Professional Documents

Culture Documents

Starting Business in Bangladesh

Uploaded by

Mohammad RanaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Starting Business in Bangladesh

Uploaded by

Mohammad RanaCopyright:

Available Formats

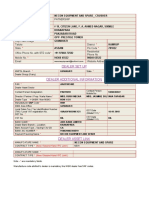

Starting Business in Bangladesh: Documents you need to get SME loan from Banks/Financial Institutions

by RUHUL KADER on Feb 22, 2012 10:48 am 1 Comment

Getting SME loan or any kind of Bank loan is, in a word, complicated. In a sense its okay to be complicated because giving money is not a good feeling for anyone but banks. Wherever you go to a bank for loan they just behave like they are not willing to give you loan but in hindsight they actually love to give loan but they love documents more. I doubt whether bankers love anything more than papers named by documents! In Bangladesh its more than true that you need a bunch of documents to get loan. To take SME loan from any Bank or financial institution you need numbers of document that many of SME loan seekers dont know. Hope this post will come to a help to them. Here goes a checklist of documents you need to get SME loan from a bank or Financial Institution:

1. 2. 3. 4. Trade license Bank Account (Current Account) in the name of Business National ID card Drug License (only for drug business) BSTI certificate (For food producing companies) Permission from DC (for Diesel and Acid Business) PetroBangla Certificate (for Diesel and Octane Business) Last 1-3 years bank statement (demand can vary based on bank) Agreement of shop or house

5.

6. 7. 8. 9.

10. Position Document

11. TIN certificate

12. VAT certificate (only in applicable case) 13. Electricity Bill 14. Telephone Bill 15. Educational qualification certificate 16. Names of employees, salary, post and monthly salary sheet 17. IRC (Import Registration Certificate) and IRE certificate ( for Export & import business) 18. Stored/Stocked products and price of that products 19. List and total price of fixed asset 20. List of creditors 21. List of debtors 22. Description of present loan from anywhere (if any)

23. CIB (Credit Information Bureau) report of Bangladesh Bank, here it has to be mentioned that, the

particular bank provides CIB form to the entrepreneur to fill up and to give it back to the bank and the bank manage the other arrangements to get CIB report from Bangladesh Bank

24. Passport size picture of Loan applicant and guarantor, here its mentionable that, financial Organization can take more than one guarantor if they want 25. Trade License and CIB report of guarantor if guarantor is a businessman 26. One year sales report and profit account of the business 27. Certificate of incorporation and Memorandum of Articles (for private limited company) 28. Resolution of loan taking decision (for private limited company) 29. Audited Financial Statement, Balance sheet, Profit-loss account, Cash flow statement, trade account (for limited company) 30. Current customers/clients list (for limited company) 31. Registered from Joint Stock Company and Notarized partnership deed from Notary club (for partnership business) 32. Resolution of partners for loan taking

Above mentioned documents are almost common documents for all kinds of bank loan. Depending on banks documents requirement it can vary.

Tags: Bank Account, Bank loan, BSTI certificate, CIB report, SME, SME loan, Starting business in Bangladesh, TIN

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Steps For Solving Rubick's CubeDocument5 pagesSteps For Solving Rubick's CubeMohammad RanaNo ratings yet

- The Chittagong Stock Exchange Election Regulations 1999Document15 pagesThe Chittagong Stock Exchange Election Regulations 1999Mohammad RanaNo ratings yet

- Quotes - 23 11 09Document7 pagesQuotes - 23 11 09Mohammad RanaNo ratings yet

- Linux Installation CheckListDocument11 pagesLinux Installation CheckListMohammad RanaNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Tale of Education Policy in BangladeshDocument13 pagesTale of Education Policy in BangladeshSammi bithyNo ratings yet

- Arbitration ClauseDocument5 pagesArbitration ClauseAnupama MahajanNo ratings yet

- Lee Vs SimandoDocument10 pagesLee Vs SimandoAJ SantosNo ratings yet

- CLP Criminal Procedure - CourtDocument15 pagesCLP Criminal Procedure - CourtVanila PeishanNo ratings yet

- 16) Tayug Vs Rural BankDocument3 pages16) Tayug Vs Rural BankJohn Ayson100% (2)

- Performance Appraisal - Butler Supervisor - Club Floor Executive - Club Floor SupervisorDocument6 pagesPerformance Appraisal - Butler Supervisor - Club Floor Executive - Club Floor SupervisorRHTi BDNo ratings yet

- Business Plan V.3.1: Chiken & Beef BBQ RestaurantDocument32 pagesBusiness Plan V.3.1: Chiken & Beef BBQ RestaurantMohd FirdausNo ratings yet

- Financial Onion LinksDocument8 pagesFinancial Onion LinksFelix Alaxandar100% (4)

- Criminal Law Notes First YearDocument12 pagesCriminal Law Notes First YearShella Hannah Salih100% (3)

- The Forrester Wave PDFDocument15 pagesThe Forrester Wave PDFManish KumarNo ratings yet

- Adverb18 Adjective To Adverb SentencesDocument2 pagesAdverb18 Adjective To Adverb SentencesjayedosNo ratings yet

- Upload 1Document15 pagesUpload 1Saurabh KumarNo ratings yet

- Solicitor General LetterDocument6 pagesSolicitor General LetterFallon FischerNo ratings yet

- 005 SPARK v. Quezon City G.R. No. 225442Document28 pages005 SPARK v. Quezon City G.R. No. 225442Kenneth EsquilloNo ratings yet

- TTX Human Trafficking With ANSWERS For DavaoDocument7 pagesTTX Human Trafficking With ANSWERS For DavaoVee DammeNo ratings yet

- Kojin Karatani - Isonomia and The Origins of PhilosophyDocument165 pagesKojin Karatani - Isonomia and The Origins of PhilosophyRafael Saldanha100% (1)

- Filamer Christian Institute V IACDocument6 pagesFilamer Christian Institute V IACHenson MontalvoNo ratings yet

- Family Budget': PSP 3301 Household Financial Management Assignment 4Document2 pagesFamily Budget': PSP 3301 Household Financial Management Assignment 4DenzNishhKaizerNo ratings yet

- (Ebook - Health) Guide To Health InsuranceDocument28 pages(Ebook - Health) Guide To Health InsuranceAndrei CarlanNo ratings yet

- Exception Report Document CodesDocument33 pagesException Report Document CodesForeclosure Fraud100% (1)

- Avengers - EndgameDocument3 pagesAvengers - EndgameAjayNo ratings yet

- Position Paper in Purposive CommunicationDocument2 pagesPosition Paper in Purposive CommunicationKhynjoan AlfilerNo ratings yet

- Nyandarua BursaryAPPLICATION FORMDocument5 pagesNyandarua BursaryAPPLICATION FORMK Kamau100% (1)

- VMA FCC ComplaintsDocument161 pagesVMA FCC ComplaintsDeadspinNo ratings yet

- PAGCOR - Application Form For Gaming SiteDocument4 pagesPAGCOR - Application Form For Gaming SiteJovy JorgioNo ratings yet

- Management of TrustsDocument4 pagesManagement of Trustsnikhil jkcNo ratings yet

- China National Technical: Item No. Contents in ITT &TDS Clarification Request Employer's ResponseDocument2 pagesChina National Technical: Item No. Contents in ITT &TDS Clarification Request Employer's ResponseMd Abdur RahmanNo ratings yet

- Introduction Business EthicsDocument24 pagesIntroduction Business EthicsSumit Kumar100% (1)

- Duas of Some Messengers and Other MuslimsDocument9 pagesDuas of Some Messengers and Other Muslimsyakubu I saidNo ratings yet

- 1 Dealer AddressDocument1 page1 Dealer AddressguneshwwarNo ratings yet