0% found this document useful (0 votes)

23 views1 pageComputation

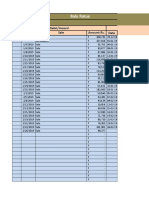

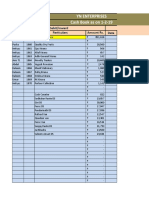

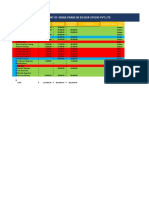

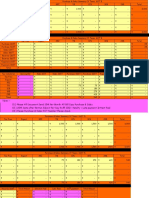

The document provides the financial details of Dhanraj Prabhakar Watkar for the assessment year 2025-26, including total income of ₹6,57,920.00 and tax liability of ₹17,896.00, which is fully offset by a rebate under section 87A. It lists various income sources, deductions, and tax computations, indicating no tax payable after rebates. Additionally, it includes bank account details for transactions related to the tax assessment.

Uploaded by

filemyitr93Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

23 views1 pageComputation

The document provides the financial details of Dhanraj Prabhakar Watkar for the assessment year 2025-26, including total income of ₹6,57,920.00 and tax liability of ₹17,896.00, which is fully offset by a rebate under section 87A. It lists various income sources, deductions, and tax computations, indicating no tax payable after rebates. Additionally, it includes bank account details for transactions related to the tax assessment.

Uploaded by

filemyitr93Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd