Professional Documents

Culture Documents

Mr. Sane Ananya

Uploaded by

MEGHNA SHOKEEN0 ratings0% found this document useful (0 votes)

6 views7 pagesna

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentna

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views7 pagesMr. Sane Ananya

Uploaded by

MEGHNA SHOKEENna

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 7

De-merger: Breaking it down

• is a corporate restructuring

• in which a business is broken into components

• either to operate on their own, to be sold or to be liquidated.

• It allows a large company, such as a conglomerate

• to split off its various brands or business units

• to invite or prevent an acquisition,

• raise capital by selling off components that are no longer part of the business's core product

line

• or to create separate legal entities to handle different operations.

• EXAMPLE: In 2001 British Telecom conducted a de-merger of its mobile phone

operations, BT Wireless, in an attempt to boost the performance of its stock.

British Telecom took this action because it was struggling under high debt

levels from the wireless venture.

Aditya Birla Group

• It is an Indian multinational conglomerate, headquartered in Mumbai, India.

• It operates in 35 countries with more than 120,000 employees worldwide

• The group was founded by Seth Shiv Narayan Birla in 1857

• The group had a revenue of approximately US$44.3 billion in year 2018

• The group has interests in sectors such

1. as viscose staple fibre,

2. metals,

3. cement (largest in India),

4. viscose filament yarn,

5. branded apparel,

6. carbonblack,

7. chemicals,

8. fertilisers,

9. insulators,

10. financial services,

11. telecom,

12. BPO and

13. IT services

Aditya Birla Nuvo-Grasim Merger

The Rationale The Swap Ratio

• will help consolidate fast- • a shareholder will get 3

growing businesses shares of Grasim for every

• unlock value by demerging 10 shares of AB Nuvo

• listing the financial services • 7 shares of AB Financial

arm Services for every 1 share of

• to simplify the group Grasim

structure by removing

cross-holding

Aditya Birla Nuvo-Grasim Merger

The Financials The Demerged Entity

• The merged entity had a • Aditya Birla Financial

revenue of Rs 59,760 crore Services will be demerged

• an operating profit of Rs • and listed as a separate

11,900 crore entity after the merger

• a profit after tax of Rs 2,300 between AB Nuvo with

crore in the year ended Grasim.

March 2017 • Its assets under

management more than

doubled to Rs 1.84 lakh

crore

Aditya Birla Nuvo-Grasim Merger-The promoters will

own 39 percent in the combined entity and public shareholders will hold the rest.

HOLDINGS: The merger is aimed at simplifying the cross-holding structure. The

combined entity will hold 28 percent in Idea Cellular, 11.4 percent in AB Fashions and

4.3 percent in Hindalco

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Old ManDocument8 pagesOld ManMEGHNA SHOKEENNo ratings yet

- Types of Takeover - ExamplesDocument5 pagesTypes of Takeover - ExamplesMEGHNA SHOKEENNo ratings yet

- Types of Takeover - ExamplesDocument5 pagesTypes of Takeover - ExamplesMEGHNA SHOKEENNo ratings yet

- LCB Information Assignment 2Document6 pagesLCB Information Assignment 2MEGHNA SHOKEENNo ratings yet

- Leadership & Capacity BuildingDocument16 pagesLeadership & Capacity BuildingMEGHNA SHOKEENNo ratings yet

- Sundar Pichai - Ceo of GoogleDocument11 pagesSundar Pichai - Ceo of GoogleMEGHNA SHOKEENNo ratings yet

- References: Leadership, 38 (3), 5-14Document1 pageReferences: Leadership, 38 (3), 5-14MEGHNA SHOKEENNo ratings yet

- Merger Acquisitions Assignment 1Document17 pagesMerger Acquisitions Assignment 1MEGHNA SHOKEENNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Boi Service ChargeDocument11 pagesBoi Service ChargeBharat ChatrathNo ratings yet

- EO 179 On The Coco Levy FundsDocument5 pagesEO 179 On The Coco Levy FundsImperator FuriosaNo ratings yet

- Working Capital Project in Ioc Barauni RefineryDocument109 pagesWorking Capital Project in Ioc Barauni RefineryBipul Kumar100% (1)

- Final Edelman Trust Barometer Case StudyDocument7 pagesFinal Edelman Trust Barometer Case Studyapi-293119969No ratings yet

- Debonair-Strategic Analysis of No Frills AirlineDocument8 pagesDebonair-Strategic Analysis of No Frills AirlineHarry LondonNo ratings yet

- Medicamente Fara Reteta 2012 PDFDocument108 pagesMedicamente Fara Reteta 2012 PDFDan PintilescuNo ratings yet

- 02 SmecorpDocument28 pages02 Smecorpsonia LohanaNo ratings yet

- Aviation Industry in IndiaDocument12 pagesAviation Industry in Indiasalim1321No ratings yet

- Stock Analysis and PredictionDocument29 pagesStock Analysis and PredictionsidhanthaNo ratings yet

- (Ex 3303-06e) Jahar Searches For Boston ExpDocument13 pages(Ex 3303-06e) Jahar Searches For Boston ExpTrial Docs100% (1)

- Bank Asia-03Document79 pagesBank Asia-03S.m. Tanvir0% (1)

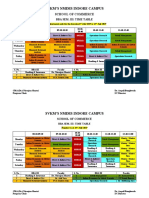

- Time-Table - BBA 3rd SemesterDocument2 pagesTime-Table - BBA 3rd SemesterSunny GoyalNo ratings yet

- Celebrating 18 Glorious Years - The 19th Foundation Day of Adarsh Credit Co-Operative Society Ltd.Document2 pagesCelebrating 18 Glorious Years - The 19th Foundation Day of Adarsh Credit Co-Operative Society Ltd.adarshcreditNo ratings yet

- Recruitment Agencies in MalaysiaDocument4 pagesRecruitment Agencies in Malaysiaماياأمال100% (1)

- A Blue Print For An Information Technology Park in MoldovaDocument23 pagesA Blue Print For An Information Technology Park in MoldovaruwanegoNo ratings yet

- Chapter C:4 Corporate Nonliquidating Distributions Discussion QuestionsDocument29 pagesChapter C:4 Corporate Nonliquidating Distributions Discussion QuestionsYang LiNo ratings yet

- Aw - 191223 2S - 0 PDFDocument133 pagesAw - 191223 2S - 0 PDFtorinomg100% (2)

- PIBTL Bullets - Observations Based On Model Sensitivity...Document6 pagesPIBTL Bullets - Observations Based On Model Sensitivity...Hamid Saeed-KhanNo ratings yet

- Deceptive and Misleading Advertisements in India by Ananya Pratap SinghDocument11 pagesDeceptive and Misleading Advertisements in India by Ananya Pratap SinghLAW MANTRA100% (1)

- AnnualCommercialRental-List (Done Excel, Pending CC)Document2 pagesAnnualCommercialRental-List (Done Excel, Pending CC)CK AngNo ratings yet

- AR: Absolute Return + Alpha. Press Release. Billion Dollar Club & Hedge Fund Report CardDocument3 pagesAR: Absolute Return + Alpha. Press Release. Billion Dollar Club & Hedge Fund Report CardAbsolute ReturnNo ratings yet

- Synopsis - A Study of Financial Prformance AnalysisDocument3 pagesSynopsis - A Study of Financial Prformance AnalysisAnurag SinghNo ratings yet

- Accounting Manager Financial Operations in Boston MA Resume Michael FarisDocument2 pagesAccounting Manager Financial Operations in Boston MA Resume Michael FarisMichaelFarisNo ratings yet

- 13744843Document10 pages13744843veercasanovaNo ratings yet

- Functional Role of Ge (Maintenance) 17 May 2016Document3 pagesFunctional Role of Ge (Maintenance) 17 May 2016Sri WatsonNo ratings yet

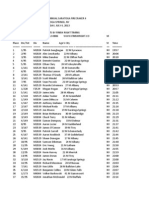

- 2013 Firecracker 4 4-Mile ResultsDocument70 pages2013 Firecracker 4 4-Mile ResultsStan HudyNo ratings yet

- A Study On Credit Risk Management at Canara Bank: Project Report Submitted in Partial Fulfilment of The Requirement ofDocument10 pagesA Study On Credit Risk Management at Canara Bank: Project Report Submitted in Partial Fulfilment of The Requirement ofbabuluckyNo ratings yet

- PEMBINAAN PURCON V ENTERTAINMENT VILLAGE (M)Document14 pagesPEMBINAAN PURCON V ENTERTAINMENT VILLAGE (M)Don NazarNo ratings yet

- Idbi Bank-Net AccssDocument2 pagesIdbi Bank-Net Accssskumar1stNo ratings yet

- CCCCCC CCCCCC: CCCCCCCCCCCCCCCCCCCCCCCCCCCCCCC CC CCCCCCCCCCCCCCCCCCCCCCDocument21 pagesCCCCCC CCCCCC: CCCCCCCCCCCCCCCCCCCCCCCCCCCCCCC CC CCCCCCCCCCCCCCCCCCCCCCRainy KansalNo ratings yet