Professional Documents

Culture Documents

Ais10 ch14

Uploaded by

J TOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ais10 ch14

Uploaded by

J TCopyright:

Available Formats

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 1 of 102

C

HAPTER 14

General Ledger and

Reporting System

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 2 of 102

INTRODUCTION

Questions to be addressed in this chapter

include:

What information processing operations are

required to update the general ledger and

produce reports for internal and external

users?

How do IT developments impact the general

ledger and reporting system?

What are the major threats in the general

ledger and reporting system and the controls

that can mitigate those threats?

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 3 of 102

INTRODUCTION

What is a balanced scorecard and how is it

used?

What are data warehouses, and how do they

support business intelligence?

How can the design of financial graphs affect

business decisions?

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 4 of 102

INTRODUCTION

The general ledger and reporting system

(GLARS) includes the processes in place

to update general ledger accounts and

prepare reports that summarize results of

the organizations activities.

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 5 of 102

INTRODUCTION

One of the primary functions of GLARS is to

collect and organize data from:

Each of the accounting cycle subsystems, which

provide summary entries related to the routine

activities in those cycles.

The treasurer, who provides entries with respect to

non-routine activities such as transactions with

creditors and investors.

The budget department, which provides budget

numbers.

The controller, who provides adjusting entries.

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 6 of 102

INTRODUCTION

The information must be organized to

meet the needs of internal and external

users.

The system must be designed to produce

regular periodic reports and to support

real-time inquiries.

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 7 of 102

GENERAL LEDGER AND REPORTING

SYSTEM

The basic activities in the GLARS are:

Update the general ledger

Post adjusting entries

Prepare financial statements

Produce managerial reports

The first three represent the basic steps in

the accounting cycle

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 8 of 102

GENERAL LEDGER AND REPORTING

SYSTEM

The basic activities in the GLARS are:

Update the general ledger

Post adjusting entries

Prepare financial statements

Produce managerial reports

The first three represent the basic steps in

the accounting cycle.

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 9 of 102

UPDATE THE GENERAL LEDGER

Updating the general ledger consists of

posting journal entries from two sources:

Summary journal entries of routine

transactions from the accounting subsystems

Individual journal entries for non-routine

transactions from the treasurer. Examples:

Issuances of or payment of debt and the

associated interest.

Issuances of or repurchases of company stock and

paying dividends on that stock.

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 10 of 102

UPDATE THE GENERAL LEDGER

Journal entries are often documented on a

form called a journal voucher.

After updating the general ledger (GL),

journal entries are stored in a journal

voucher file.

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 11 of 102

GENERAL LEDGER AND REPORTING

SYSTEM

The basic activities in the GLARS are:

Update the general ledger

Post adjusting entries

Prepare financial statements

Produce managerial reports

The first three represent the basic steps in

the accounting cycle

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 12 of 102

POST ADJUSTING ENTRIES

Adjusting entries originate in the

controllers office at the end of each

accounting period (month, quarter, year,

etc.) and after the initial trial balance has

been prepared.

The trial balance lists the balances for all

of the GL accounts.

If properly recorded, the total of all debit

balances equal the total of all credit

balances.

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 13 of 102

POST ADJUSTING ENTRIES

There are five types of adjusting entries:

Accruals

An accrual involves an event that has

occurred for which the related cash flow

has not yet taken place.

Accrued revenueThe company has

delivered a product or service to a customer

but has not yet been paid.

Accrued expenseThe company has used up

a good or service but not yet paid for it.

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 14 of 102

POST ADJUSTING ENTRIES

There are five types of adjusting entries:

Accruals

Deferrals

A deferral involves a situation where the cash flow

takes place before the related revenue is earned or the

expense is incurred.

Deferred revenueThe company received payment for a

product or service that was not yet been completely delivered

to the customer (aka, unearned revenue).

Deferred expenseThe company paid for a good or service

which they had not yet completely used up (aka, prepaid

expense).

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 15 of 102

POST ADJUSTING ENTRIES

There are five types of adjusting entries:

Accruals

Deferrals

Estimates

Estimates are used to recognize expenses

that cannot be directly attributed to a related

revenue and must be allocated in a more

subjective or systematic manner.

Examples:

Depreciation expense

Bad debt expense.

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 16 of 102

POST ADJUSTING ENTRIES

There are five types of adjusting entries:

Accruals

Deferrals

Estimates

Re-evaluations

Re-evaluations result from:

Reconciling actual and recorded values of assets

EXAMPLE: Making a lower-of-cost-or-market adjustment to

inventory

Recording an asset impairment

Recording changes in accounting principles.

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 17 of 102

POST ADJUSTING ENTRIES

There are five types of adjusting entries:

Accruals

Deferrals

Estimates

Re-evaluations

Error corrections

Error corrections involve correction

of errors previously made in the

general ledger.

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 18 of 102

POST ADJUSTING ENTRIES

Journal vouchers for adjusting entries

should be stored in the journal voucher

file.

Once adjusting entries have been

recorded, an adjusted trial balance is

prepared from the new balances in the

general ledger.

The adjusted trial balance serves as the

input for the next steppreparation of the

financial statements.

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 19 of 102

GENERAL LEDGER AND REPORTING

SYSTEM

The basic activities in the GLARS are:

Update the general ledger

Post adjusting entries

Prepare financial statements

Produce managerial reports

The first three represent the basic steps in

the accounting cycle

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 20 of 102

PREPARE FINANCIAL STATEMENTS

Activities in the preparation of financial

statements are as follows:

Prepare an income statement

The Income Statement is prepared using the

balances in the revenue, expense, gain, and

loss accounts listed on the adjusted trial

balance.

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 21 of 102

PREPARE FINANCIAL STATEMENTS

Activities in the preparation of financial

statements are as follows:

Prepare an income statement

Prepare closing entries

After preparation of the income statement, the revenue,

expense, gain, and loss accounts are closed.

Their balances are transferred to retained earnings, so that this

account will have the correct ending balance.

If a separate account is kept for dividends, that account is also

closed to retained earnings.

Most companies perform monthly and annual closes.

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 22 of 102

PREPARE FINANCIAL STATEMENTS

Activities in the preparation of financial

statements are as follows:

Prepare an income statement

Prepare closing entries

Prepare a statement of stockholders

equity

Reconciles the changes in the stockholders equity accounts

(paid-in capital and retained earnings) for the year.

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 23 of 102

PREPARE FINANCIAL STATEMENTS

Activities in the preparation of financial

statements are as follows:

Prepare an income statement

Prepare closing entries

Prepare a statement of stockholders equity

Prepare a balance sheet

Presents the balances in the

permanent accounts:

Assets

Liabilities

Owners Equity

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 24 of 102

PREPARE FINANCIAL STATEMENTS

Activities in the preparation of financial

statements are as follows:

Prepare an income statement

Prepare closing entries

Prepare a statement of stockholders equity

Prepare a balance sheet

Prepare a statement of cash flows

Presents changes in cash for

the period categorized by:

Operating activities

Investing activities

Financing activities

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 25 of 102

GENERAL LEDGER AND REPORTING

SYSTEM

The basic activities in the GLARS are:

Update the general ledger

Post adjusting entries

Prepare financial statements

Produce managerial reports

The first three represent the basic steps in

the accounting cycle

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 26 of 102

PRODUCE MANAGERIAL REPORTS

The final step is prepare of reports for

internal purposes, including:

Reports to verify the accuracy of the

posting process.

Examples:

Lists of journal vouchers by numerical sequence,

account number, or date.

Lists of general ledger account balances.

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 27 of 102

PRODUCE MANAGERIAL REPORTS

The final step is prepare of reports for

internal purposes, including:

Reports to verify the accuracy of the posting

process.

Budgets for planning and evaluating

performance

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 28 of 102

PRODUCE MANAGERIAL REPORTS

The final step is prepare of reports for

internal purposes, including:

Reports to verify the accuracy of the posting

process.

Budgets for planning and evaluating

performance:

Operating budget

Depicts planned revenues and expenses for

each unit

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 29 of 102

PRODUCE MANAGERIAL REPORTS

The final step is prepare of reports for

internal purposes, including:

Reports to verify the accuracy of the posting

process.

Budgets for planning and evaluating

performance:

Operating budget

Capital expenditure budget

Shows planned cash inflows and outflows

for each project.

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 30 of 102

PRODUCE MANAGERIAL REPORTS

The final step is prepare of reports for

internal purposes, including:

Reports to verify the accuracy of the posting

process.

Budgets for planning and evaluating

performance:

Operating budget

Capital expenditure budget

Cash flow budget

Shows anticipated cash inflows and outflows

for use in determining borrowing needs.

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 31 of 102

PRODUCE MANAGERIAL REPORTS

The final step is prepare of reports for

internal purposes, including:

Reports to verify the accuracy of the posting

process.

Budgets for planning and evaluating

performance:

Operating budget

Capital expenditure budget

Cash flow budget

Whats the difference between the operating

budget and the cash flow budget?

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 32 of 102

PREPARE MANAGERIAL REPORTS

Budgets and performance reports should be

developed on the basis of responsibility

accounting, i.e., reporting results on the basis

of the manager responsible:

Breaks down financial results by subunit.

Shows actual costs and variances for current month

and year-to-date for items the subunit controls.

The cost of a sub-unit is displayed as a single line

item on the report for the next level up.

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 33 of 102

PREPARE MANAGERIAL REPORTS

Contents of the budgetary performance

reports should be tailored to the nature of

the unit being evaluated.

- Cost centers

Examples: Production, service, and

administrative departments.

Present actual vs. budgeted costs, focusing

only on controllable costs.

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 34 of 102

PREPARE MANAGERIAL REPORTS

Contents of the budgetary performance

reports should be tailored to the nature of

the unit being evaluated.

- Cost centers

- Revenue centers

Example: Sales department.

Present actual vs. forecasted sales by

product, geographical category, etc.

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 35 of 102

PREPARE MANAGERIAL REPORTS

Contents of the budgetary performance

reports should be tailored to the nature of

the unit being evaluated.

- Cost centers

- Revenue centers

- Profit centers

Examples: IT and utilities that charge other

units for their services.

Compare actual vs. budgeted revenues,

expenses, and profits.

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 36 of 102

PREPARE MANAGERIAL REPORTS

Contents of the budgetary performance

reports should be tailored to the nature of

the unit being evaluated.

- Cost centers

- Revenue centers

- Profit centers

- Investment centers

Examples: Plants, divisions, and other

autonomous operating units.

Provide calculations of return on investment.

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 37 of 102

PRODUCE MANAGERIAL REPORTS

The method used to calculate the budget

standard is crucial:

Can use a fixed target and compare actual

results to the fixed budget.

Problem: Does not adjust for unforeseen

changes in operating environment and may

penalize manager for factors beyond his

control.

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 38 of 102

PRODUCE MANAGERIAL REPORTS

Example:

A unit forecasts sales of 1,000 units of its

product.

Actual sales are 1,200 units.

Because sales rose, the cost of goods sold

also rose.

The outcome is good for the profitability of the

company, but the production manager may be

penalized because production costs were

higher than the fixed target.

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 39 of 102

PRODUCE MANAGERIAL REPORTS

Solution:

Develop a flexible budget.

Break each item into fixed and variable

components.

Adjust the variable components for variations in

sales or production.

See example on next slide.

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 40 of 102

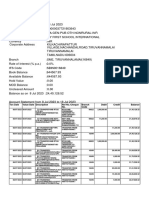

SAMPLE FLEXIBLE BUDGET

Fixed

Budget

Flexible

Budget

Actual

Results Variance

# Units Sold 100,000 120,000 120,000

Sales Revenue ($5 ea.) 500,000 $ 600,000 $ 600,000 $

Production Costs

Fixed (200,000) (200,000) (205,000) (5,000) $

Variable ($1.20 ea.) (120,000) (144,000) (141,600) 2,400 $

Selling & Admin.

Fixed (70,000) (70,000) (62,000) 8,000 $

Variable ($.50 ea.) (50,000) (60,000) (54,000) 6,000 $

Income 60,000 $ 126,000 $ 137,400 $

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 41 of 102

XBRL: REVOLUTIONIZING THE

REPORTING PROCESS

While financial statements appear electronically

in a variety of formats, until recently

disseminating this information was cumbersome

and inefficient.

Recipients (SEC, IRS, etc.) required the information

in a variety of formats which was time-consuming.

Also conducive to errors, since re-entry of the

information was often necessary.

Underlying problem: lack of standards for

identifying the content of data.

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 42 of 102

XBRL: REVOLUTIONIZING THE

REPORTING PROCESS

Solution: Extensible Business Reporting

Language (XBRL)

A variant of XML designed specifically to communicate

the contents of financial data.

Creates tags for each data item much like HTML tags.

Tag names specify line items in financial statements.

Other fields in the tag provide information such as the year,

units of measure, etc.

Major software vendors are developing tools to

automatically generate XBRL codes so

accountants wont need to write code.

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 43 of 102

XBRL: REVOLUTIONIZING THE

REPORTING PROCESS

XBRL provides two major benefits:

Organizations can publish their financial

statements on time in a format that anyone

can use.

