Professional Documents

Culture Documents

Managerial Accounting and Cost Concepts

Managerial Accounting and Cost Concepts

Uploaded by

jpschultzOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Managerial Accounting and Cost Concepts

Managerial Accounting and Cost Concepts

Uploaded by

jpschultzCopyright:

Available Formats

Managerial Accounting and Cost

Concepts

Chapter 02

PowerPoint Authors:

Susan Coomer Galbreath, Ph.D., CPA

Charles W. Caldwell, D.B.A., CMA

Jon A. Booker, Ph.D., CPA, CIA

Cynthia J. Rooney, Ph.D., CPA

2-2

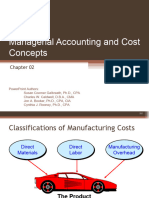

Classifications of Manufacturing Costs

Direct

Direct

Materials

Materials

Direct

Direct

Labor

Labor

The Product

Manufacturing

Manufacturing

Overhead

Overhead

2-3

Direct Materials

Raw materials that become an integral

part of the product and that can be

conveniently traced directly to it.

Example:

Example: A

A radio

radio installed

installed in

in an

an automobile

automobile

2-4

Direct Labor

Those labor costs that can be easily

traced to individual units of product.

Example:

Example: Wages

Wages paid

paid to

to automobile

automobile assembly

assembly workers

workers

2-5

Manufacturing Overhead

Manufacturing costs that cannot be easily

traced directly to specific units produced.

Examples:

Examples: Indirect

Indirect materials

materials and

and indirect

indirect labor

labor

2-6

Nonmanufacturing Costs

Administrative

Costs

All executive,

organizational, and

clerical costs.

2-7

Product Costs Versus Period Costs

Product costs include

direct materials, direct

labor, and

manufacturing

overhead.

Inventory

Cost of Good Sold

Period costs include all

selling costs and

administrative costs.

Expense

Sale

Balance

Sheet

Income

Statement

Income

Statement

2-8

Classifications of Costs

Manufacturing costs are often

classified as follows:

Direct

Material

Direct

Labor

Prime

Cost

Manufacturing

Overhead

Conversion

Cost

2-9

Variable Cost

Total Texting Bill

Your total texting bill is based on how

many texts you send.

Number of Texts Sent

2-10

Variable Cost Per Unit

Cost Per Text Sent

The cost per text sent is constant at

5 cents per text message.

Number of Texts Sent

2-11

The Activity Base (Cost Driver)

Machine

hours

Units

produced

A measure of what

causes the

incurrence of a

variable cost

Miles

driven

Labor

hours

2-12

Fixed Cost

Monthly Cell Phone

Contract Fee

Your monthly contract fee for your cell phone is

fixed for the number of monthly minutes in your

contract. The monthly contract fee does not

change based on the number of calls you make.

Number of Minutes Used

Within Monthly Plan

2-13

Fixed Cost Per Unit

Monthly Cell Phone

Contract Fee

Within the monthly contract allotment, the average fixed cost per

cell phone call made decreases as more calls are made.

Number of Minutes Used

Within Monthly Plan

2-14

Types of Fixed Costs

Committed

Discretionary

Long-term, cannot be

significantly reduced in

the short term.

May be altered in the

short-term by current

managerial decisions

Examples

Examples

Depreciation on Buildings

and Equipment and Real

Estate Taxes

Advertising and

Research and

Development

2-15

The Linearity Assumption and the Relevant

Range

Total Cost

Economists

Curvilinear Cost

Function

Relevant

Range

A

A straight

straight line

line

closely

closely

approximates

approximates aa

curvilinear

curvilinear

variable

variable cost

cost

line

line within

within the

the

relevant

relevant range.

range.

Accountants Straight-Line

Approximation (constant

unit variable cost)

Activity

2-16

Rent Cost in Thousands

of Dollars

Fixed Costs and the Relevant Range

90

Relevant

60

Range

30

0

The

The relevant

relevant range

range

of

of activity

activity for

for aa fixed

fixed

cost

cost is

is the

the range

range of

of

activity

activity over

over which

which

the

the graph

graph of

of the

the

cost

cost is

is flat.

flat.

1,000

2,000

3,000

Rented Area (Square Feet)

2-17

Mixed Costs

Total Utility Cost

al

t

o

T

d

e

x

mi

t

s

o

c

Variable

Cost per KW

Activity (Kilowatt Hours)

Fixed Monthly

Utility Charge

2-18

End of Chapter 02

You might also like

- CH - 02 - Cost Terms, Concepts and Classifications With Mixed Cost AnalysisDocument84 pagesCH - 02 - Cost Terms, Concepts and Classifications With Mixed Cost AnalysisankonmahmudNo ratings yet

- Costs Terms, Concepts and Classifications: Chapter TwoDocument40 pagesCosts Terms, Concepts and Classifications: Chapter TwoWilliam Masterson ShahNo ratings yet

- Managerial Accounting and Cost ConceptsDocument44 pagesManagerial Accounting and Cost ConceptsQUANG NGUYỄN VINHNo ratings yet

- Costs Terms, Concepts and Classifications: Chapter TwoDocument40 pagesCosts Terms, Concepts and Classifications: Chapter TwokorpseeNo ratings yet

- Chap002 Cost TermsDocument41 pagesChap002 Cost TermsNgái Ngủ100% (1)

- Basic Cost Management Concepts: Mcgraw-Hill/IrwinDocument52 pagesBasic Cost Management Concepts: Mcgraw-Hill/IrwinDaMin ZhouNo ratings yet

- Managerial Accounting Chap 2Document72 pagesManagerial Accounting Chap 2Sankary CarollNo ratings yet

- Managerial Accounting and Cost ConceptsDocument18 pagesManagerial Accounting and Cost ConceptsrisaNo ratings yet

- Cost ConceptsDocument43 pagesCost ConceptsProfessorAsim Kumar MishraNo ratings yet

- Garrison Lecture Chapter 2Document61 pagesGarrison Lecture Chapter 2Ahmad Tawfiq Darabseh100% (2)

- CHAPTER 2 Question SolutionsDocument3 pagesCHAPTER 2 Question Solutionscamd1290100% (1)

- SPPTChap 002Document16 pagesSPPTChap 002saharinshakib7505No ratings yet

- Costacctg13 SM ch02Document26 pagesCostacctg13 SM ch02Yenny TorroNo ratings yet

- Managerial Accounting and Cost ConceptsDocument19 pagesManagerial Accounting and Cost ConceptsFarhan RabbehNo ratings yet

- Hilton Chapter 2 Assigned Homework Exercises 10thDocument9 pagesHilton Chapter 2 Assigned Homework Exercises 10thWynona Gaile PagdonsolanNo ratings yet

- Basic Cost Accounting ConceptsDocument53 pagesBasic Cost Accounting ConceptsHassham YousufNo ratings yet

- Managerial Accounting and Cost ConceptsDocument18 pagesManagerial Accounting and Cost ConceptsadamNo ratings yet

- Managerial Accounting and Cost ConceptsDocument61 pagesManagerial Accounting and Cost ConceptsBobbles D LittlelionNo ratings yet

- Khanda Habeeb RaheemDocument12 pagesKhanda Habeeb RaheemHarith EmaadNo ratings yet

- Basic Management Accounting ConceptsDocument33 pagesBasic Management Accounting ConceptsNur Ravita HanunNo ratings yet

- Chapter 2 UpdatedDocument58 pagesChapter 2 Updatedbing bongNo ratings yet

- An Introduction To Cost Terms and Purposes 2-1Document33 pagesAn Introduction To Cost Terms and Purposes 2-1Moayad TeimatNo ratings yet

- Cost Terms, Concepts, and ClassificationsDocument33 pagesCost Terms, Concepts, and ClassificationsKlub Matematika SMANo ratings yet

- Cost Concept and ClassificationDocument45 pagesCost Concept and ClassificationMountaha0% (1)

- Chapter 2 Managerial Accounting and Cost ConceptsDocument49 pagesChapter 2 Managerial Accounting and Cost ConceptsFarihaNo ratings yet

- Managerial Accounting and Cost ConceptsDocument61 pagesManagerial Accounting and Cost ConceptsAmer Wagdy GergesNo ratings yet

- Ch02, MGMT Acct, HansenDocument28 pagesCh02, MGMT Acct, HansenIlham DoankNo ratings yet

- Managerial Accounting 2nd Edition Hilton Solutions ManualDocument10 pagesManagerial Accounting 2nd Edition Hilton Solutions ManualMaryBalljswt100% (60)

- Basic Concepts of Cost AccountingDocument53 pagesBasic Concepts of Cost AccountinghasnainNo ratings yet

- Managerial Accounting and Cost ConceptsDocument18 pagesManagerial Accounting and Cost Conceptsginish12No ratings yet

- Managerial Accounting and Cost ConceptsDocument18 pagesManagerial Accounting and Cost ConceptsTouhid TomalNo ratings yet

- Chap002 2Document18 pagesChap002 2ceenajhon327No ratings yet

- Chap002 - Manag AccDocument28 pagesChap002 - Manag AccSandra RohandiNo ratings yet

- Basic Concepts of Cost AccountingDocument51 pagesBasic Concepts of Cost AccountingImran KhanNo ratings yet

- Chap002 - Manag Acc & Cost ConceptDocument29 pagesChap002 - Manag Acc & Cost Conceptlilis astriyani sinagaNo ratings yet

- Basic Concepts of Cost AccountingDocument51 pagesBasic Concepts of Cost AccountingMary ANo ratings yet

- Basic Management Accounting ConceptsDocument28 pagesBasic Management Accounting Conceptslita2703No ratings yet

- Managerial Accounting 2nd Edition Hilton Solutions ManualDocument35 pagesManagerial Accounting 2nd Edition Hilton Solutions Manualiramitchellwnumr100% (26)

- Solution Manual For Fundamentals of Cost Accounting 4Th Edition by Lanen Anderson Maher Isdn 0078025524 9780078025525 Full Chapter PDFDocument36 pagesSolution Manual For Fundamentals of Cost Accounting 4Th Edition by Lanen Anderson Maher Isdn 0078025524 9780078025525 Full Chapter PDFnancy.rodriguez985100% (12)

- Basicconceptsofcostaccounting 141207032058 Conversion Gate02Document53 pagesBasicconceptsofcostaccounting 141207032058 Conversion Gate02sajjadNo ratings yet

- Managerial Accounting and Cost ConceptsDocument57 pagesManagerial Accounting and Cost ConceptsFrances Monique AlburoNo ratings yet

- Defining Construction Overhead Costs and General Conditions CostsDocument6 pagesDefining Construction Overhead Costs and General Conditions Costsdanish_1985No ratings yet

- Dwnload Full Managerial Accounting 2nd Edition Hilton Solutions Manual PDFDocument35 pagesDwnload Full Managerial Accounting 2nd Edition Hilton Solutions Manual PDFwoollyprytheeuctw100% (10)

- Chapter - 2 - Managerial Accounting and Cost ConceptDocument61 pagesChapter - 2 - Managerial Accounting and Cost ConceptSoka PokaNo ratings yet

- Managerial Accounting Chapter 2Document61 pagesManagerial Accounting Chapter 2Wajeeh RehmanNo ratings yet

- Management and Cost Accounting 6th Edition Bhimani Solutions ManualDocument25 pagesManagement and Cost Accounting 6th Edition Bhimani Solutions ManualBradleyWallgefx100% (53)

- 2B - Unit 2 - Cost Classification Behaviour & Estimation - Workbook SOLUTIONS - 2022Document47 pages2B - Unit 2 - Cost Classification Behaviour & Estimation - Workbook SOLUTIONS - 2022Bono magadaniNo ratings yet

- Solutions Manual For Managerial Accounting Creating Value in A Dynamic Business Environment Canadian Edition Canadian 2nd Edition by HiltonDocument33 pagesSolutions Manual For Managerial Accounting Creating Value in A Dynamic Business Environment Canadian Edition Canadian 2nd Edition by HiltonssabasalimNo ratings yet

- Cost Terms and Concepts-L2-UpdatedDocument23 pagesCost Terms and Concepts-L2-Updatedviony catelinaNo ratings yet

- Cost Concepts: Managerial AccountingDocument72 pagesCost Concepts: Managerial AccountingCianne AlcantaraNo ratings yet

- Full Download Managerial Accounting Creating Value in A Dynamic Business Environment Canadian Edition Canadian 2nd Edition Hilton Solutions ManualDocument36 pagesFull Download Managerial Accounting Creating Value in A Dynamic Business Environment Canadian Edition Canadian 2nd Edition Hilton Solutions Manuallinderleafeulah100% (32)

- Cost Engineering Sec.1&2Document10 pagesCost Engineering Sec.1&2Ian M OswaldNo ratings yet

- Dwnload Full Management and Cost Accounting 6th Edition Bhimani Solutions Manual PDFDocument35 pagesDwnload Full Management and Cost Accounting 6th Edition Bhimani Solutions Manual PDFjamesburnsbvp100% (9)

- Cost and Cost Classifications PDFDocument5 pagesCost and Cost Classifications PDFnkznhrgNo ratings yet

- Managerial Accounting Creating Value in A Dynamic Business Environment Canadian Edition Canadian 2nd Edition Hilton Solutions ManualDocument26 pagesManagerial Accounting Creating Value in A Dynamic Business Environment Canadian Edition Canadian 2nd Edition Hilton Solutions ManualRobertPerkinsqmjk100% (59)

- Dwnload Full Managerial Accounting Creating Value in A Dynamic Business Environment Canadian Edition Canadian 2nd Edition Hilton Solutions Manual PDFDocument35 pagesDwnload Full Managerial Accounting Creating Value in A Dynamic Business Environment Canadian Edition Canadian 2nd Edition Hilton Solutions Manual PDFjohncastroebx0100% (8)

- Pillars of Strategic Cost ManagementDocument25 pagesPillars of Strategic Cost ManagementJovanne LuagNo ratings yet

- Cost ConceptsDocument56 pagesCost ConceptsAngela De chavezNo ratings yet

- Cost ConceptsDocument18 pagesCost Conceptsmuttakin106No ratings yet

- Management Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesFrom EverandManagement Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesNo ratings yet

- Adfasdfasdfasdfasdf Asdfasdfasdfasd Fasdf Asd Fas DF Asdf Asd Fas Dfas Dfas Dfasd Fas DF Asdf Asd FDocument1 pageAdfasdfasdfasdfasdf Asdfasdfasdfasd Fasdf Asd Fas DF Asdf Asd Fas Dfas Dfas Dfasd Fas DF Asdf Asd Fee1993No ratings yet

- Adsfasdfasdfsadf Asdfasdfasdf Asdfasdfasdfasdf Asdf Asd Fas DF Asdf Asd Fas DF Asdf As Dfas DF AsdfDocument1 pageAdsfasdfasdfsadf Asdfasdfasdf Asdfasdfasdfasdf Asdf Asd Fas DF Asdf Asd Fas DF Asdf As Dfas DF Asdfee1993No ratings yet

- S&P500 Futures AnalysisDocument7 pagesS&P500 Futures Analysisee1993100% (1)

- Adsfasdfasdfsadf Asdfasdfasdf Asdfasdfasdfasdf Asdf Asd Fas DF Asdf Asd Fas DF Asdf As Dfas DF AsdfDocument1 pageAdsfasdfasdfsadf Asdfasdfasdf Asdfasdfasdfasdf Asdf Asd Fas DF Asdf Asd Fas DF Asdf As Dfas DF Asdfee1993No ratings yet

- The Value Line Sample Page: Johnson&JohnsonDocument2 pagesThe Value Line Sample Page: Johnson&Johnsonee1993No ratings yet

- Adsfasdfasdfsadf Asdfasdfasdf Asdfasdfasdfasdf Asdf Asd Fas DF Asdf Asd Fas DF Asdf As Dfas DF AsdfDocument1 pageAdsfasdfasdfsadf Asdfasdfasdf Asdfasdfasdfasdf Asdf Asd Fas DF Asdf Asd Fas DF Asdf As Dfas DF Asdfee1993No ratings yet

- Adsfasdfasdfsadf Asdfasdfasdf Asdfasdfasdfasdf Asdf Asd Fas DF Asdf Asd Fas DF Asdf As Dfas DF AsdfDocument1 pageAdsfasdfasdfsadf Asdfasdfasdf Asdfasdfasdfasdf Asdf Asd Fas DF Asdf Asd Fas DF Asdf As Dfas DF Asdfee1993No ratings yet

- Adsfasdfasdfsadf Asdfasdfasdf Asdfasdfasdfasdf Asdf Asd Fas DF Asdf Asd Fas DF Asdf As Dfas DF AsdfDocument1 pageAdsfasdfasdfsadf Asdfasdfasdf Asdfasdfasdfasdf Asdf Asd Fas DF Asdf Asd Fas DF Asdf As Dfas DF Asdfee1993No ratings yet

- Adsfasdfasdfsadf Asdfasdfasdf Asdfasdfasdfasdf Asdf Asd Fas DF Asdf Asd Fas DF Asdf As Dfas DF AsdfDocument1 pageAdsfasdfasdfsadf Asdfasdfasdf Asdfasdfasdfasdf Asdf Asd Fas DF Asdf Asd Fas DF Asdf As Dfas DF Asdfee1993No ratings yet

- Adsfasdfasdfsadf Asdfasdfasdf Asdfasdfasdfasdf Asdf Asd Fas DF Asdf Asd Fas DF Asdf As Dfas DF AsdfDocument1 pageAdsfasdfasdfsadf Asdfasdfasdf Asdfasdfasdfasdf Asdf Asd Fas DF Asdf Asd Fas DF Asdf As Dfas DF Asdfee1993No ratings yet

- Adsfasdfasdfsadf Asdfasdfasdf Asdfasdfasdfasdf Asdf Asd Fas DF Asdf Asd Fas DF Asdf As Dfas DF AsdfDocument1 pageAdsfasdfasdfsadf Asdfasdfasdf Asdfasdfasdfasdf Asdf Asd Fas DF Asdf Asd Fas DF Asdf As Dfas DF Asdfee1993No ratings yet

- Adsfasdfasdfsadf Asdfasdfasdf Asdfasdfasdfasdf Asdf Asd Fas DF Asdf Asd Fas DF Asdf As Dfas DF AsdfDocument1 pageAdsfasdfasdfsadf Asdfasdfasdf Asdfasdfasdfasdf Asdf Asd Fas DF Asdf Asd Fas DF Asdf As Dfas DF Asdfee1993No ratings yet

- Adsfasdfasdfsadf Asdfasdfasdf Asdfasdfasdfasdf Asdf Asd Fas DF Asdf Asd Fas DF Asdf As Dfas DF AsdfDocument1 pageAdsfasdfasdfsadf Asdfasdfasdf Asdfasdfasdfasdf Asdf Asd Fas DF Asdf Asd Fas DF Asdf As Dfas DF Asdfee1993No ratings yet

- Adsfasdfasdfsadf Asdfasdfasdf Asdfasdfasdfasdf Asdf Asd Fas DF Asdf Asd Fas DF Asdf As Dfas DF AsdfDocument1 pageAdsfasdfasdfsadf Asdfasdfasdf Asdfasdfasdfasdf Asdf Asd Fas DF Asdf Asd Fas DF Asdf As Dfas DF Asdfee1993No ratings yet

- Adsfasdfasdfsadf Asdfasdfasdf Asdfasdfasdfasdf Asdf Asd Fas DF Asdf Asd Fas DF Asdf As Dfas DF AsdfDocument1 pageAdsfasdfasdfsadf Asdfasdfasdf Asdfasdfasdfasdf Asdf Asd Fas DF Asdf Asd Fas DF Asdf As Dfas DF Asdfee1993No ratings yet

- Adsfasdfasdfsadf Asdfasdfasdf Asdfasdfasdfasdf Asdf Asd Fas DF Asdf Asd Fas DF Asdf As Dfas DF AsdfDocument1 pageAdsfasdfasdfsadf Asdfasdfasdf Asdfasdfasdfasdf Asdf Asd Fas DF Asdf Asd Fas DF Asdf As Dfas DF Asdfee1993No ratings yet

- Shop VacDocument4 pagesShop Vacee1993No ratings yet

- Infiniti Elite GAPDocument4 pagesInfiniti Elite GAPee1993No ratings yet

- AutoDetailingGuide PDFDocument72 pagesAutoDetailingGuide PDFee199375% (4)