Professional Documents

Culture Documents

Brief ECO Newsletter 2012186 1

Uploaded by

annawitkowski88Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Brief ECO Newsletter 2012186 1

Uploaded by

annawitkowski88Copyright:

Available Formats

This document is being provided for the exclusive use of <britholtz@fusioninvest.

com>

06.18.12 www.bloombergbriefs.com Bloomberg Brief | Economics

12

KEENES CORNER

Barry Ritholtz, chief executive officer/director of equity research, FusionIQ, talks to Tom Keene and Ken Prewitt about why the foreclosure machinery is clicking back into gear.

Q: You say the foreclosure machinery is clicking back into gear. Why are we seeing more foreclosures now? A: During the 12-to-14 months of negotiations on the robo-signing settlement, the banks had voluntarily agreed to stop a foreclosure machinery that had, to be blunt, run amok with a lot of illegality and a lot of fraud. This is the banks outside lawyers and service processors and everybody else. They had just turned them into an ongoing assembly line when it really should not have been. So we had a voluntary stop for well over a year, and during that period the number of foreclosure initiations and the number of distressed sales dropped dramatically. Ill give you a great data point from the April existing home sales. For April 2012 existing home sales, 29 percent of the total sales were distressed. The same period 12 months earlier, it was 38 percent. Distressed sales sell for about a fifth lower than the comparable house next door. Q: Are you suggesting a house price decline in the next 12 months? A: Well, here is what we see. The RealtyTrac monthly foreclosure start report came out earlier this week, and for the first time in a long time we saw a monthover-month increase. That was a 9 percent increase and is probably just the leading edge of the reversion back to the normal foreclosure process that we see. Earlier this week you had Laurie Goodman of Amherst Securities on and she had an astonishing data point: In the U.S., there are 2.8 million people living in homes with mortgages where they have not made a payment for 12 months or longer. Q: What do you make of that Federal Reserve report showing that in the first quarter home equity in the U.S. went up to $6.7 trillion. People are not only

refinancing, but they are throwing more cash into the house to lower their mortgage rates. A: Number one, it obviously reflects record low mortgage rates. And it is good for the people who have good credit scores, good payment history, good income, who can take advantage of those rates. But one in five people who have a mortgage or who qualified for a mortgage since 2007 have fallen 90 days behind at some point over those intervening months. Because of that, those people will not qualify for a new mortgage or a refi. So you have these record low rates and nine million people that simply cannot take advantage of it. Q: Right now 3.88 percent is the average on a 30-year fixed rate loan. You are looking for rates to go up? A: No, but rates at this level are likely to be as attractive as it gets. Is there is a probability that rates tick down? Well, maybe they go a little lower if we see QE5 and Operation Twist 2 and who knows what else, but statistically, at unprecedented low levels of mortgage rates, the risk of rates moving higher are better than seeing an appreciable move down. I mean how much lower can mortgage rates go? Are you going to go to 3.7 percent or 3.6 percent? That is a possibility. But sliding higher is a greater risk at these levels. Q: What do you do with your 401K? A: You know, we always use the example that the time to read where the emergency exits are and where the flotation devices are is when you are on the tarmac waiting to take off. Its not at 30,000 feet when an engine goes out and the captain announces there is trouble. With your 401K, you want to own as low-cost holdings as you can. You dont want to pay a lot of big internal fees and expenses, that is number one. Number two, you want to own the broad market. You want to own some emerging markets, some small cap, some tech, and some fixed income. All you can do is look forward and say, statistically, if I am in the market over the long haul Ill do well. That doesnt mean you set it and forget it. That doesnt mean during a secular bear market you just buy and hold and close your eyes. You know, we lowered our equity exposure about two months ago and we have been slowly, over the past four weeks, bringing it back up. We recently added Wal-Mart, which is back at levels it hasnt seen since January 2006. If the boys at ECRI are right

and we do see a recession in 2013, 2014, Wal-Mart is where the American consumer tends to end up when things get tight.

(This interview was condensed and edited.)

Todays guests: John Ryding, RDQ Economics; Athanasios Orphanides; Richard Clarida, PIMCO; Carl Weinberg, HFE; Olli Rehn, European Commission; Jim OSullivan, HFE

On Air Listen on the radio at these regularly scheduled times and dates.

SURVEILLANCE

Weekdays 7:00 AM-10:00 AM. Tom Keene joins Ken Prewitt for Bloomberg Surveillance

BLOOMBERG

ON THE ECONOMY MondayThursday 7:00-8:00 PM. Tom Keene interviews high-profile guests and looks at the economy.

PodCast Listen on the web at http://www.bloomberg.com/podcasts/surveillance/

Also available on the Bloomberg terminal: BPOD <GO>

Twitter / On Demand

Full interviews are available at Tom Keene on Demand http://www.bloomberg.com/tvradio/radio/ and follow him on twitter @tomkeene

Bloomberg Brief Economics Newsletter Ted Merz Executive Editor tmerz@bloomberg.net 212-617-2309 Bloomberg News Dan Moss Executive Editor dmoss@bloomberg.net 202-624-1881 Economics Kevin Depew Newsletter Editors kdepew2@bloomberg.net 212-617-3131 Nipa Piboontanasawat Chris Kirkham npiboontanas@bloomberg.net ckirkham@bloomberg.net +852-2977-6628 +44-20-7673-2464 Staff Economists Joseph Brusuelas David Powell jbrusuelas3@bloomberg.net dpowell24@bloomberg.net 212-617-7664 +44-20-7073-3769 Michael McDonough Richard Yamarone mmcdonough10@bloomberg.net ryamarone@bloomberg.net +852-2977-6733 212-617-8737 Tamara Henderson Niraj Shah thenderson14@bloomberg.net nshah185@bloomberg.net +65-6212-1140 +44-171-330-7500 Newsletter Nick Ferris Business Manager nferris2@bloomberg.net 212-617-6975 Advertising bbrief@bloomberg.net 212-617-6975 Reprints & Permissions Lori Husted lori.husted@theygsgroup.com 717-505-9701 To subscribe via the Bloomberg Terminal type BRIEF <GO> or on the web at www.bloombergbriefs.com. To contact the editors: econbrief@bloomberg.net

This newsletter and its contents may not be forwarded or redistributed without the prior consent of Bloomberg. Please contact our reprints and permissions group listed above for more information

2012 Bloomberg LP. All rights reserved..

1 2

3 4 5

6 7

8 9 10

11

12

You might also like

- Financial Independence Made Simple: An Illustrated GuideDocument11 pagesFinancial Independence Made Simple: An Illustrated GuideNan Stieren100% (2)

- Private Lending GuideDocument23 pagesPrivate Lending GuideRobert Granham100% (5)

- How To Sell Your Home-Sales Letter SHORT SALE15Document11 pagesHow To Sell Your Home-Sales Letter SHORT SALE15merujan1No ratings yet

- Replace Your Mortgage Interior Final PDFDocument129 pagesReplace Your Mortgage Interior Final PDFJeff SmithNo ratings yet

- Making Money From The MeltdownDocument52 pagesMaking Money From The Meltdownrnj1230100% (1)

- Vba 26 1880 AreDocument2 pagesVba 26 1880 Areapi-269916574No ratings yet

- How To Sell Your Home-Sales Letter SHORT SALE1Document12 pagesHow To Sell Your Home-Sales Letter SHORT SALE1merujan1No ratings yet

- Start-Up Real Estate Business PlanDocument23 pagesStart-Up Real Estate Business PlanEtiMkpo Stanislaus Ekong75% (4)

- Module 1 Intermediate Accounting 2Document37 pagesModule 1 Intermediate Accounting 2Andrei GoNo ratings yet

- Galvan Budget ReportDocument5 pagesGalvan Budget ReportJeevesh GoolabNo ratings yet

- Foreclosure Prevention & Refinance Report: Federal Property Manager'S Report Second Quarter 2021Document50 pagesForeclosure Prevention & Refinance Report: Federal Property Manager'S Report Second Quarter 2021Foreclosure FraudNo ratings yet

- Air Phase1 0Document13 pagesAir Phase1 0drkwng100% (1)

- BKPloanapplicationDocument3 pagesBKPloanapplicationcunninghumNo ratings yet

- Intermediate Accouting Testbank ch13Document23 pagesIntermediate Accouting Testbank ch13cthunder_192% (12)

- Financial CrisesDocument24 pagesFinancial CrisesMaria Shaffaq50% (2)

- Howard Marks Fourth Quarter 2009 MemoDocument12 pagesHoward Marks Fourth Quarter 2009 MemoDealBook100% (3)

- 14-EC-1 - Version Anglaise - Novembre 2014Document6 pages14-EC-1 - Version Anglaise - Novembre 2014LuisAranaNo ratings yet

- Stock Market Investing for Beginners: The Keys to Protecting Your Wealth and Making Big Profits In a Market CrashFrom EverandStock Market Investing for Beginners: The Keys to Protecting Your Wealth and Making Big Profits In a Market CrashNo ratings yet

- Liabilities - QuizDocument7 pagesLiabilities - Quizkarenmae intangNo ratings yet

- Thesis Real Estate BubbleDocument7 pagesThesis Real Estate BubbleAndrew Parish100% (2)

- September 22, 2010 PostsDocument543 pagesSeptember 22, 2010 PostsAlbert L. PeiaNo ratings yet

- The Pensford Letter - 7.2.12Document5 pagesThe Pensford Letter - 7.2.12Pensford FinancialNo ratings yet

- The Pensford Letter - 7.2.12Document5 pagesThe Pensford Letter - 7.2.12Pensford FinancialNo ratings yet

- The Pensford Letter - 7.2.12Document5 pagesThe Pensford Letter - 7.2.12Pensford FinancialNo ratings yet

- IceCap February 2011 Global Market OutlookDocument8 pagesIceCap February 2011 Global Market OutlookIceCap Asset ManagementNo ratings yet

- Short Sales The Current Housing MarketDocument25 pagesShort Sales The Current Housing Marketbrian3332No ratings yet

- May 2010 Charleston Market ReportDocument38 pagesMay 2010 Charleston Market ReportbrundbakenNo ratings yet

- Ricardo's Law: The Unintended Consequence of The Federal Government's Budget Only You Will SeeDocument8 pagesRicardo's Law: The Unintended Consequence of The Federal Government's Budget Only You Will Seehunghl9726No ratings yet

- The Pensford Letter - 7.22.13Document6 pagesThe Pensford Letter - 7.22.13Pensford FinancialNo ratings yet

- Call Transcript To Announce The BRT CEOs Letter On The Need To Avoid The Fiscal CliffDocument25 pagesCall Transcript To Announce The BRT CEOs Letter On The Need To Avoid The Fiscal CliffBusiness RoundtableNo ratings yet

- Script - US Real Estate, Housing CrashDocument5 pagesScript - US Real Estate, Housing CrashMayumi AmponNo ratings yet

- Four in Four ReportDocument2 pagesFour in Four ReportValuEngine.comNo ratings yet

- Back To The Future RecessionDocument10 pagesBack To The Future Recessionmsanch01No ratings yet

- Santelli: $4 Gas, $150 Oil Coming This Summer..Document9 pagesSantelli: $4 Gas, $150 Oil Coming This Summer..Albert L. PeiaNo ratings yet

- The End of Buy and Hold ... and Hope Brian ReznyDocument16 pagesThe End of Buy and Hold ... and Hope Brian ReznyAlbert L. PeiaNo ratings yet

- Dow Closes Above 11,000 This Rally Has Ignored Fundamentals, and Will Be Corrected Painfully, Hussman SaysDocument10 pagesDow Closes Above 11,000 This Rally Has Ignored Fundamentals, and Will Be Corrected Painfully, Hussman SaysAlbert L. PeiaNo ratings yet

- Dow Closes Above 11,000 This Rally Has Ignored Fundamentals, and Will Be Corrected Painfully, Hussman SaysDocument10 pagesDow Closes Above 11,000 This Rally Has Ignored Fundamentals, and Will Be Corrected Painfully, Hussman SaysAlbert L. PeiaNo ratings yet

- Should We Blame Immigration For Canada's Economic WoesDocument152 pagesShould We Blame Immigration For Canada's Economic Woesmohit01krishanNo ratings yet

- Mortgage 2.0: Executive SummaryDocument10 pagesMortgage 2.0: Executive Summarycharger1234No ratings yet

- X-Factor 102211 - Market Is Not CheapDocument11 pagesX-Factor 102211 - Market Is Not CheapmathewmiypeNo ratings yet

- KJHKHJGJHGJHGKL LokjlkjlkDocument5 pagesKJHKHJGJHGJHGKL LokjlkjlkKari WilliamsNo ratings yet

- Climbing Rates Seen Stalling Rise in Values: June 22 - July 8, 2013Document3 pagesClimbing Rates Seen Stalling Rise in Values: June 22 - July 8, 2013Anonymous Feglbx5No ratings yet

- The Credit Squeeze Is Intensifying On Main StreetDocument4 pagesThe Credit Squeeze Is Intensifying On Main StreetValuEngine.comNo ratings yet

- LTR To Investors Jan 11Document6 pagesLTR To Investors Jan 11the_knowledge_pileNo ratings yet

- ValuEngine Weekly Newsletter August 12, 2011Document11 pagesValuEngine Weekly Newsletter August 12, 2011ValuEngine.comNo ratings yet

- Global Market Outlook July 2011Document8 pagesGlobal Market Outlook July 2011IceCap Asset ManagementNo ratings yet

- Market Commentary 11-12-12Document4 pagesMarket Commentary 11-12-12CLORIS4No ratings yet

- Mcgill Personal Finance Essentials Transcript Module 7: The Realities of Real Estate, Part 1Document5 pagesMcgill Personal Finance Essentials Transcript Module 7: The Realities of Real Estate, Part 1shourav2113No ratings yet

- Confidence Sliding On Main StreetDocument4 pagesConfidence Sliding On Main StreetValuEngine.comNo ratings yet

- NMP NOV10eeditionDocument56 pagesNMP NOV10eeditionAndrew T. BermanNo ratings yet

- September 15, 2010 PostsDocument478 pagesSeptember 15, 2010 PostsAlbert L. PeiaNo ratings yet

- SPRING 2012: Policy Continues To Drive Housing PerformanceDocument4 pagesSPRING 2012: Policy Continues To Drive Housing PerformancelsteamdebokNo ratings yet

- Is There A Double Dip Recession in The Making AC - FinalDocument2 pagesIs There A Double Dip Recession in The Making AC - FinalPremal ThakkarNo ratings yet

- The Pessimist Complains About The Wind The Optimist Expects It To Change The Realist Adjusts The Sails.Document17 pagesThe Pessimist Complains About The Wind The Optimist Expects It To Change The Realist Adjusts The Sails.brundbakenNo ratings yet

- Fiscal Policy, Politics and Weather Patterns... : Julie WillisDocument4 pagesFiscal Policy, Politics and Weather Patterns... : Julie WillisJulie Crismond WillisNo ratings yet

- Sequoia Fund, Inc.Document8 pagesSequoia Fund, Inc.twoeight100% (1)

- Sanford C. Bernstein Strategic Decisions Conference: TranscriptDocument12 pagesSanford C. Bernstein Strategic Decisions Conference: TranscriptMark ReinhardtNo ratings yet

- Lovely Professional University: Department of Management Seminar Report On Contemporary Issues "Mortgage Crisis"Document23 pagesLovely Professional University: Department of Management Seminar Report On Contemporary Issues "Mortgage Crisis"renikaNo ratings yet

- The Pensford Letter - 7.23.12Document5 pagesThe Pensford Letter - 7.23.12Pensford FinancialNo ratings yet

- By Mike GleasonDocument5 pagesBy Mike GleasonBill FrindallNo ratings yet

- Jason Carrier Winter NewsletterDocument4 pagesJason Carrier Winter NewsletterjcarrierNo ratings yet

- 5 Keys To Increase Your WealthDocument5 pages5 Keys To Increase Your WealthLuis Perez-SchragerNo ratings yet

- Be Careful You Wish ForDocument5 pagesBe Careful You Wish Foredoardo.pivaNo ratings yet

- Mortgage Modifications Lag ForeclosuresDocument3 pagesMortgage Modifications Lag ForeclosuresValuEngine.comNo ratings yet

- 2010 Barrons IntvuDocument3 pages2010 Barrons IntvuZuresh PathNo ratings yet

- Selling America - A Bears ViewDocument3 pagesSelling America - A Bears ViewnagstrikesNo ratings yet

- Dividend Investing: The Beginner's Guide to Create Passive Income (Use the Power of Dividend Growth to Create a Winning Portfolio)From EverandDividend Investing: The Beginner's Guide to Create Passive Income (Use the Power of Dividend Growth to Create a Winning Portfolio)No ratings yet

- TBP Conf Oct 2012Document27 pagesTBP Conf Oct 2012annawitkowski88No ratings yet

- People V JP Morgan ComplaintDocument31 pagesPeople V JP Morgan ComplaintJames EdwardsNo ratings yet

- Single SlideDocument1 pageSingle Slideannawitkowski88No ratings yet

- Research Division: Federal Reserve Bank of St. LouisDocument43 pagesResearch Division: Federal Reserve Bank of St. Louisannawitkowski88No ratings yet

- SSRN Id2023011Document54 pagesSSRN Id2023011sterkejanNo ratings yet

- Ianco Esearch L.L.C. A R T A: What Is The Fed's Plan and Will It Work?Document44 pagesIanco Esearch L.L.C. A R T A: What Is The Fed's Plan and Will It Work?annawitkowski88No ratings yet

- Richmond Fed Research Digest: Frictional Wage Dispersion in Search Models: A Quantitative AssessmentDocument11 pagesRichmond Fed Research Digest: Frictional Wage Dispersion in Search Models: A Quantitative Assessmentannawitkowski88No ratings yet

- Income, Poverty, and Health Insurance Coverage in The United States: 2011Document89 pagesIncome, Poverty, and Health Insurance Coverage in The United States: 2011annawitkowski88No ratings yet

- Exhibit 15 - Whistleblower Affidavit (Redacted)Document11 pagesExhibit 15 - Whistleblower Affidavit (Redacted)annawitkowski88No ratings yet

- Fed SideDocument1 pageFed Sideannawitkowski88No ratings yet

- Income, Poverty, and Health Insurance Coverage in The United States: 2011Document89 pagesIncome, Poverty, and Health Insurance Coverage in The United States: 2011annawitkowski88No ratings yet

- Taxes and The EconomyDocument23 pagesTaxes and The Economychristian_trejbal100% (1)

- The Boom and Bust of U.S. Housing Prices From Various Geographic PerspectivesDocument29 pagesThe Boom and Bust of U.S. Housing Prices From Various Geographic Perspectivesannawitkowski88No ratings yet

- Woodford Rules Jackson Hole WyomingDocument97 pagesWoodford Rules Jackson Hole WyominglatecircleNo ratings yet

- Finance and Economics Discussion Series Divisions of Research & Statistics and Monetary Affairs Federal Reserve Board, Washington, D.CDocument36 pagesFinance and Economics Discussion Series Divisions of Research & Statistics and Monetary Affairs Federal Reserve Board, Washington, D.Cannawitkowski88No ratings yet

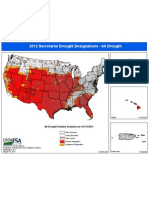

- Usda Drought Fast Track Designations 081512Document1 pageUsda Drought Fast Track Designations 081512annawitkowski88No ratings yet

- HKB 05TechRiskMgmtpolicyPreshipCreditForeignCurrencyDocument25 pagesHKB 05TechRiskMgmtpolicyPreshipCreditForeignCurrencyParamu NatarajanNo ratings yet

- FM Lecture 2 Time Value of Money S2 2020.21Document75 pagesFM Lecture 2 Time Value of Money S2 2020.21Quỳnh NguyễnNo ratings yet

- Auditing Debt Obligations TransactionsDocument9 pagesAuditing Debt Obligations TransactionsBeatrize ValerioNo ratings yet

- Business Planning Banking Sample Paper - AnswersDocument32 pagesBusiness Planning Banking Sample Paper - Answerscima2k15No ratings yet

- What Is Loan-to-Value (LTV) RatioDocument6 pagesWhat Is Loan-to-Value (LTV) RatioJason CarterNo ratings yet

- SubwayDocument6 pagesSubwaySteven ChewNo ratings yet

- HDB - Interest Rates and ChargesDocument2 pagesHDB - Interest Rates and ChargesManish PandeyNo ratings yet

- IPL Corporate ProfileDocument17 pagesIPL Corporate ProfileRohtash Singh Rathore100% (2)

- 515 Bluebird Senior Syndication Term Sheet PDFDocument23 pages515 Bluebird Senior Syndication Term Sheet PDFzoure samyrNo ratings yet

- Detailed Solutions To Problem 5Document3 pagesDetailed Solutions To Problem 5Maria AngelicaNo ratings yet

- Private Acquisition Consolidated NoteDocument28 pagesPrivate Acquisition Consolidated NoteVisit SriwattanapanyaNo ratings yet

- Chapter 1-Liabilities PDFDocument5 pagesChapter 1-Liabilities PDFMarx Yuri JaymeNo ratings yet

- Cityworks PPMDocument23 pagesCityworks PPMBefut GlobalNo ratings yet

- CH 13Document46 pagesCH 13Muhammad AmirulNo ratings yet

- Viceroy CapitecDocument33 pagesViceroy CapitecPrimedia Broadcasting100% (5)

- Dissertation Droit Commercial l2Document6 pagesDissertation Droit Commercial l2HelpWithCollegePaperWritingColumbia100% (1)

- Effect of Persons in Possession of Real Estate Other Than The Owner/Vendor On A Buyer's Status As A Bona Fide Purchaser - NY State Court CasesDocument375 pagesEffect of Persons in Possession of Real Estate Other Than The Owner/Vendor On A Buyer's Status As A Bona Fide Purchaser - NY State Court CasesrichdebtNo ratings yet

- NABARDDocument46 pagesNABARDMahesh Gaddamedi100% (1)

- Blanket Mortgage FundamentalsDocument19 pagesBlanket Mortgage FundamentalsJason CarterNo ratings yet

- Buying and Selling A Home Make The Right Choice In... - (Contents)Document4 pagesBuying and Selling A Home Make The Right Choice In... - (Contents)pankajNo ratings yet