0 ratings 0% found this document useful (0 votes) 31 views 8 pages Financials - Sample

The document contains the consolidated and company income statements, financial position, cash flows, and changes in equity for a company for the year ending March 31, 2020. It outlines key financial metrics, including operating expenses, profit before tax, and total comprehensive income, while also detailing significant accounting policies and the basis of consolidation. Additionally, it provides corporate information about the company's operations across multiple countries and its accounting practices.

AI-enhanced title and description

Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content,

claim it here .

Available Formats

Download as PDF or read online on Scribd

Go to previous items Go to next items

Save Financials- Sample For Later

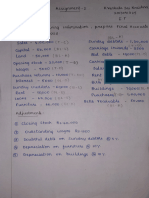

CONSOLIDATED AND COMPANY INCOME STATEMENT

costa eae 32

rote prot

Operating expenses a2

‘ea and marty cots

Crosse 82

‘Operating profess)

Protoss before tx

Protoss forth yar

uty hes af sre

Nencometing mers as

Base erin pa sharers *

Dh eamings er sharers os

uss uss uss uss

wens) cosas) ates) (5002

aver mena 34079 3m0408

2ves036s) cr szeo) _usezean) (5263611

CN

9577500) | 4702660) | rossezs)| _(es65%3)

(sane) | esses) | crserees)| (250 0

qerwsoy | 742s 309.001

“aes Tosast eer) 8962100

(awe — sworn) (as3650 zz)

S560 «S154 —~(2ART ASH) 804354

eres (1375908

075496 37raz (am ease

e19sss8 sso esas) cK

2412 zm

CONSOLIDATED AND COMPANY STATEMENTS OF OTHER COMPREHENSIVE INCOME

FOR THE YEAR ENDED 31 MARCH 2020,

Protoss forthe yar

ther comprehensive

Ta ay beret aaa o PONS PE

Netoter compretensiveovs thal may be eles rotor

Tessin eubeequent pods

am hat may ot be resets fo pM os subsequent pores (a on)

eration of pros pat ard equ .

Detar taxon vain of pry et ne sauomer u

Dott orlss in subseqven periods

‘Total comprehensive forevncome forthe yaar

enue

ay ele of

°

nour: ‘company

am 28 220 ate

uss uss uss uss

sorts 3774254 aasrase) sas end

ozs 4908080)

102590 25359

asserz) 1483799

124034 azn

06757 e470

Tiersen

(@osr sas) rtoatsa) — asvensy — seneae

a7 ze�CONSOLIDATED AND COMPANY STATEMENTS OF FINANCIAL POSITION

assers

Prey patent

cnet

reat ctr an fete

Ontarad ot

Blopal assets

Trae se one racavables

Ce curant nancaseis

‘cash ag cash equates

Tota arse

EQUITY AND LIABILITIES

Equity

State cats

‘Share based paymonts osove

Foreign catency vansistion reserve

Retained earning

Equity atbutabe to equity holders ofthe parent

Nomzonvlingmtrests

Tota equity

Lengiem baromings

Long tarmoas ites

Deter txts

Shortie borings

Shorternlesse abies

Prowsone

Income ax payable

Tota abies

Total oguty ana

sor

7

“

@

Be

RED

uss uss uss uss

segesso2 — sauTas12 saoea 0a 525

#320000 = 320.000 -

sosrare . - :

. ee ee

eizero _soaz612 :

ys4ace_aaseese1 _ataa76 _sez05e61

ee6r.08 19858957 exzew —s16774

‘ios620 359879 2 :

sozigox9 sizes gorges zs 440

nysrrr 19305753 ansssz0r—sasT7 saz,

: 285 564 s :

sess 4are0a3__zeseses 15208011

EPRI ECC TT

se2i9970 —ssaeaorr —set997 aa.

32486 30,708 21488 "390,708

uzosars 13412621 ‘zane ‘902

(sazs7si3) 7325438) :

T4s73860 9967973 s4sa0R 9.161.998

7982.75 a70n3,61 a2, 153.46 5.463.903

00ers 700264 2

73020 248

519887 .

zsoaze 1995510 19358 19.358

suase7 4168643 66.025 35208

7435560 3580868 © s2.S60801—28.484055

404,68 : - :

arms sastara or3.005 03708

szrsse8 5357358 asnz35 1 taz039

Zoovaes 1.842558 24.78 rea 288

245 505 25218 :

So2s44s9 7300 arpa ayaa

Sans ame vaya apne

wariagaa 194065518 __s0go7zT0 881718

°�CONSOLIDATED AND COMPANY STATEMENTS OF CASH FLOWS.

