0% found this document useful (0 votes)

11 views5 pagesBootstrap Hypothesis Tests in Credit Risk

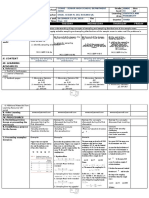

The document discusses the application of bootstrapping in credit risk modeling, highlighting its advantages such as flexibility and lack of distributional assumptions, while also noting its computational intensity and accuracy concerns with small sample sizes. It provides examples of hypothesis testing using bootstrapping, including the Population Stability Index, Herfindahl-Hirschman Index, and Area Under Curve, with visualizations and p-values for each case. Overall, bootstrapping is presented as a valuable tool for testing metrics in credit risk where traditional methods may fall short.

Uploaded by

Nicolás Leonardo Adriazola RománCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

11 views5 pagesBootstrap Hypothesis Tests in Credit Risk

The document discusses the application of bootstrapping in credit risk modeling, highlighting its advantages such as flexibility and lack of distributional assumptions, while also noting its computational intensity and accuracy concerns with small sample sizes. It provides examples of hypothesis testing using bootstrapping, including the Population Stability Index, Herfindahl-Hirschman Index, and Area Under Curve, with visualizations and p-values for each case. Overall, bootstrapping is presented as a valuable tool for testing metrics in credit risk where traditional methods may fall short.

Uploaded by

Nicolás Leonardo Adriazola RománCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd