INDEX NUMBERS

Presented by- neha mehta(4222)

B.COM - I

- smriti rana(4276)

�CONTENTS

Introduction

Definition

Uses

Characteristics

Classification

Problems

Methods

Value index numbers

Chain base index

Fixed base index

Base conversion

�INTRODUCTION

A simple index number measures the

relative change in one or more than

one variable.

An index number measures the relative

change in price, quantity, value, or

some other item of interest from one

time period to another.

.

�WHAT IS AN INDEX NUMBER

An index number measures how much

a variable changes over time.

We calculate the index number by

finding the ratio of the current value to

a base value.

�USES OF INDEX NUMBERS

To

simplify complexities.

Helpful

Useful

in Business.

Helpful

To

in comparison.

in Predictions.

measure purchasing power.

�CHARACTERISTICS OF INDEX NUMBERS

Index numbers measure the change

in the level of a phenomenon.

Index numbers are specialized

averages.

Index numbers measure the effect of

changes over a period of time.

�CLASSIFICATION OF INDEX NUMBERS

Price Index

Quantity Index

Value Index

�PROBLEMS RELATED TO INDEX NUMBERS

Selection

Selection

Selection

Selection

Selection

Selection

of

of

of

of

of

of

Items.

Prices.

Base Year.

Weights.

An Average.

An Appropriate Formula.

�METHODS OF CONSTRUCTING

INDEX NUMBERS

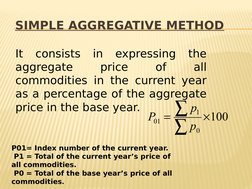

�SIMPLE AGGREGATIVE METHOD

It consists in expressing the

aggregate

price

of

all

commodities in the current year

as a percentage of the aggregate

price in the base year.

p1

P01

P01= Index number of the current year.

P1 = Total of the current years price of

all commodities.

P0 = Total of the base years price of all

commodities.

100

�EXAMPLE

From the data given below construct the

index number for the year 2007 on the base

year 2008 in Rajasthan state.

COMMODITIES

UNITS

PRICE (Rs)

2007

Sugar

Quintal

2200

3200

Milk

Quintal

18

20

Oil

Litre

68

71

Wheat

Quintal

900

1000

Clothing

Meter

50

60

PRICE (Rs)

2008

�SOLUTION :

COMMODITIES

UNITS

PRICE (Rs)

2007

Sugar

Quintal

2200

3200

Milk

Quintal

18

20

Oil

Litre

68

71

Wheat

Quintal

900

1000

Clothing

Meter

50

60

index Number for

2008-

P01

p0 3236

PRICE (Rs)

2008

4351

4351

100

100 134.45

3236

0

It means the prize in 2008 were 34.45% higher than the

�SIMPLE AVERAGE OF RELATIVES METHOD.

The current year price is expressed as a price

relative of the base year price. These price

relatives are then averaged to get the index

number. The average used could be

arithmetic mean, geometric mean or even

p1

median.

p 100

0

P01

N

hen geometric mean is used-

log P01

p1

log p 100

0

�EXAMPLE:

From the data given below construct

the index number for the year 2008

taking 2007 as by using arithmetic

mean.

Commodities

Price (2007)

Price (2008)

P

10

10

12

12

�SOLUTIONCommodities

Price (2007)

Price (2008)

10

166.7

12

16.67

150.0

10

12

120.0

12

150.0

p1

p 100 603.37

P01 0

120.63

N

5

Price

Relative

p1

=603.37

100

p

0

�Weighted Index Numbers

These are those index numbers in which rational weights are

assigned to various chains in an explicit fashion.

(A)Weighted aggregative index numbersThese index numbers are the simple aggregative

type with the fundamental difference that weights

are assigned to the various items included in the

index.

(Dorbish and bowleys method.

(Fishers ideal method.

(Marshall-Edgeworth method.

(

Laspeyres method.

(

Paasche method.

(Kellys method.

�LASPEYRES

METHOD

This method was devised by Laspeyres in

1871. In this method the weights are

determined by quantities in the base.

p01

pq

p q

1 0

0 0

100

�PAASCHES METHOD.

This method was devised by a German

statistician Paasche in 1874. The weights of

current year are used as base year in

constructing the Paasches Index number.

p01

pq

p q

1 1

0

100

�DORBISH & BOWLEYS METHOD:

This method is a combination of Laspeyres and

Paasches methods. If we find out the

arithmetic average of Laspeyres and Paasches

index we get the index suggested by Dorbish &

Bowley.

p01

pq pq

p q p q

1 0

1 1

0 0

0 1

100

�FISHERS IDEAL INDEX:

Fishers deal index number is the geometric

mean of the Laspeyres and Paasches index

numbers.

P01

pq pq

100

pq pq

1

�MARSHALL-EDGEWORTH METHOD:

In this index the numerator consists of an

aggregate of the current years price multiplied

by the weights of both the base year as well as

the current year.

p01

p q p q

p q p q

1 0

1 1

0 0

0 1

100

�KELLYS METHOD:

Kelly thinks that a ratio of aggregates with

selected weights (not necessarily of base year

or current year) gives the base index number.

p01

pq

100

p q

1

q refers to the quantities of the year which is

selected as the base. It may be any year,

either base year or current year.

�EXAMPLE:

Given below are the price quantity data,

with price quoted in Rs. per kg and

production in qtls.

Find- (1) Laspeyers Index (2) Paasches

Index (3)Fisher Ideal Index.

PRODUCTION

PRICE

PRODUCTION

15

500

20

600

MUTTON

18

590

23

640

CHICKEN

22

450

24

500

ITEMS

PRICE

BEEF

�SOLUTIO

N:

ITEMS

PRICE

PRODUC

TION

PRICE

PRODU

CTION

p1q0 p0 q0 p q p0 q1

1 1

BEEF

15

500

20

600

10000

7500

12000

9000

MUTTON

18

590

23

640

13570

10620

14720

11520

CHICKEN

22

450

24

500

10800

9900

12000

11000

34370

28020

38720

31520

TOTAL

�SOLUTION:

1.)Laspeyres index:

p01

pq

p q

1 0

0

34370

100

100 122.66

28020

2.) Paasches Index :

p01

pq

p q

38720

100

100 122.84

31520

1

1 1

0

�3.) FISHER IDEAL

INDEX:

P01

pq pq

100

p

q

p

q

34370 38720

100 122.69

28020 31520

�WEIGHTED AVERAGE OF PRICE

RELATIVE:

In weighted Average of relative, the price

relatives of the base year price. These price

relatives are multiplied by the respective

weight of items. These products are added up

and divided by the sum of weights.

Weighted arithmetic mean of price relative-

P1

P

100

P0

P01

PV

V

P=Price relative

V=Value weights = 0

p q0

�VALUE INDEX NUMBERS

Value is the product of price and quantity.

A simple ratio is equal to the value of the

current year divided by the value of base

year. If the ratio is multiplied by 100 we

get the value indexnumber.

V

p1q1

pq

0

100

�CHAIN BASE INDEX NUMBERS

Chain base index is that index number in which the year

immediately preceeding the one is taken as base year.

Steps in construction of Chain base index

1)Computation of link relatives :

Link Relatives = Current Years Price 100

Previous Years Price

2) Conversion of link relatives into chain base index :

Chain Base Index= LR of current year Chain Index of

Previous Year

100

�EXAMPLE: CONSTRUCT CHAIN

BASE INDEX

Year

Price

1985

1986

1987

1988

1989

1990

94

98

102

95

98

100

�Years

Prices

Link Relatives

Chain Base

Index

1985

94

100

100

98 100 = 104.3

94

104.3 100 =

104.3

100

1986

98

1987

102

102 100 =

104.1

98

104.1 104.3=

108.6

100

1988

95

95 100 = 93.1

102

93.1 108.6 =

101.1

100

1989

98

98 100 = 103.2

95

103.2 101.1=

104.3

100

1990

100

100 100 = 102

98

102 104.3=

106.4

�FIXED BASE INDEX NUMBERS

In Fixed base index, the base year remains fixed.

For example: We take 1990 as base year for 1991

and1992.

Steps in construction of Fixed Base Index :

1) Computation of Price Relatives

Price Relatives = Current Years Price 100

Base Years Price

Example: Calculate Chain Base Index

Year Index.

199 199 199 199 199 199 199

and Fixed

Price

31

22

28

24

30

27

25

�Solution :

Year

Price

Link

relatives

CBI

FBI

1992

31

100

100

100

1993

22

70.96

70.96

70.96

1994

28

127.27

90.30

90.3

1995

24

85.71

77.40

77.4

1996

30

125.00

96.75

96.77

1997

27

90.00

87.07

87.09

1998

25

92.59

80.61

80.64

�BASE CONVERSION

1) Conversion of CBI into FBI

Current Years FBI =Current

years

CBIPrevious Years FBI

100

2) Conversion of FBI into CBI

Current Years CBI =

Current Years

FBI 100

Previous

Years FBI

�THANK YOU