0% found this document useful (0 votes)

92 views7 pagesChapter 1 Q

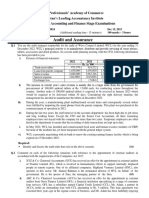

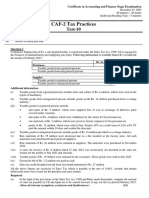

The document outlines various questions and scenarios related to audit and assurance, focusing on management responsibilities, audit evidence, professional judgment, and levels of assurance. It also discusses the requirements for the appointment of external auditors according to the Companies Act 2017, including potential conflicts of interest and compliance issues. Additionally, it addresses misconceptions about audit assurance and the importance of professional skepticism in auditing practices.

Uploaded by

ls786580302Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

92 views7 pagesChapter 1 Q

The document outlines various questions and scenarios related to audit and assurance, focusing on management responsibilities, audit evidence, professional judgment, and levels of assurance. It also discusses the requirements for the appointment of external auditors according to the Companies Act 2017, including potential conflicts of interest and compliance issues. Additionally, it addresses misconceptions about audit assurance and the importance of professional skepticism in auditing practices.

Uploaded by

ls786580302Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd