Professional Documents

Culture Documents

Narasimham Committee: Presented By: Ashutosh A. Anay V. Kushang T. Archana T

Uploaded by

Haritika ChhatwalOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Narasimham Committee: Presented By: Ashutosh A. Anay V. Kushang T. Archana T

Uploaded by

Haritika ChhatwalCopyright:

Available Formats

Narasimham Committee

Presented by:

ASHUTOSH A.

ANAY V.

KUSHANG T.

ARCHANA T.

1969- Banks Nationalization

Effects

Phenomenal increase in the geographical

coverage of our banking and financial institutions.

Despite impressive quantitative achievement- low

efficiency and productivity, bad portfolios

performance, and eroded profitability.

Several public sector banks and financial

institutions were incurring losses year after year.

Why the Committee

1991 -RBI proposed the committee chaired by

M. Narasimham, former RBI Governor to

review the Financial System

Review- aspects relating to the Structure,

Organization, Procedures and Functioning of

the financial system

Constituted in 1991, the Committee submitted two

reports, in 1992 and 1998,

which laid significant thrust on enhancing the

efficiency and viability of the banking sector

The Narasimham Committee laid the foundation

for the reformation of the Indian banking sector

About the committee

Higher rates of CRR(15%) and SLR(38.5%)

Directed credit programs

Political and Administrative interference

Subsidizing of credit

Mounting expenditures of banks

Problems faced then

Reduction of Statutory Liquidity Ratio (SLR) to 25 per

cent over a period of five years

Progressive reduction in Cash Reserve Ratio (CRR) to

3-5%

Phasing out of directed credit programme and

redefinition of the priority sector

Stipulation of minimum capital adequacy ratio of 8 per

cent by March 1996. (Capital adequacy ratios ("CAR")

are a measure of the amount of a bank's capital

expressed as a percentage of its risk weighted credit

exposures.)

Adoption of uniform accounting practices in regard to

income recognition, asset classification and

provisioning against bad and doubtful debts

The main recommendations of the Committee were:

-

Setting up of special tribunals to speed up the

recovery process of loans

Setting up of Asset Reconstruction Funds (ARFs) to

take over from banks a portion of their bad and

doubtful advances at a discount

Abolition of branch licensing

Liberalizing the policy with regard to allowing foreign

banks to open offices in India

Giving freedom to individual banks to recruit officers

Revised procedure for selection of Chief Executives

and Directors of Boards of public sector banks

Speedy liberalization of capital market

Enactment of a separate legislation providing

appropriate legal framework for mutual funds and

laying down prudential norms for such institutions, etc.

CONTD

1998- Finance minister appointed Mr. Narasimham

as chairman of one more committee.

This committee was asked to review the progress

of banking sector reforms to date and a

programme on financial sector reforms to

strengthen India's financial system and make it

internationally competitive.

The committee submitted its report to the

government in April 1998.

The report covered issues like- capital adequacy,

bank mergers, recasting bank board, and creation

of global sized banks.

Committee On Banking Sector Reforms 1998

Need for stronger banking system

Experiment with concept of narrow banking

Small local banks

Capital Adequacy Ratio

Review and update banking laws.

Major Recommendations of Narasimham

Committee 1998

The Effect

Emergence of 9 new private sector banks

Opening up of vibrant capital market

Great impact on banks balance sheets both on assets

and liabilities side

Some Fact

Nationalization of banks in 1969:

14 banks were nationalized

Branch expansion: Increased from 8260 in

1969 to 71177 in 2006

Population served per branch has come down

from 64000 to 16000

A rural branch office serves 15 to 25 villages

within a radius of 16 kms

However, at present only 32,180 villages out

of 5 lakh have been covered

Some Fact Contd.

Deposit mobilization

1951-1971 (20 years)- 700% or 7 times

1971-1991 (20 years)- 3260% or 32.6 times

1991- 2006 (11 years)- 1100% or 11 times

Expansion of bank credit: Growing at 20-30% p.a.

thanks to rapid growth in industrial and agricultural

output

Development oriented banking: priority sector

lending

Some Fact Contd.

Diversification in banking:

Banking has moved from deposit and lending to

Merchant banking and underwriting

Mutual funds

Retail banking

ATMs

Internet banking

Venture capital funds

Factoring

You might also like

- HyperinflationDocument2 pagesHyperinflationDanix Acedera50% (2)

- Kinds of PartnershipDocument4 pagesKinds of PartnershipIrvinne Heather Chua GoNo ratings yet

- Bank Negara Malaysia & Financial SystemDocument27 pagesBank Negara Malaysia & Financial SystemNatashaHaziqahNo ratings yet

- Feasibility Study - Steel Products WeldingDocument7 pagesFeasibility Study - Steel Products WeldingWaseem MalikNo ratings yet

- Honest Tea - Help SpreadsheetDocument12 pagesHonest Tea - Help Spreadsheetvirgin51100% (1)

- Sampa Video Group 5Document6 pagesSampa Video Group 5Ankit MittalNo ratings yet

- Project On Indian Banking Sector ReformsDocument30 pagesProject On Indian Banking Sector Reformshaneen75% (44)

- Evolution of The Indian Financial SectorDocument18 pagesEvolution of The Indian Financial SectorVikash JontyNo ratings yet

- Narasimham CommitteeDocument9 pagesNarasimham CommitteeSwati RathourNo ratings yet

- Narasimham Committee ReportsDocument28 pagesNarasimham Committee ReportsBindal HeenaNo ratings yet

- Narasimham CommitteeDocument27 pagesNarasimham CommitteeshivaNo ratings yet

- The Narasimham CommitteeDocument18 pagesThe Narasimham CommitteeParul SaxenaNo ratings yet

- The Narasimham CommitteeDocument18 pagesThe Narasimham CommitteeParul SaxenaNo ratings yet

- Narasimham CommitteeDocument17 pagesNarasimham CommitteeTorsha SahaNo ratings yet

- Presented by Naman Kohli A29 Neha Sopori A31 Pravesh Phogat A Rahul Gaddh A Saurabh Rai A Sirin Sam A57Document35 pagesPresented by Naman Kohli A29 Neha Sopori A31 Pravesh Phogat A Rahul Gaddh A Saurabh Rai A Sirin Sam A57Neha Sopori100% (1)

- Banking ReformsDocument13 pagesBanking ReformsRajat ChoudharyNo ratings yet

- Banking Sector Reform - Class4Document19 pagesBanking Sector Reform - Class4bando007No ratings yet

- Practical Exercise 2. Banking Sector Reforms - Narasimham Committee - Main RecommendationsDocument13 pagesPractical Exercise 2. Banking Sector Reforms - Narasimham Committee - Main RecommendationsSakthirama VadiveluNo ratings yet

- Banking Reforms 1991Document7 pagesBanking Reforms 1991asitbhatiaNo ratings yet

- Banking Operations 2 Answer KeyDocument48 pagesBanking Operations 2 Answer KeyManavAgarwalNo ratings yet

- Banking An Operations 2 Full PortionDocument126 pagesBanking An Operations 2 Full PortionManavAgarwalNo ratings yet

- BE PPT MergedDocument37 pagesBE PPT Mergeddimple.durgani.fms23No ratings yet

- Mergers in Indian Banking Sector-The Legal Framework, Role of RBI Vis-Avis Role of CCIDocument22 pagesMergers in Indian Banking Sector-The Legal Framework, Role of RBI Vis-Avis Role of CCISouvik Mukherjee100% (4)

- Narasimham Committee Recommendations 1991Document6 pagesNarasimham Committee Recommendations 1991Priya BhatterNo ratings yet

- Banking Sector Reforms - Narasimham Committee - Main RecommendationsDocument13 pagesBanking Sector Reforms - Narasimham Committee - Main RecommendationsSakthirama Vadivelu0% (1)

- Indian Financial SystemDocument23 pagesIndian Financial SystemSujeet KhadeNo ratings yet

- NBFC ModuleDocument168 pagesNBFC ModuleSAKET RATHI IPS Academy IndoreNo ratings yet

- Chapter 1 Banking An Operations 2Document27 pagesChapter 1 Banking An Operations 2ManavAgarwalNo ratings yet

- Financial Sector Reforms of 1991 and 1998Document7 pagesFinancial Sector Reforms of 1991 and 1998Mahek JainNo ratings yet

- BANKING SYSTEM The Indian Money Market Is Classified Into: TheDocument11 pagesBANKING SYSTEM The Indian Money Market Is Classified Into: Themkprabhu100% (1)

- Multiplicity of Financial InstrumentsDocument30 pagesMultiplicity of Financial InstrumentsSarath KumarNo ratings yet

- Indian Banking System AND Basic Banking ConceptsDocument19 pagesIndian Banking System AND Basic Banking ConceptsmanuyadavNo ratings yet

- Indian Banking System AND Basic Banking ConceptsDocument19 pagesIndian Banking System AND Basic Banking ConceptsNishu26No ratings yet

- Financial Sector ReformsDocument15 pagesFinancial Sector Reformslearnerme129No ratings yet

- Banking Sector ReformsDocument13 pagesBanking Sector ReformsSahil NayyarNo ratings yet

- Banking History - Structure 9 PDFDocument24 pagesBanking History - Structure 9 PDFAaron NadarNo ratings yet

- Banking Sector ReformsDocument14 pagesBanking Sector ReformsPravin ThoratNo ratings yet

- Banking SectorDocument12 pagesBanking SectorasifanisNo ratings yet

- Banking Environment and ObligationsDocument25 pagesBanking Environment and ObligationsSomesh DawaniNo ratings yet

- Banking Sector in IndiaDocument29 pagesBanking Sector in Indiahahire0% (1)

- Indian Financial System: Pravin S. Satpute Mba - Ii (Finance) Roll No. 24 Sangita Pund MBA - Ii (Finance) Roll No. 22Document23 pagesIndian Financial System: Pravin S. Satpute Mba - Ii (Finance) Roll No. 24 Sangita Pund MBA - Ii (Finance) Roll No. 22Arun KumarNo ratings yet

- Banking Sector ReformsDocument16 pagesBanking Sector ReformsDivya JainNo ratings yet

- TOPIC: Financial Sector Reforms: Name: Khalid Hassan Submitted To: Dr. Tosib AlamDocument25 pagesTOPIC: Financial Sector Reforms: Name: Khalid Hassan Submitted To: Dr. Tosib AlamOWAIS ZAHOOR BHATNo ratings yet

- Commercial Banking in India: Submitted By: Shaikh Azhar S. Roll No.28Document37 pagesCommercial Banking in India: Submitted By: Shaikh Azhar S. Roll No.28Ojas LeoNo ratings yet

- Banking Reforms CommitteesDocument24 pagesBanking Reforms CommitteesPratik KitlekarNo ratings yet

- MBF-705 Legal and Regulatory Aspects of Banking Supervision: Osman Bin SaifDocument50 pagesMBF-705 Legal and Regulatory Aspects of Banking Supervision: Osman Bin SaifAsad KhanNo ratings yet

- Rural Banking & Financial Institutions in India: Free E-BookDocument8 pagesRural Banking & Financial Institutions in India: Free E-BookPrasun KumarNo ratings yet

- Narasimhan CommitteeDocument10 pagesNarasimhan CommitteeAshwini VNo ratings yet

- Banking Law and Insurance - FINAL DRAFTDocument23 pagesBanking Law and Insurance - FINAL DRAFTAviral ChandraaNo ratings yet

- Unit 1Document83 pagesUnit 1Bothuka ShoheNo ratings yet

- Banking Sector ReformsDocument6 pagesBanking Sector ReformsM Abdul MoidNo ratings yet

- Recent Reforms in Commercial BankingDocument7 pagesRecent Reforms in Commercial BankingR SURESH KUMAR IINo ratings yet

- Regional Rural Banks - Indian Banking LawDocument28 pagesRegional Rural Banks - Indian Banking LawNeed NotknowNo ratings yet

- Banking Sector Reforms: by Bhupinder NayyarDocument18 pagesBanking Sector Reforms: by Bhupinder NayyarPraveen SinghNo ratings yet

- Tarapore Committee ReportDocument14 pagesTarapore Committee ReportChintakunta PreethiNo ratings yet

- Recommendations of Narsimham Committee 1&2Document20 pagesRecommendations of Narsimham Committee 1&2Ghanchi Imtiyazhusen U.No ratings yet

- Narasimham Committee Report I & IIDocument5 pagesNarasimham Committee Report I & IITejas Makwana0% (3)

- Main Features of The Interest-Free Banking Movement inDocument12 pagesMain Features of The Interest-Free Banking Movement inUmar SaeedNo ratings yet

