SECURITY ANALYSIS AND PORTFOLIO

MANAGEMENT

�Indian Financial Systems

IFC- Indian Financial Corporation

Money

Market

Capital Market

Commodity

market

FOREX

�UNIT- I INVESTMENT SETTING

Financial and economic meaning of Investment.

Characteristics & objectives of Investment

Types of Investment

Investment Alternatives

Choice and Evaluation

Risk and Return concepts

�Security: Interchangeable, negotiable instrument

representing financial

value.

Debt Securities , Equity Securities and Derivatives

Issuer: The company issuing the security

Securities Contracts Regulation Act (1956) defined securities include (i)

shares, bonds, stocks or other marketable securities of like nature in or of

any incorporate company or body corporate, (ii) government securities,

(iii) derivatives of securities, (iv) units of collective investment scheme, (v)

interest and rights in securities, and security receipt or any other

instruments so declared by the central government.

�Characteristics of Securities:

Represented by a certificate or by an electronic book entry.

Certificates may be bearer ( the holder to rights under the security)

Include shares of corporate stock or mutual funds, bonds issued by

corporations or governmental agencies, stock options, limited partnership

units and various forms of formal investment instruments

Help the economy for those with money to find those who need investment

capital.

Trading easy and make markets more efficient.

�What is Portfolio?

Combination of various assets such as stocks, bonds and/or cash which

have different risk return characteristics.

A grouping of financial assets such as stocks, bonds and cash equivalents,

as well as their mutual, exchange-traded and closed-fund counterparts.

Portfolios are held directly by investors and/or managed by financial

professionals.

�Security Analysis

Traditional Theory

Modern Theory

An analysis of the fundamental It relies on fundamental analysis

value of a share and its forecast of the security and also risk return

for the future through

intrinsic worth of the share.

the

analysis.

�Objectives of Security Analysis:

1. To present the important facts regarding a stock or bond issue useful to

actual or potential owner.

2. To reach dependable conclusions .

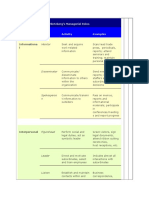

�Portfolio Management

Traditional Portfolio

Theory

Modern Portfolio Theory

Selection of securities

would fit in well with the

asset preferences, needs

and choices of investor.

Maximization of return and

or minimization of risk

will yield optimal returns .

Choice and attitude of

investor is the ultimate aim

while making an

investment decision.

Choices and attitudes of

investors are only a starting

point for investment

decision.

Risk return analysis is not

considered.

Risk return analysis is

necessary for optimization

of returns.

�INVESTMENT

What is Investment?

The money you earn is partly spent and the rest saved for meeting future

expenses. Instead of keeping the savings idle you may like to use savings

in order to get return on it in the future. This is called Investment.

Definitions:

Investment involves employment of funds on assets with the aim of

achieving additional income or growth in values.

�Financial Meaning of Investment

Commitment of a persons fund to derive future income or appreciation in

the value of their capital.

Future income may be

Interest

Dividends

Premium

Pension benefits

Purchasing of shares/debentures

Post office saving certificates

Insurance policies

�Economic meaning of Investment

Net addition to the economys capital stock which consists of goods and

services that are used in the production of other goods and services.

Formation of New and productive capital

New construction

Plant and machinery

Inventories

All these investments generate physical assets

�Characteristics of Investment

Return

Risk

Safety

Liquidity

Marketability

Concealability

Capital growth

Purchasing power

Stability of income

Tax benefits

�Return

Return refers to expected rate of return from an investment

The primary objective of it is deriving a return.

Return = capital appreciation+ Yield

Purchase price

Whereas,

Capital appreciation = sale price purchase price

Yield= Dividend or interest received from the investment

The return from the investment depends upon the nature of the investment,

the maturity period and other factors.

Ex:

Share purchased in 1998 at Rs. 50 disposed at Rs. 60 in 1999 and the

dividend yield is Rs.5 then the return would be?

Return = 30%

�Risk

Risk refers to the loss of principal amount of an Investment. It is one of the major

characteristics of an investment.

The risk depends on the following factors:

A. The investment maturity period is longer, in this case,

investor will take larger risk.

B. Government or Semi Government bodies are issuing

securities which have less risk.

C. In the case of the debt instrument or fixed deposit, the risk

of above investment is less due to their secured and fixed

interest payable on them. For instance Debentures.

��Safety

Safety refers to protection of investor principal amount and expected rate

of return

Safety is also one of the essential and crucial elements of investment.

Investor prefers safety about his capital.

Ex: If investor prefers less risk securities, he chooses Government bonds. In

the case, investor prefers high rate of return investor will choose private

Securities and Safety of these securities is low.

�Liquidity and Marketability

Liquidity refers to an investment ready to convert into cash

position.

Liquidity means that investment is easily realizable, saleable or marketable.

When the liquidity is high, then the return may be low.

Marketability

Marketability refers to buying and selling of Securities in market.

Marketability means transferability or saleability of an asset. Securities are

listed in a stock market which are more easily marketable than which are

not listed. Public Limited Companies shares are more easily transferable

than those of private limited companies.

�concealability

Concealability means investment to be safe from social disorders,

government confiscations or unacceptable levels of taxation, property must

be concealable and leave no record of income received from its use or sale.

�Capital Growth

Capital Growth refers to appreciation of investment.

Investors and their advisers are constantly seeking growth stock in the

right industry and bought at the right time

�Purchasing Power Stability

It refers to the buying capacity of investment in market.

Purchasing power stability has become one of the important traits of

investment.

Investment always involves the commitment of current funds with the

objective of receiving greater amounts of future funds.

�Stability of Income

It refers to constant return from an investment.

Stability of income must look for different path just as security of

principal. Every investor always considers stability of monetary income

and stability of purchasing power of income.

�Objectives of Investment

Maximization of return

Minimization of risk

Hedge against inflation

�Investment Vs Speculation

Short Term Perspective

Stakes of risk and returns are higher

Maximizes the return through buying and selling and delivery of securities

is least important in trade

�Basis of

Distinction

Investor

Speculator

Planning Horizon

Relatively longer

Very Short

Holding Period

Atleast One Year

Few days to few

months

Risk Disposition

Not willing to

assume more than

moderate risk

Willing to assume

high risk

Return Expectation

Seeks a modest rate

of return

Looks for a high rate

of return

Basis for Decisions

Greater Significance

to fundamental

factors and Careful

evaluation

Market Psychology

and Hearsay

Leverage

Use his own fund &

avoids borrowed

funds

Use borrowed funds

Source of Income

Earnings from

enterprise

Change in market

price

�Gambling:

Act of playing for stakes in the hope of winning including the payment of

a price for a chance to win a prize

Ex: Horse races, car races, card games, lottery, etc..

�Basis of

Distinction

Investment

Gambling

Duration

Result of Investment Result of Gambling

is known after long

is known more

time.

quickly.

Purpose

Rational People

invest for income

not for fun.

Rational People

invest for fun not for

income.

Risk Taking Capacity

Risk takers as well

as risk avoiders

Risk takers

Legal Aspect

It is regulated within

four corners of law

It is not regulated by

any law.

�Choice of Investment:

1. Security of Principal and Income

2. Rates of Return

3. Marketability and Liquidity

�1. Security of Principal and

Income

Paramount importance.

Want to be able to get their money back or not

lose money on their investments

Five different types of risks to investment values:

1. Financial Risk

2. Market Risk

3. Interest rate Risk to value of existing

investments

4. Interest rate Risk to income from investments

5. Purchasing power Risk

�Types of Risk

Description

Financial (Credit) Risk

Issuers of Investments run into

financial difficulties

Market Risk

Price fluctuations for a whole

securities market, for an

industrial group or for an

individual security regardless of

the financial ability of particular

issuers to pay promised

investment returns or stay

solvent

Interest rate Risk to value of

existing investments

A rise in general market

interest rates tends to cause a

decline in market prices for

existing securities or vice

versa.

Formula: General Market

Interest Rate is inversely

proportional to Market Prices for

existing Securities.

Interest rate Risk to income

from Investments

Any change in Interest Rate

may cause a decline in dividend

income from bonds that are

�Types of Risk

Description

Purchasing power of the risk

Uncertainty over the future. It

depends on the general price

level in the economy. When

Prices rise, purchasing power

declines and when prices

declin, purchasing power rises.

Other Risk

Associated with international

securities.

Risk that the value of the

foreign currency in which the

investment will fall with respect

to the value of the dollar.

�2. Rates of Return

i) Annual Rates of Return from Income (Yield):

A) Nominal Yield:

Nominal Yield = Annual Interest or

dividends/Investments par or face value

The Nominal Yield is often called the coupon

rate when applied to bonds and the dividend

rate when applied to preferred stocks with a par

value.

For example, a bond with a maturity value of

$1000 that pays interest of $70 per year. What

is the Nominal Yield or the Coupon Rate? 7%

�B) Current Yield:

Current Yield = Annual investment Income /

Investments current price or value

A common stock selling at $50 per share

with an annual dividend rate of $1.00. What

is the Current Yield? = 2%

�C) Yield to Maturity:

For a bond selling at a Discount:

YTM = (annual coupon interest +

( Discount / No. of yrs to maturity))/(Current

market price of bond + par value)/2

For a bond selling at a premium:

YTM = (annual coupon interest ( Premium / No. of yrs to maturity))/(Current

market price of bond + par value)/2

�ii) Capital Gains and total Rates of Return:

It results from the appreciation in the value

of assets.

3) Marketability and Liquidity:

Marketability: to find a ready market to sell

an investment

Liquidity: Not only marketable but also

highly stable in price

�Evaluation of Investment;

1. Mutual Fund Net Asset Value

Net Asset Value = Current market price of

the funds net assets / no. of shares issued.

When he decides to buy, he has to pay the

current NAV per share, plus any sales

charge.

When the NAV appreciates, he decides to

sell the share, the fund will pay him NAV

minus any other sales load.

�2. shares:

Earnings per share (EPS):

It helps in deciding shares investment and

also helps in comparing and evaluating

between companies X and Y.

Step: 1 Earnings after interest and tax

Step: 2 Deduct dividends on preferred stock

from step 1 that is called as amount

Step: 3 Divide the amount by the

outstanding number of shares

�Price Earning Ratio:

It helps to gauge the general trust or

confidence the market has in the companys

ability to grow.

Step: 1 Note down the Market price per share

of the company

Step : 2 Divide Market value per share by EPS

Better Investment Opportunity is the

Companys having P/E ratio of between 7 to

10.

�3. Debenture/Bonds:

The Current Yield refers to Yield of the bond

for a one year period (until maturity).

Step: 1 Note down the coupon rate of the

bond

Step:2 Divide the coupon rate by the bonds

current market price.

�4. Ways to value real property:

Market Approach

Cost Approach - Labor costs and material

prices. Add this value to an estimate of the

market value of the land

Income Approach -

�Investment Alternatives

Precious

Objects

�Marketable Financial Assets

Marketable financial assets those instruments which are transferable or

saleable and traded in any organized financial market.

The marketable financial assets includes

Equity shares

Preference shares

Bonds

Debentures

Money market instruments

�Equity shares

Equity shares represent ownership capital.

The equity shareholder have ownership stake in the company.

This means they have a residual interest in income and wealth .

It is more risky than preference share and bonds.

Types:

Rights share:

These are the shares issued to the existing share holders of a company to protect

the ownership rights of the investors.

Bonus share:

These are the type of shares given by the company to its shareholders as a

dividend.

Sweat equity share:

These shares are issued to exceptional employees or directors of the company

for their exceptional job in terms of providing know-how or IPR to the company.

�Preference share

Preference share are entitled to a fixed rate of dividend.

There is no Voting rights for preference share holder.

No right to participate in management.

Arrears of dividend may accumulate in certain cases.

they carry preferential right with regard to the dividend as well as

repayment of capital in case of winding up of the company.

�Types of preference shares

Cumulative and Non cumulative preference shares

Cumulative preference shares gives the right to the preference shareholders

to receive arrears of dividend which were not paid in previous years due to

company making loss.

While Non cumulative preference shareholders do not have rights like

cumulative preference share and they cannot demand any arrears of

dividend which were not paid during previous years by company.

Participating and Non participating preference shares

Participating preference shareholders have the right to receive any

remaining profit which is left after payment of dividend to equity

shareholders. While Non participating preference shareholders do not have

such rights

Convertible and non convertible preference shares:

Convertible preference shares can be converted into equity shares if

preference shareholders decides to do so, while non convertible preference

shares do not have any such right.

Redeemable and Non- Redeemable preference share:

Redeemable preference shares are those shares , the company will repay the

capital amount to the preference shareholders on the date of maturity and

discontinue the dividend payment thereon. Irredeemable preference share

cannot be redeemed by company excepting on winding up on the company. It

is also called perpetual preference share.

�Bonds

Bond is a long term debt instrument issued by government agencies as

well as large corporations that promises to pay a fixed annual sum as

interest for specified period of time.

Types:

Secured and unsecured bonds:

Secured bond is secured by real assets of the issuer. In case of insecure bonds

there is no such collateral.

Perpetual bonds and redeemable bonds:

Bonds that do not mature are called perpetual bonds. The interest alone

would be paid.

In irredeemable bond ,the bond is redeemed after a specific period of time.

Zero coupon bonds: These are issued at discount of the face value. There is

no interest paid for this bond. The return will be paid on maturity.

�Debentures

A debenture is an unsecured loan offer to a company. The company does

not give any collateral for the debenture, but pays a higher rate of interest

to its creditors. In case of bankruptcy or financial difficulties, the

debenture holders are paid after the bondholders

Types:

Redeemable Debentures

Irredeemable Debentures

Secured Debentures

Unsecured Debentures

�Money market instruments

Debt instrument which have a maturity less than one year at the time of issue

is called money market instruments. Common money market instruments are:

Treasury bills

Commercial paper

Certificate of deposit

Treasury bills are short term money market instrument issued by government. .

Its maturity period is year or less than a year. It gives very low returns.

Commercial paper: It is a short term negotiable instrument with fixed maturity

period. It is an unsecured promissory note issued by corporations either

directly or indirectly through a bank. It s maturity period is maximum 9

months.

Certificates of deposits:

The certificates of deposit are basically time deposit that are issued by the

commercial banks with maturity period ranging from 3 months to 5 year.

The return is higher than treasury bills because it assumes higher level of

risk

�Non Marketable Financial Assets

These are neither transferable nor traded in any organized financial market.

They are,

o

Fixed deposits/ term deposits

Post office schemes

Company provident fund

Public provident fund

Mutual funds