0% found this document useful (0 votes)

60 views12 pagesJournal Types

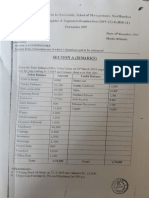

The document explains subsidiary books, which are specialized journals used in accounting to record transactions of similar nature, particularly when a business has a high volume of transactions. Key types of subsidiary books include Cash Book, Sales Book, Purchase Book, and others, each serving specific recording purposes. It also defines credit and debit notes related to the return of goods and emphasizes the importance of mastering these journal types for accurate accounting.

Uploaded by

mythris322Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

60 views12 pagesJournal Types

The document explains subsidiary books, which are specialized journals used in accounting to record transactions of similar nature, particularly when a business has a high volume of transactions. Key types of subsidiary books include Cash Book, Sales Book, Purchase Book, and others, each serving specific recording purposes. It also defines credit and debit notes related to the return of goods and emphasizes the importance of mastering these journal types for accurate accounting.

Uploaded by

mythris322Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd