Professional Documents

Culture Documents

10 Introduction

Uploaded by

mahielangoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

10 Introduction

Uploaded by

mahielangoCopyright:

Available Formats

3. PRIMARY FUNCTIONS OF BANK 3.1.

SAVINGS BANK ACCOUNT

TYPES OF SAVING BANK ACCOUNT i) Individual account ii) Joint account To open joint accounts, maximum number of persons is restricted to FOUR. It should be ensured that Survivorship clause is incorporated in NF.101 in the case of accounts operated JOINTLY. iii) Account for Minor (Minor Account) Minor is one who has not completed 18 years of age. Although father is the natural guardian, SB account can be opened in the name of the minor with mother as guardian also. No cheque book is to be issued to the minor accounts when it is operated by the minor himself. Minor's date of birth is to be recorded in the master. On attaining majority, fresh application and specimen signature card must be obtained duly countersigned by the guardian and kept along with the original application. No overdrawing should be allowed in the accounts of the minor.

(iv) Accounts for illiterate persons - Following precautions are to be taken Rules of business are properly explained to them. For withdrawing money, they should come in person.

In the case of Joint Account of an illiterate with a literate - Operational condition must be either 'Jointly' or by 'illiterate only'. Whenever the condition is jointly, no cheque book should be issued.

Left Thumb Impression of the depositor should be attested by a person known to the bank. Photo of the illiterate account holder is to be obtained and affixed in the pass book. Fact that the account holder is an illiterate person must be clearly noted in red ink in the account opening form, Specimen signature card, pass book and cheque book. Joint accounts of two illiterate persons can be opened with operational condition 'JOINTLY'.

(vii) Account for Blind Persons In addition to the above, the following special types of accounts can also be opened. Non Corporate bodies clubs, Societies, associations, schools etc. Trusts, Executors/Administrators, Government bodies, Semi Government Departments.

Document Required For Opening a Savings Account Two passport size photographs Proof of residence i.e. Passport/driving license/Gas / Telephone / Electricity Bill/ Ration An introduction of the person from an existing account holder. PAN number / Declaration in form no.60 or 61 as per the Income Tax Act 1961.

card/voters identity card

3.2 CURRENT ACCOUNT

Current Account is primarily meant for businessmen, firms, companies, public enterprises etc. that have numerous daily banking transactions. Current Accounts are cheque operated accounts meant neither for the purpose of earning interest nor for the purpose of savings but only for convenience of business hence they are non-interest bearing accounts.

In a Current Account, a customer can deposit any amount of money any number of times. He can also withdraw any amount as many times as he wants, as long as he has funds to his credit. Generally, a higher minimum balance as compared to Savings Account is required to be maintained in Current account. As per RBI directive banks are not allowed to pay any interest on the balances maintained in Current accounts. However, in case of death of the account holder his legal heirs are paid interest at the rates applicable to Savings bank deposit from the date of death till the date of settlement. Because of the large number of transactions in the account and volatile nature of balances maintained, banks usually levy certain service charges for operating a Current account. Current Account can be opened by: An individual who has attained majority. Two or more individuals in their joint names. Sole proprietorship concerns. Partnership concerns. Limited Companies. Clubs, Societies. Trusts, Executors and Administrators. Others - Govt. and semi Govt. bodies, local authorities etc.

Documents Required for Opening a Current Account Following documents are required in case of individuals Two passport size photographs Proof of residence i.e. Passport/driving license/Gas / Telephone / An introduction of the person from an existing account holder.

Electricity Bill/ Ration card/voters identity card

PAN number / Declaration in form no.60 or 61 as per the Income

Tax Act 1961. In addition to the above, the following special types of accounts can also be opened. Provident Fund Account of school/Red Cross Society and to employees Accounts of Schools/Head Masters. Accounts with minor as proprietor. Accounts of Associate of persons Account in the name of limited company- Receiver account Accounts of Post Offices

PROCEDURE FOR OPENING THE ACCOUNT: Accounts are to be opened as per Rules of Business. Guidelines issued on KYC and AML, are to be adhered to, while opening new accounts as also while monitoring the transactions in the accounts of the customers. All accounts are to be properly introduced. Account opening forms as specified above along with specimen signature cards and stamp size/pass port size photographs to be obtained duly filled and signed by the account holders. PAN number or Form 60/61 as the case may be must be obtained. In order to confirm the correctness of the address given by the account holder a copy of documentary evidence may be obtained as per Rules of Business. After verifying the signature of the introducer, the supervisor should put his signature with name and signing power /staff number as the case may be. 4

On obtention of all the relevant forms, the account should be opened after ensuring that the initial deposit is paid in cash.

Opening of new accounts should be authorized by the Manager. However in large branches, Officer-in-charge of the Department can authorize the same.

Scanning of Specimen signatures shall be done alongside by the operators while entering the data for the news accounts to be opened and uploading and verficiation shall be done by the Officers and Supervisors, including temporary supervisors.

SPECIMEN SIGNATURE CARDS: Specimen Signature should be obtained in the presence of branch officials and signed by the supervisor. It should be counter signed by the Officer/Manager concerned. Account number, name of the account holder and instructions regarding the operation of the account should be clearly noted on it. It should be date stamped Once the account is opened, Specimen Signature cards should be arranged serially which should be under lock and key and during office hours be in the custody of the concerned supervisor. The supervisor will be responsible for the safe keeping of the specimen signature cards. Specimen signature cards pertaining to inoperative accounts are to be removed from regular file and maintained in a separate file and be kept preferably in FBR strong room/FBR safe/Fire Resistant Record Cabinet (FRRC) or in a cupboard with dual locking arrangement.

OBTENTION OF PHOTOGRAPHS:

Pass port size / stamp size photograph of the depositors should be obtained in case of all SB accounts.

Photographs of the authorised signatories should be obtained in case of joint accounts, accounts of clubs, associations, societies, HUF, Trust and Minors account etc.

Photographs of the student account holders should be attested by the school authorities on the reverse.

Where the accounts are operated by letter of authority, photographs of the authority holders should be obtained duly attested by the depositor

OBTENTION OF PHOTOGRAPHS IS WAIVED (EXEMPTED) IN THE FOLLOWING CASES:

o Employees accounts o Pension accounts as the photographs will be available in the PPOs lodged with the bank. A photograph obtained from the account holder/s is/are to be stapled in the space just below the date column in the account opening form. In case of closure/transfer of accounts, photographs should not be returned to the depositors. The cost of the photograph is to be borne by the depositors. INITIAL DEPOSIT & MINIMUM BALANCE: Initial deposit must be made in cash by using NF.131 (SB Challan) duly signed by the depositor.

Non maintenance of minimum balance in the accounts where cheque books are issued attracts a charge of Rs.22/- levied once in a month. However, following categories of account holders are exempted from the above stipulation :

Pensioners drawing pension through the branches Employees of the bank Non-Resident Indians Ex-Employees of the bank who are eligible to earn preferential rate of interest.

