0% found this document useful (0 votes)

115 views6 pagesDownload

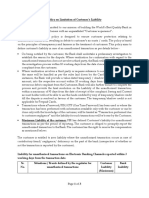

HDFC Bank's Compensation Policy outlines the framework for compensating customers for service deficiencies, including unauthorized debits, delays in cheque collections, and issues with credit cards. The policy emphasizes transparency and fairness, ensuring customers are compensated for financial losses and inconveniences without needing to file complaints. However, it excludes claims for opportunity losses and is not applicable for unauthorized electronic transactions, with specific compensation guidelines provided for various service failures.

Uploaded by

shrivastavkrishna716Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

115 views6 pagesDownload

HDFC Bank's Compensation Policy outlines the framework for compensating customers for service deficiencies, including unauthorized debits, delays in cheque collections, and issues with credit cards. The policy emphasizes transparency and fairness, ensuring customers are compensated for financial losses and inconveniences without needing to file complaints. However, it excludes claims for opportunity losses and is not applicable for unauthorized electronic transactions, with specific compensation guidelines provided for various service failures.

Uploaded by

shrivastavkrishna716Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd