0% found this document useful (0 votes)

36 views14 pagesTopic 4 Questions

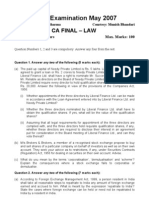

The document discusses various legal principles and scenarios related to company management, shareholder rights, and the procedures for initiating legal actions within a corporate context. It covers topics such as the proper plaintiff principle, derivative actions, unfair prejudice remedies, and the requirements for convening general meetings. Specific case studies illustrate the application of these principles, highlighting the rights and remedies available to shareholders in different situations.

Uploaded by

tjleung20030819Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

36 views14 pagesTopic 4 Questions

The document discusses various legal principles and scenarios related to company management, shareholder rights, and the procedures for initiating legal actions within a corporate context. It covers topics such as the proper plaintiff principle, derivative actions, unfair prejudice remedies, and the requirements for convening general meetings. Specific case studies illustrate the application of these principles, highlighting the rights and remedies available to shareholders in different situations.

Uploaded by

tjleung20030819Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd