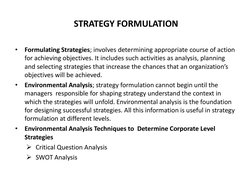

STRATEGY FORMULATION

Formulating Strategies; involves determining appropriate course of action

for achieving objectives. It includes such activities as analysis, planning

and selecting strategies that increase the chances that an organizations

objectives will be achieved.

Environmental Analysis; strategy formulation cannot begin until the

managers responsible for shaping strategy understand the context in

which the strategies will unfold. Environmental analysis is the foundation

for designing successful strategies. All this information is useful in strategy

formulation at different levels.

Environmental Analysis Techniques to Determine Corporate Level

Strategies

Critical Question Analysis

SWOT Analysis

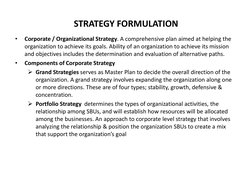

�STRATEGY FORMULATION

Corporate / Organizational Strategy. A comprehensive plan aimed at helping the

organization to achieve its goals. Ability of an organization to achieve its mission

and objectives includes the determination and evaluation of alternative paths.

Components of Corporate Strategy

Grand Strategies serves as Master Plan to decide the overall direction of the

organization. A grand strategy involves expanding the organization along one

or more directions. These are of four types; stability, growth, defensive &

concentration.

Portfolio Strategy determines the types of organizational activities, the

relationship among SBUs, and will establish how resources will be allocated

among the businesses. An approach to corporate level strategy that involves

analyzing the relationship & position the organization SBUs to create a mix

that support the organizations goal

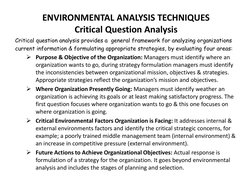

�ENVIRONMENTAL ANALYSIS TECHNIQUES

Critical Question Analysis

Critical question analysis provides a general framework for analyzing organizations

current information & formulating appropriate strategies, by evaluating four areas:

Purpose & Objective of the Organization: Managers must identify where an

organization wants to go, during strategy formulation managers must identify

the inconsistencies between organizational mission, objectives & strategies.

Appropriate strategies reflect the organizations mission and objectives.

Where Organization Presently Going: Managers must identify weather an

organization is achieving its goals or at least making satisfactory progress. The

first question focuses where organization wants to go & this one focuses on

where organization is going.

Critical Environmental Factors Organization is Facing: It addresses internal &

external environments factors and identify the critical strategic concerns, for

example; a poorly trained middle management team (internal environment) &

an increase in competitive pressure (external environment).

Future Actions to Achieve Organizational Objectives: Actual response is

formulation of a strategy for the organization. It goes beyond environmental

analysis and includes the stages of planning and selection.

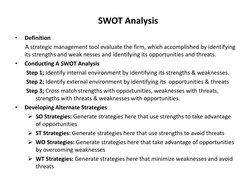

�SWOT Analysis

Definition

A strategic management tool evaluate the firm, which accomplished by identifying

its strengths and weak nesses and identifying its opportunities and threats.

Conducting A SWOT Analysis

Step 1; Identify internal environment by identifying its strengths & weaknesses.

Step 2; Identify external environment by identifying its opportunities & threats

Step 3; Cross match strengths with opportunities, weaknesses with threats,

strengths with threats & weaknesses with opportunities.

Developing Alternate Strategies

SO Strategies: Generate strategies here that use strengths to take advantage

of opportunities

ST Strategies: Generate strategies here that use strengths to avoid threats

WO Strategies: Generate strategies here that take advantage of opportunities

by overcoming weaknesses

WT Strategies: Generate strategies here that minimize weaknesses and avoid

threats

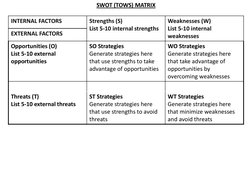

�SWOT (TOWS) MATRIX

INTERNAL FACTORS

Strengths (S)

List 5-10 internal strengths

Weaknesses (W)

List 5-10 internal

weaknesses

Opportunities (O)

List 5-10 external

opportunities

SO Strategies

Generate strategies here

that use strengths to take

advantage of opportunities

WO Strategies

Generate strategies here

that take advantage of

opportunities by

overcoming weaknesses

Threats (T)

List 5-10 external threats

ST Strategies

Generate strategies here

that use strengths to avoid

threats

WT Strategies

Generate strategies here

that minimize weaknesses

and avoid threats

EXTERNAL FACTORS

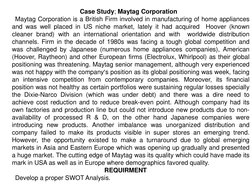

�Case Study; Maytag Corporation

Maytag Corporation is a British Firm involved in manufacturing of home appliances

and was well placed in US niche market, lately it had acquired Hoover (known

cleaner brand) with an international orientation and with worldwide distribution

channels. Firm in the decade of 1980s was facing a tough global competition and

was challenged by Japanese (numerous home appliances companies), American

(Hoover, Raytheon) and other European firms (Electrolux, Whirlpool) as their global

positioning was threatening. Maytag senior management, although very experienced

was not happy with the companys position as its global positioning was week, facing

an intensive competition from contemporary companies. Moreover, its financial

position was not healthy as certain portfolios were sustaining regular losses specially

the Dixie-Narco Division (which was under debt) and there was a dire need to

achieve cost reduction and to reduce break-even point. Although company had its

own factories and production line but could not introduce new products due to nonavailability of processed R & D, on the other hand Japanese companies were

introducing new products. Another imbalance was unorganized distribution and

company failed to make its products visible in super stores an emerging trend.

However, the opportunity existed to make a turnaround due to global emerging

markets in Asia and Eastern Europe which was opening up gradually and presented

a huge market. The cutting edge of Maytag was its quality which could have made its

mark in USA as well as in Europe where demographics favored quality.

REQUIRMENT

Develop a proper SWOT Analysis.

�Strengths

Opportunities

Quality is Maytag culture

Experienced top management

Vertical integration, as company

owns dedicated factories

Good employee relations

Hoovers international

orientation

Economic integration of

European Community

Demographics of Europe and

America favor quality appliance

Economic development of Asia

Opening of Eastern Europe

Trend to Super Stores

Weaknesses

Threats

Not process-oriented R&D

Distribution channels are weak

Finance position weak

Global positioning not favorable

Increasing government

regulations

Strong US competition

Whirlpool and Electrolux strong

Globally

New product advances

Japanese appliance companies

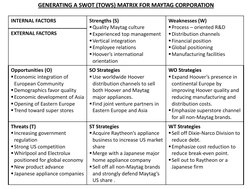

�GENERATING A SWOT (TOWS) MATRIX FOR MAYTAG CORPORATION

INTERNAL FACTORS

EXTERNAL FACTORS

Strengths (S)

Quality Maytag culture

Experienced top management

Vertical integration

Employee relations

Hoovers international

orientation

Weaknesses (W)

Process oriented R&D

Distribution channels

Financial position

Global positioning

Manufacturing facilities

Opportunities (O)

SO Strategies

Economic integration of

Use worldwide Hoover

European Community

distribution channels to sell

Demographics favor quality

both Hoover and Maytag

Economic development of Asia

major appliances.

Opening of Eastern Europe

Find joint venture partners in

Trend toward super stores

Eastern Europe and Asia

WO Strategies

Expand Hoovers presence in

continental Europe by

improving Hoover quality and

reducing manufacturing and

distribution costs.

Emphasize superstore channel

for all non-Maytag brands.

Threats (T)

Increasing government

regulation

Strong US competition

Whirlpool and Electrolux

positioned for global economy

New product advance

Japanese appliance companies

WT Strategies

Sell off Dixie-Narco Division to

reduce debt.

Emphasize cost reduction to

reduce break-even point.

Sell out to Raytheon or a

Japanese firm

ST Strategies

Acquire Raytheons appliance

business to increase US market

share

Merge with a Japanese major

home appliance company

Sell off all non-Maytag brands

and strongly defend Maytags

US share .

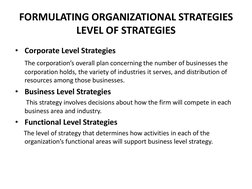

�FORMULATING ORGANIZATIONAL STRATEGIES

LEVEL OF STRATEGIES

Corporate Level Strategies

The corporations overall plan concerning the number of businesses the

corporation holds, the variety of industries it serves, and distribution of

resources among those businesses.

Business Level Strategies

This strategy involves decisions about how the firm will compete in each

business area and industry.

Functional Level Strategies

The level of strategy that determines how activities in each of the

organizations functional areas will support business level strategy.

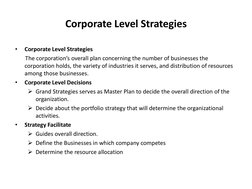

�Corporate Level Strategies

Corporate Level Strategies

The corporations overall plan concerning the number of businesses the

corporation holds, the variety of industries it serves, and distribution of resources

among those businesses.

Corporate Level Decisions

Grand Strategies serves as Master Plan to decide the overall direction of the

organization.

Decide about the portfolio strategy that will determine the organizational

activities.

Strategy Facilitate

Guides overall direction.

Define the Businesses in which company competes

Determine the resource allocation

�CORPORATE LEVEL STRATEGIES

Stability Strategy; Focuses on existing line or line of business & attempt

to maintain them. This strategy is useful in following situations;

An organization in no growth or low growth industry.

An organization that is of large size & dominates its markets.

Once further growth is costly, with detrimental effects on profitability.

Growth Strategy; A growth strategy that involves the acquisition of

organizations in existing line of business (competitors), as well as in other

industries or other line of businesses with a view to seek growth in sales,

profit and market share. Organization pursue growth by means of

Integrative and Diversification strategies.

Defensive Strategy; A grand strategy that involves reducing organizations

operations retrenchment & joint venture are the two defensive strategies.

Concentration Strategy; An organization focuses on single line of business.

This strategy is used by firms seeking to gain competitive advantage

through specialized knowledge & avoid managing too many businesses.

�Growth Strategies

Integrative Strategies

Vertical Integration; involves growth by acquiring supplier (backward

integration) or distributor (forward integration).

Horizontal Integration; involves growth by acquiring competing firms.

Intensive Strategies

Market Development; developing new market segments for current products.

Market Penetration; increasing sales of current products to current markets.

Product Development; offering new products to current market segments.

Diversification; a growth strategy by offering new products to new markets.

Diversification: A growth strategy that involves the acquisition of organizations in

other industries or other line of businesses.

Concentric Diversification; once acquired firm has similar marketing,

products, distribution channel and markets similar to those of purchaser firm.

Conglomerate Diversification; when acquired firm is in a completely different

line of business.

�Defensive Strategies

Retrenchment Strategies

Turnaround Strategy; strategy is employed when organization is performing

poorly but has not reached a critical stage. Entails getting rid of non-profitable

products, pruning workforce, reducing distribution outlets & selling assets.

Divestment Strategies: Involve in selling a particular business to improve its

financial position.

Harvest; a retrenchment strategy that involves minimizing investment and

maximizing short term profits while planning to sell or liquidate in long

term.

Liquidation Strategy; Business terminated assets sold off.

Bankrupted; organization seeks court protection to gain time and

opportunity to attempt a turnaround.

Mergers & Joint Ventures

Joint Venture; It occurs when two or more companies form a temporary

partnership for the purpose of capitalizing some opportunity.

Merger; A merger occurs when 2 or more organizations form an enterprise.

Once acquisition of merger in not desired by both parties, it is called a

takeover or hostile takeover.

�BUSINESS LEVEL STRATEGIES

Porters Generic Competitive Strategies

The level of strategy that determines how a company will compete in each of

its business units. Business level strategy is concerned with the way each

business approaches its market place.

Porters Generic Competitive business level strategies that organization can

adopt to achieve competitive advantage within their industries. These

strategies are considered generic because they can be applied in variety of

situations. Each require particular skills, resources and organizational

characteristics.

Three broad business level strategies are;

Cost leadership strategy. A generic competitive strategy that keeps cost

as low as possible to attract a broad market and to yield high profits.

Differentiation Strategy. A generic competitive strategy in which an

organization crafts a product that customers perceive to be distinctly

different from the competition.

Focus Strategy. In this strategy on organization concentrates on a limited

part of the market a limited product line or a confined geographic area.

�COST LEADRERSHIP STRATEGY; Keep cost as low as

possible to attract broad market and yield profit.

EFFECTIVENESS

REQUIREMENTS

RISKS

Buyers are sensitive to

To keep the price low high

price and always prefer low efficiency and low

price products.

overhead is mandatory.

War price is waged

resulting in less

profitability.

Normally buyers cant

differentiate between

brand and value.

Firm to undertake cost

control.

Competitors can imitate

strategy.

Underpriced competitors

can gain market share.

Reward link to cost

containment.

Firm must use technology

to achieve low production

cost.

�DIFFERENTATION STRATEGY; Customer perceive

product to be distinctively different

EFFECTIVENESS

REQUIREMENTS

Develop product by

carefully checking the

preferences and buyers

need.

Competitors should not

copy the uniqueness

quickly and cheaply.

Higher price can be

charged.

Production of a unique

product requires close

coordination between R &

D and Marketing Functions.

Can also be achieved

through superior service,

warranty & after sales

service.

RISKS

Uniqueness can at times be

quickly and cheaply

imitated.

�FOCUS STRATEGY; Concentrate on limited part of market,

product or geographic area.

EFFECTIVENESS

REQUIREMENTS

RISKS

Once competitors are not

specialized in that area.

Customers may change

preferences.

Customers have distinctive

preferences

Competitors may copy.

�Functional Level Strategies

Operations Strategy. Focuses on plant capacity, plant layout,

manufacturing / production processes. Important aspects are controlling

cost & improving efficiency.

Marketing Strategy. Focuses on developing determining markets for line

of business & developing effective marketing mix.

Financial Strategy. Focuses on forecasting, financial planning, evaluating

financial proposal & controlling financial resources. It contributes to

strategy formulation by assessing potential profits on various strategy

alternatives.

HR Strategy. Concerned with attracting, assessing, motivating & retaining

numbers & type of employees required to run business.

R&D Strategy. This strategy involves concept generation, planning &

development which are expensive and risky.

�Analyzing Business Portfolio

Business Portfolio; The collection of businesses & products that make-up of a

company.

Portfolio Strategy; An approach to corporate level strategy that involves analyzing

the relationship & positions of an organization SBUs to create a mix that will best

support achievement of organizational goals.

Business Portfolio Planning

Company must analyze current businesses & decide which business should

receive more attention

Develop future portfolios by developing strategies for growth & downsizing.

Purpose of Business Portfolio Model; are the tools for analyzing;

The relative position of each organizational business in the industry.

The relationships among all organizational business.

Approaches For Developing Portfolios

BCG Growth Share Matrix

GEs Multifactor Portfolio Matrix

��Businesses in Growth- Share Market

CELL

POSITION

CHARACTERISTIC /

REQUIREMENT

STRATEGY

QUESTION

MARK

New business in a

high growth, to

compete with

contemporaries.

Infusion of lot of funds &

this cell consume lot of

resources.

Management has to

decide about future.

Build Market Share /

Divest

STAR

A market leader in Organization has to spend Keeping up with market

high growth market money, thus cash using not growth rate & combat

cash generating

with competitors.

Build Market Share

CASH COW

Annual growth rate Cash is produced due to

is less than 10%

economy of scale & higher

profit & utilized to support

other businesses.

Hold Market Share

DOGS

Business with weak Generate low profits &

market share & low consume more

market growth.

management time than

worth.

Divest, or at times

management has a reason

to hold on dogs.

�Business Portfolio Model/Evaluation of Growth-Share Matrix

Merits of Growth-Share Matrix ; Its main contributions are; It encourages managers to view the formulation of organizational strategies in

terms of joint relationships among businesses and to take a long-range view.

The growth-share matrix acknowledges that businesses in different stages

have different cash requirements and make different contributions to

achieving organizational objectives.

The growth-share matrix is also a simple approach that provides an appealing

visual overview of an organizations business portfolio.

De-merits of Growth-Share Matrix; Variety of problems arises using this approach;

it should be used cautiously in strategy formulation. Salient problems are: The growth-share matrix focuses on balancing cash flows, whereas

organizations are more interested in the ROI that various businesses yield.

It is not always clear what share of what market is relevant in the analysis.

Many other factors besides market share and growth rate are critical in

strategy formulation.

The growth-share matrix does not provide direct assistance in comparing

different businesses in terms of investment opportunities.

��MARKET ATTRACTIVENESS & BUSINESS STRENGTH FACTORS

FACTORS

Industry

Attractiveness

Business

Strength

Overall market size

Annual market growth rate

Historical profit margin

Competitive intensity

Technological requirements

Inflationary vulnerability

Energy requirements

Environmental impact

Social / political / legal

Market share

Share growth

Product quality

Brand reputation

Distribution network

Promotional effectiveness

Productive capacity

Productive efficiency

Unit costs

Material supplies

R&D performance

Managerial personnel

RATING

(1-5)

WEIGHT

0.20

0.20

0.15

0.15

0.15

0.05

0.05

0.05

Must

acceptable

0.10

0.15

0.10

0.10

0.05

0.05

0.05

0.05

0.15

0.05

0.10

0.05

1.00

VALUE

4

5

4

2

4

3

2

3

0.80

1.00

0.60

0.30

0.60

0.15

0.10

0.15

4

2

4

5

4

3

3

2

3

5

3

4

0.40

0.30

0.40

0.50

0.20

0.15

0.15

0.10

0.45

0.25

0.30

0.20

3.40

be

�RECOMMENDED STRATEGIES

Protect Position

Invest to grow at maximum

digestible rate

Concentrate of effort on

maintaining strength

Build Selectively

Challenge for leadership

Build selectively on strengths

Reinforce vulnerable areas

Selectivity / Manage

Invest heavily in most attractive

segments

Build ability to combat competition

Profitability through productivity

Protect & Refocus

Build Selectively

Invest To Build

Protect existing program

Concentrate

investments

in

segments where profitability is

good and risks are relatively low

Manage for Earnings

Manage for current earnings

Concentrate an attractive segments

Defend strengths

Protect position in most profitable

segments

Upgrade product line

Minimize investment

Specialize around limited strengths

Seek ways to overcome

weaknesses

Withdraw if indications of growth

lacking

Harvest

Look for ways to expand without

high risks otherwise minimize

investment

and

rationalize

operations

Divest

Sell at time that will maximize cash

value

Cut fixed costs and avoid

investment meanwhile

�GES Multifactor Portfolio Matrix

Merits; This approach has several advantages over growth-share matrix;

It provides a mechanism for including a host of relevant variables in the

process of formulating strategies.

The two dimensions of industry attractiveness and business strength are

excellent criteria for rating potential business success.

The approach forces managers to be specific about their evaluations of the

impact of particular variables on overall business success.

Demerits; it also suffers with some of the limitations;

It does not solve the problem of determining the appropriate market.

It does not offer anything more than general strategy recommendations.

�STRATEGY FORMULATION CONSTRAINTS & SELECTION CRITERIA

Strategy Formulation Constraints

Availability of Financial Resources; even when a particular strategy appears

optimal for an organization, serious consideration must be given to where the

money to finance the strategy is going to come from.

Attitude towards Risk; some firms are willing to accept minimal level of risk,

regardless the level of potential return. In such cases acceptable strategy be

limited and those expose the firm to little risk.

Organization Capabilities; at times excellent strategies require capabilities

beyond those an organization currently possesses.

Channel Relationship; strategy that call for development of new channel of

distribution or that involves new suppliers requires careful consideration.

Competitive Retaliation; some strategists may have the unintended effect of

dramatically increasing competitors efforts in the marketplace.

Strategy Selection Criteria

They are responsive to external environment

They provide adequate flexibility for the business and organization.

They control firms to organization mission and long term objectives.

They are organizationally feasible.