Professional Documents

Culture Documents

Earned Value Analysis

Uploaded by

Chetan Reddy ChamalaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Earned Value Analysis

Uploaded by

Chetan Reddy ChamalaCopyright:

Available Formats

Earned Value Analysis The fundamnetal characteristics of all business financial transactions are the amount of the transaction

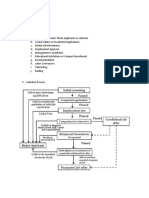

and the date of the transaction. These two components are equally important in financial planning and tracking systems. Traditional financial planning and tracking systems are not compatible with the project environment. Traditional financial planning and tracking tools do not fit the project context. For instance, the traditional financial planning tools are tied to annual budgeting cycles not project schedules. Also, traditional financial planning tools assume the business will be in the mode of continuous operation so if activity slows in one area, the resources will be shifted to another and the expenditures will stay constant. This levels out the resource requirements and eliminates spikes and valleys in resource needs. However, projects often don't operate in that fashion. Projects activities are planned with start and stop dates and resources are assigned and removed from the project plan throughout the project life-cycle. Therefore some of the major assumptions on which financial planning tools are based are invalid in the project planning environment. Further, traditional financial accounting systems make some assumptions when tracking costs that are not valid in the project control environment. For instance, the tracking cycle used in financial systems is based upon calendar events such as end of month, end of quarter, or end of year because these are major reporting points to taxing authorities and investors. However, the significant project reporting points are the project milestones; which seldom precisely align with finanical calendar dates. An additional assumption in the financial systems is that the business is on-schedule again because of the financial planning calendar it is impossible for the business to get behind schedule. There is no such thing as stretching December out to have 37 or 38 days. The financial control system assumes the project is always on schedule, so any over-spending or under-spending during a time period is a true over-run or under-run on the project. However, a project is seldom precisely on schedule, and over-spending in one month may be the result of activities being delayed or accelerated and do not necessarily indicate the final project spending will be over-run. The Earned Value Analysis (EVA) technique takes into consideration the project context for the planned and actual expenditures and integrates the project scope, schedule, and resource characteristics into a comprehensive set of measurements. This page will outline the use of Earned Value Analysis by addressing Financial Databases for EVA, Earned Value Definitions, Establishing Earned Value Budgets, Determining Earned Value, Variance Analysis, and Forecasting. The Earned Value technique allows for the temporary and intermittent nature of project work by scheduling the expenditures based upon the project plan, including the spikes and valleys in resources requirements. Further, Earned Value tracks how much money has been spent on the project in relation to how much project work has been accomplished. This takes into consideration all that has happened on the project such as schedule delays or acceleration. The variances that have occurred can then be separated into those due to timing, either ahead or behind schedule; and those due to mis-estimating the work; true under-runs or over-runs. Finally, the indices and variances generated by the Earned Value technique will aid the project management team in forecasting the financial conditions at project completion. Financial Databases for EVA The EVA techniques manipulate information gleaned from three essentially independent sources of financial data. Each of these are a cost baseline for the project. Each looks at the project from a different perspective. planned project expenditures (Planned Value) from project start until the present time. This is established at the time the project was initially planned and represents the original intent of the project team. It is developed by summing up all of the project task estimates and time-phasing them based upon the project schedule. accounting systems. These are all the costs associated with the work that has been completed on the project up through the present instant in time.

The actual project progress (Earned Value) which is the originally planned expenditures for the work that has been accomplished up to this time. This is determined by the tasks that are completed or the progress made on the tasks that are underway. The key to this measurement is that the values for each task are based upon the originally estimated values for the task. Each task is assigned a "value" that is embodied in the original task estimate. When the task is completed, the estimated value represents the value earned by completing the work on the project task - regardless of how much that work actually cost.

Determining the Earned Value Determining the EV for a partially completed task is at the heart of EVA. Therefore it is important that the EV be as accurate as possible. However, EV is a judgment call while a task is underway. If the project management team understates or over-states the EV, they can change whether a project is perceived to be running well or in significant trouble. Over time some approaches have been developed for estimating EV. These provide guidance to the project management team and can improve the accuracy of the EV. The best approach is to have detailed tasks planning with a percentage of PV assigned to each item or interim milestone within the task. Then as soon as that item is complete, that amount of EV has been earned. However, this does require very detailed task planning and often that planning has not been done, either to save time or because there are no obvious interim steps within the task. Another technique is the "0-100" technique. In this approach, no EV credit is allowed for a task until the task is completed. This is a good approach for short, discrete tasks, such as "Place Purchase Order." The "50-50" technique is also commonly used. In this approach half of the EV is credited to a task once the task is started and the other half is credited once the task is complete. This is usually done when the task is relatively long and will span multiple reporting periods. This emphasizes the start of tasks and encourages tasks leaders to begin work as soon as possible on a task. My personal favorite of the quick estimates is the "30-70" technique. In this approach 30% of the EV is credited to a task at the time of the task start and the remaining 70% is credited when the task ends. This is a good approach to use when a task has an uncertain estimate, such as software debugging. There is the recognition that work is underway, but the emphasis is on completing the task. Earned Value Variance Analysis EVA provides excellent insight into project variances. Through EVA a project manager can understand how schedule variances are impacting cost variances and vice versa. Without EVA, the project manager is at a disadvantage when trying to explain to finance why the expenditures were other than expected. Once we have the PV, AC, and EV for a project, we can begin to calculate project variances and determine the current status of the project. The first variance I will discuss is Cost Variance (CV). This is the amount of under-run or overrun the project has experienced. As with all of the measurements, I can address the Current CV, which is the variance this month, or the Cumulative CV which is the variance since the project started. CV = EV - AC In EVA, a negative CV is an over-run and a positive CV is an under-run.

Forecasting Using Earned Value The variance calculations for SV and CV give us specific values of under-run/over-run. We can also calculate indices that give us trends and that can assist in the estimating of final project cost. The two indices generated in the Earned Value technique are the Schedule Performance Index (SPI) and the Cost Performance Index (CPI). SPI = EV / PV The SPI is the ratio of Earned Value over Planned Value. When the EV is greater than the PV, we are doing more work than scheduled and the project is accelerating. The SPI will be greater than 1 in that case. When EV is less than PV, we are doing less work than scheduled and the project is being delayed. The SPI will be less than 1. CPI = EV / AC The CPI is the ratio of Earned Value over Actual Cost. When the EV is greater than the AC, we are completing the work for less than the estimate and the project is under-running. In that case the CPI is greater than 1. When the EV is less than the AC, then the cost to complete the work was greater than the initial estimate, or value, of the work. In this case we are over-running and the CPI is less than 1. A question frequently asked of project management is, "How much will this project really cost to complete it?" At the beginning of the project an estimate is made. This estimate is normally set as the project budget and is referred to as the Budget at Completion (BAC). This is also the final PV for the project when the project plan is created. But the BAC contains many assumptions and is seldom realized precisely. Therefore, the question is a legitimate one. As the project progresses and we learn more, the assumptions are proved true or discredited. Project management is then called upon to make a new estimate of the final cost to accomplish the project. This estimate takes into consideration the current business conditions and the relevant project experience to date. It is referred to as the Estimate at Completion (EAC). The EAC is the answer to the original question. It includes all of the money spent so far on the project and an estimate of what must still be spent to complete the project work. EAC = AC + ETC The Earned Value technique uses the variances and indices to calculate an EAC. This is done by taking the results of what has been spent already on the project, the AC, and adding to that an estimate of the cost to do the remaining open work on the project. This estimate for the remaining work is referred to as the Estimate to Completion (ETC). It is obvious that in order to have an accurate estimate for the final project cost, the EAC, we need to calculate the ETC. There are several methods. These four are the most widely accepted. Method 1. In this case I consider that whatever cost variance that has occurred on completed tasks is an isolated event. I do not think it is a trend and therefore the original estimate for the cost to complete the remaining work is unchanged. In this case the ETC is the value of all the work on the project that has not been done yet. It is determined by taking the total value of the work on the project (BAC) less the work that has been completed (EV). ETC1 = BAC - EV Method 2. In this case we consider that whatever cost variance that has occurred is a good indicator of what we can expect in the future, so we will extrapolate the trend through to the end of the project. This is done by determining the remaining work on the project (see Method 1) and dividing that by the CPI; which indicates the trend of under-run or over-run.

ETC2 = (BAC - EV) / CPI Method 3. In this case we assume that there is a need to complete the project on time. Therefore, if the project is behind schedule, an effort will be made to accelerate the remaining tasks. This acceleration will cost money so the remaining work is also divided by the SPI; which indicates the trend of schedule variance that must be overcome to complete on time. Normally when this method is used, the estimate for the remaining work is based upon the Method 2 approach of considering any over-run or under-run trend. ETC3 = (BAC - EV) / (CPI * SPI)

Method 4. At times we become convinced that the original estimate is so far off, or that the variances are neither isolated or clear trends, that we create a new estimate for the remaining work. This is often done when schedule acceleration techniques such as crashing or fast-tracking are used. ETC4 = New estimate for the remaining work The project management team uses whichever method they believe is the most accurate way to estimate the cost of the remaining work. Ultimately this is a judgment call based upon their understanding of the project.

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- DPDHL 2019 Annual ReportDocument170 pagesDPDHL 2019 Annual ReportPhuong Anh NguyenNo ratings yet

- Project Management and Construction Engineering Spaecialty DivisionDocument11 pagesProject Management and Construction Engineering Spaecialty DivisionKentDemeterioNo ratings yet

- Waterway IndustriesDocument2 pagesWaterway IndustriesEinstein BunNo ratings yet

- Unit 2 Process of ManagementDocument113 pagesUnit 2 Process of ManagementJatinder KaurNo ratings yet

- NOTE CHAPTER 8 - Process CostingDocument20 pagesNOTE CHAPTER 8 - Process CostingNUR ANIS SYAMIMI BINTI MUSTAFA / UPMNo ratings yet

- Typical MobilizationDocument19 pagesTypical MobilizationGCB GCBNo ratings yet

- Recruitment and Selection ProcessDocument5 pagesRecruitment and Selection ProcessJasper TabernillaNo ratings yet

- HRUSDocument12 pagesHRUSराकेश झाNo ratings yet

- EWM PP IntegrationDocument8 pagesEWM PP IntegrationpoojaNo ratings yet

- Managing Agile Boards and Reports Student GuideDocument192 pagesManaging Agile Boards and Reports Student GuideArbil acuariusNo ratings yet

- Chapter 7 Product KnowledgeDocument11 pagesChapter 7 Product KnowledgeMichaela Fuertez MarbellaNo ratings yet

- AMAN CHUGH (10P125) Amrita Nadkarni (10P126) RAHUL KUMAR (10P162) RAHUL SHARMA (10P163) MOHIT GUPTA (10P151) Preety Bansal (10Fpm58)Document11 pagesAMAN CHUGH (10P125) Amrita Nadkarni (10P126) RAHUL KUMAR (10P162) RAHUL SHARMA (10P163) MOHIT GUPTA (10P151) Preety Bansal (10Fpm58)Amrita NadkarniNo ratings yet

- BBPR2103 Planning, Recruitment & Selection of Human Resource - Esept22Document220 pagesBBPR2103 Planning, Recruitment & Selection of Human Resource - Esept22Nara Zee100% (1)

- The World of ManagementDocument138 pagesThe World of ManagementNoliboNo ratings yet

- An Integrated System ApproachDocument20 pagesAn Integrated System ApproachEhsan AlikhaniNo ratings yet

- PGDM 101 SLMDocument325 pagesPGDM 101 SLMjesNo ratings yet

- Risk Based Internal Auditing and ComplianceDocument4 pagesRisk Based Internal Auditing and Compliancejose10105No ratings yet

- SWOT Analysis For Sri LankaDocument12 pagesSWOT Analysis For Sri LankaVinthuja Murukes100% (2)

- Amazon Vs AlibabaDocument3 pagesAmazon Vs AlibabaPaulina CarmonaNo ratings yet

- Monitoring & Evaluation DocumentDocument16 pagesMonitoring & Evaluation DocumentNaqeeb Ullah Khan100% (2)

- SAP Forum - FMS Kering Eyewear Project - V4.5Document16 pagesSAP Forum - FMS Kering Eyewear Project - V4.5AndreasJauchMeyrinch100% (1)

- PPP ObeDocument43 pagesPPP ObeMichelle Matubis Bongalonta100% (1)

- Irca Briefing Note Iso Iec 20000-1 EngDocument9 pagesIrca Briefing Note Iso Iec 20000-1 EngDimeji FolamiNo ratings yet

- Orange and White Modern Creative Marketing Plan PresentationDocument12 pagesOrange and White Modern Creative Marketing Plan Presentationfakisik582No ratings yet

- Supply Chain Management AssigDocument6 pagesSupply Chain Management AssigEphraimNo ratings yet

- Qualifications and Qualities of A HR ManagerDocument2 pagesQualifications and Qualities of A HR ManagernavreenNo ratings yet

- Social Audit: Strategic Management andDocument10 pagesSocial Audit: Strategic Management andsuryaNo ratings yet

- Proposal of HRMDocument12 pagesProposal of HRMTarekNo ratings yet

- SQAM-2019 VolvoGroupDocument52 pagesSQAM-2019 VolvoGroupJanNo ratings yet

- Iso 9001Document91 pagesIso 9001Nishit Rupapara100% (1)