4-20 CHAPT E R 4 Completing the Accounting Cycle

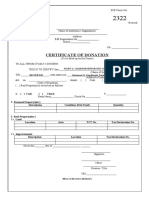

ILLUSTRATION 4.15

Required steps in the

THE ACCOUNTING CYCLE

accounting cycle

1. ANALYZE BUSINESS TRANSACTIONS

Assets = Liabilities + Owner’s Equity

Accounts Accounts Owner’s

Cash + Receivable + Supplies + Equipment = Payable + Capital + Revenues – Expenses

Equation $9,200 $1,600 $7,000 $1,850 $15,000 $1,200 $250

Analysis Service

(6) +1,500 +$2,000 +3,500

Revenue

$10,700 + $ 2,000 + $1,600 + $7,000 = $1,850 + $15,000 + $4,700 – $250

⎧

⎪

⎪

⎪

⎪

⎪

⎪

⎪

⎪

⎨

⎪

⎪

⎪

⎪

⎪

⎪

⎪

⎪

⎩

⎧

⎪

⎪

⎪

⎪

⎪

⎪

⎪

⎪

⎨

⎪

⎪

⎪

⎪

⎪

⎪

⎪

⎪

⎩

$21,300 $21,300

9. PREPARE A POST-CLOSING TRIAL BALANCE 2. JOURNALIZE THE TRANSACTIONS

GENERAL JOURNAL PAGE J1

Pioneer Advertising Date Account Titles and Explanation Ref. Debit Credit

Post-Closing Trial Balance

October 31, 2020 2020

Oct. 1 Cash 101 10,000

Debit Credit Owner’s Capital 301 10,000

Cash $15,200 (Owner’s investment of cash in business)

Accounts Receivable 200

1 Equipment 157 5,000

Supplies 1,000

Notes Payable 200 5,000

Prepaid Insurance 550

(Issued 3-month, 12% note for office

Equipment 5,000

equipment)

Accumulated Depreciation—Equipment $ 40

Notes Payable 5,000 2 Cash 101 1,200

Accounts Payable 2,500 Unearned Service Revenue 209 1,200

Unearned Service Revenue 800 (Received cash from R. Knox for

Salaries and Wages Payable 1,200 future services)

8. JOURNALIZE AND POST CLOSING ENTRIES 3. POST TO THE LEDGER ACCOUNTS

GENERAL JOURNAL J3

GENERAL LEDGER

Date Account Titles and Explanation Ref. Debit Credit Cash No. 101 Accounts Payable No. 201

Closing Entries Date Explanation Ref. Debit Credit Balance Date Explanation Ref. Debit Credit Balance

2020 2020

2020 (1) Oct. 1 J1 10,000 10,000 Oct. 5 J1 2,500 2,500

Oct. 31 Service Revenue 400 10,600 2 J1 1,200 11,200 Unearned Service Revenue No. 209

Income Summary 350 10,600 3 J1 900 10,300

4 J1 600 9,700 Date Explanation Ref. Debit Credit Balance

(To close revenue account)

20 J1 500 9,200 2020

(2) 26 J1 4,000 5,200 Oct. 2 J1 1,200 1,200

31 Income Summary 350 7,740 31 J1 10,000 15,200 Owner’s Capital No. 301

Supplies Expense 631 1,500 Supplies No. 126 Date Explanation Ref. Debit Credit Balance

Depreciation Expense 711 40 Date Explanation Ref. Debit Credit Balance 2020

Insurance Expense 722 50 2020 Oct. 1 J1 10,000 10,000

Salaries and Wages Expense 726 5,200 Oct. 5 J1 2,500 2,500 Owner’s Drawings No. 306

Rent Expense 729 900

7. PREPARE FINANCIAL STATEMENTS 4. PREPARE A TRIAL BALANCE

Pioneer Advertising

Income Statement Pioneer Advertising

For the Month Ended October 31, 2020 Trial Balance

October 31, 2020

Revenues

Service revenue Pioneer Advertising $10,600 Debit Credit

Owner’s Equity Statement Cash $15,200

For the Month Ended October 31, 2020 Supplies 2,500

Prepaid Insurance 600

Pioneer Advertising Equipment 5,000

Balance Sheet

Notes Payable $ 5,000

October 31, 2020

Accounts Payable 2,500

Assets Unearned Service Revenue 1,200

Cash $15,200 Owner’s Capital 10,000

Accounts receivable 200 Owner’s Drawings 500

Supplies 1,000 Service Revenue 10,000

Prepaid insurance 550

6. PREPARE AN ADJUSTED TRIAL BALANCE 5. JOURNALIZE AND POST ADJUSTING

Pioneer Advertising

ENTRIES: DEFERRALS/ACCRUALS

Adjusted Trial Balance

October 31, 2020 GENERAL JOURNAL J2

Debit Credit Date Account Titles and Explanation Ref. Debit Credit

Cash $15,200 2020 Adjusting Entries

Accounts Receivable 200 Oct. 31 Supplies Expense 631 1,500

Supplies 1,000 Supplies 126LEDGER

GENERAL 1,500

Prepaid Insurance 550 (To record supplies used)

Cash No. 101 Interest Payable No. 230

Equipment 5,000 31 Insurance Expense 722 50

Date Explanation Ref. Debit Credit Balance Date Explanation Ref. Debit Credit Balance

Accumulated Depreciation—Equipment $ 40 Prepaid Insurance 130 50

2020 2020

Notes Payable 5,000 (To record insurance expired)

Oct. 1 J1 10,000 10,000 Oct. 31 Adj. entry J2 50 50

Accounts Payable 2,500 31 Depreciation

2 Expense J1 1,200 11,200711 40

3 l t dD Owner’s Capital No. 301

Interest Payable 50 A i ti J1 E i t 900 10,300158 40

4 J1 600 9,700 Date Explanation Ref. Debit Credit Balance

Unearned Service Revenue 800 20 J1 500 9,200 2020

Salaries and Wages Payable 1,200 26 J1 4,000 5,200 Oct. 1 J1 10,000 10,000