0% found this document useful (0 votes)

51 views30 pagesGST Invoice

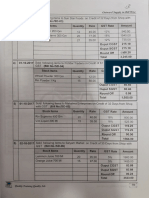

The document outlines the creation of a company named Biskfarm Enterprise and details various transactions including purchases and sales of products with corresponding GST calculations. It includes instructions for creating stock items, ledgers, and voucher entries, as well as conditions for GST adjustments and tax analysis. Additionally, it presents assignments involving the purchase and sale of computers and other goods with specified GST rates and discounts.

Uploaded by

sahilbhai1003Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

51 views30 pagesGST Invoice

The document outlines the creation of a company named Biskfarm Enterprise and details various transactions including purchases and sales of products with corresponding GST calculations. It includes instructions for creating stock items, ledgers, and voucher entries, as well as conditions for GST adjustments and tax analysis. Additionally, it presents assignments involving the purchase and sale of computers and other goods with specified GST rates and discounts.

Uploaded by

sahilbhai1003Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd