Professional Documents

Culture Documents

Acbp5112+W - Acbp5122+w Assignment 1 - Answer Booklet

Uploaded by

Kagiso MahlanguOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Acbp5112+W - Acbp5122+w Assignment 1 - Answer Booklet

Uploaded by

Kagiso MahlanguCopyright:

Available Formats

21 2021

Student No. 21996749

Bcom 1

Accounting 1B

Q1 Q2 Q3 TOTAL %

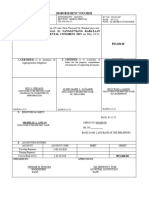

ASSESSMENT TYPE: ANSWER BOOK

TOTAL MARK ALLOCATION: 100 MARKS

TOTAL HOURS: 10 HOURS

STUDENT NUMBER:

LECTURER’S NAME:

DATE:

By submitting this assignment, you acknowledge that you have read and understood all the rules

as per the terms in the registration contract, in particular the assignment and assessment rules in

The IIE Assessment Strategy and Policy (IIE009), the intellectual integrity and plagiarism rules in

the Intellectual Integrity Policy (IIE023), as well as any rules and regulations published in the

student portal.

INSTRUCTIONS:

1. No material may be copied from original sources, even if referenced correctly, unless it is a

direct quote indicated with quotation marks. No more than 10% of the assignment may

consist of direct quotes.

2. Make a copy of your assignment before handing it in.

3. All work must be adequately and correctly referenced.

4. Begin each section on a new page.

5. Follow all instructions on the assignment cover sheet.

6. This is an individual assignment.

Additional instructions:

1. Calculators are allowed.

2. Answer All Questions.

3. Show all calculations, where applicable (marks may be awarded for this).

© The Independent Institute of Education (Pty) Ltd 2021

Page 1 of 17

21 2021

Question 1 (Marks: 40)

Q.1.1 (6)

Adjusting differences happen when the business is not aware of a transaction

recorded by the bank. Hence why when comparing the bank statement to the

business journals you would come across unreconciled credits. For example,

Interest, Direct deposits

Timing differences involve transactions that have been recorded in the cash

book payments journal but because of timing differences, are yet to appear on

the bank’s statement.

© The Independent Institute of Education (Pty) Ltd 2021

Page 2 of 17

21 2021

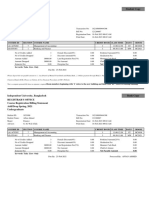

Q.1.2 Subsidiary Cashbook Receipts (15½)

DETAILS AMOUNT

Total before adjustments 8500

Adjustments: 2220

Cheque 2712 cancelation

Cheque 2712 overstated 900

Interest Income 480

Total receipts after 12100

adjustments

Subsidiary Cashbook Payments

DETAILS AMOUNT

Total before adjustments 4500

Adjustments: 8500

Deposit outstanding

Stop order 1800

© The Independent Institute of Education (Pty) Ltd 2021

Page 3 of 17

21 2021

Bank charges 530

Cheque R/D 2355

Total payments after 17685

adjustments

© The Independent Institute of Education (Pty) Ltd 2021

Page 4 of 17

21 2021

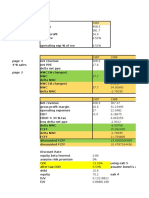

Q.1.3 (6)

BANK B5

DATE DETAILS FOL AMOUNT DATE DETAILS FOL AMOUNT

1 May 2021 Balance B/D 36500 31 May Total payments CBP 17685

31 May Total receipts CBR 12100 Balance c/d 30915

46800

1 June 2021 Balance b/d 30915

© The Independent Institute of Education (Pty) Ltd 2021

Page 5 of 17

21 2021

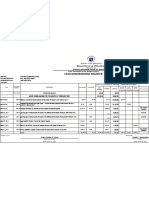

Q.1.4 Bank Reconciliation Statement of Zebra Traders for May 2021 (8½)

© The Independent Institute of Education (Pty) Ltd 2021

Page 6 of 17

21 2021

DETAILS AMOUNT

Balance per bank statement 20815

Outstanding Deposits 17300

18400

Outstanding Cheque no. 2785 (6500)

No. 2805 (7770)

No. 2691 (11330)

30915

Balance as per Bank Account

© The Independent Institute of Education (Pty) Ltd 2021

Page 7 of 17

21 2021

© The Independent Institute of Education (Pty) Ltd 2021

Page 8 of 17

21 2021

Q.1.5 PROBLEM ADVICE (4)

© The Independent Institute of Education (Pty) Ltd 2021

Page 9 of 17

21 2021

PROBLEM ADVICE

© The Independent Institute of Education (Pty) Ltd 2021

Page 10 of 17

21 2021

Question 2 (Marks: 50)

Q.2.1 (17)

Debtors control B11

DR CR

Date Details Fol. Amount Date Details Fol. Amount

1 Feb 2021 Balance b/d 54300 28 Feb Settlement payments CBR 38946

28 Feb Total debtors DJ 62612 Discounts on payments GJ 1629

28 Feb Cheque L.Simpson R/D GJ 6300 Credit returns DAJ 8855

Bad Debts GJ 26450

Balance c/d 47332

213212 123212

1 Mar

Balance b/d 47332

2021

© The Independent Institute of Education (Pty) Ltd 2021

Page 11 of 17

21 2021

Q.2.2 (20

)

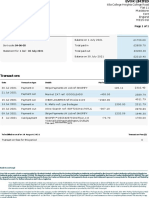

DEBTORS LEDGER OF TOWEL TALK – FEBRUARY 2021

L.SIMPSON (D1)

DATE DOCUMENT NAME AND FOL DEBIT CREDIT BALANCE

NUMBER

1 Feb Balance b/d 12000

2021

12 INV205 2875 14875

Feb

13 CN46 575 14300

Feb

14 DR28 8000 6300

Feb

24 INV208 5175 11475

FEB

25 CN48 5175 6300

Feb

26 DR30 5985 315

Feb

26 JV26 315 0

Feb

28 Cheque no DR30 R/D 6300 6300

Feb

© The Independent Institute of Education (Pty) Ltd 2021

Page 12 of 17

21 2021

Q.2.3 (13

)

DEBTORS LIST OF TOWEL TALK AS AT 28 FEBRUARY 2021

DEBTOR FOL AMOUNT

D1 6300

L. Simpson

D2 31103

Marvel Ltd (13900 + 17250 – 2875 + 2828)

D3 10463

R. Green (9600 + 1093 -230)

D4 26450

Home Centre Ltd

(2300 + 24150)

D. Patel D5 3614

(16500 + 9775 + 2300 – 24961)

© The Independent Institute of Education (Pty) Ltd 2021

Page 13 of 17

21 2021

Balance

© The Independent Institute of Education (Pty) Ltd 2021

Page 14 of 17

21 2021

Question 3 (Marks: 10)

Q.3.1 (10)

General ledger

CREDITORS CONTROL B5

DATE DETAILS FOL AMOUNT DATE DETAILS FOL AMOUNT

30 June Sundry returns (2800 + 90) CAJ 2890 1 June 2021 Balance b/d 55130

Bank (24000 + 1080) CBP 25080 30 June Sundry purchases CJ 14160

30 June (13000 – 600 + 2160 –

400)

Settlement discount GJ 250

received

Balance c/d 41570

69540 69540

1 Jul 2021 Balance b/d 41570

© The Independent Institute of Education (Pty) Ltd 2021

Page 15 of 17

21 2021

© The Independent Institute of Education (Pty) Ltd 2021

Page 16 of 17

21 2021

Workings page

END OF ANSWER BOOKLET

© The Independent Institute of Education (Pty) Ltd 2021

Page 17 of 17

You might also like

- Notice - of - Assessment - 2021 - 05 - 12 - 14 - 30 - 22 - 631038 2Document6 pagesNotice - of - Assessment - 2021 - 05 - 12 - 14 - 30 - 22 - 631038 2Dennis EnnsNo ratings yet

- Investment ChecklistDocument3 pagesInvestment ChecklistArpan chakrabortyNo ratings yet

- Trading Checklist BH v2Document2 pagesTrading Checklist BH v2Tong SepamNo ratings yet

- Notice of Assessment 2022 05 05 02 53 07 946195Document4 pagesNotice of Assessment 2022 05 05 02 53 07 946195Matt Gaming 01No ratings yet

- Meralco Bill 427881610101 01102020 - 1Document2 pagesMeralco Bill 427881610101 01102020 - 1Mary Louise82% (11)

- 5rd Sessiom - Audit of LeaseDocument20 pages5rd Sessiom - Audit of LeaseRUFFA SANCHEZNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- The Basics of Public Budgeting and Financial Management: A Handbook for Academics and PractitionersFrom EverandThe Basics of Public Budgeting and Financial Management: A Handbook for Academics and PractitionersNo ratings yet

- Avalanche Bank Statement 26.02.2021Document2 pagesAvalanche Bank Statement 26.02.2021HerbertNo ratings yet

- Greg Morris - 2017 Economic & Investment Summit Presentation - Questionable PracticesDocument53 pagesGreg Morris - 2017 Economic & Investment Summit Presentation - Questionable Practicesstreettalk700No ratings yet

- Grade 11 Control Test Two - Question PaperDocument6 pagesGrade 11 Control Test Two - Question Papertshabalalab818No ratings yet

- August 2021Document1 pageAugust 2021Julio DelarozaNo ratings yet

- Gts 1stDocument2 pagesGts 1stGOLDEN TOPSTEEL CONSTRUCTION SUPPLYNo ratings yet

- Controlled Test GR11 MG 13 April 2021Document6 pagesControlled Test GR11 MG 13 April 2021fatimah WajoodeenNo ratings yet

- ACCOx 131 EcDocument10 pagesACCOx 131 EcSinazo XhosaNo ratings yet

- ACBP5121+w Assignment 2Document10 pagesACBP5121+w Assignment 2pillaynorman20No ratings yet

- Compak Suggested AnswersDocument8 pagesCompak Suggested Answersknprop134No ratings yet

- ZetkjretkjzrtkrzDocument2 pagesZetkjretkjzrtkrzHyacinth BalmacedaNo ratings yet

- Accounting P1 Nov 2021 EngDocument12 pagesAccounting P1 Nov 2021 EngnicholasvhahangweleNo ratings yet

- Accounting P1 Nov 2021 EngDocument11 pagesAccounting P1 Nov 2021 EngLloydNo ratings yet

- Basavaraju S CDocument32 pagesBasavaraju S Cproject mailNo ratings yet

- Contoh Bukti Pembayaran Air Bersih Dan Air LimbahDocument3 pagesContoh Bukti Pembayaran Air Bersih Dan Air LimbahSukamto PrasetyoNo ratings yet

- 2022 AC202 SummerDocument4 pages2022 AC202 Summermollymgonigle1No ratings yet

- Bayba Financial Service Update Report RevisedDocument9 pagesBayba Financial Service Update Report Revisedebrima JobzNo ratings yet

- Take-Home Exam 1Document9 pagesTake-Home Exam 1Okuhle MqoboliNo ratings yet

- Exercise 17 SolutionDocument1 pageExercise 17 SolutionhontoskokoNo ratings yet

- Treasurer's+Report+ +AGA+February+2021Document12 pagesTreasurer's+Report+ +AGA+February+2021avesta HatamiNo ratings yet

- Accounting Grade 11 Revision Term 1 - 2023Document15 pagesAccounting Grade 11 Revision Term 1 - 2023sihlemooi3No ratings yet

- PR 7887Document2 pagesPR 7887Mohameed Ehteshamuddin QureshNo ratings yet

- UntitledDocument77 pagesUntitledPak CVBankNo ratings yet

- H One (PVT) LTD 20-21-ExemptDocument164 pagesH One (PVT) LTD 20-21-ExemptShehara GamlathNo ratings yet

- IFMIS Irregular Account Balanc 250920Document1 pageIFMIS Irregular Account Balanc 250920Dejene GelanNo ratings yet

- Accruals Q1 AnswerDocument2 pagesAccruals Q1 AnswerRiyu RimmyNo ratings yet

- My Summary My RewardsDocument3 pagesMy Summary My RewardsPrakash HandeNo ratings yet

- ST Joseph Waihi - SIGNED Financial StatementsDocument26 pagesST Joseph Waihi - SIGNED Financial StatementsJoshua WoodhamNo ratings yet

- 2022 Bir Tax CalendarDocument40 pages2022 Bir Tax CalendarRose Ann FrancoNo ratings yet

- Botswana Unified Revenue Service: Tax Compliance SummaryDocument1 pageBotswana Unified Revenue Service: Tax Compliance SummaryGaone Lydia SetlhodiNo ratings yet

- Interim Report July - September 2021Document35 pagesInterim Report July - September 2021Jawwad ZakiNo ratings yet

- AnswersDocument12 pagesAnswersdebate ddNo ratings yet

- Acme Financial ReportDocument11 pagesAcme Financial ReportGhost MailerNo ratings yet

- EtisalatDocument17 pagesEtisalatStena NadishaniNo ratings yet

- Akuntansi Pengantar 6Document3 pagesAkuntansi Pengantar 6WiwitvlogNo ratings yet

- SPES CDR DecemBER 2021 AutosavedDocument44 pagesSPES CDR DecemBER 2021 AutosavedEthel Paladin DizonNo ratings yet

- Page 1of 1: Tide Card: 3875Document1 pagePage 1of 1: Tide Card: 3875Julio DelarozaNo ratings yet

- (12-02-21) Managerial AccountingDocument3 pages(12-02-21) Managerial AccountingShivi CholaNo ratings yet

- FA Dec 2021Document8 pagesFA Dec 2021Shawn LiewNo ratings yet

- Accounting P1 Nov 2022Document14 pagesAccounting P1 Nov 2022Lesego TsatsinyaneNo ratings yet

- Fees 2021-1Document2 pagesFees 2021-1Hằng HoàngNo ratings yet

- Highlights Finance Bill 2022Document55 pagesHighlights Finance Bill 2022faisalzaheerNo ratings yet

- BRS Economic Update - SL Budget 2024Document22 pagesBRS Economic Update - SL Budget 2024Sudheera IndrajithNo ratings yet

- Transaction Details: Monthly Contribution Online Challan FormDocument1 pageTransaction Details: Monthly Contribution Online Challan FormSampath SanguNo ratings yet

- Bay Beak Co. - Activity StatementDocument2 pagesBay Beak Co. - Activity StatementJanine Leigh BacalsoNo ratings yet

- GST & TAX Compliance.Document2 pagesGST & TAX Compliance.Jabagodu SP & CoNo ratings yet

- JulyDocument1 pageJulyJulio DelarozaNo ratings yet

- Tenant/Debtor Transactions: Period Transaction Remarks Exclusive Tax Amount Inclusive Date TaxDocument1 pageTenant/Debtor Transactions: Period Transaction Remarks Exclusive Tax Amount Inclusive Date TaxDARSHAN JOSHINo ratings yet

- This Is A Computer Generated Bill, Hence No Signature Is RequiredDocument1 pageThis Is A Computer Generated Bill, Hence No Signature Is RequiredAffan AhmedNo ratings yet

- Straco AR2021Document188 pagesStraco AR2021Lim Yee FattNo ratings yet

- Finance Report 2022Document191 pagesFinance Report 2022Cam TuNo ratings yet

- Math Lit Session 1 - 4 Learner Guide 2023 EnglishDocument22 pagesMath Lit Session 1 - 4 Learner Guide 2023 EnglishSilindokuhle MazibukoNo ratings yet

- Nirima Sahu ComputationDocument2 pagesNirima Sahu Computationbrs consultancyNo ratings yet

- Summary For Customer Account Number (CAN) 1624259261Document2 pagesSummary For Customer Account Number (CAN) 1624259261Joris YapNo ratings yet

