0% found this document useful (0 votes)

44 views2 pagesBudget Template

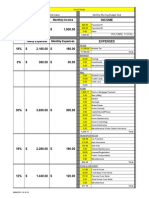

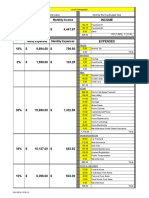

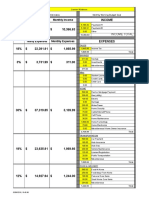

The document outlines a monthly budget simulation including income, expenses, and remaining balance. It details various expense categories such as housing, utilities, transportation, food, insurance, and miscellaneous expenses, totaling $2,165.00 in expenses with a negative remaining balance of $(2,165.00), indicating the need for adjustments in spending.

Uploaded by

khalilwhite917Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

44 views2 pagesBudget Template

The document outlines a monthly budget simulation including income, expenses, and remaining balance. It details various expense categories such as housing, utilities, transportation, food, insurance, and miscellaneous expenses, totaling $2,165.00 in expenses with a negative remaining balance of $(2,165.00), indicating the need for adjustments in spending.

Uploaded by

khalilwhite917Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd