Professional Documents

Culture Documents

Gulf Resorts Inc. v. Philippine Charter Insurance Corp. (2005)

Uploaded by

Mona LizaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Gulf Resorts Inc. v. Philippine Charter Insurance Corp. (2005)

Uploaded by

Mona LizaCopyright:

Available Formats

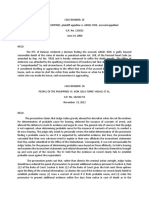

Gulf Resorts Inc. v.

Philippine Charter

Insurance Corp. (2005)

G.R. No. 156167 May 16, 2005

Lessons Applicable: Stipulations Cannot Be Segregated (Insurance)

FACTS:

Gulf Resorts, Inc at Agoo, La Union was insured with American Home

Assurance Company which includes loss or damage to shock to any of

the property insured by this Policy occasioned by or through or in

consequence of earthquake

July 16, 1990: an earthquake struck Central Luzon and Northern Luzon

so the properties and 2 swimming pools in its Agoo Playa Resort were

damaged

August 23, 1990: Gulf's claim was denied on the ground that its

insurance policy only afforded earthquake shock coverage to the two

swimming pools of the resort

o Petitioner contends that pursuant to this rider, no qualifications

were placed on the scope of the earthquake shock

coverage. Thus, the policy extended earthquake shock coverage

to all of the insured properties.

RTC: Favored American Home - endorsement rider means that only

the two swimming pools were insured against earthquake shock

CA: affirmed RTC

ISSUE: W/N Gulf can claim for its properties aside from the 2 swimming

pools

HELD: YES. Affirmed.

It is basic that all the provisions of the insurance policy should be

examined and interpreted in consonance with each other.

o All its parts are reflective of the true intent of the parties.

Insurance Code

Section 2(1)

contract of insurance as an agreement whereby one undertakes for a consideration to

indemnify another against loss, damage or liability arising from an unknown or contingent

event

An insurance premium is the consideration paid an insurer for

undertaking to indemnify the insured against a specified peril.

o In the subject policy, no premium payments were made with

regard to earthquake shock coverage, except on the two

swimming pools.

You might also like

- Bernas PIL ReviewerDocument42 pagesBernas PIL ReviewerDarla Grey100% (11)

- Philippine Bar Questions and Answers On Insurance LawDocument10 pagesPhilippine Bar Questions and Answers On Insurance LawRocky Yap100% (1)

- Third Party Affidavit 1Document1 pageThird Party Affidavit 1Mona Liza100% (1)

- Palaganas V Palaganas Case DigestDocument2 pagesPalaganas V Palaganas Case Digesthistab100% (3)

- Gulf Resorts Inc Vs Philippine Charter Insurance CorporationDocument1 pageGulf Resorts Inc Vs Philippine Charter Insurance CorporationKim Laurente-Alib100% (2)

- Gulf Resorts Inc Vs Philippine Charter Insurance CorpDocument2 pagesGulf Resorts Inc Vs Philippine Charter Insurance CorpJ. LapidNo ratings yet

- Pale Cases EugeneDocument6 pagesPale Cases EugeneMona LizaNo ratings yet

- Gulf Resorts Inc Vs PcicDocument1 pageGulf Resorts Inc Vs PcicGalanza FaiNo ratings yet

- Gulf Resorts Vs Philippine CharterDocument2 pagesGulf Resorts Vs Philippine CharterAnonymous XsaqDYDNo ratings yet

- 1 Gulf Resorts v. Philippine Charter Insurance CorpDocument2 pages1 Gulf Resorts v. Philippine Charter Insurance CorpJake PeraltaNo ratings yet

- Exam Questions From Marine To Life InsuranceDocument3 pagesExam Questions From Marine To Life InsuranceFelix C. JAGOLINO IIINo ratings yet

- Insurance Case Digest Week 2-Week 6Document39 pagesInsurance Case Digest Week 2-Week 6Ryan ChristianNo ratings yet

- Gulf Resorts Inc. v. Philippine Charter Insurance Corporation DigestDocument2 pagesGulf Resorts Inc. v. Philippine Charter Insurance Corporation DigestCaroline A. Legaspino100% (1)

- Rodolfo M. Yumang V. Atty. Edwin M. Alaestante AC. No. 10992, Jun 19, 2018Document3 pagesRodolfo M. Yumang V. Atty. Edwin M. Alaestante AC. No. 10992, Jun 19, 2018Mona LizaNo ratings yet

- Eduardo R. Alicias, Jr. vs. Atty. Myrna v. MacatangayDocument10 pagesEduardo R. Alicias, Jr. vs. Atty. Myrna v. MacatangayMona LizaNo ratings yet

- Gulf Resorts V Phil CharterDocument2 pagesGulf Resorts V Phil Charterdivine ventura100% (1)

- Gulf Resorts vs. Philippine Charter Insurance Corp (GR 156157, 16 May 2005)Document2 pagesGulf Resorts vs. Philippine Charter Insurance Corp (GR 156157, 16 May 2005)Archibald Jose Tiago Manansala100% (2)

- Gulf Resorts v. Pcic DigestDocument1 pageGulf Resorts v. Pcic DigestScarlette Joy CooperaNo ratings yet

- Insurance Digest #47-48Document3 pagesInsurance Digest #47-48May Joy ManagdagNo ratings yet

- Qua Chee Gan VDocument5 pagesQua Chee Gan VMarkonitchee Semper FidelisNo ratings yet

- Gulf Resorts Inc. v. Philippine Charter Insurance Corp. G.R. No. 156167 May 16 2005Document3 pagesGulf Resorts Inc. v. Philippine Charter Insurance Corp. G.R. No. 156167 May 16 2005Abilene Joy Dela Cruz100% (1)

- Lawyer's OathDocument1 pageLawyer's OathKukoy PaktoyNo ratings yet

- Phil Acetylene V CIRDocument1 pagePhil Acetylene V CIRShaneBeriñaImperialNo ratings yet

- Philamlife vs. CIRDocument1 pagePhilamlife vs. CIRMona LizaNo ratings yet

- Philamlife vs. CIRDocument1 pagePhilamlife vs. CIRMona LizaNo ratings yet

- De Borja Vs de BorjaDocument2 pagesDe Borja Vs de BorjaArgel Joseph CosmeNo ratings yet

- Gulf Resorts Inc Vs Philippine Charter Insurance CorporationDocument2 pagesGulf Resorts Inc Vs Philippine Charter Insurance Corporationanon_360675804No ratings yet

- Zuno Vs CabredoDocument2 pagesZuno Vs CabredoMona Liza100% (1)

- COMMREV CASES Insurance CodeDocument74 pagesCOMMREV CASES Insurance Codejamilove20No ratings yet

- Gulf Resorts, Inc. V. Philippine Charter Insurance Corporation GR NO 156167, MAY 16, 2005 FactsDocument9 pagesGulf Resorts, Inc. V. Philippine Charter Insurance Corporation GR NO 156167, MAY 16, 2005 Factsmartina lopezNo ratings yet

- Intestado de Don Valentin Descals - Tax2Document1 pageIntestado de Don Valentin Descals - Tax2Mona LizaNo ratings yet

- REDocument2 pagesREMona LizaNo ratings yet

- 6 Gulf Resorts v. PH Charter Insurance-1Document1 page6 Gulf Resorts v. PH Charter Insurance-1Sopongco ColeenNo ratings yet

- Insurance Case Digest: Gulf Resorts Inc. V. Philippine Charter Insurance Corp. (2005)Document2 pagesInsurance Case Digest: Gulf Resorts Inc. V. Philippine Charter Insurance Corp. (2005)BrenPeñarandaNo ratings yet

- Gulf Resorts Inc. vs. Philippine Charter Insurance Corp.Document2 pagesGulf Resorts Inc. vs. Philippine Charter Insurance Corp.John Mark RevillaNo ratings yet

- Insurance Digests Batch 1Document46 pagesInsurance Digests Batch 1Tinn ApNo ratings yet

- Gulf Resorts, Inc., vs. Philippine Charter Insurance CorporationDocument8 pagesGulf Resorts, Inc., vs. Philippine Charter Insurance CorporationRegina AsejoNo ratings yet

- E. Insurance Code 1. Gulf Resorts V Phil. Charter InsuranceDocument2 pagesE. Insurance Code 1. Gulf Resorts V Phil. Charter InsuranceJazem AnsamaNo ratings yet

- Gulf Resort IncDocument5 pagesGulf Resort IncJohn Warry AlvendiaNo ratings yet

- Gulf Resorts Inc. V Philippine Charter Insurance Gulf Resorts Inc. V Philippine Charter InsuranceDocument2 pagesGulf Resorts Inc. V Philippine Charter Insurance Gulf Resorts Inc. V Philippine Charter InsuranceIsabella RodriguezNo ratings yet

- InsuranceDocument8 pagesInsuranceRegina AsejoNo ratings yet

- 4 Gulf Resorts Vs Philippine CharterDocument2 pages4 Gulf Resorts Vs Philippine CharterRyan AcostaNo ratings yet

- Grts Inc. v. Philippine Charter Insurance Corp.Document3 pagesGrts Inc. v. Philippine Charter Insurance Corp.Mary Rose Aguinaldo HipolitoNo ratings yet

- Assignment No. 8 Insurance To Other Insurance ClauseDocument39 pagesAssignment No. 8 Insurance To Other Insurance ClauseDarlene GanubNo ratings yet

- Case Title: Gulf Resorts vs. Pcic G.R. No. 156167, May 16, 2005Document1 pageCase Title: Gulf Resorts vs. Pcic G.R. No. 156167, May 16, 2005Brey VelascoNo ratings yet

- Case Nos. 7 To 12 (Insurance)Document12 pagesCase Nos. 7 To 12 (Insurance)Gia RemoNo ratings yet

- Gulf Resorts Inc. v. Philippine Charter Insurance CorporationDocument1 pageGulf Resorts Inc. v. Philippine Charter Insurance CorporationAnonymous ZXUO1k3sNo ratings yet

- Gulf Resorts vs. Philippine CharterDocument14 pagesGulf Resorts vs. Philippine CharterRal CaldiNo ratings yet

- InsurancepremiumDocument2 pagesInsurancepremiumnikol crisangNo ratings yet

- Gulf Resorts Inc Vs Phil Charter Insurance CorpDocument1 pageGulf Resorts Inc Vs Phil Charter Insurance CorpAllyna GonzalesNo ratings yet

- Insurance DigestDocument90 pagesInsurance DigestKaisser John Pura AcuñaNo ratings yet

- Cases 1-10 - Insurance - Commercial Law Review IDocument19 pagesCases 1-10 - Insurance - Commercial Law Review Isandovalamber01No ratings yet

- Insurance Law Case Digests Part 2Document3 pagesInsurance Law Case Digests Part 2Darlene GanubNo ratings yet

- Gulf Resorts Inc. V. Philippine Charter Insurance CorpDocument2 pagesGulf Resorts Inc. V. Philippine Charter Insurance CorpEunice KanapiNo ratings yet

- Insurance Cases Part 1Document8 pagesInsurance Cases Part 1moeen basayNo ratings yet

- Contract of InsuranceDocument15 pagesContract of InsuranceSopongco ColeenNo ratings yet

- Insurer's Promise, The Insured Pays A PremiumDocument10 pagesInsurer's Promise, The Insured Pays A PremiumDianne YcoNo ratings yet

- Gulf Resorts, Inc., Petitioner, vs. Philippine Charter INSURANCE CORPORATION, RespondentDocument22 pagesGulf Resorts, Inc., Petitioner, vs. Philippine Charter INSURANCE CORPORATION, RespondentRomel LacidaNo ratings yet

- Insurance Cases MidDocument29 pagesInsurance Cases MidRasmirah BeaumNo ratings yet

- 23-Gulf Resorts, Inc. vs. Phil. Charter Insurance Corporation, G.R. No. 156167, 16 May 2005Document15 pages23-Gulf Resorts, Inc. vs. Phil. Charter Insurance Corporation, G.R. No. 156167, 16 May 2005Jopan SJNo ratings yet

- 3 Insurance Matrix Oct. 15 2018Document4 pages3 Insurance Matrix Oct. 15 2018Ian ButaslacNo ratings yet

- Gulf Resorts V Phil Charter DigestDocument2 pagesGulf Resorts V Phil Charter Digestdivine venturaNo ratings yet

- Finman General Assurance Corporation vs. The Honorable Courtof Appeals 213 SCRA 493 September 2, 1992 FactsDocument4 pagesFinman General Assurance Corporation vs. The Honorable Courtof Appeals 213 SCRA 493 September 2, 1992 FactsSamantha BrownNo ratings yet

- Tax Digest2 CasesDocument24 pagesTax Digest2 CasesAnonymous OAq4DyjkccNo ratings yet

- Gulf Resorts Inc Vs Philippine Charter Insurance Corporation 458 SCRA 550Document14 pagesGulf Resorts Inc Vs Philippine Charter Insurance Corporation 458 SCRA 550emmaniago08No ratings yet

- Week 2 CasesDocument11 pagesWeek 2 CasesRyan Christian LuposNo ratings yet

- First, in The Designation of Location of Risk, Only The Two Swimming PoolsDocument10 pagesFirst, in The Designation of Location of Risk, Only The Two Swimming PoolsPBWGNo ratings yet

- 2D1718 INS Sta. Barbara Borta Notes (Parties)Document13 pages2D1718 INS Sta. Barbara Borta Notes (Parties)LuluNo ratings yet

- Gulf Resorts v. PCICDocument5 pagesGulf Resorts v. PCICKaren Joy MasapolNo ratings yet

- Gulf Resorts Vs Phil CharterDocument21 pagesGulf Resorts Vs Phil CharterYaacov Eitan MeirNo ratings yet

- Digests Batch 4Document7 pagesDigests Batch 4Miguel SorianoNo ratings yet

- Gulf InsuranceDocument16 pagesGulf InsuranceimgrazielNo ratings yet

- United States Court of Appeals, Fifth CircuitDocument11 pagesUnited States Court of Appeals, Fifth CircuitScribd Government DocsNo ratings yet

- X.V. G.r.no. 108524, Nov. 10,1994Document1 pageX.V. G.r.no. 108524, Nov. 10,1994Mona LizaNo ratings yet

- Civil Procedure Up BarsoftDocument12 pagesCivil Procedure Up BarsoftMona LizaNo ratings yet

- Criminal Law Cases2Document2 pagesCriminal Law Cases2Mona LizaNo ratings yet

- VegetablesDocument7 pagesVegetablesMona LizaNo ratings yet

- Criminal Law CASEsDocument2 pagesCriminal Law CASEsMona LizaNo ratings yet

- Tambunting PawnshopDocument1 pageTambunting PawnshopMona LizaNo ratings yet

- X.viii. G.R.No. 168129Document2 pagesX.viii. G.R.No. 168129Mona LizaNo ratings yet

- Trinidad GamboaDocument10 pagesTrinidad GamboaMona LizaNo ratings yet

- Cir Vs BF GoodrichDocument1 pageCir Vs BF GoodrichMona LizaNo ratings yet

- Palaganas V Palaganas Case DigestDocument1 pagePalaganas V Palaganas Case DigestMona LizaNo ratings yet

- Eduardo R. Alicias, Jr. vs. Atty. Myrna v. Macatangay, Et. Al.Document1 pageEduardo R. Alicias, Jr. vs. Atty. Myrna v. Macatangay, Et. Al.Mona LizaNo ratings yet

- Eduardo R. Alicias, Jr. vs. Atty. Myrna v. MacatangayDocument2 pagesEduardo R. Alicias, Jr. vs. Atty. Myrna v. MacatangayMona LizaNo ratings yet

- Eduardo R. Alicias, Jr. vs. Atty. Myrna v. Macatangay, Et. Al.Document1 pageEduardo R. Alicias, Jr. vs. Atty. Myrna v. Macatangay, Et. Al.Mona LizaNo ratings yet

- Mary Grace Natividad S PoeDocument4 pagesMary Grace Natividad S PoeMona LizaNo ratings yet

- Reaction Paper On The Principle of Jus Cogens by Mona LizaDocument3 pagesReaction Paper On The Principle of Jus Cogens by Mona LizaMona LizaNo ratings yet

- 4Document5 pages4Mona LizaNo ratings yet