- Congratulations! You Are On One Airtel 1349 PlanDocument11 pagesCongratulations! You Are On One Airtel 1349 Plansandeep salavarNo ratings yet

- Weekly Meeting October 2022Document42 pagesWeekly Meeting October 2022Abang GaffiNo ratings yet

- Finance, Accounting and Risk Management: Code: AMIL38Document9 pagesFinance, Accounting and Risk Management: Code: AMIL38ilayanambiNo ratings yet

- Solutions Chapter 13Document4 pagesSolutions Chapter 13Imroz MahmudNo ratings yet

- Sample of Loancheck+ 2Document8 pagesSample of Loancheck+ 2Mohd MuzammilNo ratings yet

- Minutes BAP Sem IV Principles of Macroeconomics IIDocument2 pagesMinutes BAP Sem IV Principles of Macroeconomics IIMadhu SharmaNo ratings yet

- Own or LeaseDocument6 pagesOwn or LeaseMANOJNo ratings yet

- Tax 1 Midterms Reviewer-AuslDocument18 pagesTax 1 Midterms Reviewer-AuslAlyanna Gayle FajardoNo ratings yet

- Phuket BeachDocument7 pagesPhuket Beachaakash3978No ratings yet

- The Qatar Kuwait Pipeline Project - Economic ModelDocument7 pagesThe Qatar Kuwait Pipeline Project - Economic Modeladeel499No ratings yet

- Brigham Risk Return PP TDocument7 pagesBrigham Risk Return PP Tshahmed999No ratings yet

- ISO 4217 Currency CodeDocument7 pagesISO 4217 Currency CodeSudhir PandeyNo ratings yet

- ACC 226 Expanded OpportunityDocument4 pagesACC 226 Expanded OpportunityEllen MNo ratings yet

- Accounting EquationsDocument27 pagesAccounting EquationsSrijita ChatterjeeNo ratings yet

- Contingent Bill of The ................................................................ DepartmentDocument1 pageContingent Bill of The ................................................................ DepartmentrhengongNo ratings yet

- Indian Equity MArketDocument16 pagesIndian Equity MArketAshi RanaNo ratings yet

- Intermediate (IPC) Course Paper 3B Financial Management Chapter 4 Unit 2Document62 pagesIntermediate (IPC) Course Paper 3B Financial Management Chapter 4 Unit 2saiNo ratings yet

- Initial Public OfferingsDocument13 pagesInitial Public OfferingsPragathi T NNo ratings yet

- Pinkerton ADocument14 pagesPinkerton AGandhi Jenny Rakeshkumar BD20029No ratings yet

- Nexus Between Working Capital Management and Sectoral PerformanceDocument17 pagesNexus Between Working Capital Management and Sectoral Performancemohammad bilalNo ratings yet

- FM Case StudyDocument8 pagesFM Case StudyKD StrokerNo ratings yet

- DBB2104 Unit-08Document24 pagesDBB2104 Unit-08anamikarajendran441998No ratings yet

- PPT 1Document15 pagesPPT 1GEETI OBEROINo ratings yet

- Financial Application: Portfolio SelectionDocument16 pagesFinancial Application: Portfolio SelectionTeree ZuNo ratings yet

- ECONTWO Exercise 2Document3 pagesECONTWO Exercise 2Alexandra YapNo ratings yet

- Financial Risk Management - Case Studies With SKF and Elof HanssonDocument92 pagesFinancial Risk Management - Case Studies With SKF and Elof HanssonHaannaaNo ratings yet

- Canara HSBC (10 - 15)Document4 pagesCanara HSBC (10 - 15)AbhishekNo ratings yet

- Sk-Disbursement-Voucher AprilDocument20 pagesSk-Disbursement-Voucher AprilMerlund Rey ZamoraNo ratings yet

- Case #01:: Topic Hedge Funds The Gamestop Short SqueezeDocument4 pagesCase #01:: Topic Hedge Funds The Gamestop Short SqueezeLorena Beatriz Tacunan FloresNo ratings yet