0% found this document useful (0 votes)

24 views9 pagesUBINHYDARB2879

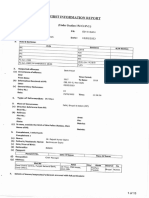

Union Bank of India is notifying the legal heirs of Late Sri. Sanyasi Rajan about the impending sale of immovable secured assets due to non-payment of dues, with a public E-auction scheduled for June 26, 2024. The notice outlines the auction process, including registration, EMD payment, and bidding procedures, as well as the terms and conditions for potential bidders. The property details, including its location and reserve price, are also provided, along with instructions for interested parties to participate in the auction.

Uploaded by

2405c10024Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

24 views9 pagesUBINHYDARB2879

Union Bank of India is notifying the legal heirs of Late Sri. Sanyasi Rajan about the impending sale of immovable secured assets due to non-payment of dues, with a public E-auction scheduled for June 26, 2024. The notice outlines the auction process, including registration, EMD payment, and bidding procedures, as well as the terms and conditions for potential bidders. The property details, including its location and reserve price, are also provided, along with instructions for interested parties to participate in the auction.

Uploaded by

2405c10024Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd