Professional Documents

Culture Documents

BFM-CH - 10 - Module B

BFM-CH - 10 - Module B

Uploaded by

Fara Mohammed0 ratings0% found this document useful (0 votes)

11 views20 pagescaiib

Original Title

BFM-Ch- 10 - Module B

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentcaiib

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views20 pagesBFM-CH - 10 - Module B

BFM-CH - 10 - Module B

Uploaded by

Fara Mohammedcaiib

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 20

Risk Regulations in Banking Industry

CAIIB

Bank Financial Management

Module B

Risk Management

Prepared By: Jagat Nagar (M : 9909792440)

- jagatnagar@yahoo.co.in

Risk Regulations in Banking Industry

In Banking Industry risk regulations have several goals, like:

1. Improving the safety of the banking industry.

2. Levelling the competitive playing field of banks.

3. Promoting sound business and supervisory practices.

4. Controlling and monitoring 'Systemic Risk'

5. Protecting interest of depositors.

Prepared By: Jagat Nagar (M : 9909792440)

- jagatnagar@yahoo.co.in

Risk Regulations in Banking Industry

Systemic Risk: It is risk of failure of the whole banking system.

Individual bank's failure is one of the major sources of the

systemic Risk.

Basel Committee on Banking Supervision (BCBS) - established

for risk-based regulation in a changed world envirnment.

The Risk of settlement that arises for time difference came to be

known as ' Herstatt Risk'

Basel Commitee established Basel-1 in year 1988 and in year

1996 many changes take place and Basel-2 enforce.

Prepared By: Jagat Nagar (M : 9909792440)

- jagatnagar@yahoo.co.in

Risk Regulations in Banking Industry

Reason for change Basel-1 to Basel-2:

1. Credit Risk assessment under Basel-I was not risk-sensitive

enough.

2. Financial decisions are not based on economic opportunities.

3. It did not recognize the role of credit risk mitigants.

4. It did not take into account operational risk of banks.

5. Better NPA Management

6. Almost all banks and RRBs in good financial health- meet

CRAR nomr

7. Explosion of new- customer centric products and More

employment.

Prepared By: Jagat Nagar (M : 9909792440)

- jagatnagar@yahoo.co.in

Risk Regulations in Banking Industry

The Basel-2 accord is based on 3 pillars:

1. Minimum Capital requirement

2. Supervisory Review process

3. Market Discipline

Prepared By: Jagat Nagar (M : 9909792440)

- jagatnagar@yahoo.co.in

Risk Regulations in Banking Industry

Basel II First Pillar: Minimum Capital requirement :

It is based on credit, market and operational risk to

(a) Reduce risk of failure by cushioning against losses.

(b) Provide continuing access to financial markets to meet

liquidity needs, and

(c) Provide incentives for prudent risk management

Minimum Capital requirement is calculated by:

1. Capital for Credit risk

2. Capital for Market risk

3. Capital for Operational risk

Prepared By: Jagat Nagar (M : 9909792440)

- jagatnagar@yahoo.co.in

Risk Regulations in Banking Industry

Standardised:

- The standardised approach establishes fixed risk weights

corresponding to each supervisory category and make use of

external credit.

- Specific provisions has already been set aside by the bank agianst

that loan. Like retail and SMEsectors a uniform risk weight of 75%.

- Most Japanese banks will start Basel II as standardised banks

- Most US banks will stay under Basel I

Foundation IRB (Internal Rating Based)

- Measure credit risk using sophisticated formulas using internally

determined inputs of probability of default (PD) and inputs fixed by

regulators of loss Given default (LGD), exposure at default (EAD)

and maturity (M).

- More risk sensitive loan require more capital.

- Most European banks will likely qualify for Foundation IRB status at

start of Basel II

Prepared By: Jagat Nagar (M : 9909792440)

- jagatnagar@yahoo.co.in

Risk Regulations in Banking Industry

Advanced IRB (Internal Rating Based)

- Measure credit risk using sophisticated formulas and internally

determined inputs of PD, LGD, EAD and M

- Transition to Advanced IRB status only with robust internal risk

Management systems and data

- Top 10 US banks expected to implement Advanced IRB at start of Basel II

Prepared By: Jagat Nagar (M : 9909792440)

- jagatnagar@yahoo.co.in

Risk Regulations in Banking Industry

Basel II Second Pillar - Supervisory review process

Qualitative supervision by regulators of internal bank risk control and

Capital assessment process, including supervisory power to require

banks to hold more capital than required under the First Pillar

Four key principles of supervisory review

Principle 1: Banks should have process for assessing overall capital

adequacy in relation to risk profile and strategy for maintaining capital

levels.

Five main features of rigorous process:

1. Board and senior management oversight

2. Sound capital assessment

3. Comprehensive risk analysis (credit risk, operational risk, market risk,

interest rate risk in banking book, liquidity risk, other risk)

4. Monitoring and reporting

5. Internal control review

Prepared By: Jagat Nagar (M : 9909792440)

- jagatnagar@yahoo.co.in

Risk Regulations in Banking Industry

Principle 2:

Supervisors should review and evaluate banks internal capital

adequacy assessments and strategies, as well as ability to monitor and

ensure compliance with ratios.

Supervisors should take appropriate action if not satisfied.

Principle 3:

Supervisors should expect banks to operate above minimum ratios and

should have ability to require banks to hold capital in excess of

minimum

Principle 4:

Supervisors should seek to intervene at early stage and require rapid

remedial action

Prepared By: Jagat Nagar (M : 9909792440)

- jagatnagar@yahoo.co.in

10

Risk Regulations in Banking Industry

Basel II Third Pillar Market Discipline

Impose market discipline on banks by requiring disclosure of key

information relevant to banks risks and capital Qualitative Disclosures

for Securitisation

1. Banks objectives for, and roles played by it in, securitisation

process

2. Banks accounting objectives for securitisation

3. Whether treated as sales or financings

4. Whether bank recognises gain on sale

5. Key assumptions used by bank for valuing retained interests

6. Banks treatment of synthetic securitisations

7. Names of rating agencies used by bank and types of exposures

rated by each agency

Prepared By: Jagat Nagar (M : 9909792440)

- jagatnagar@yahoo.co.in

11

Risk Regulations in Banking Industry

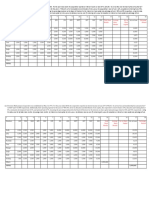

Example Page no : 213 for determining adjusted Exposure:

Example page no : 224 fo computation of Total CRAR and Tier I

CRAR

Prepared By: Jagat Nagar (M : 9909792440)

- jagatnagar@yahoo.co.in

12

Risk Regulations in Banking Industry

Q Given that Tier I capital is Rs. 500 crores and Tier II capital Rs. 800

crores and further given that RWA for credit risk Rs. 5000 crores,

capital charge for market risk and operational risk Rs. 200 crores

and Rs. 100 respectively,

Answer the following questions.

1. What are the risk weighted assets for operational risk?*

1) Rs. 1250 cr 2) Rs. 1500 cr 3) Rs. 1111 cr 4) Rs. 2000 cr

2. What are the risk weighted assets for market risk?*

1) Rs. 1000 cr 2) Rs. 1500 cr 3) Rs. 2000 cr 4) Rs. 2222 cr

3. What are the total risk weighted assets?*

1) Rs.7250 cr. 2) Rs. 8333 cr. 3) Rs. 9000 cr. 4) Rs. 7800 cr.

4. What is the Tier I capital adequacy ratio?*

1) 0.0555 2) 0.0581 3) 0.0600 4) 0.0668

5. What is the total capital adequacy ratio?*

1) 0.1486 2) 0.1111 3) 0.1200 4) 0.1282

Prepared By: Jagat Nagar (M : 9909792440)

- jagatnagar@yahoo.co.in

13

Risk Regulations in Banking Industry

6. CRAR is _________*

1) Tier I capital / Total RWAs 2) Tier II capital / Total RWAs

3) Regulatory Capital / Total RWAs 4) Tier I and II capital/ Total

RWAs

Answers :

1. -

2. -

5. -

6. -

3. -

Prepared By: Jagat Nagar (M : 9909792440)

- jagatnagar@yahoo.co.in

4. -

14

Risk Regulations in Banking Industry

Case Study: Calculation of capital

International bank has:

Paid up capital - Rs. 100 cr.

Free reserves - Rs. 300 cr.

Provisions and contingencies reserves - Rs. 200 cr

Revaluation reserve - Rs. 300 cr.

Perpetual non-cumulative preference shares - Rs. 400 cr

Subordinated debt- Rs. 300 cr

Risk weighted assets for credit and operational risk - Rs.10000 cr

Risk weighted assets for market risk - Rs. 4000 cr.

Prepared By: Jagat Nagar (M : 9909792440)

- jagatnagar@yahoo.co.in

15

Risk Regulations in Banking Industry

Tier-I = Capital + Free Reserves + Perpetual non-cumulative

preference shares

Tier-II = Provisions and contingencies reserves maximum 1.25% of risk

weighted assets + Revaluation reserve at discount 55% +

Subordinated

debts.

Total Capital Fund = Tier-I + Tier-II

Capital Adequacy Ratio = Total Capital Fund / Total RWA

Minimum Capital = RWA * 9%

Tier-I capital is equal or more than Tier-II Capital

Prepared By: Jagat Nagar (M : 9909792440)

- jagatnagar@yahoo.co.in

16

Risk Regulations in Banking Industry

Based on information give answer the following questions:

1. What is the amount of Tier-I capital?

a. 900 cr

b. 800 cr

c. 750 cr

d. 610 cr

2. What is the amount of Tier-II capital?

a. 900 cr

b. 800 cr

c. 750 cr

d. 610 cr

3. Calculate the amount of Capital fund

a. 895 cr

b. 1255 cr

c. 1410 cr

d. 1675 cr

4. What is the capital adequacy ratio of the bank?

a. 9%

b. 9.65 %

c. 10.05 %

d. 10.07 %

Prepared By: Jagat Nagar (M : 9909792440)

- jagatnagar@yahoo.co.in

17

Risk Regulations in Banking Industry

5. What is amount of minimum capital to support credit and operational

risk?

a. 900 cr

b. 950 cr

c. 1000 cr

d. 1250 cr

6. What is the amount of minimum Tier-I and Tier-II to support the credit

and operational Risk?

a. 900 cr,900 cr b. 600 cr,900 cr c. 450 cr,450cr

d. 300 cr,450cr

7. What is the amount of Tier-I capital fund, to support market risk?

a. 450 cr

b. 350 cr

c. 250 cr

d. 185 cr

8. What is the amount of Tier-II capital fund, to support market risk?

a. 450 cr

b. 350 cr

c. 250 cr

d. 160 cr

Prepared By: Jagat Nagar (M : 9909792440)

- jagatnagar@yahoo.co.in

18

Risk Regulations in Banking Industry

Answers:

1-b

5-a

2-d

6-c

3-c

7-b

4-d

8-d

Q. General provisions will be admitted upto a maximum of ____ of

RWAs*

1) 0.01 2) 0.025 3) 0.0125

4) 0.015

Prepared By: Jagat Nagar (M : 9909792440)

- jagatnagar@yahoo.co.in

19

Risk Regulations in Banking Industry

Thank You

Prepared By: Jagat Nagar (M : 9909792440)

- jagatnagar@yahoo.co.in

20

You might also like

- Classificazione AiIG 2020Document17 pagesClassificazione AiIG 2020pierluigi.zerbinoNo ratings yet

- Enterprise Performance Management - MCQDocument20 pagesEnterprise Performance Management - MCQSabina Saldanha72% (18)

- Foundational Theories and Techniques for Risk Management, A Guide for Professional Risk Managers in Financial Services - Part II - Financial InstrumentsFrom EverandFoundational Theories and Techniques for Risk Management, A Guide for Professional Risk Managers in Financial Services - Part II - Financial InstrumentsNo ratings yet

- Indian Institute of Banking & Finance: Strategic Management & Innovations in BankingDocument7 pagesIndian Institute of Banking & Finance: Strategic Management & Innovations in Bankingnikita0% (1)

- Regional Rural Banks of India: Evolution, Performance and ManagementFrom EverandRegional Rural Banks of India: Evolution, Performance and ManagementNo ratings yet

- Capital BudgetingDocument9 pagesCapital BudgetingMarcel BermudezNo ratings yet

- IIBFDocument3 pagesIIBFRauShan RajPutNo ratings yet

- Certified Credit Officer CourseDocument8 pagesCertified Credit Officer CourseAbhishek Kaushik100% (2)

- Caiib - Retail Banking (Numerical)Document24 pagesCaiib - Retail Banking (Numerical)RASHMI KUMARINo ratings yet

- Auditing Problems v.1 - 2018Document18 pagesAuditing Problems v.1 - 2018Christine Ballesteros Villamayor33% (3)

- Appendix VI: Hertz Corp. Case Study: Overview: The Hertz Buyout Is One of The Largest Private Equity Deals. ItDocument5 pagesAppendix VI: Hertz Corp. Case Study: Overview: The Hertz Buyout Is One of The Largest Private Equity Deals. ItProutNo ratings yet

- Financing Small and Medium-Sized Enterprises in Asia and the Pacific: Credit Guarantee SchemesFrom EverandFinancing Small and Medium-Sized Enterprises in Asia and the Pacific: Credit Guarantee SchemesNo ratings yet

- Risk Management for Islamic Banks: Recent Developments from Asia and the Middle EastFrom EverandRisk Management for Islamic Banks: Recent Developments from Asia and the Middle EastNo ratings yet

- CAIIB ABM Sample Questions by Murugan - For Nov 14 Exams PDFDocument142 pagesCAIIB ABM Sample Questions by Murugan - For Nov 14 Exams PDFaasifimam902088% (56)

- Bank Financial Management - CAIIB New SyllubusDocument23 pagesBank Financial Management - CAIIB New SyllubusAdi Swarup Patnaik82% (28)

- Caiib Paper 1 PDFDocument262 pagesCaiib Paper 1 PDFDeepak Rathore100% (1)

- Murugan NotesDocument189 pagesMurugan NotesparthaNo ratings yet

- Caiib Rmmodb Nov08Document24 pagesCaiib Rmmodb Nov08Gaurav Singh100% (1)

- CAIIB 2020 Resources EBook by K G KhullarDocument15 pagesCAIIB 2020 Resources EBook by K G KhullarArul ManikandanNo ratings yet

- Legal & Regulatory Aspects of BankingDocument31 pagesLegal & Regulatory Aspects of BankingKrishna HmNo ratings yet

- Memorised CAIIB BFM Questions MAY 2013Document3 pagesMemorised CAIIB BFM Questions MAY 2013Pratheesh Tulsi33% (3)

- Dtirm PDFDocument10 pagesDtirm PDFvipulNo ratings yet

- Risk Management IDocument2 pagesRisk Management IMuralidhar GoliNo ratings yet

- Canpal Guide Caiib Series 01-17 PDFDocument107 pagesCanpal Guide Caiib Series 01-17 PDFPallab DasNo ratings yet

- CAIIB ABM Sample Questions by Murugan PDFDocument82 pagesCAIIB ABM Sample Questions by Murugan PDFchatsak100% (7)

- ABM-numerical With Solutions by Neeraj AgnihotriDocument23 pagesABM-numerical With Solutions by Neeraj AgnihotriMuralidhar Goli100% (5)

- CAIIB - Financial Management - ModuleDocument26 pagesCAIIB - Financial Management - ModuleSantosh100% (3)

- Digital Banking Notes 1 PDF1Document8 pagesDigital Banking Notes 1 PDF1AnuradhaNo ratings yet

- Caiib Abm Case Studies - Iibf CertificationDocument244 pagesCaiib Abm Case Studies - Iibf Certificationafroz shaikNo ratings yet

- Canpal Guide Caiib Series 03-17Document131 pagesCanpal Guide Caiib Series 03-17Pallab DasNo ratings yet

- Abm CaiibDocument70 pagesAbm Caiibsubhasis123bbsrNo ratings yet

- NRLMDocument17 pagesNRLMShiv Shankar ChaudharyNo ratings yet

- Caiib ABM NumericalsDocument24 pagesCaiib ABM NumericalsVijay Prakash ChittemNo ratings yet

- Business Math For CAIIB IIIDocument42 pagesBusiness Math For CAIIB IIIteju16sy50% (2)

- Certified Bank Trainer CourseDocument8 pagesCertified Bank Trainer CourseAbhishek Kaushik50% (2)

- Abm-Caiib MaterailDocument5 pagesAbm-Caiib MaterailArchanaHegdeNo ratings yet

- Canpal Guide Caiib Series 04-17 PDFDocument185 pagesCanpal Guide Caiib Series 04-17 PDFkamalray75_188704880No ratings yet

- Sample Paper-CAIIB-ABFM-By Dr. MuruganDocument92 pagesSample Paper-CAIIB-ABFM-By Dr. MuruganMURALINo ratings yet

- JAIIB Paper 1 CAPSULE PDF Principles Practices of Banking PDFDocument269 pagesJAIIB Paper 1 CAPSULE PDF Principles Practices of Banking PDFLatha Mypati100% (1)

- BFM SumsDocument57 pagesBFM SumsthamiztNo ratings yet

- Caiib - BFM - Case Studies: Dedicated To The Young and Energetic Force of BankersDocument2 pagesCaiib - BFM - Case Studies: Dedicated To The Young and Energetic Force of BankersssssNo ratings yet

- Caiib Abm Case StudiesDocument241 pagesCaiib Abm Case Studieskov baghel100% (2)

- Jaiib Made Simple Paper 1Document270 pagesJaiib Made Simple Paper 1Ashokkumar MadhaiyanNo ratings yet

- Diploma in Banking & FinanceDocument10 pagesDiploma in Banking & FinanceJayashree JothivelNo ratings yet

- JAIIB AFB Sample Questions by Murugan - For Nov 14 ExamsDocument186 pagesJAIIB AFB Sample Questions by Murugan - For Nov 14 Examsraushan_ratneshNo ratings yet

- Chapter 20 Managing Credit RiskDocument11 pagesChapter 20 Managing Credit RiskJose Luis AlamillaNo ratings yet

- Caiib Paper 4 Banking Regulations and Business Laws Capsule AmbitiousDocument223 pagesCaiib Paper 4 Banking Regulations and Business Laws Capsule AmbitiouselliaCruzNo ratings yet

- Caiib Risk Manage Mod CDDocument95 pagesCaiib Risk Manage Mod CDMusahib ChaudhariNo ratings yet

- AccountingfinancebankersDocument43 pagesAccountingfinancebankersPervez KhanNo ratings yet

- Basic Notes JaiibDocument42 pagesBasic Notes JaiibSanjeev Miglani100% (1)

- Caiib Rural Banking NotesDocument2 pagesCaiib Rural Banking NotesSatish O Manchodu100% (1)

- Credit Risk Management: How to Avoid Lending Disasters and Maximize EarningsFrom EverandCredit Risk Management: How to Avoid Lending Disasters and Maximize EarningsNo ratings yet

- Financial Engineering in Islamic Finance the Way Forward: A Case for Shariah Compliant DerivativesFrom EverandFinancial Engineering in Islamic Finance the Way Forward: A Case for Shariah Compliant DerivativesNo ratings yet

- Credit Risk Black Book | What They Still Do Not Teach You at Banks and Business Schools: Credit-CueFrom EverandCredit Risk Black Book | What They Still Do Not Teach You at Banks and Business Schools: Credit-CueNo ratings yet

- Corporate Financial Analysis with Microsoft ExcelFrom EverandCorporate Financial Analysis with Microsoft ExcelRating: 5 out of 5 stars5/5 (1)

- Operational Risk Management A Complete Guide - 2021 EditionFrom EverandOperational Risk Management A Complete Guide - 2021 EditionNo ratings yet

- Treasury Operations In Turkey and Contemporary Sovereign Treasury ManagementFrom EverandTreasury Operations In Turkey and Contemporary Sovereign Treasury ManagementNo ratings yet

- Chapter No.2: Risk Management and Basics of DerivativesDocument21 pagesChapter No.2: Risk Management and Basics of DerivativesSantosh SarojNo ratings yet

- Sales and Distribution Management, 2eDocument12 pagesSales and Distribution Management, 2eSantosh SarojNo ratings yet

- Securities Transaction Tax: A.b.acharya Addl - Asst.directorDocument7 pagesSecurities Transaction Tax: A.b.acharya Addl - Asst.directorSantosh SarojNo ratings yet

- Income Under The Head "Salaries"Document22 pagesIncome Under The Head "Salaries"Santosh SarojNo ratings yet

- Certificate: Contemporary Trend in Online Shopping Behavior" With Reference To Ahmedabad in TheDocument1 pageCertificate: Contemporary Trend in Online Shopping Behavior" With Reference To Ahmedabad in TheSantosh SarojNo ratings yet

- Declaration: Shopping Behavior" With Reference To Ahmedabad Is Original To The Best of MyDocument7 pagesDeclaration: Shopping Behavior" With Reference To Ahmedabad Is Original To The Best of MySantosh SarojNo ratings yet

- Nature of Management Control SystemsDocument14 pagesNature of Management Control SystemsSantosh SarojNo ratings yet

- Malhotra Mr05 PPT 01Document33 pagesMalhotra Mr05 PPT 01Santosh Saroj100% (1)

- Dem at ClosureDocument1 pageDem at ClosureAkash MishraNo ratings yet

- Strategic Management Competitiveness and Globalisation 6th Edition Manson Test BankDocument11 pagesStrategic Management Competitiveness and Globalisation 6th Edition Manson Test Bankkiethanh0na91100% (25)

- LT BILL 46429091009 Dec22Document2 pagesLT BILL 46429091009 Dec22Deepak JhaNo ratings yet

- ANNEXUREDocument4 pagesANNEXUREimsiddh87No ratings yet

- 227Document1 page227Yuuvraj SinghNo ratings yet

- Saïd Business School, University of Oxford - Oxford Algorithmic Trading ProgrammeDocument8 pagesSaïd Business School, University of Oxford - Oxford Algorithmic Trading ProgrammeBrian ChungNo ratings yet

- CoopMan - Module 9 (Engage)Document2 pagesCoopMan - Module 9 (Engage)Vina OringotNo ratings yet

- Maintain Average Monthly Balance Of: Maintain Average Quarterly Balance ofDocument3 pagesMaintain Average Monthly Balance Of: Maintain Average Quarterly Balance ofyvonneNo ratings yet

- Flat Rate Electricity Bill For Agriculture Consumer (LV5.4) : Service Number IvrsDocument1 pageFlat Rate Electricity Bill For Agriculture Consumer (LV5.4) : Service Number IvrsAshish kumar YadavNo ratings yet

- Charles Winnick (Matrix Capital Management)Document3 pagesCharles Winnick (Matrix Capital Management)Justin ChanNo ratings yet

- LeverageDocument6 pagesLeverageutkarsh.khera98No ratings yet

- Research PaperDocument21 pagesResearch PaperRafez JoneNo ratings yet

- Synthesis On Cost of CapitalDocument2 pagesSynthesis On Cost of CapitalRu Martin100% (1)

- Konverter CSV - Batch UploaddDocument20 pagesKonverter CSV - Batch UploaddDevi Merry Sonia Sitepu50% (2)

- Save On Repair Shop PrelimDocument3 pagesSave On Repair Shop PrelimDeimos DeezNo ratings yet

- Summer Internship Project Report ON Investment Strategies: Saving Account and UlipsDocument73 pagesSummer Internship Project Report ON Investment Strategies: Saving Account and UlipsNMA NMANo ratings yet

- Employee Final SettlementDocument1 pageEmployee Final SettlementZeeshan Mirza50% (2)

- CH 13 Macroeconomics KrugmanDocument6 pagesCH 13 Macroeconomics KrugmanMary Petrova100% (2)

- Research Paper 2Document9 pagesResearch Paper 2Shraddha KotakNo ratings yet

- History of Meezan BankDocument10 pagesHistory of Meezan BankZOHA51214No ratings yet

- Ias & IfrsDocument7 pagesIas & IfrsAsiful IslamNo ratings yet

- Tax InvoiceDocument1 pageTax InvoiceSunny SinghNo ratings yet

- Financial Statement Analysis - Concept Questions and Solutions - Chapter 2Document20 pagesFinancial Statement Analysis - Concept Questions and Solutions - Chapter 2stefy934100% (2)

- Unit-5 Chapter-3: Insurance-Contract and ImportanceDocument34 pagesUnit-5 Chapter-3: Insurance-Contract and ImportanceRammohanreddy RajidiNo ratings yet

- Asset SecuritizationDocument17 pagesAsset SecuritizationAmir HossainNo ratings yet