Professional Documents

Culture Documents

Test 6

Uploaded by

ls786580302Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Test 6

Uploaded by

ls786580302Copyright:

Available Formats

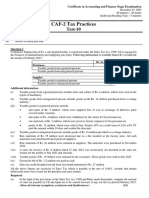

Certificate in Accounting and Finance Stage Examination

November 18,2023

35 minutes – 19 marks

Additional Reading Time – 5 minutes

CAF 2 -TAX PRACTICES

Test-6

Instructions to examinee

(i) Answer All 3 Questions

(ii) Answer in Black pen only

Question-1

Comment (in short form) whether following business expenses are allowed as deduction?

1) Cess paid to the government on the profits of the company

2) Donation in kind to a relief fund run by the Government of Sindh

3) Payment to Monsoon Hotel for holding the annual get-together function for the employees of the

company and their families

4) Salaries paid, in cash, to temporary employees in rural areas. Tax was deducted as required under the

law. The monthly salary of each employee was Rs.47,000

5) Professional tax paid at Rs. 200,000 to the Government of Punjab. The tax is payable annually

irrespective of the income of the company.

6) A fine of Rs. 50,000 paid for violation of the regulations issued by the Securities and Exchange

Commission of Pakistan (SECP).

7) Paid Rs.45,000 for personal mobile phone bill.

8) 5% commission paid by Association of Persons to all its members.

9) Paid water charges Rs. 30,000 in cash. Total is Rs. 270,000 for the year.

10) Paid Rs. 2,500,000 for the purchase of Machinery (10)

Question-2

Discuss whether the following tax services can be provided to an audit client which is not a public interest entity:

(i) Preparation of tax returns

(ii) Tax calculation for the purpose of preparing accounting entries (05)

Question-3

Determine the canon which is being complied in the following independent scenarios:

1. In order to facilitate the taxpayers, Federal Board of Revenue has provided the option to pay taxes through

mobile banking application.

2. With the progress of e-commerce business in Pakistan, the government has imposed taxes on this business;

3. The government has decided to impose new taxes and abolish taxes with little compliance by taxpayers

4. The government has imposed additional tax on persons who are earning per annum income of more than

Rs. 100 million

(04)

You might also like

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineFrom EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNo ratings yet

- A Beginners Guide to QuickBooks Online: The Quick Reference Guide for Nonprofits and Small BusinessesFrom EverandA Beginners Guide to QuickBooks Online: The Quick Reference Guide for Nonprofits and Small BusinessesNo ratings yet

- Finman 1Document49 pagesFinman 1Khai Supleo PabelicoNo ratings yet

- Intermediate Paper 11 PDFDocument456 pagesIntermediate Paper 11 PDFjesurajajNo ratings yet

- 0bba0 GSTR 9 Booklet HiregangeDocument113 pages0bba0 GSTR 9 Booklet HiregangeAMIT SHARMANo ratings yet

- T24 Account Group Parameters R16 PDFDocument117 pagesT24 Account Group Parameters R16 PDFadyani_0997100% (1)

- Quiz no. 1 Statutory Merger and Consolidation QuestionsDocument77 pagesQuiz no. 1 Statutory Merger and Consolidation QuestionsKilimanjaroNo ratings yet

- GST Procedural UpdatesDocument15 pagesGST Procedural UpdatesSP CONTRACTORNo ratings yet

- FAR IFRS QB SampleDocument50 pagesFAR IFRS QB SampleIssa Boy50% (2)

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- Problems & SolutionsDocument436 pagesProblems & Solutionsmelissa100% (1)

- taxation-sec-b-may-2024-1703584499 (1)Document8 pagestaxation-sec-b-may-2024-1703584499 (1)abhishekkapse654No ratings yet

- Ctax e PN 2017 18Document62 pagesCtax e PN 2017 18Ancy RajNo ratings yet

- Test 5Document2 pagesTest 5ls786580302No ratings yet

- Income Tax MCQs 2020-21 - Income Tax Laws and Practice MCQs - Objective Questions and AnswersDocument18 pagesIncome Tax MCQs 2020-21 - Income Tax Laws and Practice MCQs - Objective Questions and AnswersSomyaNo ratings yet

- B-4 NOV 23-B3Document9 pagesB-4 NOV 23-B3Cerealis FelicianNo ratings yet

- Section: A MCQ 20X1 20 Marks: A. B. C. DDocument12 pagesSection: A MCQ 20X1 20 Marks: A. B. C. DSarath KumarNo ratings yet

- Test 10Document4 pagesTest 10ls786580302No ratings yet

- PFM S-22Document2 pagesPFM S-22Rana Sunny KhokharNo ratings yet

- Standardised PPT On GST: Indirect Taxes Committee The Institute of Chartered Accountants of IndiaDocument11 pagesStandardised PPT On GST: Indirect Taxes Committee The Institute of Chartered Accountants of IndiamonikaNo ratings yet

- Institute of Cost and Management Accountants of Pakistan Fall (Winter) 2009 ExaminationsDocument2 pagesInstitute of Cost and Management Accountants of Pakistan Fall (Winter) 2009 ExaminationsSyed Mohammad Ali Zaidi KarbalaiNo ratings yet

- Term Test 1Document5 pagesTerm Test 1lalshahbaz57No ratings yet

- Bos 050121 Interp 4Document214 pagesBos 050121 Interp 4samartha umbare100% (1)

- Advanced Taxation: Certified Finance and Accounting Professional Stage ExaminationDocument5 pagesAdvanced Taxation: Certified Finance and Accounting Professional Stage ExaminationRoshan ZamirNo ratings yet

- Taxation (Pakistan) : Monday 2 June 2008Document13 pagesTaxation (Pakistan) : Monday 2 June 2008Uma Shankar JaiswalNo ratings yet

- CAF 8 AUD Autumn 2023Document4 pagesCAF 8 AUD Autumn 2023Huzaifa WaseemNo ratings yet

- Remembering S.P. Sathe 13th National Moot Court Competition 2018 19 FinalDocument19 pagesRemembering S.P. Sathe 13th National Moot Court Competition 2018 19 FinalAdarsh TripathiNo ratings yet

- 52 Msme WircDocument38 pages52 Msme WircRam NarasimhaNo ratings yet

- TAX COMPUTATIONDocument5 pagesTAX COMPUTATIONRamzan AliNo ratings yet

- Idt MCQDocument200 pagesIdt MCQAmrit Subedi100% (1)

- TAX Mock September 2023Document64 pagesTAX Mock September 2023Saqib IqbalNo ratings yet

- Principles of Taxation Paper 2.6march 2023Document18 pagesPrinciples of Taxation Paper 2.6march 2023Victory NyamburaNo ratings yet

- Test Series: August, 2018 Mock Test Paper - 1 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws & International TaxationDocument6 pagesTest Series: August, 2018 Mock Test Paper - 1 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws & International TaxationRobinxyNo ratings yet

- Mock Test Series 1 QuestionsDocument11 pagesMock Test Series 1 QuestionsSuzhana The WizardNo ratings yet

- Accountancy & Auditing-II 2020Document1 pageAccountancy & Auditing-II 2020Zeeshan Ashraf MalikNo ratings yet

- Revisionary Test Paper: Group IvDocument107 pagesRevisionary Test Paper: Group IvRama AnandNo ratings yet

- Caf-6 TaxDocument4 pagesCaf-6 TaxaskermanNo ratings yet

- Private Limited Complinace PlanDocument5 pagesPrivate Limited Complinace PlanKumar NivasNo ratings yet

- 06-Spring 2014 - BTDocument4 pages06-Spring 2014 - BTpabloescobar11yNo ratings yet

- Theory Type Questions - For Reference OnlyDocument13 pagesTheory Type Questions - For Reference OnlyHaseeb Ahmed ShaikhNo ratings yet

- GST E InvoiceDocument23 pagesGST E Invoicenallarahul86No ratings yet

- Suggested Answer On Tax Planning and Compliance Nov-Dec, 2023Document18 pagesSuggested Answer On Tax Planning and Compliance Nov-Dec, 2023Erfan KhanNo ratings yet

- FI CIN User Manual V1Document38 pagesFI CIN User Manual V1jagankilariNo ratings yet

- Tendernotice 1Document12 pagesTendernotice 1Prabash BagNo ratings yet

- Chapter 2Document2 pagesChapter 2Jao FloresNo ratings yet

- GITA Gt-Budget-Advisor-2024Document32 pagesGITA Gt-Budget-Advisor-2024albertsui.iii14No ratings yet

- Audit Mtp2 DoneDocument11 pagesAudit Mtp2 Donegaurav gargNo ratings yet

- Bcoc 136Document4 pagesBcoc 136Pranav KarwaNo ratings yet

- Advtt. No - Ons 2023-24 To 2025-26Document5 pagesAdvtt. No - Ons 2023-24 To 2025-26timothyifeanyichukwu046No ratings yet

- 2 Maret 2018Document5 pages2 Maret 2018Tri Alvian MachwanaNo ratings yet

- Bbfa1103 Assigment Question 2023Document13 pagesBbfa1103 Assigment Question 2023Bdq ArrogantNo ratings yet

- CAF-2-TAX-Spring-2020Document5 pagesCAF-2-TAX-Spring-2020duocarecoNo ratings yet

- Test Series: March, 2022 Mock Test Paper 1 Final Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionDocument10 pagesTest Series: March, 2022 Mock Test Paper 1 Final Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionDimple KhandheriaNo ratings yet

- Caf-6 Tax PDFDocument5 pagesCaf-6 Tax PDFRamzan AliNo ratings yet

- Test 4Document3 pagesTest 4rehmamali98oNo ratings yet

- Aino Communique Mar 23 113th EditionDocument13 pagesAino Communique Mar 23 113th EditionSwathi JainNo ratings yet

- STT Mock Test S-24 Question PaperDocument8 pagesSTT Mock Test S-24 Question PaperabdullahNo ratings yet

- Final Internal Audit Report 12-ICSIL-Ver-DraftDocument29 pagesFinal Internal Audit Report 12-ICSIL-Ver-DraftRamesh ChandraNo ratings yet

- Aino Communique May 2023 115th Edition PDFDocument14 pagesAino Communique May 2023 115th Edition PDFSwathi JainNo ratings yet

- E Invoice Under GST - NovDocument2 pagesE Invoice Under GST - NovVishwanath HollaNo ratings yet

- Audit Report PPOD 2019-20 (Merged)Document114 pagesAudit Report PPOD 2019-20 (Merged)erummaqsood14512No ratings yet

- Institute of Genomics & Integrative Biology - 632021102637328Document8 pagesInstitute of Genomics & Integrative Biology - 632021102637328robins chickuNo ratings yet

- Caf 6 Tax Spring 2019Document5 pagesCaf 6 Tax Spring 2019Raza Ali SoomroNo ratings yet

- AUDIT REPORT-GB RevenuesDocument27 pagesAUDIT REPORT-GB RevenuesAbid KhawajaNo ratings yet

- Mba Sem - 2 M O D U L E - 4 (MCQ) Financial Management Module - 4 Dividend DecisionsDocument2 pagesMba Sem - 2 M O D U L E - 4 (MCQ) Financial Management Module - 4 Dividend DecisionsKeyur PopatNo ratings yet

- Adaptation and The Selection of WordsDocument36 pagesAdaptation and The Selection of WordsNNo ratings yet

- CH 2 - HomeworkDocument5 pagesCH 2 - HomeworkAxel OngNo ratings yet

- Master BudgetingDocument3 pagesMaster BudgetingmiglapadaNo ratings yet

- Unit-4 FAADocument10 pagesUnit-4 FAARitikaNo ratings yet

- Tutorial 2Document2 pagesTutorial 2sanjeet kumarNo ratings yet

- ACCA Strategic Business Reporting (International) Mock Examination 1: Section A Question 1Document25 pagesACCA Strategic Business Reporting (International) Mock Examination 1: Section A Question 1Asad MuhammadNo ratings yet

- CVP ExerciseDocument4 pagesCVP ExerciseJericho PagsuguironNo ratings yet

- Unsur Ekorek N CashflowDocument21 pagesUnsur Ekorek N CashflowAlfina RohmaniahNo ratings yet

- BAC 200 Accounting For AssetsDocument90 pagesBAC 200 Accounting For AssetsFaith Ondieki100% (3)

- Bachelor of Commerce Honours: Financial ModellingDocument85 pagesBachelor of Commerce Honours: Financial ModellingBlossom KaurNo ratings yet

- FABMDocument8 pagesFABMMary Grace DegamoNo ratings yet

- 29 - Tej Inder - Bharti AirtelDocument14 pages29 - Tej Inder - Bharti Airtelrajat_singlaNo ratings yet

- The Modigliani-Miller Theorem HistoryDocument9 pagesThe Modigliani-Miller Theorem HistoryAlejandra Estrella MadrigalNo ratings yet

- Adamson University Business Tax Final Exam ReviewDocument7 pagesAdamson University Business Tax Final Exam ReviewMarie Tes LocsinNo ratings yet

- Part - 2 - Dashboard - Changes in Accounting TreatmentDocument4 pagesPart - 2 - Dashboard - Changes in Accounting TreatmentJaquelyn JacquesNo ratings yet

- Strategic Purchasing For Universal Health CoverageDocument23 pagesStrategic Purchasing For Universal Health CoverageJorge Armando Arrieta ArrietaNo ratings yet

- Company Summary: Start-Up ExpensesDocument33 pagesCompany Summary: Start-Up ExpensesYonasBirhanuNo ratings yet

- Accounting For ValueDocument15 pagesAccounting For Valueolst100% (5)

- CF - Questions and Practice Problems - Chapter 18Document4 pagesCF - Questions and Practice Problems - Chapter 18Lê Hoàng Long NguyễnNo ratings yet

- Seatwork 2Document8 pagesSeatwork 2Nasiba M. AbdulcaderNo ratings yet

- Intl Ifstmts 12 012 Gafs Illst DisclDocument210 pagesIntl Ifstmts 12 012 Gafs Illst DisclMaximo Gutierrez100% (1)

- QR Requirement-HAM ProjectDocument2 pagesQR Requirement-HAM ProjectJAY SHUKLANo ratings yet

- Uganda passes new public finance management lawDocument87 pagesUganda passes new public finance management lawOkema LennyNo ratings yet

- Corporate Reporting AssignmentDocument5 pagesCorporate Reporting AssignmentAbubakari Abdul MananNo ratings yet

- PARTNERSHIP DEEDDocument8 pagesPARTNERSHIP DEEDKuljit BhattNo ratings yet