Liquidity Management

Why a

Bank

faces

liquidity

crisis?

One of the most important

tasks

faced

by

the

management of any bank is

ensuring adequate liquidity.

A bank is considered to be

liquid if it has ready access to

immediately spendable funds

at reasonable cost at precisely

the time those funds are

needed. This suggests that a

liquid bank either has the

right amount of immediately

spendable funds on hand

when they are required or can

quickly raise liquid funds by

borrowing or by selling assets.

� Lack of adequate liquidity is often one of the first

signs that a bank is in serious financial trouble. The

troubled bank usually begins to lose deposits,

which erodes its supply of cash and forces the

bank to dispose of its more liquid Assets. Other

banks become reluctant to lend the troubled bank

any funds without additional security or a higher

rate of interest, which further reduces the earnings

of the problem bank and threatens it with failure.

On the other hand, excess liquid Assets/Liquidity of

a bank is to create some serious financial problems

that effect the profitability of the bank. The idle or

excess liquid assets are incurred some costs call as

cost of fund or opportunity cost. Liquidity has a

critical time dimension. Ensuring adequate liquidity

is a never-ending problem for bank management.

�The

Deman

d and

Supply

of Bank

Liquidit

y

A banks need for

liquidity immediately

spendable funds can be

viewed within a demandsupply framework. What

activities give rise to the

demand for liquidity

inside a bank? And what

sources can the bank

rely upon to supply

liquidity when spendable

funds are needed?

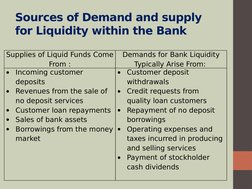

�Sources of Demand and supply

for Liquidity within the Bank

Supplies of Liquid Funds Come

From :

Incoming customer

deposits

Revenues from the sale of

no deposit services

Customer loan repayments

Sales of bank assets

Borrowings from the money

market

Demands for Bank Liquidity

Typically Arise From:

Customer deposit

withdrawals

Credit requests from

quality loan customers

Repayment of no deposit

borrowings

Operating expenses and

taxes incurred in producing

and selling services

Payment of stockholder

cash dividends

�

Liquidity

Liquidity means A banks ability to

ensure the availability of funds to

meet all on and off balance sheet

commitments at a reasonable

price at all times.

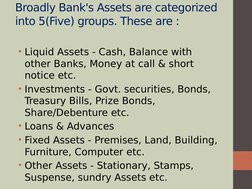

�Broadly Bank's Assets are categorized

into 5(Five) groups. These are :

Liquid Assets - Cash, Balance with

other Banks, Money at call & short

notice etc.

Investments - Govt. securities, Bonds,

Treasury Bills, Prize Bonds,

Share/Debenture etc.

Loans & Advances

Fixed Assets - Premises, Land, Building,

Furniture, Computer etc.

Other Assets - Stationary, Stamps,

Suspense, sundry Assets etc.

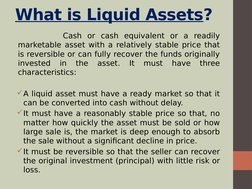

�What is Liquid Assets?

Cash or cash equivalent or a readily

marketable asset with a relatively stable price that

is reversible or can fully recover the funds originally

invested in the asset. It must have three

characteristics:

A liquid asset must have a ready market so that it

can be converted into cash without delay.

It must have a reasonably stable price so that, no

matter how quickly the asset must be sold or how

large sale is, the market is deep enough to absorb

the sale without a significant decline in price.

It must be reversible so that the seller can recover

the original investment (principal) with little risk or

loss.

�Among the most popular

liquid assets for banks are

shown into two tires :

Tire-1 : Cash & Cash

equivalent

Cash in hand

Foreign currency in hand

Balance with Bangladesh Bank

Balance with Sonali Bank

Balance with Other Bank

Balance with Foreign Bank

Call loans to Banks

STD with Other Bank

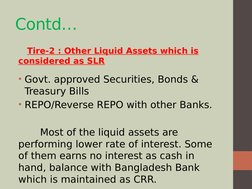

�Contd

Tire-2 : Other Liquid Assets which is

considered as SLR

Govt. approved Securities, Bonds &

Treasury Bills

REPO/Reverse REPO with other Banks.

Most of the liquid assets are

performing lower rate of interest. Some

of them earns no interest as cash in

hand, balance with Bangladesh Bank

which is maintained as CRR.

�

REPO (Repurchase

agreement)

Agreement between a seller and a

buyer, usually of government securities,

whereby the seller (bank) agrees to

repurchases the securities at an agreed

upon price and usually at a stated date.

Example : A bank with a temporary

FUNDING SHORTAGE, borrows from an

investor, typically a corporation or bank

with excess cash, using its securities as

collateral.

�REVERSE REPO (Reverse Repurchase

agreement) :

Agreement whereby a bank that has an EXCESS

CASH position, enters into a short-term agreement

to purchase securities from an investor, and the

investor agrees to repurchase them at a later date.

Both agreements are treated as collateralized

lending and borrowing transactions and are carried

on the balance sheet at the amounts at which the

securities were initially acquired or sold. Interest

earned on reverse repurchase agreements and

interest incurred on repurchase agreements are

reported as interest income and interest expenses,

respectively.

�Liquid assets at branch level

deals with :

Cash in hand, Foreign currency in hand,

Balance with Sonali Bank etc.

Liquid assets at H.O level deals

with :

Call loans to banks & other financial

institutions, Govt. approved Securities,

Bonds & Treasury Bills, REPO/Reverse

REPO with other Banks etc.

�

Estimating Liquidity

Needs

Approach for estimating future

deposits and loans :

3 key components :

a trend component

a seasonal component

a cyclical component

�Liquidity Risk Management

Framework

Business as usual

(Going concern, ultimate source of

liquidity is customer's confidence)

Contingency Funding Plan

Liquidity Crisis action Plan

�Liquidity Concerns

Liquidity is inversely related

to risk and expected profitability

Too much liquidity has a negative impact on

profitability

(Excess Cash in hand or maintain excess liquid

assets)

Too little liquidity increases the cost of

funding

(borrow money at a higher rate of interest to meet up

liquidity crisis)

�The Maturity Mismatch

approach(Cash Flow Gap

Analysis)

The

inflows

(Assets)

and

outflows(Liabilities)

into

time

bands, in accordance with their

contractual maturity and the

difference is called as Mismatch

gap.

Taking Short term deposit and

lend it in a Long term investment

creates Mismatch.