Professional Documents

Culture Documents

Mambulao Lumber Company v. PNB

Uploaded by

Alyssa Marie SobereOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mambulao Lumber Company v. PNB

Uploaded by

Alyssa Marie SobereCopyright:

Available Formats

MAMBULAO LUMBER COMPANY, plaintiff-appellant v.

PHILIPPINE NATIONAL BANK and ANACLETO

HERADO, ETC., defendants-appellees.

GR. No. L-22973 1968, Jan 30 ANGELES, J.

Sobere

SUBJECT MATTER: Sec 2. Corporation Defined: Can a Corporation recover moral damages?

DOCTRINE:

Herein appellant's claim for moral damages however, seems to have no legal or factual basis. Obviously, an artificial

person like herein appellant corporation cannot experience physical sufferings, mental anguish, fright, serious

anxiety, wounded feelings, moral shock or social humiliation which are the basis of moral damages. A corporation

may have a good reputation which, if besmirched, may also be a ground for the award of moral damages. The same

cannot be considered under the facts of this case, however, not only because it is admitted that herein appellant had

already ceased in its business operation at the time of the foreclosure sale of the chattels, but also for the reason that

whatever adverse effect the foreclosure sale of the chattels, could have upon its reputation or business standing

would undoubtedly be the same whether the sale was conducted at Jose Panganiban, Camarines Norte, or in Manila

which is the place agreed upon by the parties in the mortgage contract.

ACTION BEFORE THE SUPREME COURT: Appeal from a decision, dated April 2, 1964, of the Court of First

Instance of Manila, dismissing the complaint against both defendants and sentencing the plaintiff to pay to defendant

Philippine National Bank the sum of P3,582.52 with interest thereon at the rate of 6% per annum from December 22,

1961 until fully paid, and the costs of suit.

SUMMARY:

Petitioner Mambulao Lumber applied for an industrial loan with herein respondent PNB and was approved with its

real estate, machinery and equipments as collateral. PNB released the approved loan but petitioner failed to pay and

was later discovered to have already stopped in its operation. PNB then moved for the foreclosure and sale of the

mortgaged properties. The properties were sold and petitioner sent a bank draft to PNB to settle the balance of the

obligation. PNB however alleges that a remaining balance stands and a foreclosure sale would still be held unless

petitioner remits said amount. The foreclosure sale proceeded and petitioner’s properties were taken out of its

compound. Petitioner filed actions before the court and claims among others, moral damages.

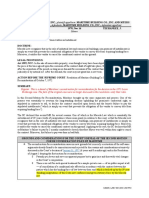

Whether petitioner corporation, who has already ceased its operation, may claim for moral damages?

No, Mambulao is NOT ENTITLED to moral damages.

Even if PNB and sheriff committed several infractions:

1. Sheriff’s actual work performed should be compensated pursuant to Sec 4 of Act 3135, which is the

governing law for extrajudicial foreclosure and not Sec 7 of Rule 130, which is applicable for judicial

foreclosure;

2. Atty’s fees was found to be excessive and unconscionable;

3. Foreclosure should be conducted in the City of Manila, as agreed in the contract. Ergo, PNB is guilty of

conversion when he sells under the mortgage but not in accordance with its terms; and

4. The amount of sale of the chattels is spurious and grossly unfair to Mambulao.

However, Mambulao’s claim for moral damages seems to have no legal or factual basis. Obviously, an artificial

person like herein plaintiff corporation cannot experience physical sufferings, mental anguish, fright, serious anxiety,

wounded feelings, moral shock or social humiliation which are basis of moral damages. A corporation may have a

good reputation which, if besmirched, may also be a ground for the award of moral damages. The same cannot be

considered under the facts of this case, however, not only because it is admitted that herein appellant had already

ceased in its business operation at the time of the foreclosure sale of the chattels, but also for the reason that

whatever adverse effects of the foreclosure sale of the chattels could have upon its reputation or business standing

would undoubtedly be the same whether the sale was conducted at Jose Panganiban, Camarines Norte, or in Manila

which is the place agreed upon by the parties in the mortgage contract.

But for the wrongful acts of PNB and Sheriff of Camarines Norte in proceeding with the sale in utter disregard of the

agreement to have the chattels sold in Manila as provided for in the mortgage contract, to which their attentions were

timely called by herein appellant, and in disposing of the chattels in gross for the miserable amount of P4,200.00,

Mambulao should be awarded exemplary damages in the sum of P10,000.00. The circumstances of the case

also warrant the award of P3,000.00 as attorney's fees for Mambulao.

BC2025 | LAW 106 | UY

ANTECEDENT FACTS:

Plaintiff Mambulao applied for an industrial loan of P155,000 with defendant PNB; it offered real estate,

machinery, logging and transportation equipments as collaterals.

o Loan application was approved for P100,000 only.

o To secure payment of the loan, Mambulao mortgaged to PNB a parcel of land, together with the

buildings and improvements, and various sawmill equipment, rolling unit and other fixed assets of

Mambulao.

PNB released from the approved loan:

o P27,500, for which Mambulao signed a promissory note wherein it promised to pay to the PNB the

said sum in 5 equal yearly installments at the rate of P6,528.40 beginning July 31, 1957, and every

year thereafter, the last of which would be on July 31, 1961.

o Another P15,500 Mambulao executed another promissory note wherein it agreed to pay to PNB

the said sum in 5 equal yearly installments at the rate of P3,679.64 beginning July 31, 1957, and

ending on July 31, 1961.

Mambulao failed or otherwise refused to pay the amortizations, despite repeated demands.

o Upon verification by PNB, it was found that Mambulao had already stopped operation about the

end of 1957 or early part of 1958.

PNB sent a letter to the Provincial Sheriff requesting him to take possession of the parcel of land, together

with the improvements existing thereon, and to sell it a public auction for the satisfaction of the unpaid

obligation of Mambulao, which amounted to P57,646.59, plus 6% annual interest thereon from September

23, 1961, attorney's fees equivalent to 10% of the amount due and the costs and expenses of the sale..

o Deputy Provincial Sheriff Heraldo took possession of the chattels mortgaged by Mambulao.

o Mambulao protested against the foreclosure of the real estate and chattel mortgages on the

grounds that they could not be effected unless a Court's order was issued against Mambulao for

said purpose and that the foreclosure proceedings, according to the terms of the mortgage

contracts, should be made in Manila (not in municipality of Jose Panganiban, Camarines Norte).

That if the public auction sale would be suspended and Mambulao would be given an

extension of 90 days, its obligation would be settled satisfactorily because an important

negotiation was then going on for the sale of its "whole interest" for an amount more than

sufficient to liquidate said obligation.

Mambulao sent a letter reiterating its request that the foreclosure sale of the mortgaged chattels be

discontinued on the grounds that the mortgaged indebtedness had been fully paid and that it could not be

legally effected at a place other than the City of Manila.

o PNB wrote to Mambulao acknowledging the remittance of P738.59 with the advice, however, that

as of that date the balance of the account of the plaintiff was P9,161.76; further explained that the

sum of P57,646.59, which was stated in the request for the foreclosure of the real estate mortgage,

did not include the 10% attorney's fees and expenses of the sale.

PNB was awarded with the mortgaged chattels.

RTC: Sentenced the Mambulao Lumber Company to pay to PNB the sum of P3,582.52 with interest thereon

at the rate of 6% per annum from December 22, 1961 (day following the date of the questioned foreclosure

of plaintiff's chattels) until fully paid, and the costs.

Plaintiff Mambulao’s Arguments:

1. That its total indebtedness to the PNB was only P56,485.87 and not P58,213.51 as concluded by

the court a quo; hence, the proceeds of the foreclosure sale of its real property alone in the amount

of P56,908.00 on that date, added to the sum of P738.59 it remitted to the PNB thereafter was

more than sufficient to liquidate its obligation, thereby rendering the subsequent foreclosure sale of

its chattels unlawful;

2. That it is not liable to pay PNB the amount of P5,821.35 for attorney's fees and the additional sum

of P298.54 as expenses of the foreclosure sale;

3. That the subsequent foreclosure sale of its chattels is null and void, not only because it had already

settled its indebtedness to the PNB at the time the sale was effected, but also for the reason that

the said sale was not conducted in accordance with the provisions of the Chattel Mortgage Law

and the venue agreed upon by the parties in the mortgage contract;

4. That the PNB, having illegally sold the chattels, is liable to the plaintiff for its value; and

5. That for the acts of the PNB in proceeding with the sale of the chattels, in utter disregard of

plaintiff's vigorous opposition thereto, and in taking possession thereof after the sale thru force,

BC2025 | LAW 106 | UY

intimidation, coercion, and by detaining its "man-in-charge" of said properties, the PNB is liable to

plaintiff for damages and attorney's fees.

[RELEVANT] Whether Mambulao is entitled to moral damages? – NO

No, Mambulao is NOT ENTITLED to moral damages.

Even if PNB and sheriff committed several infractions:

5. Sheriff’s actual work performed should be compensated pursuant to Sec 4 of Act 3135, which is the

governing law for extrajudicial foreclosure and not Sec 7 of Rule 130, which is applicable for judicial

foreclosure;

6. Atty’s fees was found to be excessive and unconscionable;

7. Foreclosure should be conducted in the City of Manila, as agreed in the contract. Ergo, PNB is guilty of

conversion when he sells under the mortgage but not in accordance with its terms; and

8. The amount of sale of the chattels is spurious and grossly unfair to Mambulao.

However, Mambulao’s claim for moral damages seems to have no legal or factual basis. Obviously, an artificial

person like herein plaintiff corporation cannot experience physical sufferings, mental anguish, fright, serious anxiety,

wounded feelings, moral shock or social humiliation which are basis of moral damages. A corporation may have a

good reputation which, if besmirched, may also be a ground for the award of moral damages. The same cannot be

considered under the facts of this case, however, not only because it is admitted that herein appellant had already

ceased in its business operation at the time of the foreclosure sale of the chattels, but also for the reason that

whatever adverse effects of the foreclosure sale of the chattels could have upon its reputation or business standing

would undoubtedly be the same whether the sale was conducted at Jose Panganiban, Camarines Norte, or in

Manila which is the place agreed upon by the parties in the mortgage contract.

But for the wrongful acts of PNB and Sheriff of Camarines Norte in proceeding with the sale in utter disregard of the

agreement to have the chattels sold in Manila as provided for in the mortgage contract, to which their attentions

were timely called by herein appellant, and in disposing of the chattels in gross for the miserable amount of

P4,200.00, Mambulao should be awarded exemplary damages in the sum of P10,000.00. The circumstances

of the case also warrant the award of P3,000.00 as attorney's fees for Mambulao.

[OTHER ISSUES] Whether the foreclosure of chattels was valid? – NO

RTC made error when it awarded interest on accrued interests, without any agreement to that effect and before

they had been judicially demanded.

Sec 5 of Act No. 2655 expressly provides that in computing the interest on any obligation, promissory note,

or other instrument or contract, compound interest shall not be reckoned, except by agreement, or in

default thereof, whenever the debt is judicially claimed.

Art 2212, NCC provides that interest due shall earn legal interest only from the time it is judicially

demanded…

Art 1959, NCC ordains that interest due and unpaid shall not earn interest.

No evidence to support the conclusion that PNB is entitled to the amount awarded as expenses of the extrajudicial

foreclosure sale. Only the amount of P1,000 would be more than sufficient for the attorney’s fees.

Fees enumerated under paragraphs k and n, Section 7, of Rule 130 (now Rule 141) are demandable only

by a sheriff serving processes of the court in connection with judicial foreclosure of mortgages under Rule

68 of the new Rules, and not in cases of extra-judicial foreclosure of mortgages under Act 3135.

The law applicable is Section 4 of Act 3135 which provides that the officer conducting the sale is entitled to

collect a fee of P5.00 for each day of actual work performed in addition to his expenses in connection with

the foreclosure sale.

PNB failed to prove during the trial of the case, that it actually spent any amount in connection with the

said foreclosure sale. Neither may expenses for publication of the notice be legally allowed in the absence

of evidence on record to support it.

Obviously, therefore, the award of P298.54 as expenses of the sale should be set aside.

Sale of Mambulao’s chattels is illegal and void.

Based on the Court’s computation, there was no further necessity to foreclose the mortgage on Dec 21.

Sale should have been made in Manila as agreed between the parties of the principal agreement.

