Professional Documents

Culture Documents

PE Ratio

PE Ratio

Uploaded by

chawlavishnu0 ratings0% found this document useful (0 votes)

5 views3 pagesOriginal Title

PE Ratio.ppt

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views3 pagesPE Ratio

PE Ratio

Uploaded by

chawlavishnuCopyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 3

P/E Ratio

Assumptions:

Acquiring firm is larger than target firm

Larger firm has PE Ratio of 25:1

Annual earnings are Rs. 1,000,000

1,000,000 shares are outstanding

Target firm has PE Ratio of 10:1

Annual earnings are Rs. 100,000

100,000 shares are outstanding

Offer from large firm stock-for-stock,

one share of acquirer for two shares of

target

Large firm issues 50000 shares to

finance the purchase

Acquisition causes EPS of higher P/E firm to

rise

1 share was earning Rs. 1. Now 1 share is

earning Rs.1.05 ( 1100000/1050000)

Assuming that PE ratio of combined firm

remains same. Stock price will rise to Rs. 26.25

( 25*1.05)

This way large firm can continue to offer small

firm significant premium while its EPS and

stock price rises

You might also like

- Pillsbury Cookie ChallengeDocument15 pagesPillsbury Cookie Challengechawlavishnu100% (2)

- Dividend PolicyDocument51 pagesDividend PolicydawarameerNo ratings yet

- Dividend PolicyDocument52 pagesDividend PolicyKlaus Mikaelson100% (1)

- Operating and Financial LeverageDocument11 pagesOperating and Financial LeverageRishi CharanNo ratings yet

- Lect +4+Dividend+PolicyDocument30 pagesLect +4+Dividend+PolicyHanh Mai TranNo ratings yet

- Cost of CapitalDocument27 pagesCost of CapitalMadhukant KumarNo ratings yet

- Accounting Terms Share Capital and OthersDocument47 pagesAccounting Terms Share Capital and OthersAnukriti VidyarthiNo ratings yet

- Leverage: Team Anuradha Kumar Akanksha Birmole Sumit DasDocument21 pagesLeverage: Team Anuradha Kumar Akanksha Birmole Sumit Dasanu2789No ratings yet

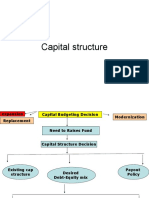

- Capital StructureDocument41 pagesCapital StructuremobinsaiNo ratings yet

- Leverage: Team Anuradha Kumar Akanksha Birmole Sumit DasDocument21 pagesLeverage: Team Anuradha Kumar Akanksha Birmole Sumit Dasanu2789No ratings yet

- Presented By: Ravi Kumar Vinish Kumar Singh Under The Guidance Of: Dr. Shashi SrivastavaDocument23 pagesPresented By: Ravi Kumar Vinish Kumar Singh Under The Guidance Of: Dr. Shashi SrivastavaAkhilesh KumarNo ratings yet

- Financial Statement & Ratio AnalysisDocument24 pagesFinancial Statement & Ratio Analysisbhavya mishraNo ratings yet

- Analysis of Leverage: Team:-Isha S.Yusra Jamal Samrjeet KaurDocument21 pagesAnalysis of Leverage: Team:-Isha S.Yusra Jamal Samrjeet KaurpranavNo ratings yet

- Dividend Yield RatioDocument10 pagesDividend Yield RatioSomnath SinhaNo ratings yet

- Kebijakan Dividen 1Document69 pagesKebijakan Dividen 1M. Rizqi HasanNo ratings yet

- Financial Ratio: Submitted By: Shipra (48) Shruti (51) SumanDocument18 pagesFinancial Ratio: Submitted By: Shipra (48) Shruti (51) SumanchankiiNo ratings yet

- LeverageDocument38 pagesLeverageAnant MauryaNo ratings yet

- Ratio Analysis: An OverviewDocument26 pagesRatio Analysis: An OverviewAnubhav Singhal0% (1)

- FM10e ch17Document51 pagesFM10e ch17gurleen_2No ratings yet

- FM106Document2 pagesFM106Andre Bay-anNo ratings yet

- Capital Structure and Leverage HDocument67 pagesCapital Structure and Leverage HNathasha RathnayakeNo ratings yet

- Ratios Important For Company Analysis For InvestorDocument13 pagesRatios Important For Company Analysis For InvestorAshvinNo ratings yet

- Dividend Policy: Financial Management Theory and PracticeDocument33 pagesDividend Policy: Financial Management Theory and PracticeSamar KhanzadaNo ratings yet

- Ratio AnalysisDocument26 pagesRatio Analysisakhil batraNo ratings yet

- Session 24Document40 pagesSession 24Ashutosh GuptaNo ratings yet

- Cost of CapitalDocument23 pagesCost of Capitaljibinjohn140No ratings yet

- Long Term Sources of FinanceDocument21 pagesLong Term Sources of Financevivek patelNo ratings yet

- Anil Final Bonus SharesDocument24 pagesAnil Final Bonus SharesKaushik AdhikariNo ratings yet

- Chapter 17 Corporate FinanceDocument27 pagesChapter 17 Corporate Financecherryl marianoNo ratings yet

- 4th ClassDocument42 pages4th ClassShreeya SigdelNo ratings yet

- Lintner and MM Dividend Models: Group MembersDocument12 pagesLintner and MM Dividend Models: Group MembersMd MirazNo ratings yet

- Ratio Analysis: Prepared By: Zaid Harithah Bin Zainulabid (62288111045) Prepared For: MR Zaid Kader ShahDocument21 pagesRatio Analysis: Prepared By: Zaid Harithah Bin Zainulabid (62288111045) Prepared For: MR Zaid Kader ShahZaid HarithahNo ratings yet

- Finance Decisions: Unit IvDocument70 pagesFinance Decisions: Unit IvFara HameedNo ratings yet

- Peer Analysis: Stock SelectionDocument17 pagesPeer Analysis: Stock SelectionJyoti SinghalNo ratings yet

- Capital Structure PlanningDocument25 pagesCapital Structure PlanningRahul sardanaNo ratings yet

- Ivb 18Document20 pagesIvb 18ShreyaRalliNo ratings yet

- A1604208075 - 15831 - 25 - 2019 - Cost of CapitalDocument43 pagesA1604208075 - 15831 - 25 - 2019 - Cost of CapitalrashmiNo ratings yet

- EBIT - EPS QuestionsDocument6 pagesEBIT - EPS QuestionsTaliya ShaikhNo ratings yet

- Pricing of Rights Issue/FPODocument11 pagesPricing of Rights Issue/FPOAnkit AgarwalNo ratings yet

- EBF 2054 Capital StructureDocument38 pagesEBF 2054 Capital StructureizzatiNo ratings yet

- Lecture 15 LevarageDocument50 pagesLecture 15 LevarageDevyansh GuptaNo ratings yet

- Ratios Revision Unit 4 1 2 1Document33 pagesRatios Revision Unit 4 1 2 1api-679810879No ratings yet

- Analysis of Published Accounts Flashcards PreviewDocument4 pagesAnalysis of Published Accounts Flashcards PreviewrudomposiNo ratings yet

- Unit 3 (Dividend Policy)Document23 pagesUnit 3 (Dividend Policy)NidaNo ratings yet

- 6.0 Poyout PolicyDocument28 pages6.0 Poyout PolicySanaFatimaNo ratings yet

- Slides 7Document35 pagesSlides 7Prince SirajNo ratings yet

- Capital StructureDocument30 pagesCapital StructureAmit KumarNo ratings yet

- Strategic Capital Group Workshop #8: Cost of CapitalDocument30 pagesStrategic Capital Group Workshop #8: Cost of CapitalUniversity Securities Investment TeamNo ratings yet

- Chapter 17 Dividend PolicyDocument7 pagesChapter 17 Dividend PolicyAia GarciaNo ratings yet

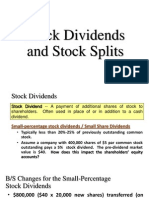

- Stock Dividends and Stock SplitsDocument18 pagesStock Dividends and Stock SplitsPaul Dexter Go100% (1)

- LeveragesDocument15 pagesLeveragesKOSHY N VARGHESENo ratings yet

- CApital Structure and LeverageDocument33 pagesCApital Structure and LeverageMD Rifat ZahirNo ratings yet

- Tutorial Chapter 19Document6 pagesTutorial Chapter 19Dickson WongNo ratings yet

- Acquisition Valuation 2 PDFDocument19 pagesAcquisition Valuation 2 PDFVibhor Agarwal0% (2)

- FDGFDSGDFGDocument3 pagesFDGFDSGDFGJesus Colin CampuzanoNo ratings yet

- Computation of DividendsDocument29 pagesComputation of DividendsGela Blanca SantiagoNo ratings yet

- Dividend PolicyDocument45 pagesDividend PolicyBusHra Alam0% (1)

- Vcpe 5Document12 pagesVcpe 5hrishikesh modakNo ratings yet

- Ratio Analysis: A2 AccountingDocument19 pagesRatio Analysis: A2 AccountingrahimiranNo ratings yet

- Syndicate 1 An Introduction To Debt Policy and ValueDocument9 pagesSyndicate 1 An Introduction To Debt Policy and ValueBernadeta PramudyaWardhaniNo ratings yet

- Leverage: Presented By: Name-Pinaky Sethy Branch-CSE Semester-7th Guided By: Prof - Joytiranjan SahooDocument20 pagesLeverage: Presented By: Name-Pinaky Sethy Branch-CSE Semester-7th Guided By: Prof - Joytiranjan SahooPinaky SethyNo ratings yet

- Vendor Landscape: IT Asset Management (ITAM)Document16 pagesVendor Landscape: IT Asset Management (ITAM)chawlavishnuNo ratings yet

- 145th - Annual - Securities - Report - 2014 PDFDocument204 pages145th - Annual - Securities - Report - 2014 PDFchawlavishnuNo ratings yet

- Using The GARCH Model To Analyse and Predict The Different Stock MarketsDocument8 pagesUsing The GARCH Model To Analyse and Predict The Different Stock MarketschawlavishnuNo ratings yet

- Investors Type and ExpectationsDocument3 pagesInvestors Type and ExpectationschawlavishnuNo ratings yet

- MBA 504 Ch11 SolutionsDocument31 pagesMBA 504 Ch11 Solutionschawlavishnu100% (1)

- Nonlife RatiosDocument73 pagesNonlife RatioschawlavishnuNo ratings yet

- CVPDocument11 pagesCVPchawlavishnuNo ratings yet

- Shouldice Hospital: Anna Swanson Phillip Dean Ben GierokDocument25 pagesShouldice Hospital: Anna Swanson Phillip Dean Ben GierokchawlavishnuNo ratings yet

- Dove's Real Woman Campaign in 2004 Increased Its SalesDocument4 pagesDove's Real Woman Campaign in 2004 Increased Its SaleschawlavishnuNo ratings yet

- Net NeutralityDocument46 pagesNet NeutralitychawlavishnuNo ratings yet

- (Rishabh Mittal) : Biodata N Pics SharedDocument4 pages(Rishabh Mittal) : Biodata N Pics SharedchawlavishnuNo ratings yet

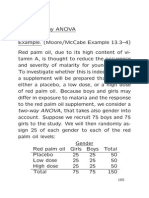

- 2 Way AnovaDocument20 pages2 Way Anovachawlavishnu100% (1)

- Ann 3Document4 pagesAnn 3chawlavishnuNo ratings yet