‘operating ates

Protos) etre ta

‘Ajutrerte oreo rf blo ae et ah os:

Deprecstn of open at an qupment ang ea asi

(Protoss on ipsa et ope, par and equipment

Reveal of npsement on vaste

Share ees tomo verte

Share based payment

anon cet

Cpersting cash Rows before working capt chang

lenge aguatnerte

Inrase in togcal sts

(ereasodecrese invade ans orcas

Decreatalinerese in aman ome by radeon

Ireea)erens) nde ane ane pavbio

(Pocrasepncsso in amounts ed to rtd ontos

Irresalsecease] in poss

Net cash tows utlsed in operating atvitos

Investing acts

Proceeds tom se of propery, ln ard equsment

Puss of pope pana equprentan nangble sel

Invermere nsubecanee

Invesmart a jontvontze

Ire esha

Net cash tows (used inigsnerate trom Investing actos

Financing activites

Proceso itu share canis ne of arse costs

Share suck

Repaynet of se iis

Capt icon ron conlingshraoler

Dido pe

rere: aie

Net csh tows generated romiutiied i) Mencngeetves

Nat (deceatoveerenoin cash an can quale

acs of exenange ce canges on nah an aah aqua

‘cash ane casn oauhalonts at Benning of you"

Cash and ea equivalents a endo your

186

wes

a

220 ane 2020 zone

uss uss uss uss

Beise0s — 55hca0 | ASTABH) 5.98

suisas 2740219 stare t39,203

(73738) 8.388) (8.089) aa

(e000) (e000) -

102"

: 27s605) «1.190851

(erossry ——renyasy 772054) 80670)

sures senor 3936997 2.771508

ragssvi7e2sM — @ssars1) (1.905630)

(Gosssos) asrass) 133035)

37238) (1280925) :

(aosa2t) 765765) (sto) SSS

aasnast (12351502) 4194805 6.505073)

arrsor—zasrs9e ——sr0280 (70840)

728320) 8757858 685805) 3.051.880

(Basees2)_—_@en2se) (606) @s34.t6)

scone) (10H 100 16428

(sm671) (7.508) assem) (as

qrssrran asa (6530188) @s0312)

(912.005) 208.508)

(685997) 6587 :

sross _rasa5__1yr2054 308

To5000) (3367340) (6.14780) e.30004

7263.06 srat88

erry, 000000)

‘sessr7 35980566 T5ash 185 30,797,388

(a3pizae2) — (2039%741) (12854078) aa0.12)

e278) :

(ase) 324) (4251780)

BAIes) sieory gangs) 221 800

(yaisauey —zaz00 (zsmngeay —arer3

ianses) 8848) :

Dress veer9308 __se20801 5603�CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Tonlconpenmi oe Tak (Ma.99} TT (aaKs A (AaKse)

oie em sy tssus amare

ATs? oanas STS aes) a7)

fount anon news » (ory) nan gota) gman) aren

coe : Sitar) amas (samen

aaa cnc by sues roe

COMPANY STATEMENT OF CHANGES IN EQUITY

Cn rarer ven

Dene sss asi

Secchi mannan

conte con ta sive Omer em te

3°�NOTES TO THE FINANCIAL STATEMENTS:

4. Corporate Information

Seed Go lnermatinal Lined ia company whchIsncorported and danciedin the Republic of Botswana ands ted on the Botswa

Slock Exchange, acts asa Roding company for a group of comparins omicedin Bolswara, Ghana, Kena, Malawi, goa, Tancari,

Rance, South Aria and Zambia hoes props’ aches are te procsesing ot agreturl seed on a conmers baes

“The consolated thancial statements of Sood Co Itomalinal Limited forth year ondod 31 March 2020 wore authosod for Issue in

_bosrcanes weh a esouton ofthe craton 12 June 2020,

2. Signineant accounting policies,

2.1 Bass of preparation

‘Th financial iatoments ar based onthe slauory record hat are mainsined onthe ison cost convention, exeap for propery,

ant and equpment and dolegcal ascts wich are measured at far value

“The consolidated franca statorents ar presented in United Stales Dos (USD),

“The consoled nancial statements prove comparave information in respect of the previous period

2.2 Basle of consolidation

‘The consolidated nancial statements compde he financial statements of te Group and ts subaldavies as at 31 Nazeh 2020, Contol

'sachoved when to Groups exposed, or has hts, ovaraborelums fom is iwowerantwih be rvesoe and has be ait fort,

‘hose rus troughs power over the wvestoe

Specialy, tha Group conto's an invest If, and only Ff, the Group has:

+ Bower over the vest (9, exising gs tha give ithe cuent by to dre the relevant acts ofthe invesoe)

* Exposur, or gt, to vant otuns rom ts invlverant win ta nvates

"The ably to use power aver he sveste Io af fe relums

General, heros prosumpton tat @ malortyof voting rights resus in control. To suppor this presumption and when the Group has

loss than a majory ff ving or siraar rats of an vests, to Group coniers a r.ovant aes and ekeurstancs in asoeing

vwhaterithas power over an investeo, lug

+ The contractual arangomens) wit th oer voto holders of the nvesio

+ Rights sing fro ober convactal arrangements

‘The Group votng rights an potetal voting igs

“The Group r-assesses whether o ott contol an investee fats and creumstances inca that hare

fine vee elements of conta,

changes to one or more

Consolation ofa subsidiary begin when the Group cians contol over te subsidy and osass when the Group loses conta ofthe

Subeisary Assets, abitos. income and exponsos oa subsilry acquired or disposod of dsig the yar ao nuded inte consodated

{nancal satemeois fom tho ate to Group gan conl unl io dare be Croup ceabes to canal he substay

Proft or loss and each component of OC! are atriute tothe amu Holter of ts pant of the Group and to the non-contoing

Inlerests, even if this rsuts Inthe non-controing inleests having defi balance, When necessary. ajusimens are made othe

‘nancial sltomant of subsist big tot aecouting poles io ine wih the Gav's account potces Al ina roup asses

and abies, egy, income, expenses and cash Fows ralaing to Wansactons between members ofthe Group are eiinates in fl on

‘oneolaton

[Achange inthe ownecsipintorost of subsidiary, without loss of conto fs aecounle for as an eau varsacton.

rte Group loses contol ove a subsiciary,t darecogits the related assots (inching good, bilies, non ontinginarest and

‘tre components of equi, whee ary resin! gan Oo is recognised poi ioss Ary ivestmont retained Is recognises 3 far

123 Summary of signicant accounting policies

2) Busines Gombinatons and good!”

Business combinations are aesoonod for uting the acquston method. Tha cos of an acquisitions measured asthe agorogate of

‘considereton anstored, whion fs moasureg a acausiton date ‘ar value. and the amount of ary non-cowellng orests nthe

Staureo For each buses canbinaton the eaup lets whethr to measure the non-coning ilceatante aequoe aa value

‘rats proportonata share o the acquis’ wont nt abso Acausttor-elated cobs ave expensed as cod an incuded

‘Siminaatve expanses

‘man tre Group acquires a busines, assesses the fancil asses and lblits assumed for appropiate cassfcation and

‘denigntion n acordance wih the conactus terms, economic ccunstanees and parinent condone asst theaequtlon dee

‘Ary contngentconsideaten ob ansfoed by the acquis Wi bs racognisad at a vale a th aquson date, Contingent consideration

‘dateies onan stseto lobitythat a anal insurer and wll tbe scope IFRS 8 Fnanlallnsumarts ie aasied ata vale

‘ih the changes in a vauorecogrisesin the prof ross�NOTES TO THE FINANCIAL STATEMENTS:

Goods inaly measures at cost (sing te oxcoss of he aggrogal ofthe consideration wansfood an te amount ecogrisedfor

hon-ontolingiaress sn any previous rarest hel ideniialeateolsacqued ard abbas assumed) te a vale

of te nel assols acqured fs xcs ofthe aggrogate consideration vansfeed, the Group ro-assosses whether i nas correctly

‘dented all of ne asootsarqurd and alc he labitasaoaume and reves the procedures ueed to maasure tne amounts BE

recognised tthe soquston dale, the reasoesavet sl eaute nan encase ote fr vue of ne ease aoqured aver tne aggregate

feonstoraionVansfred, than the gan fs rocogised n prof oss

‘At init recogniton, goodwil t measure cost loss any accumulated impairment oases. Fer the purpose of ipsiment tesa

‘good acquired na business combination fs, fom te acquiton dale aloeated to each ofthe Group's cash-generatn uns that a

Sxpected Io bene tom De combat, erepecive of whster ater sels o lablites ofthe acquvee ae assigned a thse uns.

‘mere good hasbeen allocated to cash-goneratng unt (CCU) ana part of tne operation win that unt csposed of, the goodwill

sisocatod wih the disposed operat sncuded ne caryng amount o te operate en determining he gana oss on depos

Good ssposed in these creumstances i measured bases on (ne rela valves ofthe deposed operation and the pon of he

‘cauh-goneraing unt retaes

») Invostrentsin associat and joint venturo

‘An associat ean any over utich tha Group hae near vance, Signcan influence isthe powsr to partes inthe franca

‘hel operating pate detsione of tv este, bu olson rol caitl over those poise,

‘Alin venture es typeof jot srangerant whereby te pate that have lt contal of he amangemant have rights tothe net asta

af ne it venta, Jot conse

‘ontectunlyaproed sharing of coriol ofan mangement, whi exes nly when elsions about the relevant actives requ the

Unanimous consent fhe pares sharing conta,

“The consiratins made in determining sigitcant intuance or joint contol ae smart those necessary to determine conrl over

“The Group's investment in is asocites anoint venture a

counted for using he equ tho.

Under tne equity mothe, he vostmantin an associat inaly recognise a cost. Th carying amount ofthe investments adusted

{orecognae changes nthe Groups share of net esate ofthe associate sce the soquafon date, Goodwi alaing toe associates

Droit velire is nla inthe crying rout he vesient ands not ested for parse soparatey

‘Ta statomant of prof or los reflects the Group's share of the result of operations of the assocates and Jan venture. Any chan

(Caf thot investoes is prosentod as part ofthe Grup's OC. In aston, when tare has been a change recognised doc}

‘Sgt ofthe ansocite or nt vanura, the Group recognises fs enare ofan changes, wnenapplabia ths statement of changes

tauly, Unreatoed gars and losses resuling rom tansackons belween th Group and He asada oft vane are sina ©

‘ho oxen of he ntrestin tho associat,

“Tho agaragate of tho Grows shar of proto os of ts assaciates and Jon verte f shown on he fae ofthe statment of prot or

loss flr operating proft

“Tha franca sttomans of te associates ad jon venture ar prpara forthe same roping pero asthe Group. When nacossay,

_2gusimons are made to brings aozounong poles ne wth toss of te Group

‘Aor aplcaon ofthe only moti, the Goup deternins whether it's necessary o recognise an impaimat loss on ts investments

nis aseeciatesandjoint verte. teach reporting dat, the Group determines whether heel objective evidence that te investments

Inthe eegoeates and jot vente sre unpaved. if thee 9 such evaence, the Group eacltes tha amounl of snpasmant se Ne

‘iference between tne recoorsbe amount ofthe associate ort venture ana caring vate, an hon recognises te los te

Statement of proto ss.

Upon less of significant inftuonca over tho associates or joint contol over the subsiianes, tha Group measures and recognises any

‘elaned vest tls a vale, Ary diference between the caring amauta te vesimetin the aasoclte ot Yel upon

lots of signeantinfuanee or oe convo spective andthe far valve ofthe retained invosment and praceods om cipal

Feeognisedn prot ross

£2) Curent versus non-cument asset

“The Group presets assols and lables Inthe statement of francial postion based on cuentnor-curentdassfication. An asso is

"Expected oo reals or ntanes to be solder consumed in the normal cpertng cele

+H pearly fobs purpose wasn

"Cxpacod tobe ralseswihin Wolve months flor the reporting parod|

or

“Cash cash equivalents uness restricted from beng exchanged or Use to sete a abt for at east welve months eter the reporting

eros

°�NOTES TO THE FINANCIAL STATEMENTS:

Allohorarete are lasses as non-carent.

‘iat is current when:

‘itis exacted te seted in norma oparating ote

“itis hald pena forte purpose ol acing

+s de fo be soles win twelve months alo herepering porad

or

There no uncondtnal ght forthe sttement of te abily for at east tele months a

Fe reporting period

‘The Group classifies a other lables as non-curent

Defer tx assets and lablites ae casefed as non-cuent assets an abies.

{9 Fair valve measurement

“The Group measures nernancal asses suchas property, plant and equipment and bilogial assets at far value at balance shest

Far valu isthe price that would be rceved to sl an asset ot pat tense abit nan ondary ransacton between market

patbopants atthe measutemant date The fa value measurement based an the presumon that the vasacton fo sell he sel oF

{ancora takes nace othr

inthe praipal maths fr he se olay

or

inthe absence ofa principal market. in he most advantageous market for he asset orbit.

“he pip or the most advantageous mae! must be accesible by the Group.

“Th a value ofan assatoralalty is measured using assumptons thet markt parsipants wou use when pring the asso or lity

stsumang Dat market paricpants ae. the eeohome best lores

“The fa value mssurement ofa nor-nanc asset ake nto account a market panoipants aby to ganerate economic benefte by

Using the ast ins aghast and bout Je o by olin flo anther marke patepant al wouls ute easel te highest and Bott

“The Group utes vation techniques ha ar appropratein te cxcumstances an for which sfciont daa ar aalbleo measure st

‘val, maximising tne us of flovantcbsarvale Inputs and minimising th use of unobserabs put.

[A asses and lables fo hich fi vale x measured or disclosed in he Francia taloments are calgorsed win the fi vate

earey,doscribed as olows, based on ho iowost evel put hats sgrfcant to far vas easuremort 232 Whale

"vel? Quoted (snejsteg) markt pices in an aetve marl fer Kenalassaso tbs.

* Level 2—Vatuatontocheques for which he lowest Tova input hats sgneart to thelr fa valve measurement is rely riety

beanie

+ Lev 3 = Valuation techriques for which th ows! oval nput hats sgnteat tothe far value maasuromant is unobsorvabe

For assets and abates tat ar recogeied nthe fhancial talaments on a reuring bak, the Group deemines whether anata

ave oceareabotwoon lovin he rary by re-asossing calogorsaton (based oh lowest lovel put rat fsigreart tthe ait

‘value measuremant asa whol) athe end f cach repoing peroa

‘The Group Finance Director determines tne poies and procedures for bth recuring far value measurement and for non-recurng

Excomal valor aro involved fr vahation of sean asst and signifcant ables. Invlvement of exomal valu Is doce upon

by he Group Finance Dieter after dscusson wih ard approval by the Groups Aust Commitee. Saleclonereta induce market,

‘towroige, opuaton,indapendonce and profesional accretion

‘mere avaale, the Goup Finance Direct” aso compares the fal value changes computed by extemal vatuers with relevant exemal

fours to cetorne wholhr the chango it raasonalo. As nd when vahntions mo cried out, the Group Finance Dest: proses

‘a valuation resus tothe Audt Commute and the Group's naependen! audios. Ts Incudes a dlcusson ofthe major assumptons

Forth purpose oar value éslosure, the Group has detained casos of asses and nbs on th basis of nature, characteristics

Sha ake te ately an ho lve ho fa value Mercy, a exloned above. Favaiv rele dscosute "Gears

instants anos rane aset that re measures at for valve orwere fer vauies are cles, ae sonmarsod inne 32

1) Revenue recognition

“The Group sn re business of soling seeds to reais, farmers and govermant ents,

Revenue hom conracts wits custorrs ls rocoghised when onl o De seads are Wanseied othe cstomer at an amount that efacts

{he conssration owen tho Group expt ote nite in exchange for ose sted. Tha Group has gover conelosos tat

prnpal nas roveruo arangements bacavse&yprally contol the sceds before vanstoreng tom ono customer.

Revonue fom sale of seeds recognise at he pontine when conta of tne asset is ranted othe customer, ganeraly on delivery

[tthe seed The noma er term 2 50 days rom devany�NOTES TO THE FINANCIAL STATEMENTS:

“The Group considers tnt her are no ther promises in the contact tnt ao separate performance eblgatons to which a portion of he

‘wanssction price needs fob allocated.

Revenue measured at the amount ofthe ransacton price thats located to he performance cbligston taking into account th alec

variable consseraon andthe sustonce of sical inancng omponart

‘Variable conederation

Fights of rum

Crain contracts provide a customer wih a ht to tum the seeds within a speclas patad. The seed sling season e generally

onciudod within the nancial yar andvetums ar also by thant year and therefore he Group doos nol goreranynoadt ostmate

‘a volume of seeds iat wl ot ba otumea because o pred! tho amount of vanabs consieraten to whch the Group wilbe ened,

‘Tha roquiroments in IFRS 15 on containing estimates of variable consideration ae largely not appScable forthe folowing reason:

“Miia impact of mare oly, logal ane regulatory ehangesonaaed eturalorcn

{Wear condone Keown by fnancayear end Inreore mos returns woud have taken place by ten ay,

* The Group has extonevo sxporinco wit sir contacts;

"The Group does not ofar 2 broad range opie concession o highly vara paymant terms

* Contacte ao not have large number and broad ange of possi cneseraton amour

* The uncoranty about te consideration ameunt (any bough unk) canbe esowved uk

“Thar 0 no igh of our assets an runs Habis nthe Groups financial taloments

‘Volume abstes

“Tho Group provides retrospective volume rebaes fo corisin customers ones the quanty of prosuts purchased dung the prod

‘Soseds atosnats spctiod nthe cota. Rabate ao el agaist amounts payabe By io eustomer. The pay dsroutorsstock-

Signifcant rancing component

General the Group receives pays rm i customers tn twelve month ofthe date of delivery. Using the practcal expedient in

IFRS 15, fe Group doesnot acs! tho promise aro of conisoraton frie afc fa sigsfican naneing compose expos,

‘at contract inception, ha! be paiod betwoun De rans of the promised good

5 service tothe esioma and whan the custome pay far hat good o sarice wl be one year oo,

oni balances

Conract ares

‘A contac sels the ight o consideration in exchange for goods or servo transferred othe customer tne Group perf by

\ransaring goods or sores fo a customs: before tho customer pays corsdoraton or bofers payment duo, a contact asst fs

‘ecognised or he cared conalderaton tats conditions,

“rade receivables

‘Atrade rcehable represents the Groups right to an amount of considera that uncontonal

requir before payment ofthe consceraton du),

‘ony the passage of tine Is

Contact abit

‘contra Hab i tbe obgaton fo anaes goods or sevice fo a customer for which the Grup has rcsved consideration or an

‘amount of conidration i ce) rom the customer. a customer pays conideration before he Group vansers goods or sevice oth

‘isiomer, convallis ocagnsed when Ie payments made or he payrbentis due (whichever efter) Contact sabstes a

recognised as revenue when the Group performs under te contact

Prop receipts rm cslomors are contac aby,

‘Ascls ana lapitesansing om nights of atu

Right ofretum assets

Right rtm ase! raprosois the Groups right to racover he goods oxpeces tobe rturied by customs, The asol is measured a

‘a rmer caring amount ofthe versa, ns ary expeiod costs to recover the goods, ncudng ry poten decrease nthe vale

tte rtumed goods The Group updates ha measur ofthe asset recorded fray revlon toe expected level trea,

‘tel as any asstona decreases inthe valve ofthe roamed proses

Refund apie

‘Aral tably she obigaon to refund gm o lof the consideration ectved (0 receiv) fom tne customer andi me

belcarepirdrgcarge mba Vruaclon es) aon nc preg pro Peer ave surg ply on Yrae

1 Toros

urn! reome Tax

Currant income oe asses and labs are msasurod at ths amount expected to Be racovred tom or pai to ho taxation autres.

Si tax rates and fx la used to compute the amount raced or aubstantvty enacted athe reporing date the

courses where the Group operates and genera taxa