0% found this document useful (0 votes)

155 views6 pagesVAF Personal Application Form

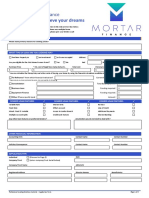

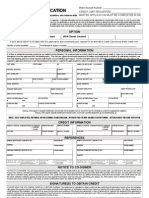

The document is a Vehicle and Asset Finance (VAF) application form that requires personal, employment, and financial information from the applicant. It includes sections for identifying information, banking details, and consent for credit reference checks. The form also outlines general terms and conditions, as well as a verification checklist for bank use.

Uploaded by

washieCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

155 views6 pagesVAF Personal Application Form

The document is a Vehicle and Asset Finance (VAF) application form that requires personal, employment, and financial information from the applicant. It includes sections for identifying information, banking details, and consent for credit reference checks. The form also outlines general terms and conditions, as well as a verification checklist for bank use.

Uploaded by

washieCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd