Professional Documents

Culture Documents

Fin. Mgmt. Tut 3

Uploaded by

Kelvin Cobbydan AbbanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fin. Mgmt. Tut 3

Uploaded by

Kelvin Cobbydan AbbanCopyright:

Available Formats

TUTORIAL 3

COURSE: LEVEL: 300 FINANCIAL 2010 MANAGEMENT 23rd October (UFIN100) 2010

DATE: 18th October LECTURER: Kofi B. Afful

CAPITAL BUDGETING TECHNIQUES QUESTION 1: The information below relates to an investment project with a project cost of GH 10,050.

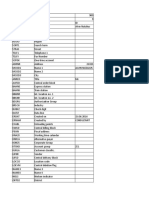

YEAR CASH FLOW 0 (now) - 10,050 1 5,000 2 4,000 3 3,000 4 2,000 5 1,000

A) What is the payback period for this investment project? B) If the discount or required rate of return is 13%, what is the net present value (NPV)? C) What is the profitability index (PI) of this investment project? SOLUTION (a): The payback period formula is: Payback

project _ cos t total _ cash _ flows _ before _ payback cash _ flow _ in _ year _ of _ payback

period

year

before

payback

Year before payback is the year before total cash flows (excluding project cost) exceeds project cost Total cash flow in year of payback = . Note that the project cost is GH 10,050. However, to find the year before payback, add all the cash flows from year 1 till it exceeds the project cost, GH 10,050. This means that add GH 5,000 + GH 4,000 + GH 3,000 = GH 12,000. Therefore, the year of payback is between the second and third year. In the second year, total cash flows are GH 5,000 + GH 4,000 = GH 9,000. This is less than the project cost of GH 10,050. In the third year the total cash flows are GH 12,000 (=GH 5,000 + GH 4,000 + GH 3,000). The cash flow in the year of payback is the cash flow in the third year of GH 3,000. Therefore, the payback period using the formula is: Payback period = year before payback +

project _ cos t total _ cash _ flows _ before _ payback cash _ flow _ in _ year _ of _ payback

10,050 9,000 1,050 3,000 =2+ = 2 + 3,000 = 2 + 0.35 = 2.35.

SOLUTION (b): The net present value formula is: project cost +

(1 + i)

CFt

WHEN USING THE NET PRESENT VALUE FORMULA, PLEASE NOTE THAT PROJECT COST ALWAYS HAS A NEGATIVE SIGN IN FRONT OF IT.

CF3 CFt CF1 CF2 1 2 3 t The NPV formula may be: project cost + (1 + i ) + (1 + i ) + (1 + i ) + + (1 + i )

Therefore, the NPV of this project is:

5,000 4,000 3,000 2,000 1,000 1 2 3 4 5 -10,050 + (1 + 0.13) + (1 + 0.13) + (1 + 0.13) + (1 + 0.13) + (1 + 0.13) =

-10,050 + 4,424.78 + 3,132.59 + 2,079.15 + 1,226.64 + 542.76 = 1,355.91. The NPV of this investment project is GH 1,355.91. According to the NPV method criteria, this NPV is positive so accept the project. SOLUTION (c): Question c wants to know the profitability index (PI). The formula for the PI is:

present _ value _ of _ cash _ flows project _ cos t

Note that the present value of the cash flows is different from the NPV!!! It is:

(1 + i)

CFt

CF3 CFt CF1 CF2 1 2 3 t = (1 + i ) + (1 + i ) + (1 + i ) + + (1 + i )

Therefore, the present value of the projects cash flows are:

5,000 4,000 3,000 2,000 1,000 1 2 3 4 (1 + 0.13) + (1 + 0.13) + (1 + 0.13) + (1 + 0.13) + (1 + 0.13) 5 = 11,405.91

Using the PI formula, the PI is:

present _ value _ of _ cash _ flows 11,405.91 project _ cos t = 10,050 = 1.14

According to the PI method criteria, this project should be accepted because it has a PI greater than 1.

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Jordan B. Peterson - Template For Writing EssaysDocument24 pagesJordan B. Peterson - Template For Writing EssaysvojarufosiNo ratings yet

- Understanding antitrust laws and how they protect consumersDocument10 pagesUnderstanding antitrust laws and how they protect consumersselozok1No ratings yet

- IS-LM Model ExplainedDocument36 pagesIS-LM Model ExplainedSyed Ali Zain100% (1)

- Budgeting ProblemDocument7 pagesBudgeting ProblemBest Girl RobinNo ratings yet

- Capital Budteting JainDocument56 pagesCapital Budteting JainShivam VermaNo ratings yet

- MEFADocument363 pagesMEFALaxminarayanaMurthy100% (1)

- Texas Pacific Land Trust: Shareholder PresentationDocument37 pagesTexas Pacific Land Trust: Shareholder PresentationTodd Sullivan100% (1)

- Cable Industry in Indonesia PDFDocument85 pagesCable Industry in Indonesia PDFlinggaraninditaNo ratings yet

- Report European Retail in 2018 GFK Study On Key Retail Indicators 2017 Review and 2018 Forecast GFK Across - 293 PDFDocument23 pagesReport European Retail in 2018 GFK Study On Key Retail Indicators 2017 Review and 2018 Forecast GFK Across - 293 PDFJoão MartinsNo ratings yet

- 31 12 17 Kakuzi PLC Annual ReportDocument71 pages31 12 17 Kakuzi PLC Annual ReportjohnmungeNo ratings yet

- Financial StatementDocument33 pagesFinancial StatementĎêěpãķ Šhăŕmå100% (1)

- Debtors SystemDocument4 pagesDebtors SystemRohit ShrivastavNo ratings yet

- Quiz 3solutionDocument5 pagesQuiz 3solutionAhsan IqbalNo ratings yet

- White Paper Disrupting DistributionDocument28 pagesWhite Paper Disrupting DistributionGopi SundaresanNo ratings yet

- Starc Modular Power Recliner Sectional Sofa WithDocument1 pageStarc Modular Power Recliner Sectional Sofa WithellamalceaNo ratings yet

- Ra 6552 PDFDocument2 pagesRa 6552 PDFjackie delos santosNo ratings yet

- Econ 3024 Assignment 1 (Final Version)Document2 pagesEcon 3024 Assignment 1 (Final Version)Van Law Wai LunNo ratings yet

- Tanzania Budget Highlights 2021-22Document35 pagesTanzania Budget Highlights 2021-22Arden Muhumuza KitomariNo ratings yet

- Food InflationDocument34 pagesFood Inflationshwetamohan88No ratings yet

- VIXDocument2 pagesVIXAnkitNo ratings yet

- Cost Analysis of Shahabad Co-Op Sugar Mills LTDDocument78 pagesCost Analysis of Shahabad Co-Op Sugar Mills LTDVinay ManchandaNo ratings yet

- Parle G Commands 65% Market Share in India's Rs 15 Billion Glucose Biscuits CategoryDocument6 pagesParle G Commands 65% Market Share in India's Rs 15 Billion Glucose Biscuits CategoryMithil Kotwal100% (1)

- CBA: 'NO SEGREGATION, NO PICK-UP' POLICYDocument17 pagesCBA: 'NO SEGREGATION, NO PICK-UP' POLICYChaiNo ratings yet

- CaseStudy PresentationDocument15 pagesCaseStudy PresentationMelisa KhawNo ratings yet

- 0761 - 10,000 Liters AST MS 5mm - Jasper Balatero - RPDocument1 page0761 - 10,000 Liters AST MS 5mm - Jasper Balatero - RPdarwin alejandroNo ratings yet

- Management Accounting Chapter 3 (Cost-Volume-Profit Chapter22)Document59 pagesManagement Accounting Chapter 3 (Cost-Volume-Profit Chapter22)yimerNo ratings yet

- MANDT Client DetailsDocument13 pagesMANDT Client DetailsEdo SilvaNo ratings yet

- LeverageDocument3 pagesLeverageSatish Kumar SonwaniNo ratings yet

- Unit - 3 Trade CycleDocument9 pagesUnit - 3 Trade CycleTARAL PATELNo ratings yet

- 2010+intro Trading KRX Stock MarketsDocument88 pages2010+intro Trading KRX Stock Markets17524No ratings yet