Professional Documents

Culture Documents

Profit Concept

Uploaded by

roseebagadiong0 ratings0% found this document useful (0 votes)

27 views15 pagesAlecsi's report

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAlecsi's report

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

27 views15 pagesProfit Concept

Uploaded by

roseebagadiongAlecsi's report

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 15

A product will be produced only if the total revenue is large

enough to pay wages , interest,rent and a normal profit to the

entrepreneur .

If the total revenue exceeds all these economic costs, the rest

goes to the entrepreneur as an added reward. This return is

called economic profit or pure profit

Economic profit is above the normal profit

Economic profit is what attracts other producers to a

particular industry.

Profits are the difference between revenues

and costs. In a trade transaction, profit is the

difference between the price at which you

sell a good and the price at which you bought

it. Running a business, net profit is what is

left out of turn-over after paying suppliers,

workers, financing institution, and the state.

Consider the case of a competitive market where

many firms sell basically the same product at the

same price. If they had the same technology and

faced the same input prices (e.g. wages), they

would enjoy similar profit levels. Let's assume

that one specialized supplier introduce a new

machine that is better than the state-of-art, say

a faster machine. The suppler sells it to one of

the firms on the market. This will result in lower

costs per unit of output, thus higher profits.

These profits are used, retrospectively, to pay

for the investment in the new machine but after

the pay-back period they can be distributed to

firm's owners.

Consider a market with product differentiation, as this. An R&D

investment over the years leads to an improvement of one product

features and the management decides to substitute this new model to

the existing one. Let's imagine for simplicity's sake that costs of product

are the same as the previous version.

Three main effects will increase sales:

1. CONSUMERS who did not buy the good because it did not satisfied

their minimum requirements on this feature can now buy, to the extend

the improvement is sufficient at their eyes;

2. consumers who decides by a "top-quality" rule and

positively value the feature could switch from their current provider, to

the extend the overall quality of the new good becomes superior;

3. consumers who decides by a "value-for-money"

rule could switch from their current provider, to the extend the price /

quality relationships of the new good becomes more convenient.

At the same time, the price of this new version could be set higher than

before, so that sales would be braken, unit profits boosted. Overall

profits would soar.

Maximising profits is said to be the objective of all firms. Indeed, it's not

always easy for the management to find out which are the right decisions

that would maximise them. For instance, short-run profits can be easily

pumped up by avoiding maintenance, discretionary costs, investments,

that however are necessary of on-going competitiveness, as you can

experiment with this free business game.

Moreover, what maximises the "overall profits" is not necessary what

allows to attain the maximum of "profitability", i.e. the percentage of

profits to turn-over, as you can better understand by using this model of

monopoly and comparing two policies: (i) extremely high prices (= high

profitability), (ii) a price set from a mark-up of 15% on costs.

In reality, firms do have profits targets, and sometimes they pay

managers for reaching them, but the goals of firms are broader than

profits alone.

Proceeding with other determinants of profits, rising prices of

competitors, better sales conditions and skills, a higher overallprice

level allow for higher prices of the considered firm's products, thus

increase nominal profits to the extent that costs are inelastic, i.e. they

rise less than proportionally to revenues.

Is a component of (implicit) costs and not a

component of business profit at all. It

represents the opportunity cost , as the time

that the owner spends running the firm could

be spent on running another firm . The

enterprise component of normal profit is

thus the profit that a business owner

considers necessary to make running the

business worth his while it is comparable to

the next best amount the entrepreneur could

earn doing another job.

Economic profit does not occur in perfect

competition in long run equilibrium; if it did, there would

be an incentive for new firms to enter the industry, aided

by a lack of barriers to entry until there was no longer any

economic profit.

As new firms enter the industry, they increase the supply

of the product available in the market, and these new

firms are forced to charge a lower price to entice

consumers to buy the additional supply these new firms

are supplying as the firms all compete for

customers Incumbent firms within the industry face losing

their existing customers to the new firms entering the

industry, and are therefore forced to lower their prices to

match the lower prices set by the new firms.

