0% found this document useful (0 votes)

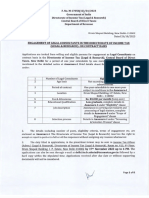

109 views3 pagesAmendment of CBIC Inspector Recruitment Rules

The document outlines proposed amendments to the Recruitment Rules for the Inspector (Directorates) position under the Central Board of Indirect Taxes and Customs (CBIC). Stakeholders are invited to provide comments on the draft rules within 30 days, as the rules are currently under inter-ministerial consultation. The amendments include changes to age and educational qualifications requirements, as well as the distribution of recruitment methods among different categories of officers.

Uploaded by

Yuvnesh SharmaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

109 views3 pagesAmendment of CBIC Inspector Recruitment Rules

The document outlines proposed amendments to the Recruitment Rules for the Inspector (Directorates) position under the Central Board of Indirect Taxes and Customs (CBIC). Stakeholders are invited to provide comments on the draft rules within 30 days, as the rules are currently under inter-ministerial consultation. The amendments include changes to age and educational qualifications requirements, as well as the distribution of recruitment methods among different categories of officers.

Uploaded by

Yuvnesh SharmaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd