Professional Documents

Culture Documents

Chapter 2

Uploaded by

Manjunathreddy Seshadri0 ratings0% found this document useful (0 votes)

17 views26 pagesaccounts

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentaccounts

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

17 views26 pagesChapter 2

Uploaded by

Manjunathreddy Seshadriaccounts

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 26

Accounting for Materials

LO1 Recognize the two basic aspects of

material control.

LO2 Specify internal control procedures for

materials.

LO3 Account for materials and relate

materials accounting to the general

ledger.

LO4 Account for inventories in a just-in-

time system.

LO5 Account for scrap materials, spoiled

goods, and defective work.

1. A specific assignment of duties and responsibilities.

2. A list of individuals who are authorized to approve

expenditures.

3. An established plan of objectives and goals.

4. Regular reports showing the differences between

goals and actual performance.

5. A plan or corrective action designed to prevent

unfavorable differences from recurring.

6. Follow-up procedures for corrective measures.

Limited access to materials storage

areas.

Segregation of duties.

Accuracy in recording.

Maintaining the appropriate level of raw

materials is one of the most important

objectives of materials control.

Inventory of sufficient size and diversity must

be maintained.

Management must determine other working

capital needs in determining inventory levels.

Adequate planning and control is required.

A minimum level of inventory should be

determined for each type of raw material,

and inventory records should indicate the

cost and quantity of items on hand.

Order point is the point at which an item

should be ordered.

The following items need to be taken

into consideration when ordering:

1. Usage anticipated rate at which the material will be used.

2. Lead time estimated time interval between the placement

of an order and the receipt of the material ordered.

3. Safety stock estimated minimum level of inventory needed

to protect against stockouts.

(Daily usage X Lead time) + Safety stock = Order point

The optimal quantity to order at one time.

Minimizes the total order and carrying costs over a

period of time.

Ordering costs may include the salaries and wages of

purchasing personnel, communication costs, and materials

accounting and record keeping.

Carrying costs are the costs that a company may incur in

storing materials. These costs may include materials storage

and handling costs, interest, insurance, and property taxes,

loss due to theft, deterioration, or obsolescence, and records

and supplies associated with carrying inventory.

EOQ = Economic

Order Quantity

C = Cost of placing

an order

N = Number of units

required annually

K = Annual carrying

cost per unit of

inventory

EOQ =

2CN

K

Materials Control Personnel

Purchasing Agent employee who does the buying

of raw materials.

Receiving Clerk employee who is responsible for

the receipt of incoming shipments.

Storeroom Keeper employee who has charge of

the materials after they have been received.

Production Department Supervisor employee who

is responsible for the operational functions within

the department.

When the order point is reached the

procurement process begins.

Supporting documents are essential to

maintain control during the procurement

process.

Purchase Requisition the form used to notify the

purchasing agent that materials are needed.

Purchase Order the purchase requisition that gives

the purchasing agent authority to order the materials.

Vendors Invoice the invoice from the vendor that

should be compared to the purchase order.

Receiving Report the form that the receiving clerk

uses to count and identify the materials received.

Debit-Credit Memorandum the document that is

used when the shipment of materials does not match

the order and/or the invoice.

Materials Requisition

Prepared by the authorized factory

personnel to withdraw materials from the

storeroom.

Returned Materials Report

Describes the materials being returned to

the storeroom and the reason for the return.

The materials accounting system must

be integrated with the general ledger.

Purchases are recorded as debits to

materials in the general ledger.

Materials account is supported by a

subsidiary stores or materials ledger in

which there is an individual account for

each item.

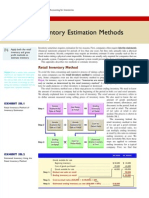

In selecting the method to be used, the

company should review their accounting

policies and the federal and state tax

regulations.

The flow of materials does not dictate the

flow of costs.

Flow of materials the order that materials are

issued for use in the factory.

Flow of costs the order in which unit costs are

assigned to materials.

First In, First Out Method (FIFO)

Assumes that materials used in production are

costed at the prices paid for the oldest materials and

the ending inventory is costed at the prices paid for

the most recent purchases.

Last In, Last Out Method (LIFO)

Assumes that materials used in production are

costed at the prices paid for the most recently

purchased prices, and the ending inventory is

costed at prices paid for the earliest purchases.

Moving Average Method

Material issued and the ending inventory are

costed at the average price. This average

unit price is computed every time a new lot

of materials is received and it continues to

be used until another lot is purchased.

The purpose of materials accounting is to

provide a summary from the general

ledger of the total cost of materials

purchased and used in manufacturing.

All materials issued during the month and

materials returned to stock are recorded

on a summary of materials issued and

returned form.

Materials purchased from vendor.

Materials XX

Accounts Payable XX

Materials issued to production.

Work in Process XX

Materials XX

Payment to vendor for invoice.

Accounts Payable XX

Cash XX

Transfer finished work to finished goods.

Finished Goods XX

Work in Process XX

Sale of finished goods on account.

Accounts Receivable XX

Sales XX

Cost of Goods Sold XX

Finished Goods Inventory XX

Collection of cash from customer.

Cash XX

Accounts Receivable XX

Materials are delivered to a factory

immediately prior to their use in

production.

Reduces inventory carrying costs.

Reducing inventory levels through JIT

may increase processing speed.

Backflush costing is the accounting

system used by JIT systems.

Traditional System

Materials xx

Accounts Payable xx

Work in Process xx

Materials xx

Work in Process xx

Payroll xx

Factory Overhead xx

Various Credits xx

Work in Process xx

Factory Overhead xx

Finished Goods xx

Work in Process xx

Cost of Goods Sold xx

Finished Goods xx

Backflush System

Raw and In-Process xx

Accounts Payable xx

No entry

Conversion Costs xx

Payroll xx

Conversion Costs xx

Various Credits xx

No entry

Finished Goods xx

Conversion Costs xx

Raw and In-Process xx

Cost of Goods Sold xx

Finished Goods xx

Scrap may be

considered waste

materials from the

production process.

These are materials

that can not be used

in the production

process.

Journal entry if the value of

scrap is relatively high

Scrap Materials XX

Scrap Revenue XX

Cash XX

Scrap Materials XX

Journal entry if the value of

scrap is unknown.

Cash XX

Scrap Revenue XX

Spoiled work has imperfections that

cannot be economically corrected. The

loss can be treated as part of the cost of

the job or charge to Factory Overhead.

Defective work has imperfections that

are correctable. The extra costs are

either charged to the job or Factory

Overhead.

You might also like

- SAP CustomizingDocument341 pagesSAP Customizingapi-27246999100% (15)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsFrom EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsRating: 5 out of 5 stars5/5 (1)

- Controlling and Costing MaterialsDocument70 pagesControlling and Costing Materialstotongop100% (1)

- Mock Exam 2023 #1 Second Session Corporate Finance, Equity, FixedDocument88 pagesMock Exam 2023 #1 Second Session Corporate Finance, Equity, Fixedvedant.diwan26100% (1)

- Arens - Aas17 - PPT - 24 (03 Edited)Document56 pagesArens - Aas17 - PPT - 24 (03 Edited)tiaraNo ratings yet

- Chapter Four: 2. Audit of Inventory, Cost of Sales and Related AccountsDocument8 pagesChapter Four: 2. Audit of Inventory, Cost of Sales and Related AccountsZelalem HassenNo ratings yet

- Since All The Data Needed To Construct An Income Statement Are AvailableDocument3 pagesSince All The Data Needed To Construct An Income Statement Are AvailableShay MortonNo ratings yet

- 02 - Marketing Creating and Capturing Customer ValueDocument70 pages02 - Marketing Creating and Capturing Customer ValuejohnNo ratings yet

- Material ManagementDocument0 pagesMaterial ManagementdeepakjothivelNo ratings yet

- Accounting For MaterialsDocument40 pagesAccounting For MaterialsAngel Alejo Acoba100% (1)

- Final Inventory ManagementDocument42 pagesFinal Inventory Managementabhinav8803No ratings yet

- Fi - KDSDocument31 pagesFi - KDSManjunathreddy Seshadri100% (1)

- SAP ERP Financials Configure and Design PDFDocument35 pagesSAP ERP Financials Configure and Design PDFAbdur RahmanNo ratings yet

- Store Keeping and Clearing and ForwardingDocument10 pagesStore Keeping and Clearing and ForwardingSooraj PurushothamanNo ratings yet

- Sap Fico TutorialDocument191 pagesSap Fico TutorialVicky Memon100% (1)

- Inventory Management: K, J, Karthika, Final Year P.G Scholar Departmnet of R&B, GAVC, TripunithuraDocument70 pagesInventory Management: K, J, Karthika, Final Year P.G Scholar Departmnet of R&B, GAVC, TripunithuraKarthika Jayan100% (1)

- AdxDocument3 pagesAdxSameer ShindeNo ratings yet

- Accounting for Materials ChapterDocument26 pagesAccounting for Materials ChapterKristine AlonzoNo ratings yet

- Lesson 4 Material Costing and ControlDocument5 pagesLesson 4 Material Costing and ControlJohn Paul BiraquitNo ratings yet

- Accounting For Materials Accounting For MaterialsDocument25 pagesAccounting For Materials Accounting For Materialsshrutisondhi81No ratings yet

- Module 2 Accounting For MaterialsDocument32 pagesModule 2 Accounting For MaterialsGhillian Mae GuiangNo ratings yet

- Chapter 7 - Accounting For MaterialsDocument24 pagesChapter 7 - Accounting For MaterialsTim ParasNo ratings yet

- Managing MaterialsDocument15 pagesManaging MaterialsDavid DavidNo ratings yet

- University of Luzon materials control guideDocument6 pagesUniversity of Luzon materials control guideLACONSAY, Nathalie B.No ratings yet

- Cost Acctg Chapter-1Document38 pagesCost Acctg Chapter-1Zarah H. LeongNo ratings yet

- CHAPTER TWO FinalDocument89 pagesCHAPTER TWO Finalyiberta69No ratings yet

- Chapter 2 Accounting For Materials: Review SummaryDocument15 pagesChapter 2 Accounting For Materials: Review SummaryGileah ZuasolaNo ratings yet

- MaterialDocument12 pagesMaterialRajat Gupta100% (1)

- Material ManagementDocument12 pagesMaterial ManagementRACHITA BASUNo ratings yet

- Direct Materials NotesDocument6 pagesDirect Materials NotesAizat HakimiNo ratings yet

- Chapter 4Document57 pagesChapter 4mNo ratings yet

- Control and Accounting For MaterialsDocument28 pagesControl and Accounting For MaterialsElla Mae SaludoNo ratings yet

- Accounting For MaterialsDocument57 pagesAccounting For MaterialsAhmed hassanNo ratings yet

- Working Capital Management 3Document4 pagesWorking Capital Management 3Roshankumar S PimpalkarNo ratings yet

- Module 3 PDFDocument6 pagesModule 3 PDFHeart Erica AbagNo ratings yet

- Costs Involved in InventoryDocument41 pagesCosts Involved in InventoryTeena ChawlaNo ratings yet

- Accounting For Materials: Lecture # 6Document17 pagesAccounting For Materials: Lecture # 6Aima AmirNo ratings yet

- School of Commerce Cost Accounting: Material and Cost Control TechniquesDocument10 pagesSchool of Commerce Cost Accounting: Material and Cost Control TechniquesHarish gowdaNo ratings yet

- Accounting For Materials: Lecture # 5Document15 pagesAccounting For Materials: Lecture # 5Aima AmirNo ratings yet

- Module 3Document25 pagesModule 3UFO CatcherNo ratings yet

- Unit-2 Material CostDocument12 pagesUnit-2 Material CostAishwarya NagrajNo ratings yet

- Supply Chain Management Mba (MM) Iii SemDocument75 pagesSupply Chain Management Mba (MM) Iii SemAbhijeet SinghNo ratings yet

- Accounting for Materials in BusinessDocument43 pagesAccounting for Materials in BusinessSophiaEllaineYanggatLopezNo ratings yet

- Chapter 2 Material CostDocument13 pagesChapter 2 Material CostRaja NarayananNo ratings yet

- Material Cost Cost Accounting T. Y. B. Com. Sem V 1644476345Document37 pagesMaterial Cost Cost Accounting T. Y. B. Com. Sem V 1644476345विद्यार्थी मित्र uvjadhaoNo ratings yet

- CAC C3M1 Accounting For Raw MaterialsDocument9 pagesCAC C3M1 Accounting For Raw MaterialsKyla Mae AllamNo ratings yet

- Direct and Indirect MaterialsDocument19 pagesDirect and Indirect MaterialsKraziegyrl LovesUtoomuch0% (1)

- 3.0 Accounting For Materials, Labor, and OH 2023Document10 pages3.0 Accounting For Materials, Labor, and OH 2023Cristina NiebresNo ratings yet

- Job Order CostingDocument7 pagesJob Order CostingElla Mae VergaraNo ratings yet

- Inventory Management: A Project Report ONDocument14 pagesInventory Management: A Project Report ONAshish GaurNo ratings yet

- Materials Management Functions and Inventory Control TechniquesDocument19 pagesMaterials Management Functions and Inventory Control Techniquessanjay975No ratings yet

- Material Cost & ValuationDocument71 pagesMaterial Cost & ValuationRiya KesarwaniNo ratings yet

- Chapter 2 Material PDFDocument73 pagesChapter 2 Material PDFShwetaJainNo ratings yet

- Module 2 Materia Costing, Planning and ControlDocument18 pagesModule 2 Materia Costing, Planning and Controlazra khanNo ratings yet

- Job Order Costing ProcessesDocument5 pagesJob Order Costing ProcessesLIGAWAD, MELODY P.No ratings yet

- Material and Labour Cost PPT - Dr.J.MexonDocument50 pagesMaterial and Labour Cost PPT - Dr.J.MexonDr.J. MexonNo ratings yet

- Chapter 21Document6 pagesChapter 21Meii ZhangNo ratings yet

- Chapter 5Document24 pagesChapter 5Genanew AbebeNo ratings yet

- Lecture+#3 Ordering+and+accounting+for+inventory - 03.02.2019Document56 pagesLecture+#3 Ordering+and+accounting+for+inventory - 03.02.2019Mokhinur TalibzhanovaNo ratings yet

- Manufacturing ReviewerDocument14 pagesManufacturing ReviewerJenifer D. CariagaNo ratings yet

- Chapter Four Accounting For MFG-1Document9 pagesChapter Four Accounting For MFG-1History and EventNo ratings yet

- Module 3 Job Order Costing Lecture Notes11Document20 pagesModule 3 Job Order Costing Lecture Notes11chorie navarreteNo ratings yet

- Finished Goods, Are An Essential Part of Virtually All Business Operations. Optimal Inventory LevelsDocument4 pagesFinished Goods, Are An Essential Part of Virtually All Business Operations. Optimal Inventory LevelsNiña Rhocel YangcoNo ratings yet

- Write Up On Cost AccountDocument16 pagesWrite Up On Cost AccountPriyanshu JhaNo ratings yet

- Materials and Inventory Cost Control AlieDocument67 pagesMaterials and Inventory Cost Control Aliealiekargbo20087473No ratings yet

- (B1) Accounting For MaterialsDocument9 pages(B1) Accounting For MaterialsGodsonNo ratings yet

- Material Cost and Its AccountingDocument83 pagesMaterial Cost and Its Accountingramadhanamos620No ratings yet

- Man L6Document34 pagesMan L6Vaibhav GoleNo ratings yet

- SAP Fico QuestionnaireDocument27 pagesSAP Fico QuestionnaireManjunathreddy SeshadriNo ratings yet

- CTDocument2 pagesCTManjunathreddy Seshadri100% (1)

- FI Basic settings configurationDocument40 pagesFI Basic settings configurationManjunathreddy SeshadriNo ratings yet

- Practic SDocument625 pagesPractic SManjunathreddy SeshadriNo ratings yet

- Actual Value Flow in Co PaDocument56 pagesActual Value Flow in Co PaManjunathreddy SeshadriNo ratings yet

- Sap NotesDocument13 pagesSap NotesManjunathreddy Seshadri100% (1)

- SAP FICO Video Course Content & Materials Detials PDFDocument3 pagesSAP FICO Video Course Content & Materials Detials PDFManjunathreddy SeshadriNo ratings yet

- Sales & DistributionDocument5 pagesSales & DistributionManjunathreddy SeshadriNo ratings yet

- Vendor Ls MWDocument2 pagesVendor Ls MWManjunathreddy SeshadriNo ratings yet

- GST Act - Clarification On Inter State Movement of Various Modes of Conveyance Carying Goods or Pessengers or For Repairs and Maintenance Regarding PDFDocument1 pageGST Act - Clarification On Inter State Movement of Various Modes of Conveyance Carying Goods or Pessengers or For Repairs and Maintenance Regarding PDFManjunathreddy SeshadriNo ratings yet

- ConsentDocument33 pagesConsentHazellyn EscritorNo ratings yet

- Actual Value Flow in Co Pa PDFDocument25 pagesActual Value Flow in Co Pa PDFSmith KumarNo ratings yet

- Sify Whitepaper Gearing Up For GSTDocument6 pagesSify Whitepaper Gearing Up For GSTManjunathreddy SeshadriNo ratings yet

- English With ImagesDocument518 pagesEnglish With ImagesJesús Pérez EsquivelNo ratings yet

- Standardised PPT On GST: Indirect Taxes Committee The Institute of Chartered Accountants of IndiaDocument29 pagesStandardised PPT On GST: Indirect Taxes Committee The Institute of Chartered Accountants of IndiaManjunathreddy SeshadriNo ratings yet

- GST Act - Clarification On Inter State Movement of Various Modes of Conveyance Carying Goods or Pessengers or For Repairs and Maintenance Regarding PDFDocument1 pageGST Act - Clarification On Inter State Movement of Various Modes of Conveyance Carying Goods or Pessengers or For Repairs and Maintenance Regarding PDFManjunathreddy SeshadriNo ratings yet

- Sappress Sap Financials Configuration and Design 2381991370858Document1 pageSappress Sap Financials Configuration and Design 2381991370858Manjunathreddy SeshadriNo ratings yet

- GST Act - Clarification On Inter State Movement of Various Modes of Conveyance Carying Goods or Pessengers or For Repairs and Maintenance RegardingDocument1 pageGST Act - Clarification On Inter State Movement of Various Modes of Conveyance Carying Goods or Pessengers or For Repairs and Maintenance RegardingManjunathreddy SeshadriNo ratings yet

- Standardised PPT On GST: Indirect Taxes Committee The Institute of Chartered Accountants of IndiaDocument29 pagesStandardised PPT On GST: Indirect Taxes Committee The Institute of Chartered Accountants of IndiaManjunathreddy SeshadriNo ratings yet

- GST Act - Meaning of Registered Brand Name in Context of GST RatesDocument1 pageGST Act - Meaning of Registered Brand Name in Context of GST RatesManjunathreddy SeshadriNo ratings yet

- GST Act - Guidance Note For Importers and Exporters Under GST With Reference To Customs OnlyDocument10 pagesGST Act - Guidance Note For Importers and Exporters Under GST With Reference To Customs OnlyManjunathreddy SeshadriNo ratings yet

- Standardised PPT On GST: Indirect Taxes Committee The Institute of Chartered Accountants of IndiaDocument42 pagesStandardised PPT On GST: Indirect Taxes Committee The Institute of Chartered Accountants of IndiaManjunathreddy SeshadriNo ratings yet

- GST Act - Number of HSN Digits Required On Tax InvoiceDocument1 pageGST Act - Number of HSN Digits Required On Tax InvoiceManjunathreddy SeshadriNo ratings yet

- SAP Document Types Inventory GuideDocument9 pagesSAP Document Types Inventory Guidegenfin100% (1)

- Standardised PPT On GST: Indirect Taxes Committee The Institute of Chartered Accountants of IndiaDocument29 pagesStandardised PPT On GST: Indirect Taxes Committee The Institute of Chartered Accountants of IndiaManjunathreddy SeshadriNo ratings yet

- Role N Functions of IntermediariesDocument3 pagesRole N Functions of IntermediariesPrasanthi DornadulaNo ratings yet

- 2021 22CarolinaVillarreal EconomicsAssignment 1.02 ADocument6 pages2021 22CarolinaVillarreal EconomicsAssignment 1.02 ACirolNo ratings yet

- T03 - Home Office & BranchDocument3 pagesT03 - Home Office & BranchChristian YuNo ratings yet

- Industry Attractiveness AnalysisDocument8 pagesIndustry Attractiveness AnalysisLoredana IrinaNo ratings yet

- EEB AssignmentDocument5 pagesEEB Assignmentrishit0504No ratings yet

- MGW3122 Week 4 Lecture NotesDocument25 pagesMGW3122 Week 4 Lecture NotesTurkish AirlinesNo ratings yet

- Inventory EstimationDocument4 pagesInventory EstimationShy Ng0% (1)

- Group 8 Restaurateur (SCM)Document22 pagesGroup 8 Restaurateur (SCM)Bea RamosNo ratings yet

- Market Structure in BangladeshDocument6 pagesMarket Structure in BangladeshIstiaque SirajeeNo ratings yet

- BMC Sweet & Sip ChocojarDocument12 pagesBMC Sweet & Sip ChocojarNur FarhannaNo ratings yet

- XYZ SHRIMP FARM Business PlanDocument24 pagesXYZ SHRIMP FARM Business PlanManny Lennox De LeonNo ratings yet

- FAR2 Chapter 6Document92 pagesFAR2 Chapter 6EmestaNo ratings yet

- Ae Week 5 6 PDFDocument26 pagesAe Week 5 6 PDFmary jane garcinesNo ratings yet

- Volume Variety Mix ProjectDocument12 pagesVolume Variety Mix ProjectAbdullah rehmanNo ratings yet

- Sigachi Quaterly and Annual ResultsDocument18 pagesSigachi Quaterly and Annual Resultsknowme73No ratings yet

- Commerce XII ISC Sample PaperDocument3 pagesCommerce XII ISC Sample PaperAkshay PandeyNo ratings yet

- Toaz - Info Toa PRDocument80 pagesToaz - Info Toa PRasffghjkNo ratings yet

- 2012 LI ss04 2 PDFDocument3 pages2012 LI ss04 2 PDFNguyenNo ratings yet

- Sanitary Protection in IndiaDocument8 pagesSanitary Protection in IndiaSourav DasNo ratings yet

- Session 12Document28 pagesSession 12Hamza BennisNo ratings yet

- Financial Management: Mba Syllabus Third SemesterDocument8 pagesFinancial Management: Mba Syllabus Third SemesterVinoos JosephNo ratings yet

- 105 Microeconomics Research TopicsDocument14 pages105 Microeconomics Research TopicsTrishauna WNo ratings yet

- EX9Document8 pagesEX9dumpanonymouslyNo ratings yet

- BBA Logistics Supply Chain Managemnet Program Structure 2018 21Document6 pagesBBA Logistics Supply Chain Managemnet Program Structure 2018 21Prince DengendeNo ratings yet

- 002 Ali Akbar KhanDocument6 pages002 Ali Akbar KhanAli Bin AnwarNo ratings yet