Sec 14 of Act 1508 provides that the officer making the sale should make a return of his doings which shall

particularly describe the articles sold and the amount received from each article. Law requires that sale be

made article by article; otherwise, it would be impossible for him to state the amount received for each

item. This requirement was totally disregarded by the Deputy Sheriff of Camarines Norte.

BC2025 | LAW 106 | UY

Mambulao is then entitled to collect from them, jointly and severally, the full value of the chattels in

question at the time they were illegally sold by them.

DISPOSITIVE: Wherefore and considering all the foregoing, the decision appealed from should be, as hereby, it is

set aside. The Philippine National Bank and the Deputy Sheriff of the province of Camarines Norte are ordered to

pay, jointly and severally, to Mambulao Lumber Company the total amount of P56,000.73, broken as follows: P150.73

overpaid by the latter to the PNB, P42,850.00 the value of the chattels at the time of the sale with interest at the rate

of 6% per annum from December 21, 1961, until fully paid, P10,000.00 in exemplary damages, and P3,000.00 as

attorney's fees. Costs against both appellees.

BC2025 | LAW 106 | UY

Court’s Computation (just in case needed, but not related to the topic):

BC2025 | LAW 106 | UY

BC2025 | LAW 106 | UY

You might also like

- Case DigestDocument1 pageCase DigestRed AlfantaNo ratings yet

- Mambulao Lumber V PNB (22 SCRA 359)Document4 pagesMambulao Lumber V PNB (22 SCRA 359)Jose RolandNo ratings yet

- Mambulao Lumber Co V. PNB 22 Scra 359Document3 pagesMambulao Lumber Co V. PNB 22 Scra 359Calagui Tejano Glenda JaygeeNo ratings yet

- Digest - Mambulao Lumber Co. vs. PNBDocument2 pagesDigest - Mambulao Lumber Co. vs. PNBPaul Vincent Cunanan100% (4)

- Mambulao l-22973Document2 pagesMambulao l-22973Mini U. SorianoNo ratings yet

- 55 Mambulao V PNBDocument2 pages55 Mambulao V PNBMaria Cristina MartinezNo ratings yet

- Mambulao Lumber Co v. PNBDocument2 pagesMambulao Lumber Co v. PNBJued CisnerosNo ratings yet

- Mambulao Vs PNB (Adverse Effects of Forclosure Doesn - T Affect The Reputation of The Company - Attorney - S FeeDocument2 pagesMambulao Vs PNB (Adverse Effects of Forclosure Doesn - T Affect The Reputation of The Company - Attorney - S FeeJM BanaNo ratings yet

- E 26 MarribulaoDocument10 pagesE 26 MarribulaoKaryl Ann Aquino-CaluyaNo ratings yet

- Mambulao Lumber Vs PNBDocument12 pagesMambulao Lumber Vs PNBJulius BrillantesNo ratings yet

- Mambulao Lumber Co. Vs PNB DIGEST: December 21, 2016 Vbdi AzDocument2 pagesMambulao Lumber Co. Vs PNB DIGEST: December 21, 2016 Vbdi AzPipoy ReglosNo ratings yet

- Mambulao Lumber Co V. PNB 22 Scra 359Document6 pagesMambulao Lumber Co V. PNB 22 Scra 359Calagui Tejano Glenda JaygeeNo ratings yet

- 3 MANILA TRADING & SUPPLY COMPANY, Plaintiff-Appellee, vs. CO KIM and SO TEK, Defendants-Appellants.Document3 pages3 MANILA TRADING & SUPPLY COMPANY, Plaintiff-Appellee, vs. CO KIM and SO TEK, Defendants-Appellants.Ken MarcaidaNo ratings yet

- CivRev2 - PNB Vs Manila Investment and Construction IncDocument6 pagesCivRev2 - PNB Vs Manila Investment and Construction IncAnonymous yisZNKXNo ratings yet

- Full Case - Rillo VS CaDocument4 pagesFull Case - Rillo VS CaDaveKarlRamada-MaraonNo ratings yet

- Power Commercial Industrial Vs Court of Appeals FactsDocument2 pagesPower Commercial Industrial Vs Court of Appeals FactsMulberry Hernandez RazNo ratings yet

- PCIC V CA Full TextDocument10 pagesPCIC V CA Full TextJohn Kelly RemolazoNo ratings yet

- Set 4 DigestsDocument14 pagesSet 4 DigestsImmah MayorNo ratings yet

- SALES - Planters Vs Chandumal - Optimum Vs JovellanosDocument4 pagesSALES - Planters Vs Chandumal - Optimum Vs JovellanosMariaAyraCelinaBatacanNo ratings yet

- Facts:: 2. Mambulao Lumber V PNBDocument2 pagesFacts:: 2. Mambulao Lumber V PNBJude ChicanoNo ratings yet

- Mambulao Lumber Company CaseDocument83 pagesMambulao Lumber Company CaseSebastian GarciaNo ratings yet

- Assignment No.4Document6 pagesAssignment No.4Zihr EllerycNo ratings yet

- Rillo vs. CADocument5 pagesRillo vs. CATESDA MIMAROPANo ratings yet

- Power Commercial and Industrial Corporation Vs Ca - GR 119745 - June 20, 1997Document4 pagesPower Commercial and Industrial Corporation Vs Ca - GR 119745 - June 20, 1997BerniceAnneAseñas-Elmaco100% (1)

- Plaintiff-Appellant vs. vs. Defendants-Appellees Ernesto P. Villar Arthur Tordesillas Tomas Besa, Jose B. GalangDocument17 pagesPlaintiff-Appellant vs. vs. Defendants-Appellees Ernesto P. Villar Arthur Tordesillas Tomas Besa, Jose B. GalangAggy AlbotraNo ratings yet

- 6 Mambulao Lumber Company Vs Philippine National BankDocument12 pages6 Mambulao Lumber Company Vs Philippine National BankkwonpenguinNo ratings yet

- Supreme CourtDocument6 pagesSupreme CourtRyannCabañeroNo ratings yet

- D7-Cembrano V City of ButuanDocument8 pagesD7-Cembrano V City of ButuanLira HabanaNo ratings yet

- G.R. No. 206037. March 13, 2017. Philippine National Bank, Petitioner, LILIBETH S. CHAN, RespondentDocument15 pagesG.R. No. 206037. March 13, 2017. Philippine National Bank, Petitioner, LILIBETH S. CHAN, RespondentEmman CenaNo ratings yet

- Philippine National Bank v. Manila Investment & ConstructionDocument2 pagesPhilippine National Bank v. Manila Investment & ConstructionbearzhugNo ratings yet

- Legal EthicsDocument29 pagesLegal EthicsNeil Patrick Pepito ErmacNo ratings yet

- PNB Vs Sps MaranonDocument2 pagesPNB Vs Sps MaranonJude ChicanoNo ratings yet

- Legal Ethics Case DigestDocument99 pagesLegal Ethics Case DigestRanger Rodz TennysonNo ratings yet

- Mambulao Lumber Company Vs Philippine National Bank 22 SCRA 359 PDFDocument10 pagesMambulao Lumber Company Vs Philippine National Bank 22 SCRA 359 PDFAkimah KIMKIM AnginNo ratings yet

- Montelibano Y Ramos v. La Compania General de Tabacos de Filipinas, 241 U.S. 455 (1916)Document5 pagesMontelibano Y Ramos v. La Compania General de Tabacos de Filipinas, 241 U.S. 455 (1916)Scribd Government DocsNo ratings yet

- Credit Case DigestDocument10 pagesCredit Case DigestBianca de GuzmanNo ratings yet

- Garrido Vs TuasonDocument1 pageGarrido Vs Tuasoncmv mendozaNo ratings yet

- G.R. No. 158635 December 9, 2005 Magna Financial Services Group, Inc., Petitioner, ELIAS COLARINA, RespondentDocument4 pagesG.R. No. 158635 December 9, 2005 Magna Financial Services Group, Inc., Petitioner, ELIAS COLARINA, RespondentBibi JumpolNo ratings yet

- Ronquillo v. CezarDocument4 pagesRonquillo v. CezarJoy PaderangaNo ratings yet

- Case DigestDocument3 pagesCase DigestVanessa May Caseres GaNo ratings yet

- (STATCON) Part I and Part 2 CasesDocument339 pages(STATCON) Part I and Part 2 CasesChaNo ratings yet

- 46.rillo v. CADocument5 pages46.rillo v. CAGedan TanNo ratings yet

- Declaratory Relief - DigestsDocument7 pagesDeclaratory Relief - DigestsTheHoneybhieNo ratings yet

- Development Bank of The PhilippinesDocument7 pagesDevelopment Bank of The PhilippinesJholo AlvaradoNo ratings yet

- Sales Digest - Maceda LawDocument3 pagesSales Digest - Maceda LawKristine KristineeeNo ratings yet

- PNB v. Manalo 717 S 254Document6 pagesPNB v. Manalo 717 S 254Kristine Faith CenizaNo ratings yet

- Modes of Extinguishment of Agency.Document6 pagesModes of Extinguishment of Agency.Dashy CatsNo ratings yet

- McLaughlin Vs CA (1986) - DigestDocument1 pageMcLaughlin Vs CA (1986) - DigestJomz ArvesuNo ratings yet

- Full Case - Magna VS ColarinaDocument4 pagesFull Case - Magna VS ColarinaDaveKarlRamada-MaraonNo ratings yet

- Polytrade V Blanco 30 Scra 187Document3 pagesPolytrade V Blanco 30 Scra 187Dee LMNo ratings yet

- 1) Philippine-National-Bank-vs.-Court-of-AppealsDocument14 pages1) Philippine-National-Bank-vs.-Court-of-AppealsShien TumalaNo ratings yet

- Oblicon Digested CasesDocument5 pagesOblicon Digested CasesKaren Cate Ilagan PintoNo ratings yet

- Mutuum Case DigestsDocument18 pagesMutuum Case DigestsHaidelyn CapistranoNo ratings yet

- Heirs of Felino M. Timbol, JR., v. PNB (Case Brief)Document3 pagesHeirs of Felino M. Timbol, JR., v. PNB (Case Brief)nikkisals100% (1)

- G.R. No. 125347 June 19, 1997 EMILIANO RILLO, Petitioner, Court of Appeals and Corb Realty Investment, Corp., RespondentsDocument5 pagesG.R. No. 125347 June 19, 1997 EMILIANO RILLO, Petitioner, Court of Appeals and Corb Realty Investment, Corp., RespondentsRyannCabañeroNo ratings yet

- 11 Francel Realty Corporation VDocument1 page11 Francel Realty Corporation VmepoNo ratings yet

- 7 Mambulao Lumber VS PNB PDFDocument13 pages7 Mambulao Lumber VS PNB PDFkatherine magbanuaNo ratings yet

- Power Commercial & Industrial Development Corporation Vs CA, 274 SCRA 597 (Digest)Document2 pagesPower Commercial & Industrial Development Corporation Vs CA, 274 SCRA 597 (Digest)Eyn Herrera GranatinNo ratings yet

- PNB Vs Ca: Judgment Debtor, He Is To Be Considered A "Third Person"Document9 pagesPNB Vs Ca: Judgment Debtor, He Is To Be Considered A "Third Person"Niruh Kyle AntaticoNo ratings yet

- City of Makati v. CIR - DigestDocument5 pagesCity of Makati v. CIR - DigestAlyssa Marie SobereNo ratings yet

- Aviles v. ArcegaDocument3 pagesAviles v. ArcegaAlyssa Marie SobereNo ratings yet

- Sun Bros. v. VelascoDocument3 pagesSun Bros. v. VelascoAlyssa Marie SobereNo ratings yet

- Silk Road (Conviction)Document1 pageSilk Road (Conviction)Alyssa Marie SobereNo ratings yet

- Luzon Brokerage v. Maritime (1978 Resolution of 2nd MR)Document3 pagesLuzon Brokerage v. Maritime (1978 Resolution of 2nd MR)Alyssa Marie SobereNo ratings yet

- Valarao v. CADocument4 pagesValarao v. CAAlyssa Marie SobereNo ratings yet

- China Passes New National Security LawDocument3 pagesChina Passes New National Security LawAlyssa Marie SobereNo ratings yet

- The Great Firewall of China - Web of Control - Financial TimesDocument5 pagesThe Great Firewall of China - Web of Control - Financial TimesAlyssa Marie SobereNo ratings yet

- Worksheets For PR2 - Q1M2Document9 pagesWorksheets For PR2 - Q1M2Gerry BaylonNo ratings yet

- Mun of Jose Panganiban, Camarines Sur Vs SHELLDocument3 pagesMun of Jose Panganiban, Camarines Sur Vs SHELLscartoneros_1No ratings yet

- Case Study: Food Poisoning ON ChildrenDocument24 pagesCase Study: Food Poisoning ON ChildrenkachirikoNo ratings yet

- Invitation Letter For Guest SpeakerDocument2 pagesInvitation Letter For Guest SpeakerKeyren100% (1)

- Approved Mineral Production Sharing Agreement: MGB Region V As of November 2020Document10 pagesApproved Mineral Production Sharing Agreement: MGB Region V As of November 2020PAMELA PARCENo ratings yet

- Slac 2021 2022 Training MatrixDocument7 pagesSlac 2021 2022 Training MatrixJoeper Perillo100% (1)

- Phil. Match Co. Ltd. vs. City of CebuDocument7 pagesPhil. Match Co. Ltd. vs. City of CebuMa Gabriellen Quijada-TabuñagNo ratings yet

- Cam. Norte HistoryDocument10 pagesCam. Norte HistoryJoel Camino100% (1)

- 1st Quarter MPL: Grade 7Document26 pages1st Quarter MPL: Grade 7Eric AntonioNo ratings yet

- Worksheets For PR2 - Q1M4Document10 pagesWorksheets For PR2 - Q1M4Gerry BaylonNo ratings yet

- YINLU BICOL MINING CORPORATION vs. TRANS ASIA OIL AND ENERGY DEVELOPMENT CORPORATIONDocument14 pagesYINLU BICOL MINING CORPORATION vs. TRANS ASIA OIL AND ENERGY DEVELOPMENT CORPORATIONATRNo ratings yet

- Certificates of Commendation To Inset Resource SpeakersDocument21 pagesCertificates of Commendation To Inset Resource SpeakersKeyrenNo ratings yet

- Travel Guide: Jomalig IslandDocument36 pagesTravel Guide: Jomalig IslandBea RomeroNo ratings yet

- Of Church Bells and Masons The Church of PDFDocument27 pagesOf Church Bells and Masons The Church of PDFSheila Hernandez PandeaguaNo ratings yet

- Arts CertificateDocument14 pagesArts CertificateErnez PeraltaNo ratings yet

- Donor's NameDocument5 pagesDonor's Namesharon LegaspiNo ratings yet

- NDEP Training Proposal TedoyDocument7 pagesNDEP Training Proposal TedoyEric AntonioNo ratings yet

- Camarines Norte TriviaDocument4 pagesCamarines Norte TriviaDrahcir ReyesNo ratings yet

- History of Barangay Group VisayasDocument141 pagesHistory of Barangay Group VisayasBhem GomezNo ratings yet

- Type of DepositDocument4 pagesType of DepositGuinevere RaymundoNo ratings yet

- Daet History June2003122323Document3 pagesDaet History June2003122323Ton TonNo ratings yet

- RDO No. 64 - Talisay, Camarines NorteDocument483 pagesRDO No. 64 - Talisay, Camarines NortedebbeelawNo ratings yet

- Region V - Camarines Norte: Dam Name SystemDocument4 pagesRegion V - Camarines Norte: Dam Name SystemRhea CelzoNo ratings yet

- List of BSP Registered Operator of Payment System (OPS)Document11 pagesList of BSP Registered Operator of Payment System (OPS)Don Jose ReclamadoNo ratings yet

- Department of Education: Activity Proposal 1. Title/Name of Project: 2. Type: 3. Duration/VenueDocument2 pagesDepartment of Education: Activity Proposal 1. Title/Name of Project: 2. Type: 3. Duration/VenueNicole EncinasNo ratings yet

- Worksheets For PR2 - Q1M3Document13 pagesWorksheets For PR2 - Q1M3Gerry Baylon100% (1)

- Item Analysis: Parang Elementary School 1St Quarter ExaminationDocument30 pagesItem Analysis: Parang Elementary School 1St Quarter ExaminationalyssaNo ratings yet

- AirportsDocument37 pagesAirportsJoyce Cua-BarcelonNo ratings yet

- Project Procurement Management Plan (PPMP) Cy 2021 Charged To GAADocument6 pagesProject Procurement Management Plan (PPMP) Cy 2021 Charged To GAAEric AntonioNo ratings yet