Professional Documents

Culture Documents

Historyofbanking 150804185358 Lva1 App6892

Historyofbanking 150804185358 Lva1 App6892

Uploaded by

Jose Luis Ttito SanchezOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Historyofbanking 150804185358 Lva1 App6892

Historyofbanking 150804185358 Lva1 App6892

Uploaded by

Jose Luis Ttito SanchezCopyright:

Available Formats

The History of Banking in One Chart

By John J. Maxfield (@OneMarlandRoad)

2,000

Annual

1,500Bank Failures

1,000

500

0

Year

A Chart About Bank Failures

e is no more powerful force in the U.S. bank industry than the credit cycle the

ating pattern of booms and busts that gave us the Roaring Twenties and the

Depression; the housing bubble and the Financial Crisis. Nothing better capture

redit cycles savagery than the failures left in its wake. More than 17,000 banks

gone under since 1865, equating to an annual average of 115 over the past 150

2,000

Annual

1,500Bank Failures

1,000

500

0

Year

he National Banking Acts of 1863 & 1864

e starting point for any conversation about bank history is the Civil War, or, to

more precise, the National Banking Acts of 1863 and 1864. These created the

nk system we know today by (1) monopolizing the printing of bank notes

., issuing money) by the federal government, and (2) providing a mechanism

ough which banks could acquire national, as opposed to state, charters.

2,000

Annual

1,500Bank Failures

1,000

500

0

Year

he Gilded Age: The Civil War to the Panic of 1907

Gilded Age, a term coined by Mark Twain, was a particularly volatile episode

ank history. Thanks to rapid economic expansion fueled by the American indust

olution as well as lax regulatory oversight, bank failures became a common

urrence. Two crises in particular, the Panics of 1873 and 1893, ignited full-blown

nomic depressions.

2,000

Annual

1,500Bank Failures

1,000

500

0

Year

913: Creation of the Federal Reserve

Federal Reserve was created in 1913 in an effort to reduce, if not stop, the frequ

urrence of banking panics. To this end, it was empowered to lend hard currency t

ks besieged by depositors withdrawing their money en masse. The theory was

, by providing access to all the currency sound banks needed to meet withdrawa

uests, it would remove depositors incentive to run on banks in the first place.

2,000

Annual

1,500Bank Failures

1,000

500

0

Year

Agricultural Depression of the 1920s

r World War I ended, the demand for American agricultural products plunged

ughout Europe. Farmers on the continent were again free to produce crops and

warring parties no longer needed the profusion of supplies to feed their armies.

es for corn, tobacco, and other crops plummeted in the U.S., taking thousands of

all rural banks down too, as farmers could no longer afford to service their loans.

2,000

Annual

1,500Bank Failures

1,000

500

0

Year

he Great Depression of the 1930s

owing a decade of excess throughout urban America, the stock market crashed i

9. In an effort to calm global markets and maintain the international gold standa

Federal Reserve unwittingly aggravated the situation by raising interest rates an

ting the money supply. The Great Depression followed, leaving more than 5,000

ed banks in its wake.

2,000

Annual

1,500Bank Failures

1,000

500

0

Year

The Great Moderation: 1945-1975

nk historians call the unusually quiet period from the end of World War II to the m

70s the Great Moderation. Few banks failed over this stretch thanks to (1) increas

ulatory oversight under FDRs New Deal legislation, (2) heightened conservatism

ong bankers with firsthand experience of the Great Depression, (3) rapid econom

ansion following the war, and (4) the introduction of national deposit insurance.

2,000

Annual

1,500Bank Failures

1,000

500

0

Year

he OPEC Oil Embargos of 1973 & 1979

Cs twin oil embargoes in the 1970s, a response to Americas support for Israel in

3 Yom Kippur War, set off a series of events that changed banking forever. Most

ortantly, high oil prices accelerated inflation, which then caused the Federal Rese

aise short-term interest rates to nearly 20%. This triggered a deep recession in 19

caused banks to hemorrhage net interest income.

2,000

Annual

1,500Bank Failures

1,000

500

0

Year

The 1980s: A Most Volatile Decade

1970s turmoil culminated in 3 distinct financial crises a decade later. (1) An ene

s fueled by high gas prices led to the first too-big-to-fail bank, Continental Illinois

ch was nationalized by the FDIC in 1984. (2) High funding costs from the Feds as

nflation yielded the S&L Crisis. (3) And the recycling of petrodollars from oil prod

loans to Latin American governments caused the Less Developed Country Crisis

2,000

Annual

1,500Bank Failures

1,000

500

0

Year

1990s: The Mergers of Equals

n effort to make the bank industry more resilient to regional economic downturn

the stiflingly high short-term interest rates of the 1980s, Congress deregulated t

ustry by, among other things, allowing banks to operate across interstate lines on

onwide basis for the first time in history. This sparked a wave of bank mergers

ergers of equals that gave us the coast-to-coast branch networks we know tod

2,000

Annual

1,500Bank Failures

1,000

500

0

Year

The Financial Crisis of 2008-09

s own, the financial crisis of 2008-09 seems to pale in comparison to the severity

e combined crises of the 1980s to say nothing of the Great Depression. But bec

me on the heels of the 1990s merger wave, the banks that did fail were almost

cognizably massive compared to earlier periods. Thanks to imprudent bets on

rime mortgages, more than 500 lenders have since ceased operations.

2,000

Annual

1,500Bank Failures

1,000

500

0

Year

Looking for more information like this?

e Motley Fools mission is to help the world invest better. Weve done this over th

st 20 years by thinking long term and outside the box even if that means turnin

ll Street on its head. To learn more about what The Motley Fool thinks about curr

estment trends, and receive a special free report about what might be the next b

ustry to come out of Silicon Valley, simply click here now.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Bfs Foreclosed Properties Listing As of 2017-04-12 PublicDocument14 pagesBfs Foreclosed Properties Listing As of 2017-04-12 PublicCianPanganibanNo ratings yet

- Euro Crisis Summary PDFDocument2 pagesEuro Crisis Summary PDFJustinNo ratings yet

- Debt Elimination Discharge Set Off, Law, TruthDocument5 pagesDebt Elimination Discharge Set Off, Law, TruthLandiBrown100% (7)

- The Great Depression Scavenger HuntDocument2 pagesThe Great Depression Scavenger Huntvickiajones60% (5)

- Bfs Property Listing For Posting As of 10.01.2018 PublicDocument10 pagesBfs Property Listing For Posting As of 10.01.2018 PublicCedric Recato DyNo ratings yet

- GFC2007Document15 pagesGFC2007Nur Hidayah JalilNo ratings yet

- Fool's Gold-Gillian TettDocument14 pagesFool's Gold-Gillian TettAnkit KhandelwalNo ratings yet

- 2008 Recession Explained in Hindi ? 2008 Financial Crisis के मुख्य कारण - Live Hindi FactsDocument4 pages2008 Recession Explained in Hindi ? 2008 Financial Crisis के मुख्य कारण - Live Hindi FactsPrayas GambhirNo ratings yet

- Lessons From Collapse - Lehman Brothers (Eco)Document19 pagesLessons From Collapse - Lehman Brothers (Eco)sweet_hitiksha299942No ratings yet

- Combating The Judicial Foreclosure Slaughterhouse Aug 4th 530pm West Palm Beach FL Monthly Happy HourDocument1 pageCombating The Judicial Foreclosure Slaughterhouse Aug 4th 530pm West Palm Beach FL Monthly Happy HourForeclosure FraudNo ratings yet

- A Reporter at Large: Eight Days, The Battle To Save The American Financial SystemDocument24 pagesA Reporter at Large: Eight Days, The Battle To Save The American Financial SystemBeer100% (1)

- Too Big To Fail Guided Notes 57Document2 pagesToo Big To Fail Guided Notes 57api-305090576No ratings yet

- Great Depression JeopardyDocument54 pagesGreat Depression Jeopardyapi-320776211No ratings yet

- Project 3 FinalDocument11 pagesProject 3 Finalapi-261340346No ratings yet

- Lecture 16Document12 pagesLecture 16Tanya SinghNo ratings yet

- Financial CrisisDocument25 pagesFinancial Crisisnuwan tharakaNo ratings yet

- The 2007Document3 pagesThe 2007Jeremy Bustamante100% (1)

- Economic Crisis, Causes and ReformsDocument12 pagesEconomic Crisis, Causes and ReformsVinit TrivediNo ratings yet

- What Is A 'Financial Crisis?'Document3 pagesWhat Is A 'Financial Crisis?'Abdul Ahad SheikhNo ratings yet

- Economic CrisisDocument3 pagesEconomic Crisisshoaibishrat_87No ratings yet

- Case StudyDocument2 pagesCase StudyJames Bryle GalagnaraNo ratings yet

- The Stock Market Crash and The Great DepressionDocument10 pagesThe Stock Market Crash and The Great DepressionJaysonNo ratings yet

- APUSH SynthesisDocument1 pageAPUSH SynthesisthaticeskatergirlNo ratings yet

- Apresentação Mauricio BenvenuttiDocument51 pagesApresentação Mauricio BenvenuttiKim ReisNo ratings yet

- Heta Asset Resolution AgDocument2 pagesHeta Asset Resolution AgSouthey CapitalNo ratings yet

- Political Economy, Vol. 108 No. 1, 1-33: Daftar PustakaDocument3 pagesPolitical Economy, Vol. 108 No. 1, 1-33: Daftar PustakaRian SopianNo ratings yet

- CDO and Synthetic CDODocument3 pagesCDO and Synthetic CDOJIGYASA KUMARINo ratings yet

- Presentation About Financial Crisis 2008Document16 pagesPresentation About Financial Crisis 2008Schanzae ShabbirNo ratings yet

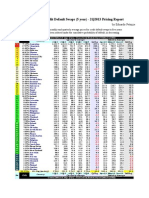

- Sovereign Credit Default Swaps (5 Year) - 2Q2013 Pricing ReportDocument1 pageSovereign Credit Default Swaps (5 Year) - 2Q2013 Pricing ReportEduardo PetazzeNo ratings yet

- الأزمة المالية العالمية 2008 جذورها و تداعياتها ساعد مرابط PDFDocument15 pagesالأزمة المالية العالمية 2008 جذورها و تداعياتها ساعد مرابط PDFساعدNo ratings yet