Recipients will no longer need to manually

reenter data they acquired electronically so

that decision support tools can analyze them.

Means search for data on the Internet will be more

efficient and accurate.

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 44 of 102

XBRL: REVOLUTIONIZING THE

REPORTING PROCESS

Benefits of XBRL apply to exchanging

financial information both externally and

internally.

XBRL provides a great example of how

accountants can actively participate in IT

development, since the accounting

profession spearheaded its development.

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 45 of 102

CONTROL: OBJECTIVES,

THREATS, AND PROCEDURES

In the general ledger and reporting system (or any

cycle), a well-designed AIS should provide adequate

controls to ensure that the following objectives are met:

All transactions are properly authorized

All recorded transactions are valid

All valid and authorized transactions are recorded

All transactions are recorded accurately

Assets are safeguarded from loss or theft

Business activities are performed efficiently and effectively

The company is in compliance with all applicable laws and

regulations

All disclosures are full and fair

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 46 of 102

CONTROL: OBJECTIVES,

THREATS, AND PROCEDURES

There are several actions a company can take

with respect to any cycle to reduce threats of

errors or irregularities. These include:

Using simple, easy-to-complete documents with

clear instructions (enhances accuracy and

reliability).

Using appropriate application controls, such as

validity checks and field checks (enhances

accuracy and reliability).

Providing space on forms to record who completed

and who reviewed the form (encourages proper

authorizations and accountability).

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 47 of 102

CONTROL: OBJECTIVES,

THREATS, AND PROCEDURES

Pre-numbering documents (encourages

recording of valid and only valid

transactions).

Restricting access to blank documents

(reduces risk of unauthorized transaction).

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 48 of 102

CONTROL: OBJECTIVES,

THREATS, AND PROCEDURES

In the following sections, well discuss the

threats that may arise in the general

ledger and reporting system, as well as

the controls that can prevent those threats.

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 49 of 102

THREATS IN THE GENERAL

LEDGER AND REPORTING SYSTEM

The primary threats in the general ledger

and reporting system are:

THREAT 1: Errors in Updating the General

Ledger and Generating Reports

THREAT 2: Loss, Alteration, or Unauthorized

Disclosure of Financial Data

THREAT 3: Poor Performance

You can click on any of the threats above to get

more information on:

The types of problems posed by each threat

The controls that can mitigate the threats.

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 59 of 102

SUPPORTING MANAGEMENTS

INFORMATION NEEDS

Three tools or abilities can be particularly

useful to management in decision making:

The balanced scorecard

Data warehouses

Proper design of graphs of financial data

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 60 of 102

SUPPORTING MANAGEMENTS

INFORMATION NEEDS

Three tools or abilities can be particularly

useful to management in decision making:

The balanced scorecard

Data warehouses

Proper design of graphs of financial data

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 61 of 102

THE BALANCED SCORECARD

A balanced scorecard is a report that

provides a multi-dimensional perspective

on organizational performance.

Contains measures relating to four

perspectives of the organization:

Financial

Customer

Internal operations

Innovation and learning

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 62 of 102

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 63 of 102

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 64 of 102

THE BALANCED SCORECARD

The balanced scorecard shows:

The organizations goals for each of the four

dimensions

Specific measures of performance in attaining those

goals.

It provides a more comprehensive overview of

organizational performance than financial

measures alone.

Properly designed, it measures key aspects of

the organizations strategy and reflects important

causal links.

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 65 of 102

THE BALANCED SCORECARD

With respect to the goals:

Many organizations mistakenly use industry

benchmarks in designing their balanced

scorecards.

This approach limits the companys

performance to that of its competitors and

fails to consider the organizations unique

strengths and weaknesses.

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 66 of 102

THE BALANCED SCORECARD

EXAMPLE: Dumbledore Insurance

Companys top management agreed on

three key financial goals:

Increased revenue streams through the sale

of new products.

Increased profitability as reflected in return on

equity.

Maintaining adequate cash flows to meet

obligations.

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 67 of 102

THE BALANCED SCORECARD

They then created the following hypotheses (or

causal links) as to how these goals could be

achieved:

If we increase employee training (innovation and

learning dimension), that should improve our service

quality (internal operations dimension).

If we increase our service quality (internal

operations dimension), that should improve our

customer satisfaction (customer dimension) and

cause us to pick up a greater market share.

Improved customer satisfaction and market share

(customer dimension) should therefore result in

improved profitability (financial dimension).

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 68 of 102

THE BALANCED SCORECARD

Given these hypotheses, Dumbledore

designs and implements the scorecard

shown on the following slide.

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 69 of 102

THE BALANCED SCORECARD

Dimension/Goals Measure Target

Current

Period

Prior

Period

Financial

New revenue streams New product sales 104 103 100

Improve productivity Return on equity % 12.5% 12.6% 12.2%

Positive cash flow Cash from ops. (000's) 156 185 143

Customer

Improve satisfication Rating (0-100) 95 93 92

Be preferred provider % of market 20% 20% 18%

Internal Operations

Service quality Error rate 2% 3% 5%

Speed of delivery App. processing days 10.4 10.5 11.2

Innovation & Learning

New products # new products 2 2 1

Employee learning % attending training 10% 25% 9%

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 70 of 102

THE BALANCED SCORECARD

Analyzing trends in the actual measures

allows Dumbledores management to test

the validity of their hypotheses:

If improvements in one perspective dont

generate expected improvements in other

areas, top management should reevaluate

and revise their hypotheses.

The ability to test and refine their strategy is

one of the major benefits of the balanced

scorecard.

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 71 of 102

THE BALANCED SCORECARD

In developing a balanced scorecard:

Top management should specify the goals to

be pursued in each dimension

Accountants and IS professionals:

Help them choose appropriate measures for

tracking attainment of these goals.

Provide input on the feasibility of collecting data to

implement the various measures.

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 72 of 102

SUPPORTING MANAGEMENTS

INFORMATION NEEDS

Three tools or abilities can be particularly

useful to management in decision making:

The balanced scorecard

Data warehouses

Proper design of graphs of financial data

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 73 of 102

USING DATA WAREHOUSES FOR

BUSINESS INTELLIGENCE

Management must constantly monitor and

reevaluate the organizations financial and

operating performance in light of strategic goals

and must be able to alter plans quickly when the

environment changes.

They may adopt ERP systems and integrated

AIS systems to facilitate these activities.

However, these systems are designed primarily

to support transaction processing needs, and

typically contain data only for the current fiscal

year and maybe an extra month.

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 74 of 102

USING DATA WAREHOUSES FOR

BUSINESS INTELLIGENCE

But strategic decision making requires access to

large amounts of historical data.

To fill this need, organizations are building separate

databases called data warehouses.

These are typically huge databases that contain both

detailed and summarized data for a number of years.

They are separate from the AIS.

Organizations may also build separate, smaller

warehouses, called data marts, for individual

functions such as finance or human resources.

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 75 of 102

USING DATA WAREHOUSES FOR

BUSINESS INTELLIGENCE

Data warehouses and data marts are updated

periodically to reflect the results of transactions that

have occurred since the last update.

They are structured differently than transaction

processing databases:

Transaction processing databases are designed to

minimize redundancy and maximize efficiency of

updates.

Data warehouses are purposely designed to be

redundant in order to maximize query efficiency.

They are usually dimensional in nature.

Most use a star schema

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 76 of 102

Fact Table

Location ID

Item number

Buyer number

Supplier number

Time period

Dollar purchases

Unit purchases

Dimension Table

Location ID

Location name

Budget

Storage Capacity

State

Region

Country

Address

Dimension Table

Item number

Item name

Description

Category

Subcategory

Dimension Table

Buyer Number

Buyer Name

Department

Division

City

State

Region

Country

Dimension Table

Time period

Date

Month

Year

Quarter

Fiscal Year

Day

Dimension Table

Supplier Number

Supplier Name

Industry Category

Subcategory

State

Region

Country

Address

At the center of the star is a

single fact table that represents

the most important variable of

interest.

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 77 of 102

Fact Table

Location ID

Item number

Buyer number

Supplier number

Time period

Dollar purchases

Unit purchases

Dimension Table

Location ID

Location name

Budget

Storage Capacity

State

Region

Country

Address

Dimension Table

Item number

Item name

Description

Category

Subcategory

Dimension Table

Buyer Number

Buyer Name

Department

Division

City

State

Region

Country

Dimension Table

Time period

Date

Month

Year

Quarter

Fiscal Year

Day

Dimension Table

Supplier Number

Supplier Name

Industry Category

Subcategory

State

Region

Country

Address

The fact table contains multiple

views or measures of a variable and

a number of foreign keys that link it

to the factors that influence it.

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 78 of 102

Fact Table

Location ID

Item number

Buyer number

Supplier number

Time period

Dollar purchases

Unit purchases

Dimension Table

Location ID

Location name

Budget

Storage Capacity

State

Region

Country

Address

Dimension Table

Item number

Item name

Description

Category

Subcategory

Dimension Table

Buyer Number

Buyer Name

Department

Division

City

State

Region

Country

Dimension Table

Time period

Date

Month

Year

Quarter

Fiscal Year

Day

Dimension Table

Supplier Number

Supplier Name

Industry Category

Subcategory

State

Region

Country

Address

This fact table contains info on

purchases of raw materials in units

and dollars.

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 79 of 102

Fact Table

Location ID

Item number

Buyer number

Supplier number

Time period

Dollar purchases

Unit purchases

Dimension Table

Location ID

Location name

Budget

Storage Capacity

State

Region

Country

Address

Dimension Table

Item number

Item name

Description

Category

Subcategory

Dimension Table

Buyer Number

Buyer Name

Department

Division

City

State

Region

Country

Dimension Table

Time period

Date

Month

Year

Quarter

Fiscal Year

Day

Dimension Table

Supplier Number

Supplier Name

Industry Category

Subcategory

State

Region

Country

Address

Relevant dimensions include

location of storage, item,

purchasing agent, department,

supplier, and time period (in red).

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 80 of 102

Fact Table

Location ID

Item number

Buyer number

Supplier number

Time period

Dollar purchases

Unit purchases

Dimension Table

Location ID

Location name

Budget

Storage Capacity

State

Region

Country

Address

Dimension Table

Item number

Item name

Description

Category

Subcategory

Dimension Table

Buyer Number

Buyer Name

Department

Division

City

State

Region

Country

Dimension Table

Time period

Date

Month

Year

Quarter

Fiscal Year

Day

Dimension Table

Supplier Number

Supplier Name

Industry Category

Subcategory

State

Region

Country

Address

Data warehouses consist of many

starsone for each important set

of data.

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 81 of 102

USING DATA WAREHOUSES FOR

BUSINESS INTELLIGENCE

Business intelligence is the process of

accessing data in a warehouse and using

it for strategic decision making. Two basic

techniques:

Online analytical processing (OLAP)

The user employs queries to investigate

hypothesized relationships in the data.

Can drill down to deeper levels with each

query.

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 82 of 102

USING DATA WAREHOUSES FOR

BUSINESS INTELLIGENCE

Business intelligence is the process of

accessing data in a warehouse and using

it for strategic decision making. Two basic

techniques:

Online analytical processing (OLAP)

Data mining

Uses sophisticated statistical analysis and artificial

intelligence techniques such as neural networks to discover

unhypothesized relationships in the data.

Lets just dig and see what we find!

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 83 of 102

USING DATA WAREHOUSES FOR

BUSINESS INTELLIGENCE

Proper controls are needed for data

warehouses:

Data validation controls are essential to ensuring data

accuracy.

The process of verifying the accuracy of the data, aka

scrubbing, is often one of the most time-consuming and

expensive steps.

Information should be protected from competitors or

from destruction by using:

Access controls

Encryption

Backup provisions

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 84 of 102

SUPPORTING MANAGEMENTS

INFORMATION NEEDS

Three tools or abilities can be particularly

useful to management in decision making:

The balanced scorecard

Data warehouses

Proper design of graphs of financial data

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 85 of 102

PRINCIPLES OF GRAPH DESIGN

Accountants and IS professionals can help

management deal with information

overload by preparing graphs that highlight

and summarize important facts.

Well-designed graphs make it easy to

identify and understand trends and

relationships.

Poorly-designed graphs can impair

decision making.

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 86 of 102

Insurance Type as % of Total

Business

Life, 62%

Health, 22%

Auto, 16%

Life

Health

Auto

Pie charts show the relative size of sub-components.

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 87 of 102

Bar charts are the most common type and are used

to display trends.

601

603

610

605

612

540

553

566

589

519

460

480

500

520

540

560

580

600

620

2000 2001 2002 2003 2004

Oklahoma

Texas

Auto Insurance Sales (In Thousands) By State

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 88 of 102

PRINCIPLES OF GRAPH DESIGN

Principles that make bar charts easy to

read:

Use titles that summarize the basic

message.

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 89 of 102

Millions of Dollars of Sales by Line of Insurance

Business

681

520

418

0

100

200

300

400

500

600

700

800

Life Health Auto

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 90 of 102

PRINCIPLES OF GRAPH DESIGN

Principles that make bar charts easy to

read:

Use titles that summarize the basic message.

Include data values with each element

instead of labeling the vertical axis. This

practice facilitates mental calculations and

analyses

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 91 of 102

Millions of Dollars of Sales by Line of Insurance

Business

681

520

418

0

100

200

300

400

500

600

700

800

Life Health Auto

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 92 of 102

PRINCIPLES OF GRAPH DESIGN

Principles that make bar charts easy to

read:

Use titles that summarize the basic message.

Include data values with each element instead

of labeling the vertical axisfacilitates mental

calculations and analyses

Use 2-dimensional, instead of 3-

dimensional, bars. This practice makes it

easier to accurately assess magnitude of

changes and trends.

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 93 of 102

Life

Health

Auto

681

520

418

0

100

200

300

400

500

600

700

Millions of Dollars of Sales by Line of Insurance

Business

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 94 of 102

PRINCIPLES OF GRAPH DESIGN

Principles that make bar charts easy to read:

Use titles that summarize the basic message.

Include data values with each element instead of

labeling the vertical axisfacilitates mental

calculations and analyses

Use 2-dimensional, instead of 3-dimensional,

barsmakes it easier to accurately assess

magnitude of changes and trends.

Use different shades of gray or colors instead

of patterns, dots, or stripes. They are easier to

distinguish

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 95 of 102

Millions of Dollars of Sales by Line of Insurance

Business

681

520

418

0

100

200

300

400

500

600

700

800

Life Health Auto

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 96 of 102

PRINCIPLES OF GRAPH DESIGN

While readability is important, the ultimate

value of graphs is to support decision

making. Two principles are essential to

accurate interpretation:

Begin vertical axis at zero

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 97 of 102

Millions of Dollars of Sales by Line of Insurance

Business

681

520

418

0

100

200

300

400

500

600

700

800

Life Health Auto

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 98 of 102

PRINCIPLES OF GRAPH DESIGN

While readability is important, the ultimate

value of graphs is to support decision

making. Two principles are essential to

accurate interpretation:

Begin vertical axis at zero

For graphs that depict time-series data,

order the x-axis chronologically from left

to right.

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 99 of 102

Life Insurance Sales By Year (In Millions of $)

320

345

406

385

410

0

100

200

300

400

500

1985 1986 1987 1988 1989

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 100 of 102

PRINCIPLES OF GRAPH DESIGN

Many annual reports contain graphs that

violate these principles:

Some done automatically by software.

Some done intentionally.

There are no authoritative guidelines in

GAAP or auditing standards that prohibit

these behaviors, even though the results

can be deceptive.

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 101 of 102

SUMMARY

Youve learned about the information processing

operations that are required to update the

general ledger and produce reports for internal

and external users.

Youve learned how IT developments impact the

general ledger and reporting system.

Youve learned about the major threats in the

general ledger and reporting system and the

controls that can mitigate those threats.

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 102 of 102

SUMMARY

Youve learned how data warehouses and

data marts support business intelligence.

Youve learned how the design of financial

graphs can affect business decisions.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Sol Man Baysa Chapter 1Document21 pagesSol Man Baysa Chapter 1Jayson Villena Malimata100% (2)

- Simplicity and SilenceDocument12 pagesSimplicity and SilenceJ TNo ratings yet

- 03 LasherIM Ch03Document47 pages03 LasherIM Ch03Maryam Bano100% (5)

- MA - HiltonDocument38 pagesMA - HiltonJ T100% (1)

- MA - HiltonDocument37 pagesMA - HiltonJ T100% (1)

- MA - HiltonDocument37 pagesMA - HiltonJ TNo ratings yet

- PSQC 1Document35 pagesPSQC 1Airah Abcede FajardoNo ratings yet

- MA - HiltonDocument34 pagesMA - HiltonJ TNo ratings yet

- 1the Rule of Common InterestDocument13 pages1the Rule of Common InterestJ TNo ratings yet

- Chap 2 Tax Admin2013Document10 pagesChap 2 Tax Admin2013Quennie Jane Siblos100% (1)

- What Fama and Frenchs Latest Research Doesnt Tell UsDocument7 pagesWhat Fama and Frenchs Latest Research Doesnt Tell UsJ TNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Albka Lkyltvkc NU8Document4 pagesAlbka Lkyltvkc NU8mfsiNo ratings yet

- Quiz - Chapter 4 - Accounts Receivable - Ia 1 - 2020 EditionDocument4 pagesQuiz - Chapter 4 - Accounts Receivable - Ia 1 - 2020 EditionJennifer Reloso100% (1)

- Adv Accounting by Ma GhaniDocument107 pagesAdv Accounting by Ma Ghanimianzeeshanullah20% (5)

- Navin Packaging LTD: Share Capital A/cDocument4 pagesNavin Packaging LTD: Share Capital A/cMaryNo ratings yet

- CHAPTER - 2 - Exercise & ProblemsDocument6 pagesCHAPTER - 2 - Exercise & ProblemsFahad MushtaqNo ratings yet

- Ch10 Current Liabilities and PayrollDocument48 pagesCh10 Current Liabilities and PayrollchuchuNo ratings yet

- 18 - Oracle 1z0 1074Document31 pages18 - Oracle 1z0 1074JanardhanNo ratings yet

- CBLM Coc1Document48 pagesCBLM Coc1Kenneth Catalan SaelNo ratings yet

- Acn Chapter 7 Problem 6-19Document10 pagesAcn Chapter 7 Problem 6-19Lady Zyanien DevarasNo ratings yet

- LLB 2003Document60 pagesLLB 2003concast_pankajNo ratings yet

- Allied Banking Corporation v. Spouses Macam (Fausto)Document3 pagesAllied Banking Corporation v. Spouses Macam (Fausto)Bluei FaustoNo ratings yet

- Test Bank For Accounting For Governmental Nonprofit Entities 19th Edition Jacqueline Reck Suzanne Lowensohn Daniel NeelyDocument32 pagesTest Bank For Accounting For Governmental Nonprofit Entities 19th Edition Jacqueline Reck Suzanne Lowensohn Daniel Neelyandrewmorriswxkfobqpjc100% (17)

- Partnership and Corporation Accounting: True or FalseDocument2 pagesPartnership and Corporation Accounting: True or FalseBaby BabeNo ratings yet

- Account NotesDocument31 pagesAccount NotesbharatNo ratings yet

- (EXCEL) Dianita Safitri - 7193220005Document26 pages(EXCEL) Dianita Safitri - 7193220005Jack WilisNo ratings yet

- Chapter 15 - Joint Arrangements 08312018 Rev 31919Document11 pagesChapter 15 - Joint Arrangements 08312018 Rev 31919Arnel ManalastasNo ratings yet

- Ondeck Asset Securitization Trust II LLC Series 2016 1 Rating ReportDocument16 pagesOndeck Asset Securitization Trust II LLC Series 2016 1 Rating ReportMarkNo ratings yet

- ConsignmentDocument47 pagesConsignmentSumitasNo ratings yet

- Fa2 Ch-2 Current LiabilitiesDocument82 pagesFa2 Ch-2 Current LiabilitiesTsi AwekeNo ratings yet

- CAF7-Financial Accounting and Reporting II - QuestionbankDocument250 pagesCAF7-Financial Accounting and Reporting II - QuestionbankEvan Jones100% (7)

- Chapter 14Document7 pagesChapter 14Ignatius LysanderNo ratings yet

- Fundamentals of Accounting Suggested Answer Attempt All Questions. Working Notes Should Form Part of The AnswerDocument28 pagesFundamentals of Accounting Suggested Answer Attempt All Questions. Working Notes Should Form Part of The AnsweralchemistNo ratings yet

- A141 Tutorial 3 Bkal1013Document5 pagesA141 Tutorial 3 Bkal1013CyrilraincreamNo ratings yet

- Final Account of Sole Trading ConcernDocument7 pagesFinal Account of Sole Trading ConcernAMIN BUHARI ABDUL KHADER50% (2)

- R&D Reforms (Presentation From KVSM)Document55 pagesR&D Reforms (Presentation From KVSM)kansanNo ratings yet

- Hotel AccountingDocument19 pagesHotel AccountingSreedevi P MenonNo ratings yet

- 3 - Hansen - CH 4.ppt-Dikonversi PDFDocument80 pages3 - Hansen - CH 4.ppt-Dikonversi PDFRamaNo ratings yet

- Accounting Concepts Are The Broad Assumptions Which Underline The Periodic Financial Accounts of Business EnterprisesDocument5 pagesAccounting Concepts Are The Broad Assumptions Which Underline The Periodic Financial Accounts of Business EnterprisesHenry MayambuNo ratings yet

- 01 - Introduction To AccountingDocument10 pages01 - Introduction To AccountingNasikNo ratings yet

- Consignment JournalDocument2 pagesConsignment JournalkamalkavNo ratings yet