- Eco Group 6Document29 pagesEco Group 6Rohan PaiNo ratings yet

- Sm-1 - Lesson 4 Economic Reforms in IndiaDocument15 pagesSm-1 - Lesson 4 Economic Reforms in IndiarahultelanganaNo ratings yet

- Ifs PPT 101-110Document39 pagesIfs PPT 101-110Dhaval PadhiyarNo ratings yet

- Banking Sector Reforms in IndiaDocument43 pagesBanking Sector Reforms in IndiaChandini KambapuNo ratings yet

- Emerging Issues in Finance Sector Inclusion, Deepening, and Development in the People's Republic of ChinaFrom EverandEmerging Issues in Finance Sector Inclusion, Deepening, and Development in the People's Republic of ChinaNo ratings yet

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No ratings yet

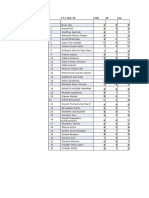

- Coding of Data SetDocument105 pagesCoding of Data SetHaritika ChhatwalNo ratings yet

- Solution Set For Mergers and Acquisitions MBA IIIDocument20 pagesSolution Set For Mergers and Acquisitions MBA IIIHaritika ChhatwalNo ratings yet

- Research Design Quantitative Analysis For DataDocument50 pagesResearch Design Quantitative Analysis For DataHaritika ChhatwalNo ratings yet

- FINANCIAL STATEMENT ANALYSISDocument7 pagesFINANCIAL STATEMENT ANALYSISHaritika ChhatwalNo ratings yet

- Hargreaves Et Al (2002) Perspectives - On - Alternative - Assessment - ReformDocument29 pagesHargreaves Et Al (2002) Perspectives - On - Alternative - Assessment - ReformHaritika ChhatwalNo ratings yet

- WS 9igcse Business April May 2018-19Document6 pagesWS 9igcse Business April May 2018-19Haritika ChhatwalNo ratings yet

- Ws 9igcse Business July 2018-19Document5 pagesWs 9igcse Business July 2018-19Haritika ChhatwalNo ratings yet

- Session 17-18 Consumer and Wholesale Banking (Autosaved)Document61 pagesSession 17-18 Consumer and Wholesale Banking (Autosaved)Haritika ChhatwalNo ratings yet

- Ws 9igcse Business October 2018-19Document3 pagesWs 9igcse Business October 2018-19Haritika ChhatwalNo ratings yet

- Giisacp Igcse10 BS 2018 19Document6 pagesGiisacp Igcse10 BS 2018 19Haritika ChhatwalNo ratings yet

- Syllabus OrientationDocument3 pagesSyllabus OrientationHaritika ChhatwalNo ratings yet

- CH 5 - Legal DimensionsDocument49 pagesCH 5 - Legal DimensionsHaritika ChhatwalNo ratings yet

- Assignment Food Nutrition 2019Document10 pagesAssignment Food Nutrition 2019Haritika ChhatwalNo ratings yet

- Session 1 - Fmi - 17 NovDocument10 pagesSession 1 - Fmi - 17 NovHaritika ChhatwalNo ratings yet

- SESSION 1-2 (Autosaved) (Autosaved)Document79 pagesSESSION 1-2 (Autosaved) (Autosaved)Haritika ChhatwalNo ratings yet

- Dias PresentationDocument12 pagesDias PresentationHaritika ChhatwalNo ratings yet

- Session - 1 FmiDocument17 pagesSession - 1 FmiHaritika ChhatwalNo ratings yet

- 6.1 Chapter 24 Government Economic Objectives: and PoliciesDocument59 pages6.1 Chapter 24 Government Economic Objectives: and PoliciesHaritika ChhatwalNo ratings yet

- Unit 1 RDM: February 2018Document16 pagesUnit 1 RDM: February 2018Haritika ChhatwalNo ratings yet

- Final Assignment Cardiogood FitnessDocument31 pagesFinal Assignment Cardiogood FitnessHaritika ChhatwalNo ratings yet

- Unit Five RDMDocument4 pagesUnit Five RDMHaritika ChhatwalNo ratings yet

- 8 IG A - CT1 - CompiledDocument2 pages8 IG A - CT1 - CompiledHaritika ChhatwalNo ratings yet

- Unit Four RDMDocument7 pagesUnit Four RDMHaritika ChhatwalNo ratings yet

- Unit Three RDMDocument12 pagesUnit Three RDMHaritika ChhatwalNo ratings yet

- Unit Two RDMDocument14 pagesUnit Two RDMHaritika ChhatwalNo ratings yet

- An Phasewise Empirical Analysis of Integration Between Nse and NyseDocument25 pagesAn Phasewise Empirical Analysis of Integration Between Nse and NyseHaritika ChhatwalNo ratings yet

- Possible Questions Business Management May 2019 - ALLDocument3 pagesPossible Questions Business Management May 2019 - ALLHaritika ChhatwalNo ratings yet

- India's Capital Market GrowthDocument9 pagesIndia's Capital Market GrowthHaritika ChhatwalNo ratings yet

- Swot AnalysisDocument4 pagesSwot AnalysisHaritika ChhatwalNo ratings yet

- Mickeystartsatextilebusinessaccontacyppt 150824161312 Lva1 App6891Document37 pagesMickeystartsatextilebusinessaccontacyppt 150824161312 Lva1 App6891Sandeep ManipatruniNo ratings yet

- Accounting/Series 4 2011 (Code30124)Document16 pagesAccounting/Series 4 2011 (Code30124)Hein Linn Kyaw100% (1)

- Corporate Finance Practice Questions MidDocument9 pagesCorporate Finance Practice Questions MidFrasat IqbalNo ratings yet

- Sometimes I Let Them Fill Up The CheckDocument4 pagesSometimes I Let Them Fill Up The CheckGrethel H SobrepeñaNo ratings yet

- The Accounting Cycle: Preparing An Annual Report: Irwin/Mcgraw-HillDocument36 pagesThe Accounting Cycle: Preparing An Annual Report: Irwin/Mcgraw-HillJumma KhanNo ratings yet

- PPTDocument35 pagesPPTShivam ChauhanNo ratings yet

- The International Monetary System Chapter 11Document23 pagesThe International Monetary System Chapter 11Ashi GargNo ratings yet

- Current Exchange RatesDocument4 pagesCurrent Exchange RatesmarkmwalimuNo ratings yet

- Make in IndiaDocument2 pagesMake in IndiaßläcklìsètèdTȜèNo ratings yet

- Measuring Macroeconomic Activity: © 2014 Pearson Education, IncDocument22 pagesMeasuring Macroeconomic Activity: © 2014 Pearson Education, IncchooisinNo ratings yet

- 2009 MFI BenchmarksDocument281 pages2009 MFI BenchmarksRogelio CuroNo ratings yet

- The Three Basic Macroeconomics RelationshipDocument5 pagesThe Three Basic Macroeconomics RelationshipNicole Echanes0% (1)

- Group 4 - MANAC Report - DraftDocument11 pagesGroup 4 - MANAC Report - DraftviewpawanNo ratings yet

- Classification, Rescheduling, Write OffDocument17 pagesClassification, Rescheduling, Write OffismailabtiNo ratings yet

- Leverages 1Document33 pagesLeverages 1mahato28No ratings yet

- M - Ch17 MacroeconomicsDocument32 pagesM - Ch17 MacroeconomicsKristel YeenNo ratings yet

- Strategy - Tejasvi RanaDocument6 pagesStrategy - Tejasvi RanaB AspirantNo ratings yet

- EE40 Homework 1Document2 pagesEE40 Homework 1delacruzrae12No ratings yet

- 4.model Problems On Final AccountsDocument4 pages4.model Problems On Final Accountsparth38No ratings yet

- Aqa Accn2 W QP Jun10Document12 pagesAqa Accn2 W QP Jun10Saadmani RahmanNo ratings yet

- Commercial Banks in India..Document21 pagesCommercial Banks in India..Dakshata GadiyaNo ratings yet

- Receivables ManagementDocument4 pagesReceivables ManagementVaibhav MoondraNo ratings yet

- 6001 01 Rms 20110817Document19 pages6001 01 Rms 20110817Tamzid KhanNo ratings yet

- 7110 s14 Ms 21Document8 pages7110 s14 Ms 21Muhammad UmairNo ratings yet

- Financial Management - 2 Marks Questions and AnswersDocument2 pagesFinancial Management - 2 Marks Questions and AnswersKumara Kannan Rengasamy100% (4)