Salaried class is permitted to open zero balance pay roll accounts Penalty for non-maintenance of minimum balance waived till first credit Cheque books to be issued after the first credit.

GUIDELINES IN RESPECT OF NEW ACCOUNTS: A close and intelligent watch over the newly opened accounts especially during the first six months is to be exercised in allowing operations therein, particularly those involving huge deposits and withdrawals. Branches have to be cautious where cheque/drafts for large amounts are lodged. Inward remittances etc. received have to be verified with greater care. All debits of Rs. 25,000/- and above during the first six months should be authorised by the Manager - in - charge of the branch/department. All cheques issued should be marked NEW ACCOUNT for the first six months. These cheques received should be screened under Ultra Violet Lamps wherever necessary. CLOSURE OF ACCOUNTS: 7

A letter of request for closing the account should be obtained from the account holder. The signature in the letter should be verified with the specimen signature.

In the case of accounts of can card holders, the account should be closed only after getting instructions from Cancard Division.

If the account is closed before completion of one year, a service charge of Rs. 10/- per account is to be levied and credited to commission account - Service charges. However, this is not applicable in the following cases: Transferring the account to another branch of our Bank. Opening another account in joint names On account of death of the Account holder.

The proceeds of closed/transferred SB accounts are to be routed through Demand Draft only.

INTEREST: Interest should be paid at half yearly rests before 10th of February and August. Interest is to be calculated on the basis of minimum balance in the account between 10th and last day of the month. Interest rates of the Saving Bank account are 3.5% per annum. Normally, no interest is payable on Current account.

IN OPERATIVE ACCOUNTS: These are the accounts in which there are no operations for a period of one years and above from the date of last operation except by way of any charges debited or interest credited. All the accounts are to be reviewed at least once in a calendar year and inoperative accounts are to be segregated.

Among the inoperative accounts, such of those accounts which do not earn any interest should be segregated and grouped separately classifying them as "Non-Interest Earning Inoperative accounts" (NIE accounts.)

Debits other than service charges, excess interest credited etc., in inoperative accounts are to be permitted only after transferring inoperative accounts to operative account. Such accounts should be transferred to operative account after obtaining a suitable letter from the account holder and operations are permitted only after getting the approval from the Manager-in-charge of the department of branch-in-charge.

Issue of cheque book/loose leaves only after properly identifying the account holder and should be authenticated by the Officer/Manager/Senior Manager.

PASS BOOK AND PASS SHEETS Pass books/ pass sheets should be issued to all current account holders. The same should be written neatly, accurately and legibly and should be initialed by the Supervisor after verifying the correctness of the ledger balance. Duplicate pass book/pass sheets can be issued in case the original is lost or misplaced after collecting applicable service charges. CASUAL OVER DRAWINGS IN CURRENT ACCOUNT: Depending upon the credit worthiness of the party and Manager's experience of the party's transaction, casual overdrawing may be allowed subject to delegation of powers. Such overdrawing must be regularized within 15 days. Interest as applicable to clean advances should be charged. If it is not regularized within the specific period, penal interest at 2% over and above the normal rate of interest to be charged compounded quarterly (calendar quarter). Current accounts in which over drawings remain outstanding beyond the stipulated period of 15 days must be reported. IN OPERATIVE CURRENT ACCOUNTS.

Accounts in which there are no operations for a period of two years and above from the date of last operation except by way of any charge debited are to be treated as inoperative current accounts

These accounts are to be transferred to a separate ledger called "Inoperative ledger". This is to be done at least once in a calendar year by reviewing all the accounts. Debits other than service charges, excess interest credited etc., in inoperative accounts are to be permitted only after transferring inoperative accounts to operative ledger. Such account should be transferred to operative ledger after obtaining a suitable letter from the account holder and operations are permitted only after getting the approval from the Manager-in-charge of the Department of Branch In charge.

CURRENT ACCOUNT FOR EMPLOYEES Employees are not allowed to open Current account in the normal course. However, in exceptional cases, if the employee submits a request in writing explaining the reasons for operating a current account, the same may be opened after obtaining permission from the concerned staff section (W/O). A Supervisor should not authorize payment of his own cheque.

FIXED DEPOSITS

Fixed Deposits are term deposits repayable after an agreed period , fixed at the time of deposit. Fresh Deposits as well as renewals etc. may be accepted in odd amounts with a minimum of Rs.1000/-. It is desired that branches shall try to maintain deposits in round amounts wherever possible. The period of deposit should be 15 days or more but should not exceed 10 years (120 months).(exceptions under Court Orders and deposits in the name of minors, subject to satisfactory position.)

VALARMADHI DEPOSITS

10

Valarmadhi Deposits are term deposits repayable along with accrued interest after an agreed period fixed at the time of deposit. Here the depositor makes a lump sum deposit at one time for a fixed term and receives payment thereof on maturity. The interest accrued is ploughed back so that the deposit earns compound interest. DEPOSIT MAY BE OPENED BY: An individual in his/her name More than one individual (but not more than four) in their joint names payable 'to all of them jointly', or 'to any one or more of them or survivor/s' or 'No.1 or survivor/s'. A guardian on behalf of a minor on furnishing a declaration as to the date of birth of the minor. By Minor himself / herself provided he/she is aged 12 years and above and he/she is able to read, write and capable of understanding what he/she does, in the opinion of the Bank. Guidelines for opening of accounts of Trustees/Provident Funds/ Executors and Administrators etc., are detailed in Manual of Instructions on Current and SB accounts. INTRODUCTION OF ACCOUNTS The account should be opened in the name of a person who is properly introduced to the Bank. Introduction by our existing account holder is considered to be the best form of introduction. The person who is introducing a new account, should himself have maintained an account with the branch, at least for the past twelve months prior to the date of introducing the new account. However, where the introducer is well known and the Bank is satisfied, he/she may introduce a new account, though his/her account might not have completed twelve months.

11

If the depositor is well known to the Manager or any other Officer or confirmed employee, such members of the staff may introduce the account. Where it is not possible to obtain introduction from an existing account holder, branches may accept introduction of any respectable person of the locality known to the Bank. Identification by way of passport, postal identity card introductory letter issued by commanding officer of the unit for opening accounts of JCOs / Jawans etc., is considered adequate introduction for opening new accounts.

IDENTITY AND ADDRESS PROOF: Any one of the following documents can be produced as proof of identity of the prospective account holder. Passport Original letter of introduction from existing bank Driving License Voter's identity card Employee Identity card with photograph and address of the employee (subject to satisfaction of the bank) PAN card Photo Credit Card along with the current billing cycle (latest statement) Arms License issued by State / Central Government of India authority with photograph of applicant. Pension book issued by Government of India with photograph of applicant containing name, address and validity period. Freedom fighter's pass, issued by Home Ministry of Government of India authority with photograph of applicant.

12

In case any of the documents listed above does not contain the address of the applicant and in case address is different for genuine reasons other documents may be submitted by the applicant.

OPENING OF AN ACCOUNT Application Form-NF.108 is to be used for opening the accounts. All the application forms should invariably be date stamped and signed by an Officer/Manager in token of having accepted the deposit. NOMINATION FACILITY: Nomination can be made in respect of all types of deposit accounts held jointly or singly including sole proprietorship accounts. However, nomination facility is not available for accounts held In representative capacities, capacity of partners, accounts of Joint stock companies / association / clubs and such other organizations. Nomination can be accepted in favor of an individual only. Passport size / stamp size photographs should be obtained in all cases where maturity value is more than Rs.10000/-. Photograph need not be insisted from depositors already having their SB/Current accounts with photographs. JOINT ACCOUNTS Joint accounts should be opened with a maximum number of 4 persons only. Conversion of existing individual account into a joint account can be permitted with a maximum addition of 3 persons only subject to guidelines. PAN /GIR etc. Quoting of PAN / GIR or obtention of declarations in form 60 / 61 as applicable and reporting of transactions is required only for Term Deposits exceeding Rs.50, 000/13 OBTENTION OF PHOTOGRAPHS:

received in cash. Deposits accepted through account payee cheque, Demand Drafts in favour of a banker, transfer from an account Term deposit opened either by way of crossed draft / crossed cheque / debit to account are not covered irrespective of the amount. ISSUE OF DEPOSIT RECEIPT: NF 108 Application form (duly introduced and filled in) should be obtained along with other applicable enclosures such as Resolution, Constitution letters etc. FD Challan NF.133 should be used for remitting the deposit amount either in cash or by cheque drawn on the account with the Branch. When the challan is received, the concerned clerk and supervisor should verify whether the 'Cash received' or 'Transfer' seal has been affixed thereon under due authentication of the Shroff and the concerned Supervisors. Deposit Receipt is to be properly written, duly incorporating the name and address, rate of interest, due dates etc - The deposit receipt should be delivered to the depositor against his acknowledgement. RATE OF INTEREST Rate of interest is determined with reference to the period /quantum of the deposit, rate of interest is advised by HO from time to time. PAYMENT OF INTEREST: Branches have to refer to the date wise sheet for interest payment of the corresponding date every day (in case there are preceding holidays, those sheets should also be dealt with). Referring to the respective FD ledger folios slips are to be prepared for crediting interest amount to respective operative accounts as per the instructions of the depositors already noted in the respective ledger folios. 14

Where periodical interest is payable to the depositor, eligible TDS shall be deducted before payment of interest.

DEPOSIT DUE NOTICE: NF.140 should be sent 14 days before the due date of deposit by ordinary post. Banks should ensure sending of intimation of impending due date of deposit well in advance to their depositor as a rule in order to extend better customer service. However, there is a provision in the fresh Account opening form NF.108 to seek a mandate from the depositor for sending intimation of impending due date notice or not. Also, the depositor can express their desire not to send due notice in writing. PAYMENT ON DUE DATE: Fixed Deposit Receipts are not transferable or negotiable, no endorsements are permitted. The depositor/s is/are required to give discharge on the reverse of the fixed deposit receipt in the space provided for the purpose. The proceeds of deposit shall be repaid to the depositor by crediting to his operative account or by way of DD / Pay Order. Payment in cash should be restricted to less than Rs.20, 000/-. PAYMENT OF OVERDUE DEPOSITS All debits under overdue deposits head, except renewals, are to be authorized by Manager / Senior Manager of the branch or Manager-in-charge of deposits department. In case of renewals with same terms and conditions prevailing system of authorization to continue.

15

EXTENSION OF THE PERIOD OF DEPOSITS DURING TENURE (PREMATURE EXTENSION) During the tenure of a deposit, the depositor may wish to keep the deposit with the Bank for a period longer than the period originally agreed to. Branches can accede to such requests subject to guidelines detailed in Manual of Instructions. WITHDRAWAL OF DEPOSITS BEFORE MATURITY Managers are authorized to permit such withdrawals of deposits before maturity, without any ceiling on amount and period. The guidelines for payment of interests on such premature closure are as under: RENEWAL OF DEPOSITS: The request for renewal of the deposit could be obtained on the reverse of FDR.In respect of joint accounts; a provision has been made on page 1 of NF.108 for authorizing any one of the depositors or any one or more of the surviving depositor/s to renew the deposits on the same conditions of repayment and interest payment. If this clause is opted for, the branch may act as per the above clause. Where the clauses are not opted, the request for renewal should be obtained signed by all the depositors. Fresh application forms need not be obtained for renewal of fixed deposits, if they are renewed In the same names and in the same order with the same principal amount (or with whole or part of accrued interest), with the same repayment terms In case depositor desires to renew only a part of the overdue deposit from the date of maturity subject to overdue period not exceeding 14 days, such requests can be acceded to, provided interest is paid only on the renewed portion of the overdue deposits after obtaining fresh application form. Two or more overdue deposit accounts may be combined and a consolidated FDR may be issued provided all these overdue deposits have matured on the same day subject to overdue period not exceeding 14 days and also if each of these overdue deposits stand in identical names and repayment conditions. 16

Where deposits are continued, a note of this fact should be made on the renewed DR issued by affixing a rubber stamp. Whenever deposit receipts are issued in respect of renewed fixed deposits, a suitable note of this fact should be made in the deposit receipt as well as in the ledger folio and also in the application form.

Branches are permitted to transfer terms deposits from one branch to another branch outside the city / town / municipal area during the tenure of the deposit up to a maximum of Rs. 5 lacs under domestic / NRO / NRE deposits and the equivalent of US $ 10000 under FCNR deposits.

LOANS / ADVANCES AGAINST TERMS DEPOSITS OF THE BANK Branch-in-charge may sanction loans / advances against term deposits of our bank (prime security) with 10% margin (standing in the name of depositor/s only) in respect of loans upto their delegated powers. In respect of loans / advances in the case of third party deposits 20% margin to be maintained.

3.4 LOANS 3.4.1 HOME LOANS

PURPOSE: For construction, purchase, repairs, additions, renovations of residential house or flat including the purchase of land and construction thereon. For taking over of the Housing Loan liability with other recognized Housing Finance Companies, Housing Boards, Co-operative Banks, Co-operative Societies and Commercial Banks at our prevailing low rate of interest. ELIGIBILITY: 17

Employees of the bank. RATE OF INTERST AND PROCESSING CHARGES

Repayment Period 0 300 months

Upto Rs. 30 lacs ROI EMI PER

Above Rs. 30 lacs upto Rs.1.00 crores ROI 9.00 9.75 BPLR 2.00% subject to minimum of 10.50% EMI PER LAC 840/890/940/-

Processing Charges

LAC First 12 months 8.25 790/Next 48 months 9.25 860/Above 60 months BPLR 2.50% 900/upto 300 months subject to minimum of 10.00% SECURITY: Hypothecation of the asset. REPAYMENT:

NIL (upto 31.12.2009)

Convenient equated monthly installments up to 20 years. PREPAYMENT : At your choice. Bank do not levy prepayment penalties except in case of takeover of the loan by other bank/HF institution. 18

DOCUMENTS / FORMALITIES: Stipulated Loan Application with 2 passport size photos of applicant / guarantor Sale Deed, Agreement for Sale. Copy of the approved plan for the proposed construction / extension / addition. Detailed cost estimate / valuation report from Bank's Panel Chartered Engineer / Architect . Allotment letter of Co-operative Housing Society / Apartment Owners' Association / Housing Board / NOC from the Society / Association / Builders / Housing Board . Salary Certificate and Form No.16 (in case of salaried persons) . IT Returns filed for the past two years (in case of non-salaried persons) . A brief note on the nature of business, year of establishment, type of organization, etc., (in case of self-employed) .Balance Sheet and P&L Account for the past three years (in case of self-employed).

HOME IMPROVEMENT LOANS

PURPOSE: For furnishing house / flat with household furniture items, air conditioners, wardrobes, kitchen cabinets, refrigerator, washing machine, etc.,

Can be availed along with a Housing Loan from Co-operative Bank OR Separately in cases where Housing Loan is obtained from other Banks /

Financial Institutions OR Without any Housing Loans This loan can also be availed where a Housing Loan is already obtained from us and the liability is subsisting.

19

ELIGIBILITY: Employees of the bank. LOAN QUANTUM & MARGIN: When availed along with Housing Loan from Co-operative Bank, amount up to one year's gross salary / income over and above the normal eligible amount for housing finance. In other cases, one year's gross income / salary will be reckoned to determine the loan quantum under this Scheme. Subject to above, normally, the maximum loan quantum shall be Rs.2 lacs. Higher quantum considered selectively. If availed as a part of the housing finance from our Bank, then, the margin stipulated is 15%. In other cases, the margin is 20%. RATE OF INTEREST: 12% if Housing loans are availed from the bank. If not 12.50% of interest is charged. Along with the interest the bank collect processing charge for the loan taken which varies with the loan amount. SECURITY: Hypothecation of assets created out of this loan. Mortgage of house / flat (if housing loan is availed from us) Suitable co-obligation / personal guarantee. Waiver considered selectively.

REPAYMENT: 20

In convenient equated monthly installments up to 60 months. DISBURSEMENTS : Amount will be normally disbursed only after acquiring ready built house / flat or completion of construction of house / flat or completion of repairs / renovations, etc., where the loan is availed along with housing finance. In case this loan is sanctioned independent of a housing loan then, the loan can also be disbursed against proforma invoice, etc. DOCUMENTS / FORMALITIES: Stipulated Loan application with 2 passport size photographs Latest Salary Certificate and Form No.16 ITAO / IT Returns (for professionals and non-salaried persons) Proforma Invoices, cost estimates

3.4.2 GOLD LOANS

INTRODUCTION Lending against the security of gold and gold jewellery is a highly secured way of providing finance. Even though initially the facility was permitted for agricultural purpose, recently the lending has become broad based as schemes are evolved to meet the needs of nonpriority segments. Further even lending against gold bullion is permitted at specific branches. The gold loans are divided into two categories: a) Loans against gold ornaments for agricultural operations and allied activities Loans against gold ornaments are granted to meet the expenses of agricultural operations and allied activities. b) Swarna Gold loans 21

To meet the medical expenses and other unforeseen commitments /

contingencies and investment purposes / domestic purposes. CONDITIONS FOR GRANTING GOLD LOAN Gold loans are to be granted only against gold ornaments and not against gold coins, bullion etc. Gold loan is to be sanctioned only to the true owner of the jewels. A declaration has been incorporated in the pledge letter NF.497 to the effect that the applicant is the true owner of the jeweler offered as security. Gold loans are granted only after getting jewels duly appraised by the jewel appraiser appointed by the Bank. INTEREST 14% rate of interest. With 3% subsidy. The subsidy will be paid back to customer at the end of September and March. REPAYMENT The entire loan should be cleared within 12 months from the date of sanction, to be repaid in monthly / quarterly / half - yearly instalments or by lump sum payments. The repayment schedule so fixed should depend upon type of agricultural / allied activities and cash generation from the enterprises / repayment capacity of the borrower. GUIDELINES FOR ISSUE OF GOLD LOANS JEWEL APPRAISER Selection of Jewel Appraiser is to be made by the concerned Regional Office / Circle Office. APPRAISING OF SECURITY Jewels to be accepted as security for gold loan, will be handed over to the Jewel Appraiser for weighing, appraisal and certification. 22

The appraisal should be done at the branch itself in the presence of the borrower and officer of the Bank. The Jewel Appraiser after appraising the jewels, should record the details in NF.497 under his signature.

Once gold jewellery is appraised, the same should not be parted with. However, for any reason the jewels are handed back to the intending borrower, they should be re-appraised before granting the loan and the reappraisal charges in such cases are also to be borne by the borrower.

PROCEDURE FOR GRANTING Gold loan application in NF.497 should be obtained from the borrower. All the details are to be filled in. Jeweler is to be got appraised by jewel appraiser. The Manager should specify the amount of loan granted against, in consultation with the party and within the rate of advance permitted. The letter of request NF.497 should be handed over for preparing the slips. Necessary slips as per requirement and mode of payments are to be prepared. Two copies of photograph should be obtained from illiterate borrowers and the left thumb impression of the illiterate borrowers should be taken on the reverse of the photographs. One copy has to be kept with loan application and the second one attached to the ledger folio, if not obtained earlier. New series of numbers is to be allotted for gold loans granted every year beginning from 1st followed by the year like 1/06, 2/06, 3/06 etc. Loan account Pass Card - NF.385 is to be prepared. The same should be handed over to the borrower for his reference.

23

Loans granted against gold jeweler for all agricultural purposes are to be classified as direct agricultural finance.

SAFE KEEPING OF SECURITY All particulars of the loan account such as name, number, date of advance, amount etc., are written on the Gold Loan Ticket NF.367 in duplicate. The jewels are to be kept in a cloth bag of adequate size. One Gold Loan Ticket is securely fastened to it and the other ticket is placed inside the bag, so that in case the outside ticket gets detached due to constant handling, the jewels could be identified. The bag should be tied in such a way that the contents do not drop out of the bag. The double lock key holders have to check the jewels with the letter of request for loan NF.497 and place the same in the FBR strong room / FBR safe, after making entries in NB 132 (Loan paper inward register). The securities have to be arranged serially and kept in the double lock.

PROCEDURE FOR CLOSING GOLD LOAN Branches should invariably insist on production of gold loan pass card NF.385 while closing the loan account. In cases where the production of NF.385 is not possible for any genuine reason Branch Manager should take necessary precautions to ensure that the person is genuine. In all cases of redemption of gold jewellery, the borrower should be asked to give the description of jewels pledged. Up to date interest is calculated in the Gold Loan Ledger and debited to the concerned loan account. Total liability is to be recovered. An acknowledgement from the party is to be obtained for having received the jewels in original condition, in the concerned folio in the Gold Loan Ledger.

24

In the case of illiterate persons, while delivering the jewels, utmost care is to be taken. His / her left thumb impression should be got attested by a person known to the Bank.

After satisfying himself about the correctness / genuineness of the signature, the concerned Officer should hand over the securities to the party and affix his signature in the Gold Loan Ledger for having delivered the securities followed by a date seal.

In case of difference in the signature of the pledger as affixed in the Gold Loan Ledger with that on NF.497, attestation of the signature of the pledger by a respectable party known to the Bank should be insisted upon.

The account number should be rounded off in the Gold Loan Ledger and Index Book.

AUCTION If the gold loan / interest is outstanding beyond due date even after sending follow up notices the branch should take steps to auction the securities pledged in consultation with RO/CO within 3 months from the date of becoming overdue.

3.4.3 AGRICULTURE LOANS

Agriculture Loans are classified into three categories. They are: A. B. C. PRIORITY - DIRECT FINANCE TO AGRICULTURE. PRIORITY - AGRICULTURE LOAN TO PACS. NON PRIORITY AGRICULTURE-AIDED LOANS.

A) DIRECT FINANCE TO FARMERS FOR AGRICULTURAL PURPOSES: SHORT TERM LOANS: For rising of crops. This may be in the form of Kisan Credit Card, crop loans, ALOD, FGCS, etc, 25

Produce loans as extension of crop loan up to a maximum limit of Rs.10 lacs to farmers against pledge/hypothecation of agricultural produce [including warehouse receipt for a period not exceeding 12 months ) provided parties should have availed crop loans from our Bank.

To traditional/ nontraditional plantations and horticulture to meet the production expenses. For allied activities such as dairying, fishery, piggery, poultry, beekeeping, etc. to meet their working capital requirements.

Charges for hired water from wells and tube wells, canal water charges, maintenance and upkeep of oil engines and electric motors, payment of labour charges, electricity charges, marketing charges, service charges to custom service units, payment of development, etc.

TYPES OF SHORT TERM LOANS 1) PURCHASE OF AGRICULTURAL IMPLEMENTS AND MACHINERY 2) DEVELOPMENT OF IRRIGATION POTENTIAL THROUGH 3) RECLAMATION AND LAND DEVELOPMENT SCHEMES 4) CONSTRUCTION OF FARM BUILDINGS AND STRUCTURES, ETC. 5) CONSTRUCTION AND RUNNING OF STORAGE FACILITIES 6) PRODUCTION AND PROCESSING OF HYBRID SEEDS OF CROPS 7) PAYMENT OF IRRIGATION CHARGES, ETC 8) OTHER TYPES OF TERM LOANS B) AGRICULTURE LOAN TO PACS: a) Credit for financing the distribution of fertilizers, pesticides, seeds, etc.

b) Credit limits up to Rs.40 Lakhs granted for financing distribution of inputs for the allied activities, such as cattle feed, poultry feed, etc. 26

Loans to electricity boards for reimbursing the expenditure already incurred by them for providing low tension connection from step-down point to individual farmers for energizing their wells. (REC-SPA Scheme, System Improvement Schemes).

Loans to farmers through PACS, FSS & LAMPS. Deposits held by the banks in Rural Infrastructural Development Fund (RIDF) maintained with NABARD. Subscription to bonds issued by Rural Electrification Corporation (REC) exclusively for financing pump set energisation programme in rural and semi urban areas.

However, the investments that may be made by banks on or after April 1, 2005 in the bonds issued by REC shall not be eligible for classification under priority sector lending and such investments which have already been made by banks upto March 31, 2005 would cease to be eligible for classification under priority sector lending from April 1, 2006

Subscription to bonds issued by NABARD with the objective of financing exclusively agriculture/allied activities. However, the investments made by banks in such bonds issued by NABARD, shall not be eligible for classification under priority sector lending with effect from April 1, 2007

Financing farmers for purchase of shares in co-operative sugar mills, sugar mills set up as Joint stock companies and other agro based processing units (upto Rs.6000/).

Other types of indirect finance such as: Finance for hire-purchase scheme for distribution of agricultural machinery and implements. Loans for construction and running of storage facilities (warehouse, market yards, godowns, silos) including cold storages units designed to store agriculture produce / products irrespective of their location.If the cold storage unit is registered as SSI unit, the loans granted to such units may be classified under advances to SSI provided the investment in plant and machinery is within the stipulated ceiling. Advances to custom service units managed by individuals, institutions or organisations who maintain a fleet of tractors, bulldozers, well boring equipment, threshers, combines, etc, and undertake work for farmers on contract basis. 27

Loans to individuals, institutions or organisations who undertake spraying operations/pest control measures. Loans to co-operative marketing societies, co-operative banks for relending to co-operative marketing societies (provided a certificate from the State Co-operative Bank in favour of such loan is produced) for disposing of the produce of members.

Loans to co-operative banks of producers (eg. Aarey Milk Colony Co-operative Bank consisting of licensed cattle owners). Advances to State sponsored corporations for onward lending to weaker sections. Advances to National Co-operative Development Corporation for onward lending to the co-operative sector.

Finance extended to dealers in drip irrigation / sprinkler irrigation systems/agricultural machinery irrespective of the location subject to the following conditions:

C) NON - PRIORITY AGCRICULTURE-AIDED LOANS The Non-priority Agriculture loan includes Loan to purchase motors Loan to purchase cows Loan to purchase tractors

NON REPAYMENT OF LOANS Seizure and enforcement of vehicles are to be resorted to in time and in the initial stages of irregularities. As vehicles are of fast deteriorating nature, if this recourse is adopted with delay, Bank may be put into greater loss owing to poor realisation. If 3 or more monthly installments remain unpaid, if no rephasement is considered branches should initiate steps for seizure of the vehicle. Necessary guidance / help may be sought from the RO / CO in this direction It is made clear that any decision not to enforce the securities in such cases should have the approval of the RO / CO.

28

It is not necessary to transfer the account to LPD / R&L Section before resorting to enforcement of securities. However, once the vehicle is seized, among others, concerned RTO, Insurance and police authorities are to be informed of the matters

Recovery, Follow up, seizure and disposal of vehicle hypothecated to the Bank. Whenever the overdues are observed under LHVs either under principal or interest dues, branches should initiate suitable recovery action including seizure of the vehicle/s.

4. SUBSIDIARY FUNCTIONS 4.1 DEMAND DRAFTS

INTRODUCTION This is one of the subsidiary functions which facilitate remittance of funds. HIGH RISK AND LOW RISK DD FORMS Demand Draft of Rs. 1 lakh and above i.e. TL and OC series are treated as high risk security items. These are to be verified leaf by leaf to ensure that the same has been received as mentioned in the delivery note. Demand Drafts of less than Rs. 1 lakh are treated as low risk security items. In such cases, it should be ensured that packets received are in tact without breaking the sealed packet. ISSUE OF DEMAND DRAFTS: On receipt of the challan, the clerk in DD department should verify the following before writing / printing a DD. Whether the challan bears `CAS RECEIVED'/`TRANSFER' stamp. Whether it bears the signature of the cashier / supervisor. 29

Whether it bears the signature of cash supervisor / supervisor who has passed the contra debit. We have branches at several places which have common or similar names. When DD is sought on such a place, correct geographical location of the centre should be got by getting additional information such as name of the taluk, district, state and PIN code correctly in NF.220 and correct commission is included.

RULES FOR DRAWING A DD: The DDs should be written in English. As per rule 10(4) of OL Rules 1976, Demand Drafts are to be written in Hindi when the applications are filled up in Hindi by the customers. If the application is filled up in English with the approval of the customers DD may be written in Hindi. DDs for Rs.10, 00,000/- and above are to be issued crossed account payee only. Further, where the DD for Rs.10 lakhs and above is issued, the issuing branch should send on the same day an informatory confirmation by way of a telegram/ through a courier to the drawee branch/office. Such confirmation shall cover DD No., date of issue, name of the payee and amount in code words. DDs should be written legibly without any strikings/ alterations. If any strikings occurs, the leaf should be cancelled duly observing the procedure and a fresh one should be used. PAYMENT OF DEMAND DRAFTS: DDs for Rs.1, 000/- and above paid in cash and DDs for Rs.5, 000/ and above received in clearing/collection and for transfer should be screened under ultra violet lamp before payment by the concerned supervisor. Payment of DDs for Rs.50, 000/- and above should be routed through account only In case of DDs for Rs.1.00 lakh and above, before making payment, verification of the DD in all respects, including signatures of the two authorised signatories is done jointly by two 30

Officers. Branches/offices where two officers are not provided / available such scrutiny shall be made by that single Officer only. In case of DDs for Rs.10.00 lakhs and above, verify as to whether related Informatory Confirmation has been received by drawee branch/office. Payment of such DDs shall not be refused for non-receipt of Informatory Confirmation. In such cases, if the DD is otherwise in order, payment is to be made and immediately the matter is to be taken up with the drawee branch/office/ overseeing DO/RO/CO (as the case may be).

4.2PAY ORDERS

INTRODUCTION A Pay Order is an order by a branch of a Bank drawn upon itself to pay a certain sum of money to or to the order of the payee named therein. Pay Orders should be issued for local remittance, excepting for the purpose of payment of fees by the students for college / university or for job applications or towards payment of Common Entrance Cell (CET) or for payment to Government and Semi-Government Department etc. (in which case issue of local DD is permitted) Pay Orders should be issued wherever local DD is sought by customers. However, in respect of remittance between FD and branches and vice versa, existing local DD system will continue. Further, administrative units shall continue to issue local DDs as at present. No local DDs except for above cases are to be issued by branch hereafter. Pay Orders should also be issued to or on behalf of customers when requested for. Pay Orders are to be used for interbank settlements other than clearing like reimbursement of TT, Borrowing, Call money transaction etc. Pay Orders shall also be drawn in favour of Commercial Banks, Financial Institutions, Corporate bodies, Central and State Government departments / undertakings, Public Sector Undertakings, reputed money market players authorised by RBI on behalf of our customers etc.

31

Pay Orders are security forms. Branches should, therefore, devote special attention and keep a close watch over such items particularly at the time of receiving the stocks, taking them out for use, keeping them in the proper custody etc.

ISSUE OF PAY ORDERS There is no upper ceiling limit for issuance of pay order as the payment of pay orders is restricted to the issuing branch On receipt of the challan the clerk writing the Pay Order should verify the following: Whether the challan bears "CASH RECEIVED / TRANSFER" stamp. Whether it bears the signature of the Cashier / supervisor. Whether it bears the signature of cash supervisor / supervisor who has passed the contra debit. PAYMENT OF PAY ORDERS: At branches other than the branch of issue The Pay Order presented at branch other than branch of issue should be treated as an instrument for collection only. Such Pay Orders should be presented to the issuing branch in the immediate next clearing and proceeds are to be credited to payees account only after realisation. At the branch of issue: When a Pay Order is presented for payment either in clearing or across the counter for cash payment or for credit of an account, it should be scrutinised in all respects including the correctness of endorsements, identity of the payee etc., by the concerned clerk and ensure having issued the Pay Order earlier. The earlier entry is to be matched in respect of printed number, beneficiary, amount and date of issue. The Pay Order itself should be treated as the debit slip for debiting "SL Accounts payable Pay Orders issued Account". In case of cash payment, dummy debit slip should be prepared as the pay order is to be retained along with Cash Paid instruments. VALIDITY PERIOD / OVERDUE PAY ORDERS 32

Pay Orders issued are valid for a period of 6 months only from the date of issue. There is no provision for revalidation. Pay Orders presented for payment after six months of issue should be returned with the reason "Stale Pay Orders". When the Pay Order remains unpaid, after completion of 6 months from the date of issue, the branch should transfer all such unpaid Pay Orders to a separate folio "SL Accounts payable - Overdue Pay Orders".

All the overdue pay orders are to be reported in PRR-43. The overdue Pay Orders should be paid to the purchasers themselves duly observing the guidelines detailed under chapter 13, Part I of Manual of Instructions on Transfer of Funds (revised till 31.12.2005) and fresh Pay Orders, if required can be issued to such purchaser.

CANCELLATION OF PAY ORDERS All guidelines applicable for cancellation of DD are also applicable here. Moreover, the fact of cancellation is to be noted against credit entry and on the concerned slip etc.

4.3 COLLECTION OF CHEQUES:

INTRODUCTION Collection of instruments is an important subsidiary function of the Bank. Our customers tender cheques and other instruments i.e., Demand Drafts, Pay Orders, Dividend Warrants, Interest Warrants, Refund Orders etc. drawn on other Banks/ branches of our Bank for collection. BANKERS' CLEARING HOUSE Banks which desire to participate in the clearing house are required to become members of the clearing house as per the rules of the clearing house. The Bank conducting the clearing house business acts as the Banker to the other banks participating in the clearing. Member banks shall have to open an operative account with 33

the Bank conducting the clearing house and shall have to maintain the minimum prescribed balance as required under the clearing house rules, which however shall not be less than Rs.25,000/-. Banks receive instruments tendered by their customers drawn on other local banks. Such instruments are to be properly segregated bankwise and a schedule representing the total number of cheques drawn on each bank - i.e., bankwise and the total amount receivable from the drawee bank, is prepared. Every day at the appointed time (twice a day where members meet twice) all the member banks assemble at the clearing house. Normally, a clerical staff will represent each member bank at the clearing house. Instruments drawn on each other are exchanged by the representatives of the member banks duly recording the inward instruments drawn on them and the total amount. Each member bank has to pay other banks the total amount of the instruments drawn on them which are presented in the clearing. Similarly, for all the instruments presented to other banks, the total amount of the instruments presented has to be received from the drawee banks. However, the banker conducting the clearing house will credit or debit to the accounts of the member banks only the difference between the amounts payable and receivable by them. It may be noted that while exchanging the clearing instruments and settling the accounts at the clearing house, the validity, legality or otherwise of the instruments is of no consequence. Only amount payable / receivable to / from the banks is verified with reference to the number of instruments and total amount mentioned in the schedule / each instrument. When the clearing is adverse i.e., the amount payable by us is more than the amount received on a day, the bank conducting the clearing will debit the difference to our account and when it is favourable, credit the difference to our account. If the balance in our account is not sufficient to meet the clearing deficit, we have to remit cash or discount a TT immediately to meet the obligation. If there is substantial balance in

34

our account due to favorable clearing, the surplus should be transferred to our account of the pooling centre with the RBI by way of a TT. Periodically, the bank conducting the clearing will send statement of accounts to various member banks concerning the transactions in their respective accounts. Statements so received should be scrutinised by the banks concerned and they should satisfy as to the correctness of the particulars mentioned in the statement. Errors, if any, should immediately be brought to the notice of the banker to the clearing house.

PROCEDURE FOR CLEARANCE OF CHEQUES In places where we have more than one branch but where we do not have an Accounts Section or Clearing Section, one of the branches in the place will be designated / identified as main branch for participating in the clearing on behalf of other branches. Where we have Accounts Section or Clearing Section, all our branches in such a place are required to present the instruments to Accounts Section / Clearing Section who in turn would represent our branches at the clearing house. OUTWARD CLEARING It should be noted that instruments for collection are to be accepted only from our customers so as to get the legal protection under Section 131 of the Negotiable Instruments Act. Acceptance of instruments from the customers may be done at the Clearing Department itself by the concerned Supervisor / Officer / Clerk, to speed up the collection work. Instruments for clearing should be tendered along with SB/CA challans duly filled up with all the required particulars and signed. The counterfoil of the same should be returned to the lodger by way of receipt, duly signed by the supervisor, after ensuring that the instruments are in order. Then the Supervisor should affix the special crossing seal on the clearing instruments. 35

On receipt of the instrument, the challan counterfoil should be returned to the customer in token of receipt of the instrument. It should be ensured that the details such as cheque number, DD number, name of the drawee bank and branch and amount of the instrument etc., are noted in detail by the customer on the back of the challan. Where a party tenders two or more instruments under cover of a single challan, branches should ensure that clearing and collection instruments are not pinned together.

Where the instruments are tendered after the time fixed for receiving the clearing instruments, it would be possible to present the instruments in clearing on the same day. The date stamp with the words "Too late for today's clearing" should be affixed on the challan and the counterfoil.

Special clearing challans - Parties tendering large number of instruments for clearing, may be requested to make use of special clearing challans NF.136 - Special Pay-in-slips for Current Account.

The challans with the instruments are then to be sorted out account wise, i.e., CA, SB account, OD/OCC account etc., for posting in the Waste Sheet Subsidiary (Clearing and Collection - NB.67).

All the instruments drawn on clearing members are to be entered in the "Clearing Column". The day's clearing stamp is to be affixed on all the instruments and the challans. Where the clearing house meets twice a day, the clearing stamp should be affixed clearly indicating whether the instruments pertain to first or second clearing.

SERVICE CHARGE Collection charges are not applicable for inward clearing cheques. However, if such cheques are returned unpaid for want of funds, a flat charge of Rs.12/- for SB accounts and

36

Rs.25/- for Current Accounts per cheque should be debited to the drawer's account under advice to him. In case of local inward cheques returned in clearing for want of funds or for any other reason attributable to the drawer of the cheque, interest shall be levied as follows to the drawer: Interest shall be levied only on cheques of Rs.50,000/- and above returned in clearing For want of funds, irrespective of whether it is an SB/ Current/OD cheque. Interest shall be charged from the date of debit of our Bank's account with RBI/SBI till the date of credit of our Bank's account with RBI/SBI. If both the presentment and return of the cheque take place in the same day's clearing and are adjusted with RBI/SBI on the same day, interest need not be levied, as there will be no outlay of funds for the Bank on account of return of the cheque. DEBITING INWARD CLEARING CHEQUES ON NEXT DAY OF PRESENTATION: Inward clearing cheques are to be debited to respective accounts on the date of presentation / receipt of cheques itself. In exceptional circumstances, where the branches are not in a position to debit the inward clearing cheques to the accounts on the date of presentation / receipt of cheques, for reasons such as break down in law and order situation after the receipt of clearing instruments. Branch enjoying weekly off, system failure in computerised branches etc., they can debit them on the next working day as the first entry of the day. However, to adopt this procedure, permission from respective RO/CO as the case may be should be obtained by the branch, explaining the difficulties faced by it. ROs shall report to respective Circle Offices as and when such permission is granted to the branches. LOCAL CLEARING AND CASH REMITTANCE (LCCR) LCCR is a new accounting procedure evolved for local clearing launched in 1995. This system is introduced in some specified Circles at present. It may be noted that for the present, only clearing 37

transactions are to be brought under this head of account. For cash remittances, the existing procedure shall continue. ISSUE / HANDLING OF MICR INSTRUMENTS - TIPS FOR ADHERANCE Where instruments are payable at MICR Centres, they should be drawn in MICR format only. Paper quality / size should be as per specification of MICR Signature of the authorised singnatories and rubber stamp indicating names and signing power number of signatories of the Demand Draft issued by us should not encroach on to the bottom band reserved for code line. Customer should be advised to the effect that their signature on cheques and other instruments should not encroach on to the bottom band reserved for code line. Avoid folding of MICR cheques / instruments on code line. While mailing cheques / drafts, envelopes of adequate size are to be used to avoid folding. Crossing of cheques / drafts should be done only on the top left hand corner thereof. Use of stamping ink with metallic contents should be strictly avoided. Pinning and stapling of instruments should be totally avoided. Encoding is to be done within MICR band and alignment should be proper. Encoding should not be done on perforated portion of instrument. The perforated portion of instrument should be removed before encoding. There should not be overlapping in the encoding process and over writing on MICR band. In case of return, sticker should not be pasted on MICR band (Neither earlier encoding should be cancelled by pen nor fresh encoding should be done on the reverse of the cheque in the same MICR position). Instead, multi-fields encoding should be done on the reverse top portion of the instrument. Poor / defective encoding ribbons should not be used to avoid high reject rate at MICR centres. 38

While encoding for the first time, ensure encoding on MICR band on the face of the cheque and arrange the instruments properly. Where, first encoding is not proper, in such cases, encoding should be done on the reverse top portion of the instrument, but not on reverse of MICR band. After encoding, instruments are to be arranged properly so that encoded portion of all the instruments appear / fall / collate on the same side. Presentation of the same instruments repeatedly should be avoided. Use of wrong transaction codes while encoding to be avoided. In addition to the above, attention of the customers to be drawn on the following DONT's printed on the cover of cheque book and guide them accordingly : Do not write / sign on the code line Do not pin / staple on the code line Do not paste on code line Do not fold the cheque on code line Do not affix Rubber stamp on code line (affix crossing stamp on the top left corner only)

HIGH VALUE CLEARING: Instruments drawn for value above a specified amount as decided by the concerned clearing house are exchanged separately for collection in certain centres. This is named as High Value Clearing. DRAWINGS AGAINST CLEARING CHEQUES Such drawings are permitted only in accordance with the sanctioning powers delegated to the Manager / Senior Managers.

5. CONCLUSION

The bank already has good number of employee on board and is recruiting personal banker heavily to take the headcount to many more.

39

The project opportunities provided was market segmentation and identifying prospective customers in potential geographical location and various loans and institutions helping the needy people. Through this project, it could be concluded that people are not much aware about the various products of the bank and many of them not interested to open an account in cooperative banks. Services was considered as unsought good which require hard core selling ,but in changing trend in income and people becoming financially literate, the demand for banking sector is increasing day by day. Technically some of the district cooperative banks are yet to be developed. Still they are following ledger and book keeping system. And the banks are facing difficulty towards nonperforming assets. The bank has reduced its nonperforming assets to 8% from 13% in three years.

8.BIBLIOGRAPHY

WEBSITES

www.tnsc.gov.in www.google.com www.books.google.co.in

BOOKS

JAIIB, Principles of Banking, Indian Institute of Banking and Finance Shekar, Banking Theory and Practice Mcmillan Publication, 19th Edition, New Delhi

40

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- AutoCAD Dinamicki Blokovi Tutorijal PDFDocument18 pagesAutoCAD Dinamicki Blokovi Tutorijal PDFMilan JovicicNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- (ENG) Visual Logic Robot ProgrammingDocument261 pages(ENG) Visual Logic Robot ProgrammingAbel Chaiña Gonzales100% (1)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- KrauseDocument3 pagesKrauseVasile CuprianNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Belimo Fire & Smoke Damper ActuatorsDocument16 pagesBelimo Fire & Smoke Damper ActuatorsSrikanth TagoreNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Understanding Consumer and Business Buyer BehaviorDocument47 pagesUnderstanding Consumer and Business Buyer BehaviorJia LeNo ratings yet

- Powerpoint Presentation R.A 7877 - Anti Sexual Harassment ActDocument14 pagesPowerpoint Presentation R.A 7877 - Anti Sexual Harassment ActApple100% (1)

- The "Solid Mount": Installation InstructionsDocument1 pageThe "Solid Mount": Installation InstructionsCraig MathenyNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Department of Labor: 2nd Injury FundDocument140 pagesDepartment of Labor: 2nd Injury FundUSA_DepartmentOfLabor100% (1)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Algorithm - WikipediaDocument34 pagesAlgorithm - WikipediaGilbertNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Gmo EssayDocument4 pagesGmo Essayapi-270707439No ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Writing Task The Strategy of Regional Economic DevelopementDocument4 pagesWriting Task The Strategy of Regional Economic DevelopementyosiNo ratings yet

- Tendernotice 1Document42 pagesTendernotice 1Hanu MittalNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Dr. Najeebuddin Ahmed: 969 Canterbury Road, Lakemba, Sydney, NSW, Australia, 2195Document2 pagesDr. Najeebuddin Ahmed: 969 Canterbury Road, Lakemba, Sydney, NSW, Australia, 2195Najeebuddin AhmedNo ratings yet

- Fundamental RightsDocument55 pagesFundamental RightsDivanshuSharmaNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- NIELIT Scientist B' Recruitment 2016 - Computer Science - GeeksforGeeksDocument15 pagesNIELIT Scientist B' Recruitment 2016 - Computer Science - GeeksforGeeksChristopher HerringNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- FBW Manual-Jan 2012-Revised and Corrected CS2Document68 pagesFBW Manual-Jan 2012-Revised and Corrected CS2Dinesh CandassamyNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Legal Ethics HW 5Document7 pagesLegal Ethics HW 5Julius Robert JuicoNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Effects of Organic Manures and Inorganic Fertilizer On Growth and Yield Performance of Radish (Raphanus Sativus L.) C.V. Japanese WhiteDocument5 pagesEffects of Organic Manures and Inorganic Fertilizer On Growth and Yield Performance of Radish (Raphanus Sativus L.) C.V. Japanese Whitepranjals8996No ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Small Signal Analysis Section 5 6Document104 pagesSmall Signal Analysis Section 5 6fayazNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Audit Certificate: (On Chartered Accountant Firm's Letter Head)Document3 pagesAudit Certificate: (On Chartered Accountant Firm's Letter Head)manjeet mishraNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Sciencedirect: Jad Imseitif, He Tang, Mike Smith Jad Imseitif, He Tang, Mike SmithDocument10 pagesSciencedirect: Jad Imseitif, He Tang, Mike Smith Jad Imseitif, He Tang, Mike SmithTushar singhNo ratings yet

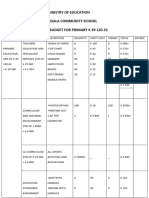

- Ministry of Education Musala SCHDocument5 pagesMinistry of Education Musala SCHlaonimosesNo ratings yet

- VP Construction Real Estate Development in NY NJ Resume Edward CondolonDocument4 pagesVP Construction Real Estate Development in NY NJ Resume Edward CondolonEdwardCondolonNo ratings yet

- Nissan E-NV200 Combi UKDocument31 pagesNissan E-NV200 Combi UKMioMaulenovoNo ratings yet

- Dmta 20043 01en Omniscan SX UserDocument90 pagesDmta 20043 01en Omniscan SX UserwenhuaNo ratings yet

- Kicks: This Brochure Reflects The Product Information For The 2020 Kicks. 2021 Kicks Brochure Coming SoonDocument8 pagesKicks: This Brochure Reflects The Product Information For The 2020 Kicks. 2021 Kicks Brochure Coming SoonYudyChenNo ratings yet

- EASY DMS ConfigurationDocument6 pagesEASY DMS ConfigurationRahul KumarNo ratings yet

- Delta PresentationDocument36 pagesDelta Presentationarch_ianNo ratings yet

- Napoleon RXT425SIBPK Owner's ManualDocument48 pagesNapoleon RXT425SIBPK Owner's ManualFaraaz DamjiNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)