Only in the short

run can a firm in a

perfectly

competitive

market make an

economic profit.

Economic profit is, however, much more

prevalent in uncompetitive markets such as in a

perfect monopoly or oligopoly situation. In these

scenarios, individual firms have some element of

market power: Though monopolists are

constrained by consumer demand, they are not

price takers, but instead either price-setters or

quantity setters. This allows the firm to set a

price which is higher than that which would be

found in a similar but more competitive industry,

allowing them economic profit in both the long

and short run.

A monopolist can set a

price in excess of costs,

making an economic profit

(shaded). The above

Picture shows a Monopolist

(only 1 Firm in the

Industry/Market) that

obtains a(Monopoly)

Economic Profit. An

Oligopoly usually has

"Economic Profit" also, but

usually faces an

Industry/Market with

more than just 1 Firm

(they must share available

Demand at the Market

Price).

Often, governments will try to intervene in uncompetitive

markets to make them more competitive. Antitrust(US) or

competition (elsewhere) laws were created to prevent

powerful firms from using their economic power to

artificially create the barriers to entry they need to

protect their economic profits. This includes the use of

predatory pricing toward smaller competitors

].

For

example, in the United States, Microsoft Corporation was

initially convicted of breaking Anti-Trust Law and engaging

in anti-competitive behavior in order to form one such

barrier in United States v. Microsoft; after a successful

appeal on technical grounds, Microsoft agreed to a

settlement with the Department of Justice in which they

were faced with stringent oversight procedures and

explicit requirements designed to prevent this predatory

behavior. With lower barriers, new firms can enter the

market again, making the long run equilibrium much more

like that of a competitive industry, with no economic profit

for firms.

In a regulated

industry, the

government examines

firms' marginal cost

structure and allows

them to charge a

price that is no

greater than this

marginal cost. This

does not necessarily

ensure zero Economic

profit for the firm,

but eliminates a "Pure

Monopoly" Profit.

Gross profit equals sales revenue minus cost of goods sold(COGS), thus removing

only the part of expenses that can be traced directly to the production or purchase

of the goods. Gross profit still includes general (overhead) expenses like R&D, S&M,

G&A, also interest expense, taxes and extraordinary items.

Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) equals

sales revenue minus cost of goods sold and all expenses except for interest,

amortization, depreciation and taxes. It measures the cash earnings that can be

used to pay interest and repay the principal. Since the interest is paid before

income tax is calculated, the debtholder can ignore taxes.

Earnings Before Interest and Taxes(EBIT)/ Operating profit equals sales revenue

minus cost of goods sold and all expenses except for interest and taxes. This is the

surplus generated by operations. It is also known as Operating Profit Before Interest

and Taxes (OPBIT) or simply Profit Before Interest and Taxes (PBIT).

Earnings Before Taxes (EBT)/ Net Profit Before Tax equals sales revenue minus

cost of goods sold and all expenses except for taxes. It is also known as pre-tax book

income (PTBI), net operating income before taxes or simply pre-tax Income.

Earnings After Tax/ Net Profit After Tax equal sales revenue after deducting all

expenses, including taxes (unless some distinction about the treatment of

extraordinary expenses is made). In the US, the term Net Income is commonly

used. Income before extraordinary expensesrepresents the same but before

adjusting for extraordinary items.

Earnings After Tax/ Net Profit After Tax minus payable dividends becomes Retained

Earnings.

THANK YOU !!

You might also like

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Faith in GenesisDocument5 pagesFaith in Genesischris iyaNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Causes of The Fall of Rome 1Document8 pagesCauses of The Fall of Rome 1api-334241910No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Bekaert BrochureDocument14 pagesBekaert BrochurePankaj AhireNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- FILL OUT THE Application Form: Device Operating System ApplicationDocument14 pagesFILL OUT THE Application Form: Device Operating System ApplicationNix ArcegaNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Code of Ethics For Public School Teacher: A. ResponsibiltyDocument6 pagesCode of Ethics For Public School Teacher: A. ResponsibiltyVerdiebon Zabala Codoy ArtigasNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Manajemen Rantai Pasok Tugas Studi Kasus Seven-Eleven: OlehDocument11 pagesManajemen Rantai Pasok Tugas Studi Kasus Seven-Eleven: OlehRane ArthurNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

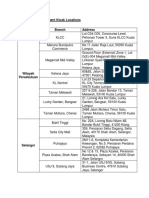

- Debit Card Replacement Kiosk Locations v2Document3 pagesDebit Card Replacement Kiosk Locations v2aiaiyaya33% (3)

- Naseer CV Dubai - 231017 - 215141-1Document2 pagesNaseer CV Dubai - 231017 - 215141-1krachinaseebbiryaniNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Public Administration and Governance: Esther RandallDocument237 pagesPublic Administration and Governance: Esther RandallShazaf KhanNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Cat 178 BooksDocument35 pagesCat 178 BooksXARIDHMOSNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Determinate and GenericDocument5 pagesDeterminate and GenericKlara Alcaraz100% (5)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Impact of Brexit On TataDocument2 pagesImpact of Brexit On TataSaransh SethiNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Concept Note Digital Platform Workshop - en PDFDocument3 pagesConcept Note Digital Platform Workshop - en PDFgamal90No ratings yet

- ORENDAIN vs. TRUSTEESHIP OF THE ESTATE OF DOÑA MARGARITA RODRIGUEZ PDFDocument3 pagesORENDAIN vs. TRUSTEESHIP OF THE ESTATE OF DOÑA MARGARITA RODRIGUEZ PDFRhev Xandra Acuña100% (2)

- CPAR FLashcardDocument3 pagesCPAR FLashcardJax LetcherNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Conditions of The Ahmediya Mohammediya Tijaniya PathDocument12 pagesConditions of The Ahmediya Mohammediya Tijaniya PathsamghanusNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- ЛексикологіяDocument2 pagesЛексикологіяQwerty1488 No nameNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- ID-MSHKKT46-KT-2 E-PolicyDocument4 pagesID-MSHKKT46-KT-2 E-Policymeilll130935No ratings yet

- Best Answer For Language of ParadosDocument2 pagesBest Answer For Language of Paradosrafiuddin003No ratings yet

- Capital BudgetingDocument24 pagesCapital BudgetingHassaan NasirNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Universalism and Cultural Relativism in Social Work EthicsDocument16 pagesUniversalism and Cultural Relativism in Social Work EthicsEdu ArdoNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- A Comparison of The Manual Electoral System and The Automated Electoral System in The PhilippinesDocument42 pagesA Comparison of The Manual Electoral System and The Automated Electoral System in The PhilippineschaynagirlNo ratings yet

- NYSERDA AnalysisDocument145 pagesNYSERDA AnalysisNick PopeNo ratings yet

- Written Report ON Ethical Issues IN Media CoverageDocument3 pagesWritten Report ON Ethical Issues IN Media CoverageEMMANo ratings yet

- Health CertsxDocument2 pagesHealth Certsxmark marayaNo ratings yet

- Guyana Budget Speech 2018Document101 pagesGuyana Budget Speech 2018stabroeknewsNo ratings yet

- 173 RevDocument131 pages173 Revmomo177sasaNo ratings yet

- 10 ĐỀ HSG ANH 9 + FILE NGHE + KEYDocument86 pages10 ĐỀ HSG ANH 9 + FILE NGHE + KEYHa TrangNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Contribution of Tourism Industry in Indian Economy: An AnalysisDocument8 pagesContribution of Tourism Industry in Indian Economy: An AnalysisHarsh GuptaNo ratings yet

- Trade Infrastructure (Maharashtra)Document5 pagesTrade Infrastructure (Maharashtra)RayNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)