0% found this document useful (0 votes)

25 views51 pagesUnemployment and Fiscal Policy Insights

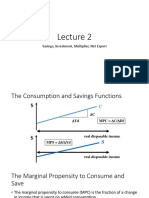

Unit 14 focuses on the relationship between unemployment and fiscal policy, emphasizing the Keynesian multiplier model and its components, including consumption and investment. It explores how government intervention can stabilize the economy and the effects of changes in aggregate demand on real GDP and unemployment. The unit also covers the calculation and interpretation of the Keynesian multiplier, as well as the consumption function and its implications for economic equilibrium.

Uploaded by

Rhulani MthembiCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

25 views51 pagesUnemployment and Fiscal Policy Insights

Unit 14 focuses on the relationship between unemployment and fiscal policy, emphasizing the Keynesian multiplier model and its components, including consumption and investment. It explores how government intervention can stabilize the economy and the effects of changes in aggregate demand on real GDP and unemployment. The unit also covers the calculation and interpretation of the Keynesian multiplier, as well as the consumption function and its implications for economic equilibrium.

Uploaded by

Rhulani MthembiCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd