0% found this document useful (0 votes)

39 views4 pagesCash Flow Analysis and Projections

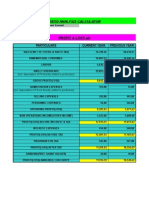

The document presents a financial analysis of projected cash flows over five years, detailing savings, depreciation expenses, profits before and after tax, and net cash flows. It includes calculations for net present value, internal rate of return, and payback period, indicating a positive net present value of 14,932.01 and an IRR of 20.58%. Additionally, it compares cash flows under different discount rates, showing varying net cash flows and cumulative balances.

Uploaded by

Nouman SheikhCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

39 views4 pagesCash Flow Analysis and Projections

The document presents a financial analysis of projected cash flows over five years, detailing savings, depreciation expenses, profits before and after tax, and net cash flows. It includes calculations for net present value, internal rate of return, and payback period, indicating a positive net present value of 14,932.01 and an IRR of 20.58%. Additionally, it compares cash flows under different discount rates, showing varying net cash flows and cumulative balances.

Uploaded by

Nouman SheikhCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd