Professional Documents

Culture Documents

APV 10 Slides

Uploaded by

sanjeev0 ratings0% found this document useful (0 votes)

8 views5 pagesOriginal Title

APV 10 slides.pptx

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views5 pagesAPV 10 Slides

Uploaded by

sanjeevCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 5

Investment Decision on a Project

Normally for a Project evaluation like purchasing any

company, we use capital of two forms Equity & Debt

We ascertain the future cash flows for the project on yearly

basis

We have to discount the future cash flows and arrive at the

Present Value

With this Present Value of inflow we compare with the Present

Value of outflow, which is the value of investment. If NPV is >

0 we go ahead with the investment, while if NPV is < 0, we

do not invest.

We have learnt so far that the discounting rate used is WACC

Drawbacks of WACC Method over APV

WACC assumes that for all the future years will have the same D:E ratio

same. This, in practice may not be a valid assumption.

So the drawback with WACC in this case is that if every year the D:E ratio changes,

the WACC should change but the discounting is done with a constant WACC.

We have learnt that WACC / Discounting rate is nothing but Opportunity

Cost.

Opportunity Cost = Real rate of return + Risk Premium

Real Rate of Return is fairly constant for a wide variety of cash flow regimes.

Risk Premium changes

So the drawback here is that WACC considered the risk premium same for all the

various avenues of cash flows. This a very broad range assumptions and

practically incorrect.

In our example in Handout, risk premium for Margin Improvement may not be the

same a Risk Premium of Net Working Capital Reduction.

We can see that as Debt is reducing wrt Equity r E is also reducing

It is clear that when we use constant WACC of 7.7% for all 5 years we get a total PV of 167.3

million $, while when we use the respective years WACC, we get a PV of 146.5 million $

Thus in this case we would be over-estimating the PV while using constant WACC when the D:E

ratio is not constant.

1st Drawback which was claimed is proved.

You might also like

- Img 20161004 0002Document1 pageImg 20161004 0002sanjeevNo ratings yet

- GSTDocument62 pagesGSTsanjeevNo ratings yet

- Six Principles of InfluenceDocument16 pagesSix Principles of InfluencesanjeevNo ratings yet

- Analyzing Financial StatementsDocument2 pagesAnalyzing Financial Statementssanjeev0% (1)

- FrameworkDocument12 pagesFrameworksanjeevNo ratings yet

- 1.towards World Class PROD0234Document17 pages1.towards World Class PROD0234sanjeevNo ratings yet

- Six Principles of InfluenceDocument16 pagesSix Principles of InfluencesanjeevNo ratings yet

- Case Analysis Group 2Document18 pagesCase Analysis Group 2sanjeevNo ratings yet

- Contributed / Share Capital: Transaction As On: 1st Jan 2010Document18 pagesContributed / Share Capital: Transaction As On: 1st Jan 2010sanjeevNo ratings yet

- Innovation at GoogleDocument8 pagesInnovation at GooglesanjeevNo ratings yet

- Lease Problems Hw1Document5 pagesLease Problems Hw1sanjeevNo ratings yet

- MCM Internet QuizDocument29 pagesMCM Internet QuizsanjeevNo ratings yet

- 1 Strategy Planning - 14 MarchDocument15 pages1 Strategy Planning - 14 MarchsanjeevNo ratings yet

- Case Analysis Group 2Document18 pagesCase Analysis Group 2sanjeevNo ratings yet

- TATA & CORUS: A Case of AcquisitionDocument24 pagesTATA & CORUS: A Case of AcquisitionHemant RathodNo ratings yet

- F 01114147Document7 pagesF 01114147Ashish KumarNo ratings yet

- FADocument20 pagesFAsanjeevNo ratings yet

- HP Compaq Case ADocument3 pagesHP Compaq Case AsanjeevNo ratings yet

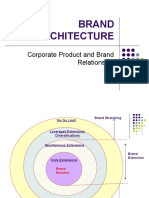

- Brand ArchitectureDocument35 pagesBrand Architecturesanjeev100% (1)

- TATA & CORUS: A Case of AcquisitionDocument24 pagesTATA & CORUS: A Case of AcquisitionHemant RathodNo ratings yet

- RwservletDocument1 pageRwservletsanjeevNo ratings yet

- Sampa Video IncDocument1 pageSampa Video IncsanjeevNo ratings yet

- APV 10 SlidesDocument5 pagesAPV 10 SlidessanjeevNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)