0% found this document useful (0 votes)

2K views29 pagesInterest Rate and Currency Swaps

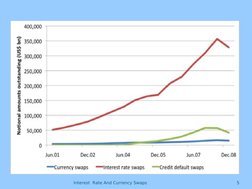

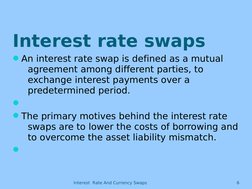

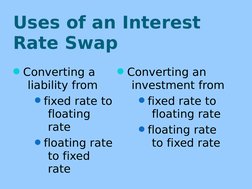

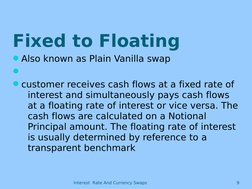

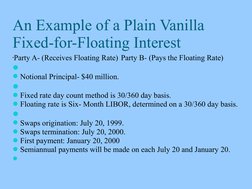

The document discusses different types of financial swaps, including interest rate swaps and currency swaps. It provides background on the origins of swaps in 1981 with currency swaps between IBM and the World Bank. Interest rate swaps later emerged as an alternative method to manage asset-liability mismatches and lower borrowing costs. The document then describes various types of interest rate swaps and currency swaps, including plain vanilla, floating-floating, callable, and putable swaps. It provides examples of fixed-floating interest rate and currency swaps and discusses valuation methods for swaps.

Uploaded by

sheetal221237269Copyright

© Attribution Non-Commercial (BY-NC)

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPTX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

2K views29 pagesInterest Rate and Currency Swaps

The document discusses different types of financial swaps, including interest rate swaps and currency swaps. It provides background on the origins of swaps in 1981 with currency swaps between IBM and the World Bank. Interest rate swaps later emerged as an alternative method to manage asset-liability mismatches and lower borrowing costs. The document then describes various types of interest rate swaps and currency swaps, including plain vanilla, floating-floating, callable, and putable swaps. It provides examples of fixed-floating interest rate and currency swaps and discusses valuation methods for swaps.

Uploaded by

sheetal221237269Copyright

© Attribution Non-Commercial (BY-NC)

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPTX, PDF, TXT or read online on Scribd

- Introduction

- Meaning of Financial Swaps

- Background

- Types of Swaps

- Interest Rate Swaps

- Currency Swaps