0% found this document useful (0 votes)

62 views2 pages2025 Spring Course Outline

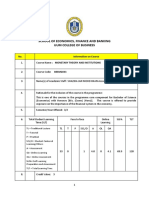

The course ECON1420 C/D or UGEC1560 C/D at The Chinese University of Hong Kong provides an overview of banking and finance, focusing on their impact on economic well-being. It covers topics such as interest rates, banking operations, investment returns, and financial market analysis, aimed at students with no prior economics knowledge. Assessment includes a closed-book test and an open-book final test, with academic honesty emphasized throughout the course structure.

Uploaded by

katie.li.man.manCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

62 views2 pages2025 Spring Course Outline

The course ECON1420 C/D or UGEC1560 C/D at The Chinese University of Hong Kong provides an overview of banking and finance, focusing on their impact on economic well-being. It covers topics such as interest rates, banking operations, investment returns, and financial market analysis, aimed at students with no prior economics knowledge. Assessment includes a closed-book test and an open-book final test, with academic honesty emphasized throughout the course structure.

Uploaded by

katie.li.man.manCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd