0% found this document useful (0 votes)

22 views5 pagesAccounting 1A Test Instructions and Questions

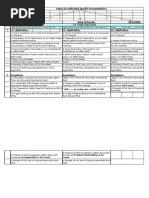

The document outlines the assessment details for Accounting 1A, including instructions for a test with a total of 60 marks and a duration of 1 hour plus reading time. It includes specific questions requiring the completion of tables related to transactions, calculations of financial figures, and preparation of subsidiary journals. The assessment is closed book, and students must adhere to strict guidelines regarding the use of answer booklets and submission of work.

Uploaded by

2qk5m74f7nCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

22 views5 pagesAccounting 1A Test Instructions and Questions

The document outlines the assessment details for Accounting 1A, including instructions for a test with a total of 60 marks and a duration of 1 hour plus reading time. It includes specific questions requiring the completion of tables related to transactions, calculations of financial figures, and preparation of subsidiary journals. The assessment is closed book, and students must adhere to strict guidelines regarding the use of answer booklets and submission of work.

Uploaded by

2qk5m74f7nCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd