floor, Nariman Point, Mumbai 400 021. Phone Number: (91 22) 66578000 Date: August 10, 2011 Place: Mumbai Investment objectives: DSP BlackRock Savings Manager Fund (DSPBRSF) is an open ended income scheme, seeking to generate an attractive return, consistent with prudent risk, from a portfolio which is substantially constituted of quality debt securities. The Scheme will also seek to generate capital appreciation by investing a smaller portion of its corpus in equity and equity related securities of issuers domiciled in India. Features: Entry Load: Nil, Exit Load: Holding period < 12 months: 1%; Holding period >= 12 months: Nil. Statutory Details: DSP BlackRock Mutual Fund was set up as a trust and the settlers/sponsors are DSP ADIKO Holdings Pvt. Ltd & DSP HMK Holdings Pvt. Ltd. (collectively) and BlackRock Inc. (Combined liability restricted to Rs. 1 lakh). Trustee: DSP BlackRock Trustee Company Pvt. Ltd. Investment Manager: DSP BlackRock Investment Managers Private Limited. Risk Factors: Mutual funds, like securities investments, are subject to market and other risks and there can be no assurance that the Schemes objectives will be achieved. As with any investment in securities, the NAV of Units issued under the Scheme can go up or down depending on the factors and forces affecting capital markets. Past performance of the sponsor/AMC/mutual fund does not indicate the future performance of the Scheme. Investors in the Scheme are not being offered a guaranteed or assured rate of return. Each Scheme/Plan is required to have (i) minimum 20 investors and (ii) no single investor holding>25% of corpus. If the aforesaid point (i) is not fulfilled within the prescribed time, the Scheme/Plan concerned will be wound up and in case of breach of the aforesaid point (ii) at the end of the prescribed period, the investors holding in excess of 25% of the corpus will be redeemed as per SEBI guidelines. DSPBRSF is the name of the Scheme and does not in any manner indicate the quality of the Scheme, its future prospects or returns. For scheme specific risk factors, please refer the SID. For more details, please refer the Key Information Memorandum cum Application Forms, which are available on the website, www.dspblackrock.com, and at the ISCs/Distributors. Please read the Scheme Information Document and Statement of Additional Information carefully before investing.

You might also like

- World Energy Fund: DSP BlackrockDocument32 pagesWorld Energy Fund: DSP BlackrockRavi GeraNo ratings yet

- Sbi Capital DraftDocument39 pagesSbi Capital DraftDinesh DulaniNo ratings yet

- Kotak Gold Fund SIDDocument30 pagesKotak Gold Fund SIDsabyasachi_paulNo ratings yet

- BSL Income FundDocument13 pagesBSL Income FundVineet MishraNo ratings yet

- Sid RgessDocument36 pagesSid Rgessu4rishiNo ratings yet

- DSP BlackRock US Flexible Equity Fund - NFO Application From With KIM FormDocument16 pagesDSP BlackRock US Flexible Equity Fund - NFO Application From With KIM FormprajnacapiralNo ratings yet

- Axis Hybrid 9Document12 pagesAxis Hybrid 9Arpan PatelNo ratings yet

- HDFC Annual Interval FundDocument7 pagesHDFC Annual Interval Fundsandeepkumar404No ratings yet

- HDFC Mutual Fund ListDocument60 pagesHDFC Mutual Fund Listhshah21No ratings yet

- Offaaer DocumentDocument137 pagesOffaaer DocumentsatishiitrNo ratings yet

- HDFC Floating Rate Income Fund December 2012Document24 pagesHDFC Floating Rate Income Fund December 2012Dinesh GodhaniNo ratings yet

- VIP OnepagerDocument2 pagesVIP Onepagerkarthik.vNo ratings yet

- Offer DocumentDocument14 pagesOffer DocumentsidhanthaNo ratings yet

- Letter To Unitholders Segregation of Portfolio - Kotak Dynamic Bond FundDocument8 pagesLetter To Unitholders Segregation of Portfolio - Kotak Dynamic Bond FundShubham KansalNo ratings yet

- Offer FFFDocument102 pagesOffer FFFKapil RewarNo ratings yet

- Kim - Sbi Long Term Equity Fun5Document28 pagesKim - Sbi Long Term Equity Fun5vicky.sajnaniNo ratings yet

- Sid - Sbi S P Bse Sensex Index FundDocument136 pagesSid - Sbi S P Bse Sensex Index FundKrish MudaliarNo ratings yet

- L&T Tax Saver Fund Application FormDocument32 pagesL&T Tax Saver Fund Application FormPrajna CapitalNo ratings yet

- SID ABSL Multi Index Fund of FundsDocument81 pagesSID ABSL Multi Index Fund of FundsMoorthy MadhavanNo ratings yet

- Combined SID Debt FundsDocument40 pagesCombined SID Debt FundsDinesh GodhaniNo ratings yet

- DSP Blackrock Rajeev Gandhi Equity Saving Scheme (RGESS)Document12 pagesDSP Blackrock Rajeev Gandhi Equity Saving Scheme (RGESS)sushilbajaj23No ratings yet

- INFO UBS - SPACs - Investment Considerations BDocument19 pagesINFO UBS - SPACs - Investment Considerations BPer HuberNo ratings yet

- Kim DSP Multicap Fund - Asba FormDocument42 pagesKim DSP Multicap Fund - Asba Formfinal bossuNo ratings yet

- DBH 1st Mutual FundDocument34 pagesDBH 1st Mutual Fundrishav_agarwal_1No ratings yet

- Why & How To InvestDocument6 pagesWhy & How To InvestDeepak JashnaniNo ratings yet

- Investment Avenues (Securities) in PakistanDocument7 pagesInvestment Avenues (Securities) in PakistanPolite Charm100% (1)

- Mutual Fund Final Group 1Document122 pagesMutual Fund Final Group 1dharit1710No ratings yet

- Nism Module VaDocument15 pagesNism Module VaNeha BahetiNo ratings yet

- EmaarDocument167 pagesEmaarTshepo NthoiwaNo ratings yet

- MaxcapDocument3 pagesMaxcapRajuRahmotulAlamNo ratings yet

- Sbi Mutual FundDocument38 pagesSbi Mutual FundAbhilash MishraNo ratings yet

- Rajiv Gandhi Equity Savings Scheme, 2012 (Rgess) : TitleDocument10 pagesRajiv Gandhi Equity Savings Scheme, 2012 (Rgess) : Titleabhi_sek200No ratings yet

- Asset Allocator Fund KotakDocument79 pagesAsset Allocator Fund KotaksandipktNo ratings yet

- HDFC Children's Gift Fund - Savings Plan - : Nature of Scheme Inception Date Option/PlanDocument5 pagesHDFC Children's Gift Fund - Savings Plan - : Nature of Scheme Inception Date Option/Plansandeepkumar404No ratings yet

- NiSM QuestionzssDocument709 pagesNiSM Questionzssatingoyal1No ratings yet

- Pakistan Zindabad.Document73 pagesPakistan Zindabad.Muhammad Ali BhattiNo ratings yet

- SMIC Series C and D Bonds Final Prospectus Dated June 21 2012Document427 pagesSMIC Series C and D Bonds Final Prospectus Dated June 21 2012dendenliberoNo ratings yet

- Firststepblue 010622Document3 pagesFirststepblue 010622boss savla VikmaniNo ratings yet

- Combined KIM For Liquid & Debt SchemesDocument15 pagesCombined KIM For Liquid & Debt SchemesSrikanth SwaNo ratings yet

- Sid Sbi Magnum Childrens Benefit Fund Investment PlanDocument113 pagesSid Sbi Magnum Childrens Benefit Fund Investment Plansanketjio100No ratings yet

- SBI Fact ShewtDocument28 pagesSBI Fact ShewtRaawakeNo ratings yet

- DSP Blackrock Tax Saver Fund KimDocument22 pagesDSP Blackrock Tax Saver Fund KimPRANUNo ratings yet

- Annx 1Document162 pagesAnnx 1Ajay singhNo ratings yet

- PMS GuidelinesDocument5 pagesPMS GuidelinesTrader NepalNo ratings yet

- Answer The Following QuestionsDocument23 pagesAnswer The Following QuestionsnirajdjainNo ratings yet

- RHB-OSK Malaysia DIVA Fund-PhsDocument5 pagesRHB-OSK Malaysia DIVA Fund-PhsNur Hidayah JalilNo ratings yet

- Rgess - Sid Final AssignmentDocument52 pagesRgess - Sid Final AssignmentNikhil JethwaniNo ratings yet

- B.M Collage of B.B.ADocument12 pagesB.M Collage of B.B.AnilamgajiwalaNo ratings yet

- CMPCir1668 13 PDFDocument38 pagesCMPCir1668 13 PDFsunilNo ratings yet

- Presentation On BSEC (Debt Securities) Rules, 2021Document39 pagesPresentation On BSEC (Debt Securities) Rules, 2021Asif Abdullah KhanNo ratings yet

- SID - Kotak NASDAQ 100 Fund of Fund-1-10Document10 pagesSID - Kotak NASDAQ 100 Fund of Fund-1-10nicenikeNo ratings yet

- Birla Sun Life T-20 Fund: Scheme Information DocumentDocument41 pagesBirla Sun Life T-20 Fund: Scheme Information DocumentSatya NarayanaNo ratings yet

- Key Information Memorandum Cum Application FormDocument46 pagesKey Information Memorandum Cum Application FormChintan JainNo ratings yet

- CMBS Pitchbook Ver 1 13112011Document17 pagesCMBS Pitchbook Ver 1 13112011Rashdan IbrahimNo ratings yet

- Financial Reporting and Auditing in Sovereign Operations: Technical Guidance NoteFrom EverandFinancial Reporting and Auditing in Sovereign Operations: Technical Guidance NoteNo ratings yet

- Discounted Cash Flow Demystified: A Comprehensive Guide to DCF BudgetingFrom EverandDiscounted Cash Flow Demystified: A Comprehensive Guide to DCF BudgetingNo ratings yet

- CCSF - Annual Salary Ordinance - 2010 - Aso 2009-2010 - 07-21-09Document219 pagesCCSF - Annual Salary Ordinance - 2010 - Aso 2009-2010 - 07-21-09prowagNo ratings yet

- Sample UCPB - Biz Secretary's CertificateDocument2 pagesSample UCPB - Biz Secretary's CertificateBrikkzNo ratings yet

- Economic Growth: Trade BalanceDocument54 pagesEconomic Growth: Trade BalancepiyushmamgainNo ratings yet

- Mepco Online BillDocument1 pageMepco Online Billhassan khanNo ratings yet

- 56 - 2001 WinterDocument61 pages56 - 2001 Winterc_mc2100% (1)

- Pif 12 VoDocument10 pagesPif 12 VoJohn Lee PueyoNo ratings yet

- MYPF Pref Database 15may'13Document319 pagesMYPF Pref Database 15may'13Fiachra O'DriscollNo ratings yet

- Working Capital ManagementDocument17 pagesWorking Capital ManagementThilaga SenthilmuruganNo ratings yet

- Placido Cidito Ledesma Mapa JRDocument2 pagesPlacido Cidito Ledesma Mapa JRArnel MorallosNo ratings yet

- Financial Analysis & Inventory Management in WIMCODocument65 pagesFinancial Analysis & Inventory Management in WIMCOMayankNo ratings yet

- Field Verification Proforma For DR - YSR Aarogyasri Health CardDocument1 pageField Verification Proforma For DR - YSR Aarogyasri Health Cardjegurupadu gpNo ratings yet

- Man U IpoDocument258 pagesMan U IpoMichael OzanianNo ratings yet

- Assignment: On Financial Statement Analysis and ValuationDocument4 pagesAssignment: On Financial Statement Analysis and ValuationMd Ohidur RahmanNo ratings yet

- The Impact of Credit Risk Management On The Performance of Commercial Banks in CameroonDocument20 pagesThe Impact of Credit Risk Management On The Performance of Commercial Banks in CameroonAmbuj GargNo ratings yet

- Marketing Plan WIDocument33 pagesMarketing Plan WIAlliah Mari Pelitro BairaNo ratings yet

- Circular No. 38 /2016-Customs: - (1) Notwithstanding Anything Contained in This Act ButDocument18 pagesCircular No. 38 /2016-Customs: - (1) Notwithstanding Anything Contained in This Act ButAnshNo ratings yet

- Tatckt2 Link 2Document18 pagesTatckt2 Link 2Nguyễn Ngọc Thanh TrangNo ratings yet

- FN2029 - FI - 2011 Examiners Commentaries - Zone-BDocument8 pagesFN2029 - FI - 2011 Examiners Commentaries - Zone-BScarlett Ford GeronimoNo ratings yet

- 032465913X 164223Document72 pages032465913X 164223March AthenaNo ratings yet

- Public Finance Research Paper TopicsDocument6 pagesPublic Finance Research Paper Topicshanamituzil2100% (1)

- Neugene Marketing v. CADocument3 pagesNeugene Marketing v. CAJustin MoretoNo ratings yet

- What Is A Financial Intermediary (Final)Document6 pagesWhat Is A Financial Intermediary (Final)Mark PlancaNo ratings yet

- Excercise Chapter 2Document2 pagesExcercise Chapter 2Loan VũNo ratings yet

- RFQ - M40 Milton Tactical Boots PDFDocument19 pagesRFQ - M40 Milton Tactical Boots PDFSkhumbuzo Macinga0% (1)

- Wallstreetjournaleurope 20170711 TheWallStreetJournal-EuropeDocument20 pagesWallstreetjournaleurope 20170711 TheWallStreetJournal-EuropestefanoNo ratings yet

- Technical Asssistance For Policy Development For Enabling The Housing Market To Work in Indonesia. HOMIDocument580 pagesTechnical Asssistance For Policy Development For Enabling The Housing Market To Work in Indonesia. HOMIOswar MungkasaNo ratings yet

- Acknowledgement of Indebtedness (Pengakuan Hutang)Document6 pagesAcknowledgement of Indebtedness (Pengakuan Hutang)Savara MarhabanNo ratings yet

- 1.3.3 Cash-FlowDocument3 pages1.3.3 Cash-FlowDhyey Trivedi0% (1)

- 4HANA Treasury and Risk ManagementDocument50 pages4HANA Treasury and Risk Managementsaigramesh100% (1)

- AF102 Final Exam Revision PackageDocument22 pagesAF102 Final Exam Revision Packagetb66jfpbrzNo ratings yet